Inflation Is So Back

Consumer prices rose 0.4 percent in March and the annual inflation rate ticked up to 3.5 percent, the highest rate seen since September.

At the start of the year, it looked like America's fight with inflation was finally coming to an end.

Not so fast.

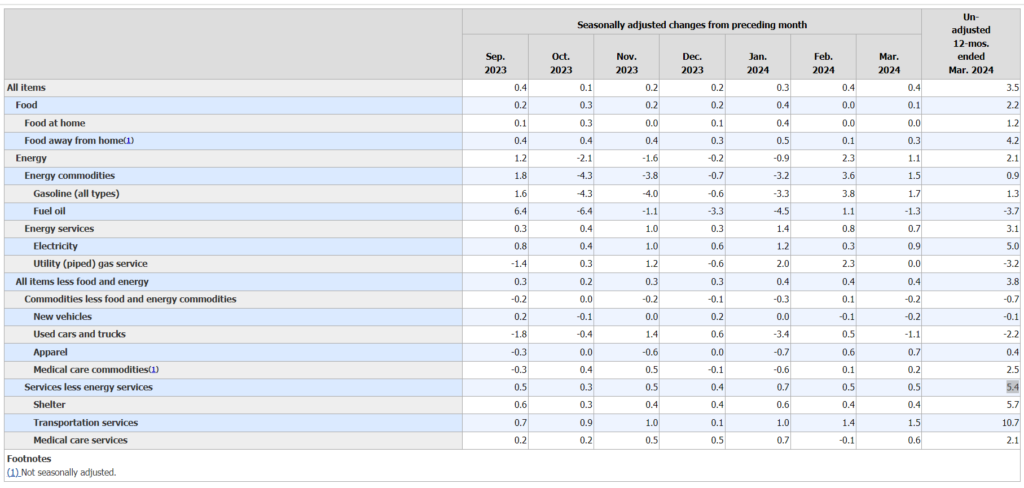

Consumer prices rose 0.4 percent in March and the annual inflation rate ticked up to 3.5 percent, according to data released Wednesday morning by the Department of Labor. So-called "core inflation," which filters out the more volatile categories like food and energy prices, also jumped 0.4 percent in the past month and has climbed by 3.8 percent since a year ago. Both figures rang in higher than expected.

Inflation remains well below the shockingly high levels reached in 2022—when it peaked above 9 percent—but the past two months have been a worrying reversal. March's annual inflation figure of 3.5 percent is the highest mark since September.

Prices had increased by no more than 0.2 percent in October through December. A small jump in January was waved away as an "anomaly" by some analysts, but that no longer appears to be the case.

The new data released Wednesday "are not kind to the thesis that January was a seasonal anomaly," Jason Furman, the Harvard economist and former White House economic advisor under President Barack Obama, wrote on X (formerly Twitter). "The issue is services inflation has been unrelenting, much of that shelter."

Indeed, prices for shelter—a category that includes rental housing, but also things like hotel room prices—are up 5.7 percent over the past year. But other aspects of the service sector are also playing a role in inflation's rebound too. Prices in that category rose by 0.5 percent in March and are up 5.4 percent over the past year, likely reflecting rising wages.

As The Washington Post's Heather Long pointed out on X, vehicle costs are particularly high right now—a significant factor for many American households, since 90 percent own at least one car. Insurance costs are up 22 percent in the past year, while car repair prices have surged by more than 11 percent.

While the most important impact of ongoing inflation is obviously how it affects Americans' household budgets, there's also the undeniable question of what this means for the presidential election, now less than seven months away. President Joe Biden's message of an economic recovery may continue to struggle against the trend of rising prices. Then again, former President Donald Trump has so far not outlined a clear answer for addressing inflation—and his signature economic policy of higher tariffs would likely raise prices even higher.

Perhaps the most important fallout from Wednesday's inflation report will be the response of the Federal Reserve. The central bank had previously indicated a willingness to consider three rounds of interest rate cuts this year—potentially good news for anyone seeking loans or mortgages in the future.

But, with higher interest rates being one of the few useful tools for combatting high inflation, the latest price data may throw cold water on that plan, The Wall Street Journal reports. Federal Reserve Chairman Jerome Powell recently said that the central bank would want more confidence that inflation is falling towards 2 percent before cutting rates.

"If the Federal Reserve was thinking of cutting interest rates at its next meeting later this month, it probably isn't now," said Ryan Young, an economist with the Competitive Enterprise Institute, in a statement to Reason. "Just as the last mile is the costliest part of shipping, the last percentage point is proving to be the hardest part of fighting inflation."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

It's not back. It never left.

We will have inflation as long a democrats control any part of the government.

I suspect that you're one of those people who wants a strong economy, full employment, and zero inflation.

Who doesn’t want that?

I would like that but it's impossible both in theory and practice. Hence "want" is absurd, like my wanting a threesome with Megan Fox and Scarlett Johansson.

You used the word want.

I'm mature enough not to want the impossible. YMMV.

Oh really?

..like my wanting a threesome with Megan Fox and Scarlett Johansson.

I said, "absurd".

Seen Megan Fox lately? She's becoming an abomination of plastic and ink.

I can live with it.

https://www.dailymail.co.uk/tvshowbiz/article-13218217/Megan-Fox-plastic-surgery.html

What a waste.

I would take that threesome if it included a trip back in time to 2007.

Appears you are not mature enough to not to want the impossible.

According to shrike.

At least the impossible things I’m too immature to want don’t include fucking small children. Not like Shrike, or guv’na Shrike, or Jeffy.

On the contrary, deflation was the norm for millennia and there were periods in there with both a strong economy and full employment. The economic theory asserting that they are mutually unachievable goals is a very beautiful theory but it does not fully describe the historical facts.

Absolutely.

Look up "inflation 1800-present", here's one link.

https://economics-charts.com/chart-of-consumer-price-index-1800-2005/

Look at how steady overall prices are, up until the creation of the Fed in 1913. Little wiggles up and down. Larger wiggles up during wars, larger wiggles down afterwards. Notice the overall long term down trend after the Civil War, as productivity gains lowered prices.

Good hard gold money.

It is required under MMT to justify government spending now.

On the contrary, deflation was the norm for millennia and there were periods in there with both a strong economy and full employment.

Really? Evidence?

The economic theory asserting that they are mutually unachievable goals is a very beautiful theory but it does not fully describe the historical facts.

Find me a counter example from the onset of the industrial revolution

Do you know how CPI is calculated and how products move in and out of the calculation?

Yes.

non-sarc: fwiw If you've not come across hedonic regression before, you might find this interesting.

https://en.wikipedia.org/wiki/Hedonic_regression

(I first came across it when I was part of an abortive attempt to get the real estate derivatives market off the ground in the US.)

Deep fakes are getting pretty good these days, man.

What is 'full' employment? How about we have jobs not created by the government that aren't necessary. Have you actually looked at the jobs report? Most are government jobs and part time jobs. Also why has the report been revised down 11 out of 13 times?

Long is right currently. Biden's view is "hey we are in debt, let's spend a lot more". Maybe if the government lived within it's means inflation would drop.

I don't want a threesome with Megan Fox. She is too plastically now

Maybe Jewel Staite and Morena Baccarin, possibly Summer Glau from their Firefly years, or substitute Allyson Hannigan for any of those three, especially her Buffy years.

I don't get the Allyson Hannigan thing at all. Morena Baccarin, on the other hand - Gal Gadot with acting ability and a hint of teh crazy.

Throw in Eliza Dushku form her Buffy years and I’m definitely there.

When you have a party who believes in extremely loose monetary policy, you tend to get the consequences of that when said party controls monetary policy.

Both major parties tend to loose monetary policy when in power.

https://fred.stlouisfed.org/series/M2SL

Perhaps, but Modern Monetary Theory is off the charts on that.

Good thing no one is trying to implement MMT today. M2 supply is down 4.4% in two years.

Just quit reading Zerohedge pal. They suck. It is where Jesse gets his bullshit lies.

Good thing inflation was transitionary. Hey guess what happened when the M2 supply shrunk in the past.

Four times over the last 154 years when this money supply metric fell by 2% or more. Two of those instances were in the 19th century -- 1878 and 1893. The other two occurred in 1921 and 1931 through 1933.

Yeah, we're past due for a recession (maybe worse).

So why cry about inflation now? Enjoy the full employment and record stock prices.

I keep buying puts on that over-priced garbage Carvana and the shit keeps going up.

…and record stock prices

Humorously said on a day the Dow dropped 422 points.

The stock market doesn't have to go up every day. After today's drop, the Dow is still higher than at any time before Jan 2024. Still, I prefer the S&P500 as an index. And that too has recently seen record heights.

Still, honesty (look it up in the dictionary) compels me to note that in the long term the stock market goes up so record-breaking levels don't necessarily mean too much. Without checking, I suspect that all modern presidents experienced record stock market levels.

More relevant is to look at returns relative to prior administrations or periods. I'm sure the arithmetic isn't beyond you.

Aren’t you a fun guy.

turd, the TDS-addled ass-clown of the commentariat, lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

turd, the ass-clown of the commentariat, lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

Other than Nixon ramping up inflation by taking us off the gold standard, and Trump kicking off our current inflation by adding trillions of dollars to the economy, yeah it's definitely all because of Democrats.

Not a lefty.

Whatever their faults, Republicans at least sometimes try to reign in spending. When’s the last time a Democrat even thought of doing that?

The last time a president tried it was Obama. Then before that Clinton.

They actually both cut the deficit quite a bit.

Fatass Donnnie? Deficit skyrocketed.

Obama ran trillion dollar deficits until the Republicans took the House and cried like a little bitch when Republicans passed sequestration. Fuck off with your revisionist bullshit.

This is completely false but expected from a dumbass democrat.

See ACA. See Obama budget proposals. See Obama comments against Ryan and shut down threats. See Obama campaign videos against Romney.

Do you ever try to be honest?

The deficit initially went up under Obama in response to the financial crisis, but thereafter it declined, though not to pre-Obama levels. When Trump became president, the annual deficit promptly started rising (contrary to his promises and claims) and eventually exploded - even pre-Covid,

https://fred.stlouisfed.org/series/FYFSD

See shrike. This is why you are called shrike. I asked you, shrike, about the specific actions of Obama. Not the end result of compromise with the House GOP.

But in your rush to be just like shrike you rushed in to defend Obama despite his specific actions. Got it shrike?

Also notice your reliance on the stl fed just like shrike. Lol.

Listen, you lying cunt, anyone who uses Fed data will go to Fred because that’s the fucking source. Though I don’t recall you ever citing them, possibly because you prefer not to contaminate your opinions with actual data.

And as far as defending Obama is concerned, why shouldn’t I? He was better than Bush, who you probably voted for (though possibly you voted for Pat Buchanan), and than Trump, who you voted for. You lied, or at least misrepresented, and I presented actual facts.

Your position now appears to be that anyone who corrects your errors/lies is shrike, and that anyone who uses primary government sources is also shrike: “Oh look, SRG2 is citing BLS for BLS stats! SPBP also uses BLS for BLS stats, they must be the same person.”

Simmer down guv’na Shrike.

Okay shrikr. Then answer the question and examples i posited. Where did Obama want reduced spending?

An you answer shrike? Or are you pretending congress doesn't apply to any of the process like shrike?

Obama proposed budget was always higher than what the House GOP passed. He wanted MORE spending. He and Pelosi worked, we have evidence, to reduce the CBO costs for ACA. He modified SSA disability to INCREASE the costs of the SSA disability program. He didnt want to reduce the deficit. But he sure took credit. Because doing so works on democrat sycophants like yourself.

Got it?

You were addressing SPBP not me.

I merely provided some data, Got it?

Now fuck off, you lying cunt

Republicans talk a good talk when they're not in power, but when they actually are in power spending always goes up.

And when they don’t hold both chambers and the presidency, they generally try to rein it in. The Democrats have literally never done that in my lifetime, instead taking the Republicans overspending and ramping it up. So it’s not even a close comparison.

They had that opportunity with Trump, and they were like lesbians in a locker room. Didn’t do dick.

In trumps first 3 years 2/3rds of spending growth was payments on the debt and entitlements. Source: Eric Boehm. Two things not able to be reigned in because of the neocons you want to return to and democrats.

Continue.

Increase in on-budget interest payments,$,000

2016 $11,459

2017 $18,455

2018 $59,721

2019 $48,878

Source: OMB

Shrike. I gave you the source. You stopped posting it after I kept quoting from Mr. boehm. Do you want to know one of the biggest increases? ACA and Medicare expansion costs passed under Obama. Lol.

Growth in interest is here. Note this growth is from passage of various programs passed under Obama.

https://www.pgpf.org/blog/2023/02/interest-costs-on-the-national-debt-are-on-track-to-reach-a-record-high

Your numbers are additive. So between 2015 to 2017 the increase is 100B a year in spending increases. Who the fuck do you think you're fooling shrike?

I didn't start posting until after your post. You may have provided actual data from Boehm before, but all you did here was claim that this is what Boehm posted.

And indeed, all my data show was that the interest rate expense jumped sharply after two years of Trump - which is not something one would have expected given your claims.

I am well aware of other factors increasing the deficit - of course, because I actually have the OMB's historical tables downloaded for ease of reference.

It is a fact that after the initial high deficit, the annual deficit thereafter came down under Obama. It is also a fact that it rose under Trump and jumped sharply towards the end - and you cannot blame all of that on Obama. Trump's tax cuts assuredly contributed to the rising deficit.

BTW didn't Trump promise a cheaper better healthcare system? Whatever happened to that promise, I wonder?

https://www.history.com/this-day-in-history/fdr-takes-united-states-off-gold-standard

Oh. Sorry. Not supposed to talk ill of democrats.

SPB2 will be along shortly to explain that it's not all that bad.

His sock (SRG2) has already chimed in.

Another lying POS, I see. And evidently too stupid to make up your own mind, being content to believe JesseAz's initial lie.

Poor shrike.

He may well be. I don't know. I am not.

You were that kid in HS who desperately wanted the cool kids to like him, so made pathetic attempts to please them.

Jesse’s sycophants (they know who they are) are among the most pathetic people I’ve ever had the misfortune of dealing with in my entire life. Worse than middle school.

You need to brag more about muting people.

Pretty sure he mutes me. He’s been terrified of me since he drunkenly threatened me last year. He’s hid like a little bitch since then.

Jesse’s sycophants

If you would just show the proper fealty to Trump you could be cool like them.

It’s not so much fealty to Trump that’s required to be part of the clique. You’ve got to join in on telling lies to and about people to goad them into defending themselves, then ramp it up if they say anything. Just like middle school only with less pointing. That you can see anyway.

Awe, poor sarc.

Yep, pour Sarc.

turd, the ass-clown of the commentariat, lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a TDS-addled lying pile of lefty shit.

You deal with yourself every day buddy. Why you drown yourself in alcohol and delusions.

Die.

Hey shrike!

"Inflation is back."

"Gee, we missed you so much," said no one, ever, at any time.

This, unfortunately, is untrue. Debtors love inflation. They love it because they get to pay back their debts with dollars that are worth less than the dollars they originally borrowed.

Notable to this discussion - the US government is the world's largest debtor. Which means to me that we will never get our inflation problem under control until we first get our debt under control.

That will never happen as long as voters pick politicians who promise free shit.

We hit Peak Free Shit in 2020 when Fatass was POTUS.

(ML screams NOT FAIR! as his lame response)

Forgot about student loan forgiveness?

"We hit Peak Free Shit in 2020"

This is one of those cut-off-from-reality, pure narrative fantasy posts that defy explanation.

Similar to Obama ended combat in Iraq / Reagan nominated Ginsberg to the SC / all presidents since Clinton were impeached.

(Yes, some of those were sarc, but the venn diagram between your delusions and his is becoming a circle.)

Show your math.

The deficit blew up to $3.1 trillion in 2020 because of Free Shit.

Of course "free shit" is subjective. Biden's student loan giveaway fits it of course. But CARES and PPP were massive.

Dude, math makes Trump look bad. That means math is leftist.

I’m sure you’re stoked for another deficit free four years of Biden.

Are you two still retardly blaming Trump for Covid?

How desperate are you two?

Trump hasn’t been president for over three years. Since he became president, Biden has turned absolutely everything he touches into a dumpster fire, but these assholes make it all about Trump.

It’s a very special combination of dishonesty, stupidity, fanaticism, and treason that drives these faggoty, subnormal hunks of rotting crap.

Why is Biden still giving away free stuff? Between question since Covid has been done, why is Biden still wanting a 1.5 trillion deficit per year? Yeah no free stuff in that right? No crony payouts?

If it's Orange man is bad and runs up debt slower vs Pototaus who runs up debt like a champ, Orange man isn't so bad.

Potatus made me almost spit out my tea all over my phone.

It sure is amazing how Trump did that unilaterally with no involvement from the legislative branch.

turd lies. turd lies when he knows he’s lying. turd lies when we know he’s lying. turd lies when he knows that we know he’s lying.

turd lies. turd is a TDS-addled lying pile of lefty shit and a pederast besides.

PPP lasted maybe 3 years. Obamacare permanently raised baseline spending and will continue to add to entitlement spending (the bulk of all nondiscretionary spending) for all eternity.

My root canal treatment and dental crown probably cost close to 2,000- 3,000 dollars, which is around what I got from the government during the pandemic. I'm not even on food stamps or other benefits. Millions are. It's hilarious to see you freak about "free shit" with zero sense of perspective.

Free shit wasn't the driver of inflation. The entire country was locked down or semi locked for over a year, which led to intense demand of certain items. Surplus cash chasing he same amount of limited goods - inflation.

Most of this is on your side. Many blue states became draconian on lockdown and hampered recovery for FAR longer than they should have. Their hostility to law and order almost certaintly led to normalizing theft, which wrecked havoc on volume heavy retail industry.

There’s hordes of knocked up teens and baby daddies coming from all over the world for something? Camping on an interstate median strip ain’t it.

An American president sent everyone a check with his fucking name on it. That's definitely Peak Free Shit.

After your precious democrats shit everything down for months and months without any real justification or legal authority.

Goddamn you’re a lying drunken pussy.

And, some James Bond Villain nazi publishes a global autocratic book

‘Covid 19, The Great Reset’

I thought you were joking, but a lougle search revealed this…..

https://www.amazon.com/exec/obidos/ASIN/2940631123/reasonmagazinea-20/

I mean, goddamn, we really need to cleanse the world of these people.

Seeing you and shrike spiral down into spitting lunatics gives me hope that Biden really is going to lose. Thanks both of you!

"An American president sent everyone a check with his fucking name on it."

The problem wasn't just the check. Millions of people get social security checks every year.

Inflation exploded when the pandemic created a supply logjam. People started to hoard certain items in lockdown conditions. Surplus money chasing limited goods = inflation. The summer riots and prolonged school lockdowns didn't help.

The pandemic destroyed so many businesses that the "job gains" that appear incredible on paper aren't meaningfully net gains. Even the MSM recognizes this.

turd lies. turd lies when he knows he’s lying. turd lies when we know he’s lying. turd lies when he knows that we know he’s lying.

turd lies. turd is a lying pile of lefty shit and a pederast besides.

I took out a line of credit at 2.75% 2 years ago. 5 year payback, $50k maximum. Only used about 25% but relatively free money.

It’s been entertaining watching millennials, and gen Y/Z kids freak out about interest rates in the 5-7% range. Then I regale them with tales of the Carter years. The look on their faces is always priceless.

You know, that's one of my biggest "OK Boomer" moments.

I get that it was rough in your day, walking up hill, both ways, in the snow, etc... Everyone likes to chime in on the "You don't know..." stories.

But that detracts from the real issue, which is the remarkable damage to the housing market done both by decades of suppressed interest rates combined with QE and bailouts -- basically driving dollar price of housing way up while restricting normal homebuyers from getting a mortgage during the time when house prices were suppressed (Dodd-Frank was a big part of that).

That, compounded exponentially by free money policies on the back of the 'rona era economic shutdowns means everyone who had a house got a lovely re-fi at 3%, and now they'll NEVER sell the thing because moving would boost their payment by $2K a month. Ever see water poured on a grease fire? Yeah, best analogy I can think of for the Fed's policies in the last 4 years. And it's a fire they caused, after 2008, which was the result of trying to engineer a soft landing for the dot com bust at the turn of the century.

I get Gen-Z bitching about rates. They've been getting fucked around by the government their whole adult life, and they're seeing record high prices for housing -- rental, too. Sure, grampa paid 9%, and maybe even 12% for a couple years on a house he bought in the 1980s until he could refinance after the recession, but morgage rates were 8% in the 70s, and 8% in the 90s, so the pricing was stable.

Gen Z doesn't give a shit about rates, specifically. They give a shit about an apartment that was $1100 a decade ago being $2500 today, a house that had a mortgage/tax payment of $2500 5 years ago being $4500 today. Sooner or later it has to balance out, but when you're under 25 it has only been getting worse for literally your entire life.

I was told that it's transitory. Therefore, anyone who claims different is a transphobe.

>>At the start of the year, it looked like America's fight with inflation was finally coming to an end.

to whom?

Chtst.

To whom brother! To whom!

Does no one get that quote?

Experts, economist technocrats and top men at D.C. cocktail parties and X.

exactly. ^^^^

As long as I can inflate away the loan on my bitchin' Camaro...

Did you drive it up from the Bahamas?

he ran over his neighbor. now he's in all the papers.

Is his dad the mayor?

I hear it's the reason he didn't get arrested.

"... with higher interest rates being one of the few useful tools for combatting high inflation ..."

By all means focus on the Fed and pretend that cutting trillion-dollar deficit spending every year wouldn't be a thing ...

People are dying! Maga! Democracy!

Recent: 20 billion to NGO Maoist jobs programs:

https://www.msn.com/en-us/money/markets/biden-admin-to-fund-20-billion-for-green-bank-projects/ar-BB1l4w1k

Magic money tree, 2024!!

Oh yeah, Newsom lost track of ~40 billion in NGO fix homelessness jobs/spending in the PR of CA.

Silicon Valley FAANGs should be threatening to leave the state over this.

https://www.washingtonexaminer.com/news/2925437/california-lawmakers-propose-slash-73-billion-budget-deficit-newsoms-rainy-day-funds/

turd hardest hit!

*****

The average yearly inflation rate since 1914 is 3.3 percent. Hopefully that puts some perspective on the March 3.5 percent yearly rate.

link?

Inflation has really risen, but I don't see wages rising as well. Nobody is reducing rents and prices in general)) Simple hard workers are looking for any ways to improve their lives. My eldest son began to read soccer-tips.ke instead of online games. Apparently it pays for itself faster than washing cars at the local car wash.

The bots are beginning to learn…

Someone is getting their ?free? ponies bill.