How Much Will Trump's Tariffs Cost?

Much of the detail remains to be worked out, but lawmakers and corporations are already preparing.

President-elect Donald Trump's calls for higher taxes on imports is already triggering discussions in the halls of Congress and the corporate board rooms of America.

Trump's transition team has reportedly had discussions with Rep. Jason Smith (R–Mo.), chairman of the House Ways and Means Committee, about including tariffs in a major tax package that Congress will be working on next year—due to the scheduled expiration of some of the 2017 tax cuts. Politico reports that those discussions are centered around using tariffs as offsets for other tax cuts that Republicans would like to pass, though it is unclear if the House's rules allow for that trade-off to be made.

But, hey, at least it's an acknowledgement that tariffs are taxes!

Finding ways to raise revenue that could offset the extension of the 2017 tax cuts is not just prudent fiscal policy when the federal government is running deficits of near $2 trillion annually. It's also probably necessary if Republicans want to pass any major tax bill through the Senate without needing 60 votes—thanks to the specifics of the reconciliation process, which allows some issues to by-pass the filibuster as long as they are judged to be revenue-neutral.

On the campaign trail, Trump repeatedly promised to use tariffs to offset a bunch of different tax changes, including his plans to exempt tipped income and Social Security transfers from income tax. He also floated the idea of using tariffs to fully replace the income tax, which is laughably impossible.

Still, the signals indicate that Congress is taking Trump's tariff-hiking plans seriously, and so too are American businesses. The Washington Post reported last month that some companies were already bracing for price hikes that could come if Trump won the election. "We're set to raise prices," Timothy Boyle, CEO of Columbia Sportswear, told the Post. "We're buying stuff today for delivery next fall. So we're just going to deal with it and we'll just raise the prices."

Meanwhile, The New York Times reported Friday that some clothing and shoe retailers are rushing to stock up on imports before January, when Trump could use his executive authority to unilaterally impose higher tariffs.

Whether passed through Congress or enacted with the stroke of a presidential pen, higher tariffs will ultimately fall on American consumers. A new report this week by the National Retail Federation, a trade association that represents grocers, department stores, and online sellers, estimates that Trump's proposed tariffs would "reduce American consumers' spending power by $46 billion to $78 billion every year the tariffs are in place."

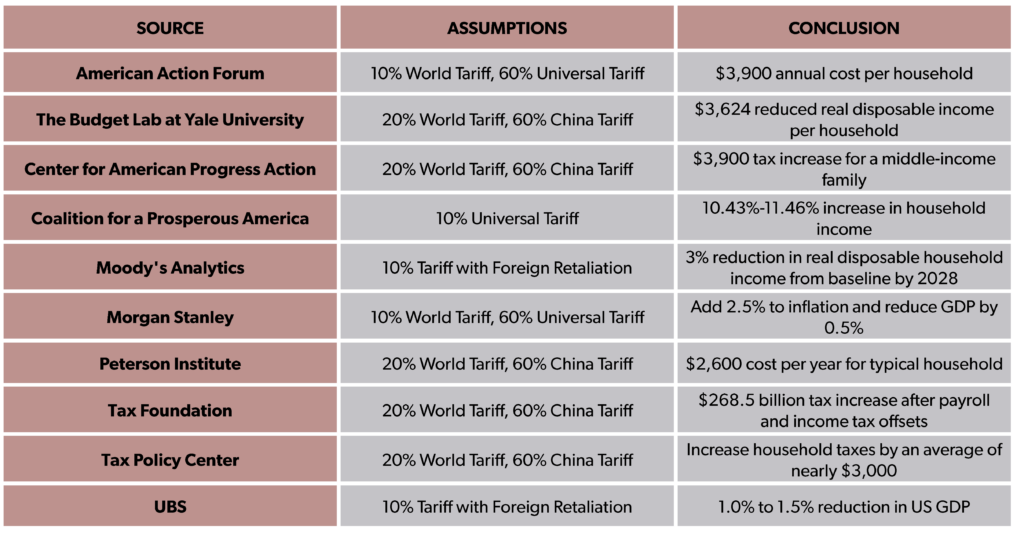

Those estimates depend on many variables that won't be known for sure until an executive order or tariff legislation is made public, of course. But there is broad agreement among economists that higher tariffs will make Americans poorer—the only question is by how much? Here's a tidy summary of those calculations, pulled together by the National Taxpayers Union Foundation:

Procedurally, passing tariffs through Congress would give them more legitimacy than if they were imposed solely by the executive branch. That has upsides and downsides.

If the tariffs are passed as part of a broader tax bill, their impact could be blunted by the extension of the lower individual income tax rates. Americans would still be paying higher prices for many goods, but at least they wouldn't also be hit with a higher tax bill from the IRS.

Also, the legislative process could whittle down the impact of the tariffs, as lobbyists for affected industries would certainly work hard to create loopholes and carveouts in the final product.

Of course, that leads to one of the downsides: any special treatment afforded to certain industries would leave a relatively higher tariff burden on businesses with less influence in Washington.

Another downside is the fact that tariffs imposed by legislation would be more difficult to undo, as the next president couldn't simply wipe them off the books unilaterally (of course, that probably wouldn't happen anyway, as the Biden administration demonstrated).

There are a lot of moving parts here, and there's still time for Trump to reconsider this foolish idea—or for his advisors and key figures in Congress to talk him out of it. The one thing we know for sure is that, if more tariffs are headed our way in 2025, consumers will have the least influence over the process and will end up bearing most of the cost.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Much of the detail remains to be worked out, but…

Go ahead and wishcast an article out of it anyways.

I’m convinced that Boehm furiously masturbates when he writes these ‘Trump tariff’ articles.

Boehm the Birdbrain is at the ‘bargaining’ stage of grief.

Nothing at all if you don't buy the tariffed items.

Lol, and the Iraq war was paid by oil revenues, right wolfy?

Tariffs = Iraq war?

How, exactly?

How? Failure to impose tariffs on dictatorial nations of the Middle East led to overdependence on oil from those nations. The U.S. fought in the Middle East – Iraq War 1 and Iraq War 2 – to ensure a steady supply of oil from those nations, which we would not have had to have done if we pumped that oil domestically and pumped a lot less of it in anti-libertarian dictatorial nations of the Middle East. There’s no such thing free trade with unfree nations.

Not only are “items” subject to tariffs, but input materials as well. Which means prices are not only going to go up on finished goods from abroad, but things made with or from imported products. Which translates to most everything. Not only that, but tariffs allow domestic producers to raise prices. How? If a Chinese widget costs $15 before the tariff and $25 after, then the American producer who was charging $20 before will charge $24 after.

What do economists call it when prices go up across the board? Inflation. What’s going to happen when Trump’s tariffs cause prices to go up across the board? Inflation. Who will he and his defenders blame? Not him.

Ahh. The old price gouging claims from Harris. Run with that.

Meanwhile, domestic production increases their goods due to costs of IP theft. If they sold more to divide IRAD costs, items would cost less as well. Then reduce the costs spent on protecting their IP and even further reductions in cost. Then the supply chain risk cost added to cost of sales.

Oh wait. Only tariffs raise costs in your economic system.

Meanwhile you continue to ignore raised prices from regulatory policy of Democrats that dwarfs tariff estimates. It is so fucking weird.

If Trump does as he promises and reduces regulatory burdens, it will likely be a net decrease due to the magnitude of each.

“Price gouging” is when sellers raise prices due to increased demand and/or reduced supply, usually in the wake of a natural disaster. Laws prohibiting the adjustment of prices result in shortages. Looks like a misunderstanding of basic economics is something you and Harris have in common.

The rest of your post is an argument with the voices in your head.

I do like that you admit to not understanding what price gouging is, along with free trade, inflation, comparative advantage, supply and demand, the price system, and everything else related to economics.

Your claim is domestic producers will stop competing with each other to set prices at China-1. That is idiotic.

I can cite the rest of my post with links if you want.

Tariffs reduce competition and a lack of competition pushes up prices (which is the whole point of the mercantilist and protectionist policies you support). Broad tariffs, like the ones you are defending, will result in inflation by increasing prices of imports, increasing the price of imported input goods, and reducing competition. That’s as basic as economics gets.

You going to triple-down in this now?

Do corporate taxes and regulations have the same effect on prices?

What are those? - sarc

Heh. That's the thing. The article says "consumers... will end up bearing most of the cost." First off, is anyone *not* a "consumer"? Second, does a tax exist that *doesn't* directly or indirectly affect consumers one way or another?

Doubles down on domestic will set China-1 while ignoring non China importers. Amazing. Truly the Adam Smith of our time.

Are you lying and claiming I said only Chinese imports would be subject to tariffs, or are you too stupid to understand what “broad” means?

Which is it, lying or stupid?

Also, you yourself claim that you read a paper on game theory that debunked everything Adam Smith ever said.

I'm quoting your post retard.

Why do you ignore other cost drivers buddy? Seems pretty consistent. Your love affair seems to be China. Lome Waltz. Fits with your new found leftist.

Now. Are you aware there is also domestic competition or not?

“Which is it, lying or stupid?”

For you, it’s both. In spades.

sarcasmic, what is the actual record from '45' (2017-2020) wrt tariffs and inflation?

The tariffs that '45' imposed did not increase inflation. How do you explain that?

I know that Boehm the Birdbrain cannot. He don't have the chops.

How do tariffs align with libertarian ideals of free trade?

How does ignoring anti free market acts, subsidizing those countries and foreign business, align with libertarianism.

Libertarianism doesn't require being ignorant. Well. Unless you're a chase voter.

It's gAmE tHeOrY. Jesse read a book about it once. To get to free trade, you need to tax your own people on imported items first.

About three fiddy?

Still, the signals indicate that Congress is taking Trump's tariff-hiking plans seriously,

This is good news, maybe instead of an unconstitutional executive order, we'll get a bill from congress which has input from the peoples reps the way our founders intended.

Bohem is an anti American sub human cancer.

About 10x less than Biden’s estimated regulations.

Less than a half of the open borders costs.

Oddly I don't have an addiction to cheap Chinese shit that you have to rebuild yearly making long term costs actually higher.

Imagine Eric’s surprise when his Chinese made insertable sex toy broke while in turbo mode.

Was still too big for Eric. He complained on the TEMU site.

Was it the “me love you long time” model?

The tangerine colored “Orange Man Oh So Good” model.

The Richard Geere Peanut as an SP2 Buttplug, SQRLSY action model with the Spermy Daniels stimulator attachment.

As long as he has a toaster it's all good.

How do tariffs align with libertarian ideals of free trade?

Application of the NAP.

You are correct. The government interfering in trade via tariffs is indeed a violation of the NAP.

You are correct. When a foreign government bombs your city, you government responding would be a violation of the NAP.

How does ignoring free market violations align with libertarianism. Have you heard of the NAP. Libertarianism doesn’t demand pacifism against the aggressor.

It also doesn't require ignorance to much higher cost drivers.

You voted chase I guess.

Tariffs and use fees (such as gas tax) are less odious than say income tax.

Is it pure libertarianism? No. But neither are all the things the US government thrusts on to domestic businesses making them less competitive.

How do tariffs align with libertarian ideals of free trade?

There’s no such thing as free trade with unfree nations. Suppose there was a Chinese language translation of Reason Magazine and the Reason website with anonymous comments. Ya think such website and print magazine would be accessible in Red China?

Every bit of trade with Red China, and the Chinese industries created by the west due to it, is taxed by Red China giving them tax revenue with which to finance, and the technology with which to implement, oppression of it’s citizens and to pose a greater military threat to it’s neighbors.

About 10x less than Biden’s estimated regulations.

Less than a half of the open borders costs.

Oddly I don’t have an addiction to cheap Chinese shit that you have to rebuild yearly making long term costs actually higher.

Oddly, you don't have a cite for any of the numbers you just pulled out of your ass.

Depends on how much Taxes are cut.

Maybe the only ?cost? will be have a productive USA instead of a dependent one.

Who knows how much Trump’s will cost. It’s hypothetical until he does.

The current question is how much will Biden’s cost?

Talking about what might come is less important to our pocketbook than what is here.

FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices

https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/

How about we put tariffs on goods that we know exploit slave or child labor?

Like iPhones, EV batteries, Nike shoes, etc.

How about tariffs on actual slaves and trafficked children?

LOL

There goes consumer goods prices.

You don’t understand supply shift or cost of goods sold I see.

You idiots have 200 years of tariffs to examine to show the inflationary effects. Yet it is always solely prediction models. Weird.

Part of the plan is to lower tariffs if other countries lower theirs. Tit for tat strategy. Trump even offered 0 tariffs if reciprocal.

He wants to lower regulatory costs which dwarf tariffs costs. You idiots never notice that.

And what did Domestic Tax-Cuts do?

TARIFFS!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

If manufacturing shifts domestically (all businesses respond to incentives, so naturally a tariff will be seen as one), very little.

American VAT.

In general, tariffs have limited utility.

Der Rumper Trump disagrees.

We shall see.