How Inflation Breaks Our Brains

From salt riots to toilet paper runs, history shows that rising prices make consumers—and voters—grumpy and irrational.

When Russian peasants set fire to hundreds of buildings in Moscow in 1648, the acute cause was a sharp rise in the price of salt. When they rioted again 12 years later, it was to protest a government policy that made copper money equal in value to coins made from silver—a policy that naturally caused widespread price inflation.

An increase in the price of bread, and an inept government response to it, helped set the French Revolution on its bloody course.

Periodic violence targeting Jews and other minority groups throughout European history has been linked to inflation and other sources of economic instability. The most infamous and horrific of those incidents, of course, began as an attempt to scapegoat Jews for the spike in inflation that plagued Germany in the wake of World War I. American history, too, is littered with panics, riots, and upheaval caused by sudden rises in prices and the public's perception that they are being ripped off. In the early days of the American experiment, indebted Massachusetts farmers took up arms against the new federal government's monetary policies. Two centuries later, dozens of farmers drove their tractors to the front door of the Federal Reserve in downtown D.C. to protest rising costs.

It may be tempting to dismiss the unsettling history that links high inflation with political unrest and aggressive xenophobia. Americans living today are the richest cohort of human beings ever to inhabit the planet. Surely we're not as susceptible to the psychological effects of inflation as our forebears, for whom a spike in the price of basic goods might be a matter of life and death?

And yet we may not be as far removed from Russian serfs or Weimar Germans as we'd like to think. Just look at the panicked runs on toilet paper in the early days of the COVID-19 pandemic, and the social media–fueled outrage over last year's sharp increase in the price of eggs. Or there's the bipartisan political impulse to reduce international trade and limit immigration—policies that will not reduce inflation but attempt to deflect blame for it onto foreigners.

Milton Friedman famously described inflation as being "always and everywhere a monetary phenomenon." That's still true when it comes to the causes of inflation—more money chasing the same number of goods is a surefire recipe for higher prices. But it does not fully capture the effects of inflation, which academics are still studying.

Inflation, it turns out, is also a psychological phenomenon. It makes us angry. It makes us irrational. In any democratic system, that anger and irrationality can be quickly translated into poor policies—unless elected and unelected officials are prepared to withstand it, and to recognize that combating inflation often requires unpopular actions. Now is not the time to indulge the wisdom of the mob.

In short, inflation breaks our brains. It makes us poorer, and poorer citizens too.

'Paying Them Without Mercy'

Inflation has been a trigger for political and social unrest for as long as America has had its own paper money.

The country's first inflation incident occurred while the Revolutionary War was ongoing, according to Carola Binder, the chair of the Haverford College department of economics and the author of a new book, Shock Values: Prices and Inflation in American Democracy,which examines the interplay between rising prices and politics. The fledgling American government issued paper money, known as "continentals," to fund the war effort, but the bills were seen as being mostly worthless. As a result, inflation occurred.

"Inflation meant that debtors could pay off their debts in depreciated currency, which of course infuriated their creditors," says Binder. "The big problem was that creditors were forced to accept the Continentals in repayment for debts, even though the value of the Continentals had fallen."

John Witherspoon, one of the signers of the Declaration of Independence, dryly noted the humorous results. Rather than lenders pursuing borrowers to seek repayment, he wrote, creditors were "running away from their debtors, and the debtors pursuing them in triumph, and paying them without mercy."

A postwar period of deflation—in which prices actually fell—left some farmers unable to sell food at high enough prices to make payments on their mortgages. That triggered Shays' Rebellion, a violent Massachusetts uprising in 1786 and 1787. "The army eventually quashed the rebellion, but it sure made an impact," says Binder. "It showed the framers of the Constitution that price fluctuations affected not only the economic but also the political and social well-being of the states and the union."

Much of the first 100-plus years of U.S. history is marked by that same pattern of inflation and deflation, along with the corresponding panics, bankruptcies, booms, and busts. Each shift in the value of money triggered calls for political action, often in the form of protectionist schemes like tariffs or direct political intervention in the economy to set prices.

When the Federal Reserve system was created in response to the Panic of 1907, the new central bank was given a mandate to keep prices stable. In theory, that would remove the levers of monetary policy from American politicians, who had for decades used those powers to influence elections, reward friends, and punish enemies.

The Federal Reserve's main tool for combating inflation is the ability to raise interest rates. Higher interest rates make it marginally more attractive to save money rather than spend it, so dialing up interest rates can reduce the amount of money circulating in the economy and thus ease inflation.

Of course, people don't like higher interest rates either. When the Federal Reserve raised interest rates to combat inflation in 1980, homebuilders mailed lengths of lumber to Chairman Paul Volcker's office as a form of protest, since higher interest rates made it more difficult for Americans to afford homes (as is happening again today). Dozens of farmers staged a protest outside the Federal Reserve's headquarters in Washington. "They wanted a general lowering of interest rates. They also wanted the rates on loans to farmers lowered a little more than the rest," The Washington Post reported at the time.

That interplay between inflation and interest rates is essential to the Federal Reserve's mandate. It's also essential to understanding why so many Americans report being unhappy about the state of the economy today, even though inflation has fallen a long way from its mid-2022 peak and unemployment remains near historical lows.

Something Missing

The official story of inflation in the early 2020s is well known. There was a pandemic, and the government response at all levels was unprecedented. Businesses closed, unemployment briefly skyrocketed, and stimulus spending of borrowed dollars reached previously unimaginable heights. Supply chains were severely stressed. Consumer behavior shifted seemingly overnight. Trillions of dollars in monetary intervention spiked demand and, most importantly, meant that suddenly there was a lot more money sloshing around in the economy. Prices, naturally, rose quickly—and kept rising.

During the 12 months that ended in June 2022, consumer prices in the United States climbed by 9.1 percent, according to the Department of Labor. It was the highest inflation rate recorded in more than 40 years—and even that statistic fails to capture just how abnormal of an economic event this was.

Before 2021, the last full year in which America experienced an average inflation rate of more than 4 percent was 1991. There was only a single year (2008) from then through 2020 when the annual inflation rate exceeded 3 percent. During peak inflation in the first half of 2022, the price increases were two to three times worse than the worstbout of inflation that most Americans could easily recall.

It also means that even though inflation has fallen significantly since its mid-2022 peak, the current rate of 3 percent (in June 2024) is still high by recent historical norms. It's also well above the Federal Reserve's official target rate of 2 percent.

Consumers are still feeling the sting. An annual survey of Americans' economic opinions released in May found that inflation was the top worry for a third year in a row. Interestingly, the number of Americans who named inflation as their top concern has grown (from 35 percent in 2023 to 41 percent this year) even as the inflation rate has fallen. It dwarfs other issues: "The cost of owning or renting a home" ranked second at just 14 percent.

Inflation has fallen, but Americans are more worried about it than two years ago when it was running three times as high—and more likely to view the economy as a whole in a negative light. How can this be?

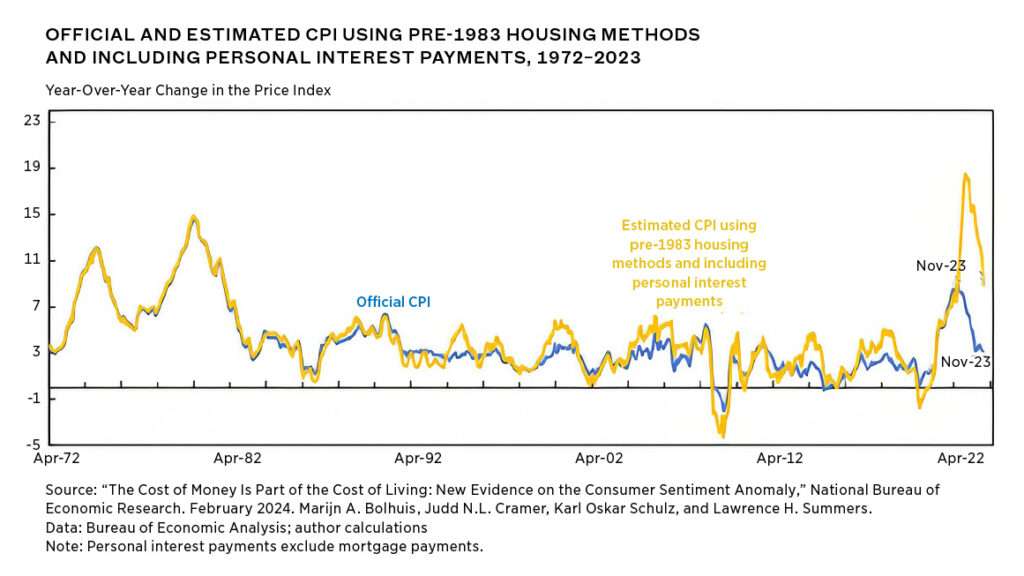

"We propose that borrowing costs, which have grown at rates they had not reached in decades, do much to explain this gap," argue economists from Harvard and the International Monetary Fund in a February 2024 working paper. The four authors, including Obama administration economic adviser Lawrence Summers, write that "concerns over borrowing costs…are at their highest levels" since the early 1980s.

To combat rising prices, the Federal Reserve raised its baseline interest rate 11 times from March 2022 to July 2023 in an attempt to curb rising prices. In total, the central bank has raised its baseline interest rate from near 0 to over 5 percent, and those changes have filtered into the economy in the form of higher borrowing costs for anyone who needs a car loan, a mortgage, a business loan, or some other form of debt.

But higher interest rates aren't taken into account in the government's official inflation calculation, known as the Consumer Price Index (CPI). To understand why that's significant, Summers and his three co-authors point to the process for buying a new car. The cost of new and used vehicles is weighted to account for roughly 7 percent of the monthly CPI, but the cost of financing a car is not included at all, even though more than 80 percent of all car purchases are made with a loan.

The same problem pops up when you look at housing. The monthly mortgage payment on the median-priced home in the United States has climbed from $1,621 in 2020 to $2,722 in July 2024. Yes, housing prices have increased during that time, but not enough to account for that 68 percent increase. The bigger factor—one that does not get included in the official CPI metrics, even though it makes a big difference to a potential homebuyer—is the increase in interest rates.

The paper's authors calculate that if the pre-1982 inflation metrics were being used today, the rate of price increases would have peaked at an astonishing 18 percent in June 2022 rather than 9.1 percent. In November 2023, the most recent month that the paper covers, inflation would have rung in at 9 percent instead of barely over 3 percent.

It's not just that the money in your wallet is worth less. The money you don't have—the amount you might need to borrow to make a big purchase like a home or car—is now further out of reach.

Being able to afford a mortgage or a car loan is "integral to American consumers' sense of their economic well-being but their price is not included in official inflation measures, it is no wonder that sentiment lags traditional measures of economic performance," the four economists write. "Consumers are including the cost of money in their perspective on their economic well-being, while economists are not."

And if inflation is worse than the official numbers would suggest, that's potentially a worrying sign for a variety of other social indicators too.

Facts and Feelings

If there's a silver lining to three-plus years of rising prices, it's that wages have been rising across the board too—and after the initial inflation surge in 2022, pay increases have actually outpaced the official inflation numbers. In fact, the Congressional Budget Office reported in May that average wages have grown faster than inflation at all income levels since 2019. President Joe Biden has touted rising wages as part of the White House's messaging strategy aimed at convincing Americans the economy is doing well.

Of course, the wages-are-growing-faster-than-prices argument doesn't include the toll that higher interest rates have taken.

Regardless, it seems like Americans' feelings don't care much about those facts.

New research from Harvard economist Stefanie Stantcheva shows that human beings are simply less likely to recognize the potential benefits of inflation—higher wages, chief among them—and will instead focus on the negatives. For her aptly titled paper "Why Do We Dislike Inflation?" Stantcheva interviewed more than 2,000 people. She concludes that most respondents believe wage increases are due to their on-the-job performance, while they view inflation as being to blame for their paychecks not stretching as far as before.

The bigger problem is that Americans don't see inflation as "a mere 'yardstick' or a unit of measure," Stantcheva writes. Instead, "individuals anticipate a variety of tangible adverse effects on both their personal financial situation and the economy at large."

That stress and uncertainty quickly turns into something else. In Stantcheva's survey, 48 percent of respondents were "angry" about inflation. This anger can be expressed in haphazard ways, though the most common responses are about what you'd expect if you've spent much time talking to people or scrolling through social media in recent years.

"The most common [target] is Biden and the administration ('I think it has to do with Joe Biden', 'Joe Biden's policies for this round of inflation') followed by Greed ('I believe the sole reason is greedy corporations who care more about their bottom line than actually helping people')," Stantcheva reports.

Meanwhile, just 13 percent of high-income respondents and only 3 percent of low-income earners blame monetary policy. Overall, 18 percent of respondents blamed Biden and 10 percent blamed "greed," but low-income respondents are far more likely to blame the president (22 percent of them do) than high-income earners (12 percent) are.

Fears about the consequences of inflation also extend beyond the economic realm and into metapolitics. Close to three-quarters of all respondents in Stantcheva's survey say inflation will hurt America's international reputation and will decrease political stability at home. Those types of worries can become self-fulfilling—or can give voters an incentive to embrace radical alternatives.

Having a large number of people angry about their declining living standard, even (or perhaps especially) if they don't fully understand the underlying cause, seems like a formula for broader discontent. History, and Stantcheva's research, suggests many people will be looking for someone to blame.

For large sections of the electorate, immigrants seem to be a likely scapegoat. An annual Gallup survey released in July showed that 55 percent of Americans want to see immigration to the U.S. decreased. For decades, that figure had been gradually declining, and the inflection point lines up almost exactly with the acceleration of inflation. In May 2020, Gallup found just 28 percent of Americans favored less immigration. That number climbed to 38 percent in 2022, 41 percent in 2023, and then jumped again in 2024.

Certainly, anti-immigrant political rhetoric has been a feature of right-wing politics since well before the current bout of higher inflation. Gallup's numbers suggest something has changed in the past four years, however, and that argument is now connecting with a much larger audience.

"Without fully understanding inflation's monetary roots, we can all mistake the symptoms for its cause," says Ryan Bourne, a Cato Institute economist who edited the recent book The War on Prices.

Bourne says "unexpected inflation creates conflict" and warns that frustration about inflation can lead to "blaming malevolent actors or external forces, and moralizing about people's self-interested behavior."

Though the contours of those conflicts have differed throughout history, it seems unwise for officials to ignore the ways that ongoing higher-than-normal inflation can stress our already overheated political system. If you want to safeguard democracy, one of the top agenda items should be limiting inflation.

Unfortunately, that has not been at the top of the agenda.

Who Gets the Blame?

It's only fair to pause for a moment and point out that no one actively chose this result.

Presidents are not singularly responsible for everything that happens to the economy while they are in office. There is no toggle switch on the side of the Resolute desk to increase inflation or wages, just as there is no button for low gas prices or full employment. This has always been true, under Biden and Trump and all who came before them, and it will be true when someone new gets to the Oval Office.

And yet, both Trump and Biden must bear some responsibility for all this. At nearly every turn, the two most recent presidents repeatedly made choices that heightened the risk of accelerating inflation. Once the risk materialized, Biden has taken steps to worsen it, Trump has promised to pursue similar measures, and both have sought to stoke popular discontent for political gain. Neither seems to have much in the way of a solution.

Start with Trump. In just four years, he oversaw more than $8 trillion in new borrowing. In doing so, he and his fellow Republicans didn't just reveal that their Obama-era criticism of high spending was unserious. They also ignored a pile of economic evidence that large debt-to-GDP ratios tend to nudge inflation higher, and to make it harder to control once it hits.

When COVID-19 arrived, Trump pushed for and signed two multitrillion-dollar spending bills that included a number of items likely to increase inflation—such as direct payments distributed to many American households regardless of whether they'd suffered any economic hardship from the pandemic.

Then came Biden. Not long after taking office in January 2021, his administration made a choice to pursue what Bloomberg termed "run-it-hot economics," which included the $1.9 trillion American Rescue Plan and the distribution of another round of stimulus checks. Although some economists, like Summers, warned that more borrowing risked tipping the economy into an inflationary cycle, the White House had significant support in mainstream, liberal institutions for cranking the spigot wider. Neil Irwin, then The New York Times' senior economics correspondent, wrote that the most important lesson for the incoming administration was the fact that "a 'hot' economy with high deficits didn't cause runaway inflation."

And then it did.

Now What?

When inflation peaked at various other times in American history, Binder says, the political system has struggled to respond. The same has happened in the past few years.

"We saw the Biden administration blaming inflation on [Vladimir] Putin and corporate greed, because they didn't want tighter monetary policy that might risk a recession or higher unemployment," she says. She also notes that issues that frequently popped up during inflationary periods in the 19th century have returned. The political right wants to hike tariffs. The left is focused on using antitrust laws to break up big businesses and somehow combat greed itself.

None of that is likely to lower inflation in a meaningful way, because of course it is a monetary phenomenon—thank you, Milton Friedman. But waiting for inflation to ease on its own or substituting the squeeze of higher prices for the pinch of higher interest rates is not a satisfying solution for most people. The voters demand that the politicians do something, and those who want to get reelected feel the urge to try.

That's what is missing in Stantcheva's survey, says Binder, who reviewed the paper before it was published. "Even though people report disliking inflation on her survey, they often do like, and push for, policies that are inflationary—like expansionary monetary policy (low interest rates) and fiscal stimulus," Binder says.

Officials should resist calls for inflationary policies in the middle of an inflationary period. Unfortunately, inflation breaks people's brains—and politicians are people too.

Inflation is one of the defining factors of the election season. Biden's "run-it-hot economics" was the fulfillment of a campaign promise to deliver more stimulus—and to send more checks to American households, a policy idea that unsurprisingly polled extremely well when it was tried during the pandemic. When that was no longer tenable, Biden and Congress passed the Inflation Reduction Act, which hiked spending on a variety of lefty priorities such as green energy subsidies and taxpayer-funded health care. Analysts at the Penn Wharton Budget Model calculated that the bill would marginally increase inflation over the next decade rather than, well, reduce it.

Trump, meanwhile, has responded to popular anger about inflation by calling for more tariffs and for reducing the Federal Reserve's political independence. Binder says that's a mistake. When inflation unleashes anger that the political process channels into dubious quick fixes, that's exactly why an independent central bank with a price stability mandate matters.

"If we left it to elected officials, there would always be excessive pressure for inflationary policies," she says. "The Fed often has to take actions that are politically unpopular in the short run to preserve price stability in the longer run."

Since the 1980s, inflation control has been one of the Fed's core responsibilities. Regardless of what other problems libertarians might have with the central bank, it's difficult to argue that it didn't do a decent job of keeping inflation low for several decades. Keep in mind: One of the reasons people seem to be so bothered by inflation rates between 3 percent and 4 percent is that inflation averaged well below 2 percent for so long.

"Inflation, once out of control, lasts a few years. This fosters the idea that technocratic institutions like the Fed just aren't very good at their jobs and don't have control. Having called inflation 'transitory' and said it would be over in months adds to this," says Bourne. But politicizing the Federal Reserve and giving presidents more control over interest rates "would be way worse," he adds.

Instead, elected officials in the legislative and executive branches should focus on what they can control. Excessive spending that relies on multitrillion-dollar deficits (much of which is financed by the Federal Reserve's willingness to buy Treasury bonds) makes inflation more likely in the future—and more difficult to contain in the present. If democracy is poorly equipped to deal with inflation, that's ultimately an argument for why America's leaders must resist the siren calls of stimulus spending in the first place. Once unleashed, inflation is difficult to tame and will unpredictably disrupt social and political cohesion, leading to yet more poor policy.

There may be no easy way out. In a letter to shareholders in early April, JPMorgan Chase CEO Jamie Dimon warned of "ongoing concerns about persistent inflationary pressures." Dimon, one of the world's most influential bankers, urged his shareholders and employees to prepare for a lengthy battle against higher prices, no matter what the official inflation stats say each month.

"Today there is tremendous interest in monthly inflation data, although it seems to me that every long-term trend I see increases inflation relative to the last 20 years," he wrote. "Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world and the restructuring of global trade—all are inflationary."

Søren Kierkegaard, the 19th century philosopher whom Biden has a penchant for quoting in stump speeches, once wrote that there are two ways to be fooled. "One is to believe what isn't true, and the other is to refuse to believe what is."

When it comes to inflation, our political leaders seem guilty of both errors. For the better part of two decades, politicians in both parties have acted like inflation had been permanently tamed, that low interest rates meant that borrowing was cheap and easy, and that it appeared there would be no consequences for soaring deficits. This was not true.

Now both candidates for president seem to refuse to see what is true. Inflation is not a passing or transitory concern, and it is not a problem to be solved with bumper-sticker talking points or by scapegoating it away. America's ongoing battle with inflation is the story of the 2024 election, and it may very well be the story of 2025 and 2026 too. It should serve as a warning for the next generation of political leaders: Unleash this monster at your own risk.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The panic laden runs on toilet paper during Covid were not caused by inflation. There was a widespread rumor of supply issues causing a shortage and the resulting mass hysteria caused the shortage. It was really silly because as a truck driver I went into toilet paper/paper towel plants and they were all running as usual.

I still know people who have hundreds of rolls in storage for the next toilet paper apocalypse.

I usually buy the biggest packages I can, and they last several months. That shortage hit when I has 2-3 rolls left and usually buy the next bulk pack, and all they had was some miserable 1-ply stuff. When they got small 2-ply packs of an unknown brand, I still hadn't used any of the 1-ply, so I bought one of the 2-ply packs, and had used one roll when a better small 2-ply pack came out, and so on. I probably have a couple dozen rolls of lousy TP which I hope to never use.

I just pick up a 30 pack at Costco every year or so. Same with paper towels. The price is pretty good.

Yeah, I told the Peanuts to just buy their food at Costco. The bulk pricing is still reasonable.

The "inflation" was all in the smaller 8 oz packages.

One of the Peanuts said I was joking. They must buy everything in the small rip-off sizes.

^^^

Speaking of people who like little things.

Funny how Buttplug has evolved from "Inflation isn't happening!" to "It's your fault for not buying in bulk at Costco!"

Wrong, Sam's Club bulk paper towels (Bounty) went from $17 to $24, and toilet paper jumped from $22 to $32 (Charmin).

They do occasionally have $5/off specials on the app, so that's when I stock up.

Of all the things at the supermarket that I might panic over--and fear for my life or at least standard of living--toilet paper is near the bottom of the list. Now if people had been hoarding coffee, and emptying the shelves...

Imagine Pedo Jeffy’s panic if there was a shortage of Ben & Jerry’s.

I was driving during Covid also. Gretchen Whitmer shut down the rest areas in Michigan ostensibly to stop toilet paper theft. I quit going to Michigan until she reversed that. That's how fucking crazy it was.

Imagine the toilet paper theft and smuggling entrapment scams the FBI was working on.

Somewhat. But the reason it hit toilet paper is because toilet paper is a product that is very dependent on Just In Time logistics, and even the smallest disruptions can have big consequences.

Let's remember that this was a problem for like 3 weeks.

The problem with TP is that it is very bulky for its number of uses. A bulk pack of Cheerios with 84 servings will last a family of 4 for 21 days- 3 weeks. A four pack of ass-wipe that is the same volume will last 5 days(especially when the family is at home 24x7). So consider that a shelf that holds 10 boxes of cheerios is holding 210 days of supplies (for a family of four) while the same shelf can only hold 40 days of toilet paper.

Everything in the supply chain that provides toilet paper is heavily strained because it is so bulky- fewer units fit in shelves, and in the back of the store, and on the truck, and in the distribution warehouse. In a just in time supply-chain, that's fine- but if trucks are shut down for even a week, TP and other bulky items are exactly where you see problems.

But as you say, it has NOTHING to do with inflation. Boehm is being stupid here.

Let’s remember that this was a problem for like 3 weeks.

Mostly three weeks BEFORE govts did anything. What that hoarding showed is that the economy was going to collapse anyway. Govt may have made things worse but it did not CAUSE the collapse caused by people bunkering up at home. TP was the one product that proved people were gonna bunker up anyway.

Uh, sure. The people went into panic buying (and panic living) just by themselves. Good, honest government, and their media lap dogs, were just telling people to stay calm and continue their lives as normal.

Retard.

I find it amazing that people will simp for the government.

Toilet paper hoarding began in late Feb 2020 and became very obvious as empty shelves by the end of the first week of March 2020. That latter was a few days before Trump's first Oval Office address and more than a week before any federal govt action. re say NY, before the number of confirmed cases had passed 100, a week before there was a single death, and probably about the time they declared a state of emergency

Again, JFear doesn't know what the fuck he is talking about.

There was some "hoarding" but the main problem was the supply chain logistics. There is only so much free toilet paper sitting in the supply chain at one time. And one week of disruption, at the same time everyone is being told to prepare for 2 - 3 weeks of lockdown, causes shortages.

Idiots like JFear love nothing more than to make shit up in their brain that sounds right. And being the arrogant asses that they are, "What sounds right" is always something to the effect of "Everyone was stupid, but I totally knew what was going on".

No there was hoarding. People decided they wanted their stores of TP to be in the garage rather than at the grocery store. That was done for a reason and it wasn't because of govt. It was because of the virus and how individuals themselves choose to prepare.

The first article here re TP hoarding was on Mar 11 2020, where deRugy talks about the difficulty of acquiring tp for 'the last few weeks '. She wrote about what govt were talking about by Mar 11 2020 - price control and gouging and such. Which is what you would expect from govt. But the important point for this discussion - even re your logistics chain point which I already commented on below - is that govt was yapping about stuff that was already obsolete by a 'few weeks'.

The hoarding did not happen BECAUSE of govt. Govt merely responded -and yes inappropriately - to it. If you don't understand that cause precedes effect, you need a lesson in how time works.

Lol. Fuck off coward. Nothing shut down here until government got involved. You are trying to justify your irrational behaviors.

Arizona had the highest concern of all states about toilet paper availability early on. A local AZ story dated Mar 16 2020.

Not really a surprise considering you as the source of any info. Apparently not only were you morons hoarding toilet paper early. You were talking about toilet paper on social media. Were you all trying to crowd source stores with toilet paper?

Another AZ toilet paper story from Mar 13 2020 wondering why people are so interested in toilet paper and can't find any?

I don't live in phx retard.

And again. Shit didn't SHUT DOWN here until government got involved. Which was early March.

Are you incapable of reading?

"Mostly three weeks BEFORE govts did anything. What that hoarding showed is that the economy was going to collapse anyway."

Nothing you said is insightful, or relevant. But this is a very instructive response from JFear.

You see, JFear got that name because he was one of the authoritarian nannies running around screaming "Doooom!" and demanding that everyone submit to the will of the government. He made terrible, scientifically idiotic pronouncements about how masking works in asia (this is untrue), and justified all sorts of nonsense.

And now, any time anyone brings up lockdowns, JFear has this compulsive need to swoop in and tell us that all the shit he promoted was justified or would have happened anyways. It would be funny if it wasn't just so pathetically annoying. Like that washed up football player who can't let anyone talk about highschool without boring everyone (again) about how the Coach ruined his sure-to-be pro career.

You should spend your effort making a real comment rather than trying to splain.

Panicky democrat ninnies like you created the self fulfilling prophecy of toilet paper shortages. Something that otherwise would have been minimal.

The hoarding/shortage phenomenon happens all the freaking time. The perfect example is gasoline in advance of a hurricane. The nanosecond people decide that they want gas in their gas tank (just in case) rather than at the gas station - the gas station is now empty. Because the volume of 'gas tanks in America's cars' is a lot more than the volume of 'gas tanks in America's gas stations'. They don't have to actually go anywhere. Just change where they are storing gasoline.

Yes. Panicky Democrats create these problems. At least mostly.

The issues at the retail level was the sheer amount of shelf space devoted to toilet paper. That is a very very low value product per foot of shelf space. At core – a land issue.

Once demand went up (because everyone knows that the response to a respiratory virus is to hoard toilet paper), the only possible response by retailers was to allocate shelf space (land) away from some other product that is higher value. That’s just insane. So they let the shelves go empty – which just exacerbated the hoarding tendency. Price would not really work on its own to equilibrate supply to demand. True end-use demand did not change – customers were hoarding TP at a different location not shitting more. There’s no way price could rise enough to incentivize more frequent delivery of toilet paper. Filling a truck with a low value product like toilet paper would merely reduce that same number of trucks to haul other more valuable products.

JFC, JFear is the reason for the phrase "don't believe what you read on the internet". He is constantly just making shit up in his head and running with it without spending a moment of diligence to test his hypotheses. There are so many factual inaccuracies in one paragraph that it boggles the mind.

This reminds me of the time JFear just decided that masking worked in Asia because it caused people to social distance. He did nothing to test this theory against reality, and made himself a fool. Good times!

https://reason.com/2023/05/03/surgeon-general-vivek-murthy-refuses-to-acknowledge-the-governments-misrepresentation-of-mask-research/?comments=true#comment-10048358

For the record, stores didn't "let shelves go empty". There was a dual shock to the system. Stores had more shoppers per hour during the run up to lockdown (demand shock), and the logistics lines were strained because lines of transportation were being shut down.

JFear's entire theory here is silly. Stores want to sell you shit. And when you take it off the shelves, they put more stuff there. They did not choose to allocate space away from TP to higher margin items (and premium TP is very high margin, anyways). They were just running out of stuff to sell, period.

Contrary to JFear's imagination, use demand *did change*, because people were now spending the entire day in their house, instead of going out to restaurants, offices and schools. (This is why so many restaurants turned around and started adding TP to their delivery orders- they had excess).

People love talking about hoarders and irrationality because people like JFear like to feel superior to others, like they wouldn't be the one shitting their bed in a crisis. But any simulation that shows a demand shock or a supply shock (or both) will show you that products with a poor "uses per square meter" ratio will sell out first.

Again with the splaining. And you clearly couldn’t even read/comprehend what I posted. With the same problem of time re cause and effect as above.

Yes, like that time JFear confused cause and effect for inflation. You see, JFear actually argued that the cause of inflation was people selling houses for more than they were worth, rather than the increase in money supply.

https://reason.com/2023/02/02/covid-stimulus-spending-played-sizable-role-in-inflation/?comments=true#comment-9908500

No one is disputing that hoarding existed. The point is that the actual cause of the shortages was the compressed demand. Millions of people shopped over a period of a few days instead of a few weeks. This made it difficult to keep shelves stocked, and that led to hoarding.

But again, JFear wants to think he is the smartest person in the room, even though he is at high school junior level of understanding. Many young people think that when you sell a house for $100,000 more than market, you have "inflated" the economy. Then they grow up and realize that it is the opposite- that inflation happens, and that causes the houses to sell for more. Likewise, hoarding was a symptom of the supply shock, not the cause.

Absolutely right.

And "the bipartisan political impulse to reduce international trade and limit immigration—policies that will not reduce inflation but attempt to deflect blame for it onto foreigners." comment is fraudulent as well.

The impulse to reduce international trade (with some nations) and limit immigration (done illegally) are issues of national security, making sure we can provide our critical goods without relying on our potential enemies for them and who is coming into our country and what are they bringing with them when they do not follow our immigration laws.

So, is Eric Boehm wildly ignorant, an idiot, or a liar?

It's a self-fulfilling prophecy, since the panic led to hoarding and stockpiling which did result in a shortage.

No. The run on toilet paper during Covid was caused by whenever someone coughed, three people would shit their pants.

I believe we call those people ‘democrats’. And watch your phrasing. We don’t want to summon a ravenous SQRLSY.

The REAL root cause of recent inflation is that The Donald's erections were STOLEN!!! Spermy Daniels (among udders) is PISSED, and fartility-productivtitty are, ass a result, both WAY down!!

Zzzzzz

Was that gray box SQRLSY? Did he get excited by the vision of shitted pants?

He didn't see anything to troll so he made something up.

SQRLSY should be euthanized immediately. Either take it to the vet, or do it Old Yeller style. Maybe throw it live into a battle of acid.

Fire works too.

Don't worry, be happy... The FIX is in! If only we will erect Camel-Toe, She will implement price cuntrolls! THIS will Shirley SNATCH inflation victory from the jaws of defeat!

FOAD, spastic asshole.

It is decidedly rational to vote out of office the democrat politicians whose policies created the present inflation problem. It would be irrational on the verge of insanely self-destructive to give them more power.

^THIS +100000000000000000.

Should we vote this Big Gov, Big Deficit, Big Spending asshole out too?

Start with Trump. In just four years, he oversaw more than $8 trillion in new borrowing.

At least you are a consistent retard.

It is just remarkable how you GOP knob-polishers forget how Bush Sr bailed out the S&L industry for $160 billion in 1990 dollars, then Bush the Idiot son spent $700 billion on TARP, and Fatass Donnie stole $3 trillion from taxpayers and then you have the gall to complain about Democrats.

Never change, SBP.

turd, the TDS-addled ass-clown of the commentariat, lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

It is amazing to me how the Not A Democrats here focus solely in a post state shut down covid spending that Democrats demanded be even bigger while ignoring his first 3 years. Almost like you guys prefer a narrative.

Democrats continued pushing covid spending after 2020.

Also TARP somehow ended up being deficit neutral. Reid and Pelosi made the spending part if the baseline though. Obama loved it. Even claimed credit of repayments as his deficit reduction.

Actually TARP earned a profit. The interest rate charged to the banks was over 20% - like they hammer consumers on with credit cards. It was Geithner who did that. Thank him.

Anyway the banks paid off their loans quickly to avoid those fees.

So why did you bring it up as "spending" while ignoring Reid and Pelosi adding it to baseline spending dumbass?

"GOP knob-polishers forget how Bush Sr bailed out the S&L industry for $160 billion in 1990 dollars, then Bush the Idiot son spent $700 billion on TARP"

Literally Team Buttplug.

Former Vice-President Dick Cheney to vote for Kamala

George W. Bush won't support Donald Trump’s reelection, report says

More than 200 Bush, McCain, Romney aides endorse Harris

White House lawyers who advised Bush endorse Harris over Trump in 2024 showdown

These Are The Republicans Who Endorsed Joe Biden For President

Buttplug IS the Bush administration.

I saw the Dick Cheney article and thought to myself 'boy, they're really going after Harris aren't they'.

Made me want to vote for Trump twice.

You think you're a Democrat or something?

Vote early, vote often.

It’s amazing that republicans have the power to unilaterally pass these budgets without the involvement of Congress.

McConnell is a Republican, idiot. He was all on board Donnie's Big Deficit spending.

And Dick Cheney just endorsed Kamala.

You won’t be able to figure it out though.

You want to explain those links I just gave you, Pluggo? Or should I say Bushpig?

McConnell is a Republican ... but not a MAGA one. I don't know if you noticed, but the Neocon wing of the GOP is not too fond of Trump.

Haha. At least they didn’t call it the inflation reduction act. Now that takes real gall.

You’d have to be an idiot to support people who would insult your intelligence like that.

https://www.youtube.com/watch?v=Wh4hpvZ96fw

Inflation Reduction Act: Biden says he wishes it wasn't named that

Since I was not in favor of either Bush, I take no offense to your critique of them.

Donald Trump has, to best of my knowledge, been the only President in recent history to have: donated all of his Presidential salary to charity, and left office with lower net worth that when he started. And of course, you $3 trillion claim has no supporting evidence, as usual.

What I an convinced we really need is a 100% fatal, wildly contagious, virus that only attacks Democrats, Socialists and Communists.

Hmmm, the Chinese made the last one, maybe they will make one that is actually helpful.

turd, the ass-clown of the commentariat, lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

There is no chance federal spending returns to pre-covid levels. There is no chance consumer prices return to pre-covid levels.

Then there’s no chance that democrats can be allowed to live.

You NAZI Party murderers are losing.

Post any illegal links lately, pedo?

Woodchipper's not a Democrat.

Consumer prices will not return to pre-Covids levels BECAUSE the FED will not allow DEFLATION to occur. They will print ANY amount of money required to prevent deflation.

This is a stated, long term policy.

Nothing is going to be done about the skyrocketing deficit spending and debt. We're headed for an unprecedented economic collapse. It will be a nightmare. Time to prepare either your bunker or your suicide plan.

Stock up on toilet paper? I hear that stuff is like gold.

Pay your bills, deadbeat, and stop whining.

“……suicide plan.”

Yikes. That’s dark, dude.

Sorry, but at my age I'm just not up for a Mad Max scenario. I'm sure many people feel that way, especially older people. As soon as the food riots start, I'm checking out.

"Inflation has fallen, but Americans are more worried about it than two years ago when it was running three times as high—and more likely to view the economy as a whole in a negative light. How can this be?"

How many times does it need to be explained that Inflation is a cumulative process? The reason why Americans are worried about it is because 3% added on top of the much higher previous inflation equals EVEN HIGHER INFLATION. There's nothing magical about the one year time frame that makes it the only thing people should care about.

If your house floods and you stop the water from coming in, you don't just relax and say "problem solved." You now have to get all that water out of your house and repair the damage that was done. If we wanted to play the "inflation target" game (which we absolutely shouldn't), the targets should be cumulative over time: so if there's a sudden spike, then the current target should come down in order to match a much longer term target.

Or maybe just end the Federal Reserve. This article acts like it's discussing the economic problems of 19th Century America when it was the greatest expansion of economic prosperity in the history of the planet.

The 3% Boehm brags about here is still 50% more than under Trump and the fed target.

I am really beginning to wonder if Boehm failed high school math and can't even do a simple pert equation.

Numbers are just feelings.

Math is racist!

Where has the little collectivist Jeff been lately anyways?

Diabetic coma? His heart exploded?

Either way, hopefully dead.

Still using the leftist tactic of saying percentages when the numbers are unimpressive. Like when leftists talk about mass shooting for example, or so-called climate disasters. You’re just like the people you hate.

By the way, if Trump has won the election there still would have been inflation because of all those checks with his name on them.

Math is a leftist tactic? Lol.

Too golden not to bookmark.

Seriously, how stupid are you sarc? Do you have trouble with exponential functions as well? Lol.

I like how you're back to defending democrats by trying to claim they had no contribution and continued increased spending. See IRA and other bills. God you're a dumb leftist fuck.

You know what sarc. I’m going to expand on your fucking ignorance.

Trump was saying no more spending bills after 2019. Biden signed every one.

Biden let in and funded over 6M illegals thr last 4 years, adding consumers to housing, energy, grocery, hospitals, etc. Paid for by government adding inflationary pressure. Ironically you support this shit like a retard.

Biden has limited federal expansion of energy, expansion occurring on leases signed by trump or in states. This reduction on energy supply causes price expansion and inflation.

Biden has ramped up regulatory policy, making costs increase.

But because you’re an economically ignorant little leftist retard whose sole purpose is to attack Trump you deny all this shit.

Attack dog goes whoof!

Fuck off, drunky. He owned your ass with actual facts and you were unable to respond with a coherent argument, so you're calling names.

Retarded troll.

What do you think Sarc has more of? Stupid or Dunning-Kruger?

Way to debate his response, you drunken piece of shit.

Amazing how you can never respond with an intelligent argument.

Well. Not that amazing. You're not intelligent.

When the actual numbers are unimpressive, like something increased from ten to fifteen, it’s expected that people on the left will say “Oh my God the numbers are up fifty percent!” to make it seem impressive.

You’re doing the same thing. You are what you hate.

I don’t care if you bookmark this. The only people you impress with your library of bookmarked comments are losers like you.

You really have the intellect of typical leftist, you actually brag about ignorant you are.

When the actual numbers are unimpressive, like something increased from ten to fifteen

Yes, folks. He really is that dumb.

Losers? Pretty sure we’re all at least marginally successful. While you’re a homeless derelict living in a piss soaked alley behind a bar, that drinks away his welfare checks. The only other thing you do is rant and rave in favor of the democrats here.

When dealing with exponential functions, 50% is meaningful you retarded fuck. It isn’t a comparison of a small sample a to small sample b.

If you weren’t a HS drop out you’d understand this.

If you got a 1% increase to your welfare check instead of 2% you would be losing your shit.

Yeah so people mistakenly perceive that inflation is a problem when it's only 3 percent. This is straight out of the DNC playbook and Boehm plays along. Prices have not and will not return to 2019 levels and even if inflated wages ultimately reach inflated prices your savings and anything you own denominated in USDs is worth a whole lot less.

And sarc just above.

'Surely we're not as susceptible to the psychological effects of inflation as our forebears, for whom a spike in the price of basic goods might be a matter of life and death?'

Americans susceptible to emotions about economics?

Based on comments people write opposing the Kroger-Albertson's merger, I say HELL YEAH! Most of these are narratives about how people love shopping at one brand or store, and despise the other. And how their lives will end if anything changes. All this despite the fact that they can buy the same exact shit for the same prices.

This is bohem getting ready to tell us he is voting for kamala. Hey bohem we already know your an evil fag Marxists peice of shit

Start with Trump. In just four years, he oversaw more than $8 trillion in new borrowing.

The author must be a Democrat for pointing this fact out.

See what I mean about consistent retard?

Official statements like this that destroy his narratives make him so mad:

PROTECTING AMERICANS AND RECOVERING FROM THE COVID-19 PANDEMIC

or stories like this:

With the nation’s financial system on the brink of collapse, all but three Republicans voted against the massive stimulus package designed to protect millions of Americans from financial ruin.

or this:

Democrats Say Relief Programs Could Become This Generation's New Deal

or this:

House Democrats pass $3 trillion relief bill despite Trump's veto threat

or this:

Pelosi unveils $3 trillion coronavirus relief plan amid squeeze from left and right

The DEMOCRATS FAT LIE.

They know it's a FLAT LIE but they'll repeat it without consequence endlessly.

2017 US National Debt $20,244,900,016,053.51

2020 US National Debt $26,945,391,194,615.15

---- BASIC F'EN MATH--------$6,700,491,178,561.64

https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding

$6.7T you LYING P.O.S.

Year to Date

2020 US National Debt $26,945,391,194,615

2024 US National Debt-Clock $35,353,680,000,000

---- BASIC F'EN MATH----------------$ 8,408,288,805,385

Bidens at $8.5T

More to the point, take out the total panic, hair-on-fire spending in 2020, in which Trump was complicit but far from sole responsibility, and the debt during his first three years increased by around $2.5 trillion. We can project that for a normal 4th year to $3.3 trillion.

Not a good thing but less than Obama's 4 year average, and, as you pointed out, way less that Sleepy Joe. Plus with Trump we got lower taxes.

Democrats wanted 50% more spending on the Covid bills.

Yes. It's dishonest to talk about spending in 2020 without pointing out that it was a reaction to the authoritarian Covid scam which crushed the economy over a flu with a fatality rate lower than the 1968 flu which is almost forgotten. Trump didn't crush the economy. State level authoritarians did.

Indeed. Without the DEMOCRAT written, unanimously supported, pushed and passed Cares Act Bill in a [D]-House Trumps highest deficit with a FULL [R]-trifecta was $779B and lowest $665B. Making an [R]-trifecta average over a 4-year Term a total of $2.9T.

Biden’s [D]-trifecta lowest deficit was $1.4T TWICE Trumps Highest and Biden’s highest was $2.8T making the [D]-trifecta average a 4-year Term a total of $8.4T (3-TIMES as much debt).

Leftards are the biggest lying BS’ers on the planet.

It's all on Fatass Donnie. He wanted MORE that Pelosi was willing to spend.

Hey, just like law enforcement presence at the Capitol on Jan. 6.

100% a lie. Quite usual for Democrats to lie though. Lol.

Indeed +10000000. Not just a Lie a self-projecting Lie.

It was the Democrats who were insisting MORE spending.

As-if only a partisan-shill (loyalist w/o question) wouldn’t know that.

turd, the ass-wipe of the commentariat, lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

Facts are leftist.

No, but you are.

Those aren't facts, drunky.

Sarcasmic, "Obvious blatant Lies are Facts!"

Yep; Sounds like a leftard to me.

Weren't you just crying above that inflation was called 50% above target. Lol.

Fucking dumbass

All you care about is whatever the left tells you to say.

Inflation is just the effect of 'Gun' (Gov-Gun) backed $fake$ will make sh*t for us mentality. 'Guns' don't make sh*t.

Something so obvious a preschooler gets it. You'd think after all these years people could LEARN something so obvious (Guns don't make sh*t) and Government is nothing but a monopoly of 'Gun' force.

Yet the criminal-mentality (evil) continues on trying to defy basic common-sense, projecting, making excuses, scamming, lying and stealing; pretending their UN-reasonable equations can some how work if only done ?right? (Which always defaults to by 'Gun' point).

And just like the criminals they are; the more times they get-away with it the more of them join their criminal crusade and the more of them there are till honorable people have to stand up for themselves again.

It seems that for the Keynesians it's 'animal spirits' all the way down. I mean it's not even possible they might be wrong.

Is that the animal spirit that says "All government spending is all good all the time"?

+1 multiplier effect

Here’s a fact that Trump’s Deranged Supporters are incapable of acknowledging: if he’d won the election all those checks he sent out would still have caused inflation.

Here is a fact. Sarc is inferring a strawman that people believe there would be zero inflation so he can defend Kamala and Joe from their contributions. Illegal immigration which sarc is a huge fan of being one of the big causes especially for rents. Sarc also either of lying about the extra spending bills post 2020 passed solely by democrats. Sarc has an incessant need to deflect any criticism away from the left.

When you call it Bidenflation you’re putting 100% of the blame on him while pretending those checks with Trump’s name on them never happened.

Get a life, man. Defending Trump 24/7/365 in the comments of an obscure magazine is pathetic.

Get a life man. Attacking Trump 24/7/365 in the comments of an obscure magazine is pathetic.

Even for you.

Introduced in the [D]-majority house as H.R. 748 by [D]Joe Courtney.

Then there's something about about [R]Thomas Massie objecting.

Course you've been told this time and time again; yet your BS ignorance never hears it.

The article is about "inflation", which is an increase in money supply (devaluation of money). However, some of the initial examples of price spikes were actually due to acute product shortage (e.g. 1788 crop failure causing bread riots in France), which is *not* inflation.

If the author ever updates this article, I hope that examples of acute commodity shortages will be removed, perhaps replaced by more events in which the money supply was actually inflated.

It's not irrational to get upset when someone screws up the value of your money and makes stuff you need cost more, even if the blame is occasionally assigned to the wrong source.

The official story of inflation in the early 2020s is well known.

It didnt happen in isolation or come out of the blue. It is the culmination of 100+ years of the same policies. It seems more that kids under 30 seem to think history started in 2010 or so.

So in the end, my Grandmother was right; if you can't pay cash, you can't afford it.

That applies more to consumption than investment.

But people often can't tell the difference. A house, for example, is a consumption good, that people mistakenly think of as an investment.

It applies to anything requiring Human Labor.

Calling it 'investment' doesn't excuse the Labor like it came from a slave.

Inflation doesn't 'break our brains'.

Most people don't even understand the concept that if you left $100 in a savings account, it will be worth less and less over time. The return on a savings account is usually less than inflation over time, which in my view is pretty close to being a scam. No sane person lends someone money for a negative return, provided they actually know that's what they are doing.

The idea that the currency you use to pay for anything is not a fixed point of reference and always depreciates is a ruse. We are currently quibbling over the rate at which we're spending ourselves into the poor house, with no one saying stop.

People wonder why 'the rich' put their money into everything except a savings account, and don't have a lot of liquidity? This is literally one of the reasons. Things hold value, cash is a depreciating asset. It's also why the idea of 'eating the rich' is absolute nonsense put forward by hucksters to economic retards.

What, exactly, is the government supposed to do with a lot of assets? Just sell them off? To whom? Why does that make sense to them when the government seizing the assets is the one who prints the money? Sure, just printing money is insane (actual inflation) but it's far less insane than seizing assets.

Governments do that because their currency is worthless most times, and it's worthless because of the government's programs. We're on that road now, to be sure, and having a target of only depreciating the cash in your pocket by 2% year over year is batshit insane when you really think about it.

Also, for what it's worth, the ancient examples that predate fiat currency are probably not a good foil for modern inflation. In fact, some of them simply don't apply at all.

Well Said +100000000000000.

The Government wears-out your $/Labor faster than you can wear out a tractor.

A 1960s JD4020 costs more USD all worn out today than it did brand new right off the factory floor.

It was wearing out your $/Labor faster than you could wear out your car during COVID. Probably still is.

The FED has consistently and intentionally destroyed the currency so not only is saving dollars pointless, everybody is forced into speculative investments in the hope that the value will beat inflation. The retail investor must compete with massive wall street bankers who can manipulate asset prices in seconds. Hardly an even playing field. In ancient times when I was growing up grandma could put 10% of her take home pay in a passbook savings account and through the magic of compound interest she had enough to survive on 30 years later. That world no longer exists and since the Fed lowered the bank reserve rate to 0 in 2020, destroying fractional reserve banking, grandma will probably end up paying the bank to store her money.

^ This

This is yet another muddled mess from Reason. Just this line says all you need to know about how bad this is:

"Since the 1980s, inflation control has been one of the Fed's core responsibilities. Regardless of what other problems libertarians might have with the central bank, it's difficult to argue that it didn't do a decent job of keeping inflation low for several decades."

What a bunch of bullshit! For the record, the target inflation rate of the Fed is 2%. TWO PERCENT. That is their goal, written in legislation. In the past 43 years, they have stayed within that range 13 times. The average inflation rate during that time was 60% higher at 3.2%. The Fed exceeded that average 18 years. So they were higher than the (already high) average more than they were meeting their goal.

This is just how terrible Boehm is. He loves to condescend on people for not noticing certain precise details (he has the balls to lament that people don't cheer higher wages as their prices increase in inflationary markets), and then he makes terribly imprecise statements like this.

I don't know what Boehm's political ideology is, but it isn't libertarianism.

Also helps to change the definition of inflation. Works for vaccines too.

It's also worth noting that essentially every single thing that gets excluded from the official inflation calculations has risen in price at a higher rate than the things actually included in the calcs.

The natural state of things is likely for prices to go down: as technology improves, the costs associated with shipping items, preserving perishables and advertising the item's availability should all reduce the cost of producing the item for market.

Agreed. Deflation is the natural course of events.

We should always remember that Deflation, like inflation, is a monetary phenomenon. While it is expected for many things to decrease in price due to productivity improvement (My hour of labor should tend to buy more and more things) that is uneven and will not follow some general trend. Some things are highly resistant to technological price pressure, and others are not.

Deflation should be regarded as the counter-trend to inflation- the general decrease in supply or velocity of money relative to productivity. If productivity stays the same and money supply goes up, we get inflation. If money stays the same, but Productivity goes up, we get deflation.

The reason this is important is that there has never been a Zero sum money supply before in history. There was always some way to mint new currency- even if that meant getting more gold out of the ground.

I'll take my inflation in gold. I have no problem with that.

It's also also worth noting that they've changed the things they include in the calculations over time. So comparing the official rate of inflation as calculated today to the official rate of inflation as calculated forty years ago is comparing, at best, different varieties of apples. And might well be apples and oranges.

More like apples, and processed fruit paste that smells like ass and tastes like roadkill.

Our official government "economists" call this scam "substitution", and it helps them understate inflation by about half.

“Since the 1980s, inflation control has been one of the Fed’s core responsibilities. Regardless of what other problems libertarians might have with the central bank, it’s difficult to argue that it didn’t do a decent job of keeping inflation low for several decades.”

What the fed actually does is manipulate, by decree, the price of money. But ultimately the market decides the real price as we are witnessing in the mortgage market. This is the opposite of a free market economy and libertarians have nothing to cheer about. And Boehm briefly mentions 80s inflation but is not curious about the cause. Just an act of nature I guess. It's worth noting that Nixon in 1971 unilaterally defaulted on the US gold debt as negotiated at Bretton Wood because it constrained his ability to fight wars and expand the welfare state. The dollar became an unrestrained fiat currency and predictably, inflation roared. Half a century later politicians accept without question that there are no constraints on government spending. And they are correct. Meanwhile the Fed covers their asses by "cooling" the economy so, you want to buy a house? Fuck you. We've got too many phoney baloney jobs to protect.

Do we even have to go into the horrible side effects of their policies in an attempt to meet those marks while providing a "soft landing"?

Massive perverse incentives, asset inflation, and the gutting of the middle class, just to name a few. Inflationary whackamole while trying to protect the banking system has been a nightmare for everyone no already wealthy. The current housing cost inflation is just one ridiculous byproduct of the Fed's "decent job", and there's no way in hell you can argue that near zero interest rates and massive pumping from the fed's whiplash monetary policies didn't create it.

They've not done a decent job. That's like saying I did a decent job cooking the peas when they're only a little overcooked and the rest of the dinner is burnt to shit.

"anti-immigrant political rhetoric has been a feature of right-wing politics"

Just...wow. Anyone remember a guy named Clinton?

No. But I remember that guy Reason called the Deporter In Chief. Barach or Obama or something like that.

Inflation is an invisible tax, and no sane person would want it.

I dunno. If I owed the world $32 trillion, I might like a spell of hyperinflation now and then.

Precisely why there is also a Debt Interest payment on that debt.

Speaking of immigration (hey Eric brought it up) the August jobs report is out and the good news is Koch Industries is a big winner.

"Great Replacement Job Shock: 1.3 Million Native-Born Americans Just Lost Their Jobs, Replaced By 635,000 Immigrants"

https://www.zerohedge.com/markets/great-replacement-job-shock-13-million-native-born-americans-just-lost-their-jobs-replaced

Starting at the top, while the number of employed workers did rise by 168K, looking closer at the composition of this increase is disastrous: that's because it consisted of an increase of 527K part-time jobs, offset by a 438K plunge in full-time jobs.

This means that since last June, the US has added just over 2 million part-time jobs, and lost over 1.5 million full-time jobs.

And while the quality of job gains in the past year has clearly been catastrophic - a necessary condition to give the impression that headline, or quantiative, job growth was strong - there was a very clear reason for that, and it goes back to what we have been pounding the table on in the past: the reason is the continued replacement of native-born workers with immigrants (some legal but mostly illegal). And as the following chart shows, it is anything but a theory: it is cold hard fact.

In an absolute shocker of a data point, in the past month, the US added 635K foreign-born workers, while losing 1.325 million native-born workers. This was tied for the biggest one-month drop in native-born workers since the covid crash!

As long as enough of the poors vote (D), and enough immigrants do the same (before or after they are citizens), it's all good.

That number, like all others, will be revised.

Overall, 18 percent of respondents blamed Biden and 10 percent blamed “greed,” but low-income respondents are far more likely to blame the president (22 percent of them do) than high-income earners (12 percent) are.

The attempt to assign blame is usually a consequence of a divide and conquer strategy not a real understanding of what is causing that inflation. Libertarians suck just as hard as anyone else in trying to ‘explain inflation’ (read – create a particular narrative for their preferred divide-and-conquer strategy). This article is an example. It is not gummint that creates money anymore. It is banks/FIRE that does so – via issuing debt.

We spend way too much effort trying to pretend that public debt/GDP means something special. It doesn’t. It is merely one of many different types of debt. All of which create inflation in the debt issuing/spending phase – and deflation in the debt payback phase.

The data that means something is total debt to GDP.

Where that total debt/GDP number was about 725% in 2008; 725% in late 2019; rising to about 825% of GDP in early 2021; now falling to about 735% of GDP now.

It’s very easy to see the spike in debt that ultimately led to inflation. Very easy to quantify the amount of monetary/debt stimulus – $22 or so trillion. One entire year's worth of income. Very easy to see the Fed ‘mistake’ (it wasn’t a mistake it was as always a bailout) of early 2020. They should have kept interest rates as is or even raised them since debt/GDP was rising not falling. And the final fixing of the Fed mistake as that debt spike is reversed.

What becomes a bit troubling to the libertarian narrative is that $22 trillion of extra debt stimulus (inflation creating) in 2020 is not very close to the 6 or so trillion in extra government spending.

It amazes me you can’t see the obvious…

“but low-income respondents are far more likely to blame the president”

Identify as ‘low-income’ and a ?free? dinner is expected from the people.

That is the mentality problem of the nation.

Believing their lack of effort entitles them to everyone else’s labors.

Ya know; almost like those slavery days when anothers labors was legally ‘owned’ by another.

Washing away foundational concepts such a Liberty and Justice and replacing them with flat-out selfishness and greed while running around self-projecting day-in and day-out.

And all you want to do is play equation games still trying to figure out how to get something from nothing. Maybe your total debt to GDP plays a bigger factor in less GDP than it does debt. Maybe too many think their laziness is suppose to be part of the GDP (ironically; calculated that way - includes Gov-Spending).

Like it or not - inflation is mostly created by those who use debt to leverage their spending up. Not merely govt.

As the article states inflation is always a monetary issue. The only entity that can increase monetary supply is government. Private actors cannot, by definition, cause inflation.

The only things that create money are:

coins (irrelevant now)

bills (which are also irrelevant - and entirely a consequence of banks even if the Comptroller manages the production)

bank accounting transactions when loans are created.

Let me repeat - the first two are irrelevant now. Unlike either the gold standard or Germany 1923. The latter is how money is created now - and it does not matter one whit (re inflation) whether the money is created through a private loan or a public one.

The purpose of the ideological sales pitch now that 'only govt creates money' is SOLELY to pretend that 'real money' is created by hard work and 'fake money' is created out of thin air but only by govt. Well guess what. There's no difference between 'fake dollars' and 'real dollars'. They are all created by banks - and out of thin air. Regardless of who is borrowing the money

"There’s no difference between ‘fake dollars’ and ‘real dollars’. They are all created by banks – and out of thin air."

Do you not realize that is a contradiction?

The whole ‘real’ in ‘real dollars’ is it cannot be created out of ‘thin air’.

You may want that to be how money is created. But it is not how money is created now.

This guy explains inflation pretty well. Maybe Better than Eric.

https://www.zerohedge.com/political/kamalanomics-means-more-inflation-america

Governments do not reduce prices. Governments create and perpetuate inflation by printing currency that loses value every year.

Corporations, landlords, and grocery stores do not create or increase inflation; they reduce it through competition and efficiency. Even if all corporations, grocery stores, and landlords were evil and stupid at the same time, they would not make aggregate prices rise and consolidate a constant trend of increases. For the same quantity of money, even a monopoly would not be able to increase aggregate prices. The only one that can make aggregate prices rise, consolidate, and continue increasing, although at a slower pace, is the government issuing and printing more currency than the private sector demands.

By admitting that the deficit will soar by $16.3 trillion in ten years in a budget that expects record revenues, no recession, and continued employment growth, the Harris team is conceding that they will strive for inflation to dilute the currency in which that debt is issued… and make you poorer.

Interventionists argue that the government does not have a budget constraint, only an inflation constraint, and can always tax the excess money in the system. Beautiful. This implies an increase in the size of the government during periods of economic expansion and further government expansion during periods of perceived normalcy. The government receives an enormous transfer of wealth from the productive sector, resulting in the creation of a dependent citizen class.

High taxes are not a tool to reduce debt. High debt and high taxes are tools to confiscate the productive sector’s wealth and create a subclass of dependent citizens.

Socialism redistributes middle-class wealth to bureaucrats, not rich to poor.

Massive government spending, constantly increasing taxes, and printing money.

A plan to reduce the economy to serfdom.

Harris’ economic plan is not aiming to reduce inflation but to perpetuate it. Indeed, this economic policy mirrors Argentina’s 21st-century socialism, and it threatens the US dollar’s status as the world’s reserve currency. The government does not determine the level of confidence in a currency. When confidence in a currency declines, it does so quickly. Saying it will not happen in the US because it has not occurred yet is the equivalent of driving at 200mph and saying, “We have not killed ourselves yet; accelerate.”

Governments do not reduce prices. Governments create inflation.

Nothing proves that better than.....

Grocery Pricing versus Commie-Healthcare Pricing.

+100000 well said.

Inflation is always and everywhere a monetary problem. CPI is a bogus manipulated metric. The only way out is separating Money from State via a ‘sly, roundabout way’. I’m very surprised that Eric didn’t even utter a whisper about the solution that’s been gaining steam over the past 14+ years. The natural state of a free market is falling prices, so the presence of inflation is proof of a manipulated market. In a free market overall prices should drop ~3-5% per year but the Fed aims for a 2% inflation target. That implies the government is debasing the money at an average of 7% per year resulting in an our money losing half of its value every 10 years.

That is unconscionable. What is this ‘sly, roundabout way’? Bitcoin. Orange is color of Reason and Bitcoin.

Separate money from state.

I agree and as the article I posted above notes, businesses in a free competitive market reduce inflation by increasing efficiencies and they cannot by definition increase inflation because they cannot increase the money supply. Deflation is the natural course of events. If Bitcoin can actually function as a widely used alternative currency it can separate money from the state if and when a majority lose faith in the USD. But. government will do everything in it's power to prevent that. And lately Bitcoin has become mostly an investment vehicle with it's value measured in USDs. Trump has recently become a Bitcoin believer and says the treasury should hold it as a reserve asset. A Harris administration will of course try to crush it.

"Since the 1980s, inflation control has been one of the Fed's core responsibilities. Regardless of what other problems libertarians might have with the central bank, it's difficult to argue that it didn't do a decent job of keeping inflation low for several decades. Keep in mind: One of the reasons people seem to be so bothered by inflation rates between 3 percent and 4 percent is that inflation averaged well below 2 percent for so long."