The Federal Reserve Cuts Rates With Inflation Still Hot. Is Political Pressure Winning?

When the Federal Reserve is concerned about inflation, it increases the federal funds rate. Despite expressing such concerns, the Fed lowered it.

The Federal Open Market Committee (FOMC) announced Wednesday that the Federal Reserve would lower its federal funds rate target—the interest rate that banks charge each other to borrow overnight—by 0.25 percentage points. The decision, which has been expected for weeks, may lower interest rates for mortgages, other loans, and savings accounts, but it could come at the expense of an elevated cost of living.

Federal Reserve Chair Jerome Powell voted to lower the fed funds target range between 4.0 percent and 4.25 percent alongside 10 members of the 12-person FOMC. Stephen Miran, nominated by President Donald Trump to be a member of the Board of Governors on September 2 and confirmed by the Senate on Monday, was the sole member who dissented. Miran "preferred to lower the target range for the federal funds rate by 1/2 percentage point at this meeting," per the Fed's statement.

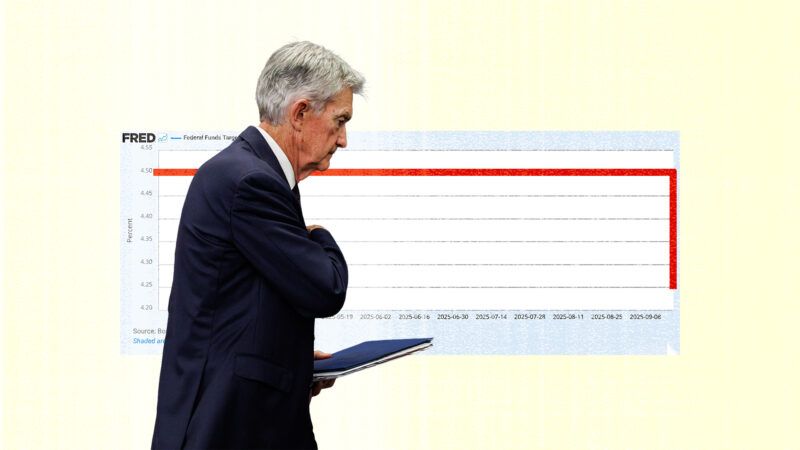

Miran's preference for a lower rate than the rest of the FOMC comes as no surprise; Trump has been pressuring the Fed to lower rates since February. In a June letter, in which the president referred to Powell as "too late," Trump indicated that the U.S. should be paying "1% Interest, or better!" (The last time the federal funds rate upper limit was 1 percent was May 2022, when the U.S. was still recovering from pandemic-era lockdowns.) Powell earned this moniker in July, when the FOMC held the fed funds rate between 4.25 percent and 4.50 percent, where it has been since December 2024 in a bid to bring year-over-year inflation down from 2.6 percent.

Inflation, as measured by the Fed's preferred price index, remained at 2.6 percent in July, the most recent month in which data are available. The Fed's target is 2 percent. Moreover, in August, the consumer price index, which the Bureau of Labor Statistics uses to measure inflation, increased by 0.4 percent—the greatest monthly increase in inflation since January.

At the time of the last FOMC meeting in July, Reason spoke to Peter C. Earle, director of economics and economic freedom at the American Institute for Economic Research, who said the Fed's decision not to lower rates reflected both inflation vigilance and strategic positioning, affording it "room to maneuver should a tariff-induced shock…suddenly materialize." Earle is less rosy about the Fed's most recent decision, which he says is "less an act of prudence than of expedience—an effort either to placate political pressure from the White House or to indulge a reflexive bias toward intervention."

Although the Fed is charged with keeping unemployment low, and average monthly jobs growth is down to 75,000 from 186,000 jobs per month in 2024, the unemployment rate has held steady around 4.2 percent since January. Earle says that "a measurable rise in unemployment of two to three tenths of a percentage point would strengthen the case [for the rate change]." Since that has not been observed—unemployment peaked at 4.3 percent in August, "the most likely outcome is…a temporary lift to asset markets accompanied by renewed upward pressure on consumer prices."

The FOMC acknowledged in its own announcement that "inflation has moved up and remains somewhat elevated" while the unemployment rate "remains low." Increasing the fed funds rate is one of the Fed's primary tools to combat inflationary pressures; lowering it is the opposite of what the Fed should do if it's seriously concerned about inflation. Apparently, it's not.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Release the Epstein files, your distractions mean nothing !

So much for central bank independence.

It's okay because Trump knows more than economists.

Most of these so-called "economists" like Powell are the same geniuses who said that we didn't have to worry about the inflation that was caused by Biden's unprecedented peacetime conjuring up and injection of new money into the economy (at the very same exact time we had a "pandemic" induced supply crunch no less) because it was "transitory", and thus decided to wait until we were approaching double-digits before deciding to act.

Powell is easily one of the absolute worst Fed chairmen of my lifetime, and he's also a shitty economist who doesn't seem to understand what it is that drives inflation. It's not taxes (and I hate taxes).

Trump is just as culpable as Biden on inflation. Of did you forget that he proudly signed the CARES act and demanded his name be on the stimulus checks backed by conjured money.

When Trunp left office in January of 2021 the recovery was already well underway (albeit in a somewhat uneven fashion as some places reopened far more quickly than others) and inflation was still well under the 2% target rate.

It was only after Biden took control that inflation really exploded. He gets alnost all of the blame for it, especially since he and his fellow blue city and blue state democrats were pretty much the ones who were still insisting that it was too early to fully reopen by the time he took office.

End the Fed

Ending the Fed would result in a collapse of the global financial system. The US can not afford to lose the dollar being the dominant currency.

Trying to save a sinking-ship by poking more holes in it.

The US cannot afford the Nazi-Empires Spending period.

The dollar has already lost 90%+ of it's initial value; your not saving anything by keeping the holes open.

Yes, they did cave to political pressure. But it will not work, Trump will still destroy them.

I guess it's now a libertarian thing to demand that a bunch of well heeled private bankers determine the cost of the currency. And if we dig down deep enough, as usual, Trump is at the bottom fucking things up. Here's a crazy idea. How about we let the market decide the price. Then neither Trump nor the FED could fuck with the decimals or fractions thereof. We're now a nation obsessed with basis points. Seriously.

The Fed isn’t going away. So as long as it is around it needs to be independent.

"Independent" by managing through a lens of Keynesian bull-crap?

No other ideas are ever allowed in the door, so they're not really "independent" at all, regardless of Orange Man's misdirected anger about interest rates.

The Fed doesn't do Keynesian fiscal policies.

What else would you call "Let's cut rates while inflation is hot, we need 'growth' at all costs" policy?

The dissenters apparently wanted a bigger rate cut, which would have been an even dumber policy move.

"it's now a libertarian thing to demand that a bunch of well heeled private bankers determine the cost of the currency."

J. P. Morgan was the oligarch who basically controlled the US economy for decades in the late 19th and early 20th centuries. That was why the Fed was created!

Just maybe, for once, the fed is ahead of the curve, being proactive instead of reactive.

How could anyone think the Fed is lowering rates due to political pressure. Everyone knows the time to cut rates is when all asset bubbles are at all-time highs and lower interest rates are needed to jack them just a bit higher. What could possibly go wrong.

Yeah. And the desire for lower mortgage rates that predicates this is misguided, as the Fed rate only indirectly affects them. Heck, they actually SPIKED up to 7% the last time they cut, and they're only down to about 6.3% now.

I would have INCREASED rates, Volker style, until inflation was eliminated. But instead the corporations want more easy money, so that's what they get, while we get what's left of our money metaphorically lit on fire. AGAIN.

I'm fine with a lot of what Trump's done, but on this one he's either an idiot, or the donors/ruling class are pulling the strings. Or the Fed governors are deliberately stoking inflation to hurt him and reassert evil globalist dominance using the problem/reaction/solution model, but as I said above, they're Keynesian idiots, so I'm not sure they're that clever.

Remember that Bessant worked for Soros for decades.

OMG! 0.25%!!! 1/4 of a %!!!

We're all going to DIE! /s

Needless to remind the zombies how minor this is ... There is nothing free-market about Gov 'Guns' price-fixing the cost on borrowed $. Though a predictable consequence of all the Fake-Monopoly-$ games the UN-Constitutional [Na]tional So[zi]alist Empire has created.

END the 'Fed' already! It's time to implant some natural value back into trade-medians.