How Much Will Trump's Tariffs Cost?

Much of the detail remains to be worked out, but lawmakers and corporations are already preparing.

President-elect Donald Trump's calls for higher taxes on imports is already triggering discussions in the halls of Congress and the corporate board rooms of America.

Trump's transition team has reportedly had discussions with Rep. Jason Smith (R–Mo.), chairman of the House Ways and Means Committee, about including tariffs in a major tax package that Congress will be working on next year—due to the scheduled expiration of some of the 2017 tax cuts. Politico reports that those discussions are centered around using tariffs as offsets for other tax cuts that Republicans would like to pass, though it is unclear if the House's rules allow for that trade-off to be made.

But, hey, at least it's an acknowledgement that tariffs are taxes!

Finding ways to raise revenue that could offset the extension of the 2017 tax cuts is not just prudent fiscal policy when the federal government is running deficits of near $2 trillion annually. It's also probably necessary if Republicans want to pass any major tax bill through the Senate without needing 60 votes—thanks to the specifics of the reconciliation process, which allows some issues to by-pass the filibuster as long as they are judged to be revenue-neutral.

On the campaign trail, Trump repeatedly promised to use tariffs to offset a bunch of different tax changes, including his plans to exempt tipped income and Social Security transfers from income tax. He also floated the idea of using tariffs to fully replace the income tax, which is laughably impossible.

Still, the signals indicate that Congress is taking Trump's tariff-hiking plans seriously, and so too are American businesses. The Washington Post reported last month that some companies were already bracing for price hikes that could come if Trump won the election. "We're set to raise prices," Timothy Boyle, CEO of Columbia Sportswear, told the Post. "We're buying stuff today for delivery next fall. So we're just going to deal with it and we'll just raise the prices."

Meanwhile, The New York Times reported Friday that some clothing and shoe retailers are rushing to stock up on imports before January, when Trump could use his executive authority to unilaterally impose higher tariffs.

Whether passed through Congress or enacted with the stroke of a presidential pen, higher tariffs will ultimately fall on American consumers. A new report this week by the National Retail Federation, a trade association that represents grocers, department stores, and online sellers, estimates that Trump's proposed tariffs would "reduce American consumers' spending power by $46 billion to $78 billion every year the tariffs are in place."

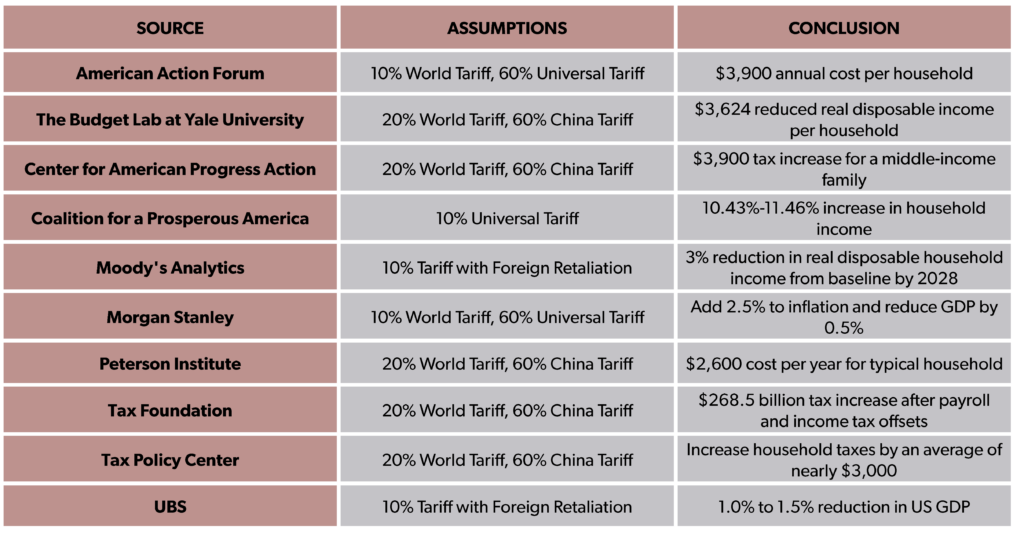

Those estimates depend on many variables that won't be known for sure until an executive order or tariff legislation is made public, of course. But there is broad agreement among economists that higher tariffs will make Americans poorer—the only question is by how much? Here's a tidy summary of those calculations, pulled together by the National Taxpayers Union Foundation:

Procedurally, passing tariffs through Congress would give them more legitimacy than if they were imposed solely by the executive branch. That has upsides and downsides.

If the tariffs are passed as part of a broader tax bill, their impact could be blunted by the extension of the lower individual income tax rates. Americans would still be paying higher prices for many goods, but at least they wouldn't also be hit with a higher tax bill from the IRS.

Also, the legislative process could whittle down the impact of the tariffs, as lobbyists for affected industries would certainly work hard to create loopholes and carveouts in the final product.

Of course, that leads to one of the downsides: any special treatment afforded to certain industries would leave a relatively higher tariff burden on businesses with less influence in Washington.

Another downside is the fact that tariffs imposed by legislation would be more difficult to undo, as the next president couldn't simply wipe them off the books unilaterally (of course, that probably wouldn't happen anyway, as the Biden administration demonstrated).

There are a lot of moving parts here, and there's still time for Trump to reconsider this foolish idea—or for his advisors and key figures in Congress to talk him out of it. The one thing we know for sure is that, if more tariffs are headed our way in 2025, consumers will have the least influence over the process and will end up bearing most of the cost.

Show Comments (51)