Inflation Is So Back

Consumer prices rose 0.4 percent in March and the annual inflation rate ticked up to 3.5 percent, the highest rate seen since September.

At the start of the year, it looked like America's fight with inflation was finally coming to an end.

Not so fast.

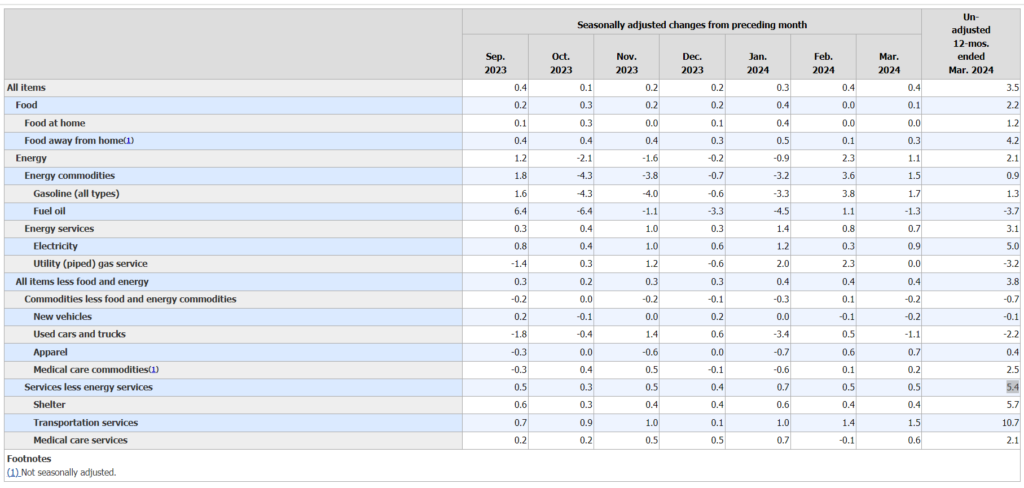

Consumer prices rose 0.4 percent in March and the annual inflation rate ticked up to 3.5 percent, according to data released Wednesday morning by the Department of Labor. So-called "core inflation," which filters out the more volatile categories like food and energy prices, also jumped 0.4 percent in the past month and has climbed by 3.8 percent since a year ago. Both figures rang in higher than expected.

Inflation remains well below the shockingly high levels reached in 2022—when it peaked above 9 percent—but the past two months have been a worrying reversal. March's annual inflation figure of 3.5 percent is the highest mark since September.

Prices had increased by no more than 0.2 percent in October through December. A small jump in January was waved away as an "anomaly" by some analysts, but that no longer appears to be the case.

The new data released Wednesday "are not kind to the thesis that January was a seasonal anomaly," Jason Furman, the Harvard economist and former White House economic advisor under President Barack Obama, wrote on X (formerly Twitter). "The issue is services inflation has been unrelenting, much of that shelter."

Indeed, prices for shelter—a category that includes rental housing, but also things like hotel room prices—are up 5.7 percent over the past year. But other aspects of the service sector are also playing a role in inflation's rebound too. Prices in that category rose by 0.5 percent in March and are up 5.4 percent over the past year, likely reflecting rising wages.

As The Washington Post's Heather Long pointed out on X, vehicle costs are particularly high right now—a significant factor for many American households, since 90 percent own at least one car. Insurance costs are up 22 percent in the past year, while car repair prices have surged by more than 11 percent.

While the most important impact of ongoing inflation is obviously how it affects Americans' household budgets, there's also the undeniable question of what this means for the presidential election, now less than seven months away. President Joe Biden's message of an economic recovery may continue to struggle against the trend of rising prices. Then again, former President Donald Trump has so far not outlined a clear answer for addressing inflation—and his signature economic policy of higher tariffs would likely raise prices even higher.

Perhaps the most important fallout from Wednesday's inflation report will be the response of the Federal Reserve. The central bank had previously indicated a willingness to consider three rounds of interest rate cuts this year—potentially good news for anyone seeking loans or mortgages in the future.

But, with higher interest rates being one of the few useful tools for combatting high inflation, the latest price data may throw cold water on that plan, The Wall Street Journal reports. Federal Reserve Chairman Jerome Powell recently said that the central bank would want more confidence that inflation is falling towards 2 percent before cutting rates.

"If the Federal Reserve was thinking of cutting interest rates at its next meeting later this month, it probably isn't now," said Ryan Young, an economist with the Competitive Enterprise Institute, in a statement to Reason. "Just as the last mile is the costliest part of shipping, the last percentage point is proving to be the hardest part of fighting inflation."

Show Comments (122)