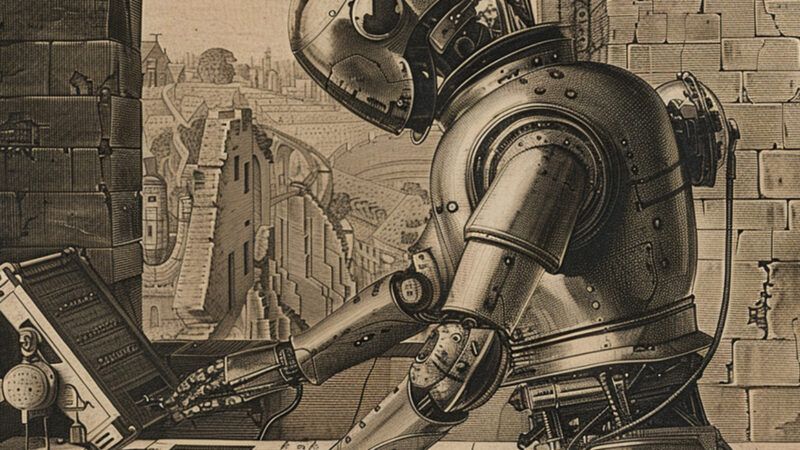

Artificially Inflated?

Plus: Ted Cruz eyes 2028, Nicolás Maduro imagines, and more...

What's going on in Silicon Valley? Revenue is looking good almost across the board. Advancements in artificial intelligence—and the infrastructure that supports it—are surging. But layoffs also keep happening. Is this the new paradigm the sector must adjust to?

The Reason Roundup Newsletter by Liz Wolfe Liz and Reason help you make sense of the day's news every morning.

"Technology firms have announced more than 141,000 job cuts so far this year, according to outplacement firm Challenger, Gray & Christmas, a 17 percent increase from the same period last year," reports The Washington Post. "In the last two years, the tech workforce has shrunk nationwide by about 3 percent a year, with California posting a much steeper 19 percent drop, according to data from the U.S. Bureau of Labor Statistics."

Per-employee productivity, possibly enhanced by AI, is on the rise; firms are able to easily make do with less headcount. So it tracks that "the overall level of tech employment will be under pressure," Mark Zandi, Moody's chief economist, tells The Washington Post. Of course it will be: This is what efficiency advances look like.

"According to a project from economist Ezra Karger aiming to predict the progress of AI, more than 18 percent of American work hours will be AI-assisted by 2030," writes Niall Ferguson for The Free Press. "Ten years later, AI will be as important to this century as electricity or the car were to the previous one."

"AI—or rather the promise of AI—is now the principal driver of both the U.S. economy and the stock market," continues Ferguson. "Between a sixth and two-fifths of the rise in gross domestic product over the past year is attributable to investments in computer and communications equipment, including chips, data centers, grid upgrades, and AI software."

Some, like economist/writer Noah Smith, theorize that it's the AI boom that's canceling out the economic blow that would otherwise be dealt to the U.S. economy by tariffs. "AI companies have accounted for 80 per cent of the gains in US stocks so far in 2025," writes Financial Times' Ruchir Sharma. Smith adds that "more than a fifth of the entire S&P 500 market cap is now just three companies—Nvidia, Microsoft, and Apple—two of which are basically big bets on AI."

It's possible these bets don't yield as much as investors expect, at which point we're in for a very rude awakening. It's possible that the productivity gains from AI result in even worse worker displacement than we're expecting, and the total erasure of a lot of entry-level positions. But it's also possible that the AI boom serves as a means of enabling greater worker productivity, and softens the pain that would otherwise have been felt during these weird economic times.

As for whether or not AI is a bubble, some—like Tyler Cowen—take the tack that bubbles get too bad of a rep: "A lot of so-called bubbles pay off in the long run" writes Cowen for The Free Press (a theory also advanced by Byrne Hobart).

OpenAI, for example, might have an inflated valuation. But "Nvidia is often considered a bellwether AI stock" since so much of its "revenue comes from selling graphics processing units to power advanced AI systems, meaning that its success gives investors insight into the health of the sector overall," writes Cowen. "Currently, Nvidia's stock-price-to-earnings ratio is in the 54 to 55 range, roughly twice the typical market average. That means the market expects great things from this stock. Those projections may or may not be validated, but it's hard to conclude they're entirely divorced from reality." Cowen notes that many of these tech companies have invested their earnings in AI projects, not assuming tons of debt, meaning they're even less likely to incur a sudden crash.

Scenes from New York: Yep.

This was always the insoluble problem for the "abundance Left": there is zero appetite for this politics within the Democratic Party, and they will dutifully vote for a mayor who wants to open government grocery stores and "seize the means of production"—pure anti-abundance. https://t.co/ZfTgmqeawj

— Christopher F. Rufo ⚔️ (@christopherrufo) November 17, 2025

QUICK HITS

- How recycling car batteries leads to whole towns in Nigeria being lead-poisoned.

- "Not long after Covid ended, a tenant in one of my Manhattan buildings died. He was an elderly Italian immigrant who lived alone in a small studio near Gramercy for decades," writes Matt Miller for The Free Press. "Normally, it doesn't take too long for landlords like me to renovate an empty apartment and list it on StreetEasy so that new people can move in and start the next chapter of their lives. But since this particular apartment is rent-stabilized, laws that were passed in 2019 essentially prevent me from doing anything with it except shutting the door and keeping it empty. Strict limits on rent increases under the 2019 laws have left an estimated 50,000 apartments like this one vacant across the city. Because the restrictions on what landlords can charge for these apartments often don't even cover the costs of maintaining them, they become ghosts. It's like they don't exist at all."

- Do you feel the Cruzmentum?

SCOOP: Sen. Ted Cruz is laying the groundwork for a 2028 presidential bid by leaning into his feud with Tucker Carlson.

He is putting himself on a collision course with VP Vance, a Carlson ally widely seen as the 2028 GOP frontrunner. https://t.co/a8tIAYWtxW

— Axios (@axios) November 17, 2025

- "Rio Tinto Group is imposing surcharges on aluminum shipments it sells to the US, a move that threatens to further disrupt a North American market already roiled by import tariffs that are driving up costs for consumers," reports Bloomberg. "The Anglo-Australian mining giant is including the extra charge on aluminum orders delivered to the US citing low inventories, as demand starts to outstrip available supply, according to people with direct knowledge of the matter."

- Abolish public sector unions:

https://twitter.com/EsotericCD/status/1990587335675977824

- As if we needed more reasons to hate the man:

Venezuela's President Nicolás Maduro breaks into singing John Lennon's 'Imagine' as he talks about US tensions. pic.twitter.com/R270tpM5AF

— The Associated Press (@AP) November 16, 2025

Show Comments (351)