87% of Americans Want Politicians To Do Something Before Social Security Runs Out of Money

Entitlement reform has long been considered a third rail in American politics, but that perspective might be changing.

Entitlement reform has long been considered a third rail of American politics, even as the insolvency of Social Security and Medicare creeps closer.

That perception might need some reconsidering. A new poll shows that the vast majority of Americans believe policymakers should make changes as soon as possible to extend the life of America's two old-age entitlement programs and avoid possible benefit cuts that will hit in the early 2030s if nothing is done.

That poll, which was shared with members of Congress and staffers at a closed-door meeting on Wednesday morning and obtained by Reason, found that only 5 percent of voters say Congress and President Joe Biden should do nothing to address the looming benefit cuts that will hit Social Security when insolvency hits.

"Our polling shows that Americans are seriously worried about the solvency of these entitlement programs," David Williams, president of the Taxpayers Protection Alliance (TPA), a free market group that sponsored the survey (it was conducted in August and included about 1,000 likely voters). "Congress can no longer continue to ignore the facts that without action, Social Security and Medicare will face deep and automatic cuts."

Indeed, the poll suggests that many Americans have a better understanding of the crisis facing Social Security and Medicare than most elected officials seem to believe. In the survey, 87 percent of respondents agreed that action is needed to extend Social Security's solvency and avoid benefit cuts, and 89 percent said the same thing about Medicare.

According to the trustees responsible for overseeing the two programs, Medicare's main trust fund will be depleted by 2031 and Social Security's reserves will be gone by 2033. Though those trust funds are largely an accounting fiction, their insolvency will trigger mandatory across-the-board cuts that will affect retirees and anyone who expects to benefit from the programs in the future. The two programs are also the primary drivers of the federal government's future budget deficits, responsible for 95 percent of long-term unfunded obligations, according to the Treasury's recent Financial Report. Those looming problems are contributing to the federal government's declining credit rating and threaten America's future economic growth.

Despite that, leading politicians on both sides of the aisle continue to promise that inaction is possible. Biden has used fictional Republican plans to cut Social Security to demagogue against the idea that reforms to the program are necessary—most notably by sparring with GOP members of Congress during this year's State of the Union address. Meanwhile, former President Donald Trump (the leading contender to be the GOP's presidential nominee in 2024) has repeatedly promised not to touch Social Security, and other prominent figures on the so-called "New Right" have done the same.

Realistically, the only serious approach will require some changes to existing Social Security benefits. That could mean reducing benefits for wealthier retirees or implementing across-the-board benefit reductions that would be phased in over time, allowing younger workers to offset smaller Social Security benefits with private savings. Ideally, workers would be able to opt out of Social Security altogether, so they can save and invest for their own retirement without having to pay payroll taxes.

But none of those options can begin to be considered if a critical mass of elected officials continue to ignore the problem.

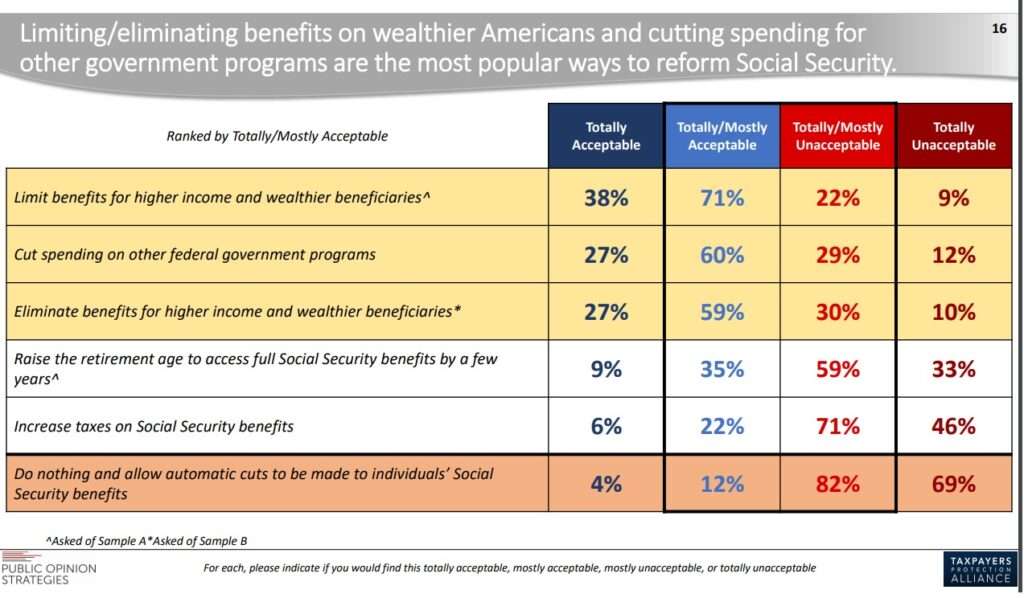

The TPA poll released Wednesday offers some insight into how more serious politicians might proceed. The poll found that 71 percent of Americans find means-testing for Social Security benefits—that is, limiting benefits for wealthier recipients—to be acceptable, while 60 percent would approve of cutting other government programs to fund Social Security.

When it comes to Medicare, 66 percent approve of means-testing benefits, and 84 percent are in favor of the always-popular option of reducing rampant fraud and waste within the government-run healthcare system.

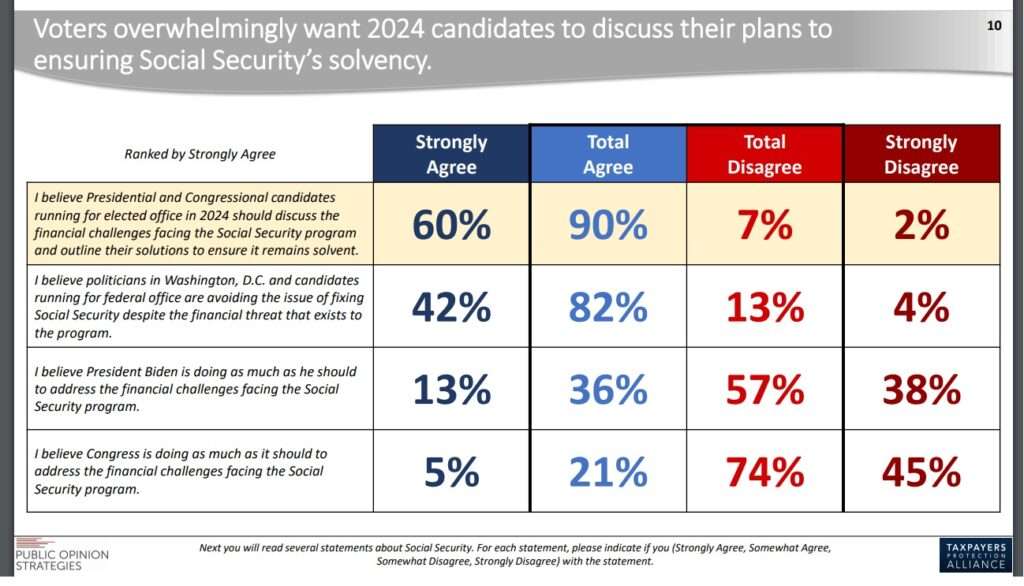

Perhaps most importantly, 90 percent of voters say presidential and congressional candidates running for office in 2024 should discuss the financial challenges facing the entitlement programs. They might take note of former South Carolina Gov. Nikki Haley's rise in the Republican primary field, which has followed her willingness to provide some straight talk about the difficult fiscal situation that the government must face.

Finding solutions to these highly fraught issues that voters will accept is no easy task, but it can't start until politicians recognize that ignoring the government's entitlement-driven debt crisis is not a real option.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

>>the vast majority of Americans believe policymakers should make changes as soon as possible to extend the life of America's two old-age entitlement programs

the vast majority of Americans remain economically retarded.

Corollary 1A: The vast majority of Americans will not like any changes suggested to reform SS.

shame. I'd sacrifice mine right now to kill it.

Same.

Same here.

Absolutely.

Who is this person named F.I.C.A. that keeps monkeying around on my paystub? I'd give up all of my Social Security to get them off!

🙂

😉

Converting to Amish is probably your only option then.

I think the only changes on the table will be increased retirement age, cutting off benefits to those that saved enough themselves to stay above the poverty line and removal of SS tax cap for the wealthy. The latter 2 which will discourage earning/saving.

I think the Simpson-Bowles Commission probably gave a blueprint to refer to, when addressing SSA shortfalls. In short, do a little of everything.

A raise in retirement age from 67 to 70, phased in over a few decades

An increase in minimum claiming age from 62 to 65, phased in over a few decades

A small increase in SSA tax, from 6.4% to ~7%; employer and employee side

Implement 'means testing' of benefits for high income (let the reader interpret what is high income) taxpayers. One way this could be done is limit benefits to the first bend point for high income taxpayers. They still get much of what they paid into the system, but the portion of their benefits from 2nd bend point would go to lower income taxpayers who do not meet the first bend point.

Finally, there has to be a road to privatize social security. We cannot allow the Federal government control over our retirements. The Feds have done a terrible job. Allow taxpayers to invest in broad-based index funds that conform to the government version of the TSP plan (ultra low cost, great selection - the Feds take care of themselves).

Sounds easy, right? Tell Congress.

A raise in retirement age from 67 to 70

How do we get employers to hire people in their 60s? Right now if you're 55 and out of work you're basically permanently unemployed unless you have some rare in-demand skills and very good luck. Perhaps make the vicissitudes of old age a protected disability under the ADA?

Yeah there aren't many job opportunities for 60 year olds let alone 70 year olds. And SS has already been increasing the retirement age for decades. And SS is taxed as income if you make more than 25k as a single taxpayer. So if you're withdrawing money saved in an IRA to pay the bills you will pay taxes on both. I would have bailed out in the 80s but never got the chance. This ain't no gravy train.

You can always get a job as a greeter at Wally World.

Not if they raise SS retirement age to 70 and there's tens of millions of old folks competing for those jobs.

The proposals are all to raise the retirement age gradually over time to avoid your scenario.

So require higher income taxpayers to pay in much much more over their working careers and then cut their benefits when they retire to less than those who paid in much less? F**k that. How about cutting out benefits entirely for those who never paid in?

Seems reasonable to me. Let’s see how it works:

•First, take the “cap” off of “SS taxable” income so that all earned income is subject to SS tax (further separating the program from the principle that pension payments should be related to amount paid in) In the next year make unearned income subject to SS taxation at twice the rate of earned income (only fair, ya’ know).

•Next limit the amount that can be drawn by “high income” recipients, completely separating SS contributions from SS receipts upon retirement

•Rename the program WELFARE FOR PO’ OL’ FOLKS; declare anyone who complains is a racist homophobic hater and declare all such individuals ineligible to receive any retirement benefits as they will be "provided for" in re-education camps.

It will get really interesting when the determination has to be made at what level SS “recipients” are deemed “high income” and have their payouts limited, or maybe even withheld altogether. Will just income be considered, or should it not be applied to savings accounts, real estate, art work, ownership of precious metals – this would be a “stealth wealth tax” that might dodge the Constitutional limitations of the Federal Government’s ability to levy individual taxes. After all, you’re not taxing – you’re just limiting that which the S.C. has repeatedly ruled that individuals have no vested interest in receiving regardless of how long they paid into it.

Lastly, go back to the 90+% income tax rates of the past without the deductions that were part and parcel of that high rate, (and try to get someone to be willing to lift a finger for more than a UBI that all of us must be entitled to.) Unless you are, or have an ancestor who was, “an oppressor” => then NO SOUP FOR YOU! (But an extra bowl for those to whom “reparations” are owed.)

The wheels are going to run off folks – the only question is whether it will first be a front wheel or a back wheel, on the left or on the right? And heaven help those who are unable or unwilling to defend what is theirs. Does anyone reading this think there is any possible outcome to the mess we have worked ourselves into other than an outright repudiation of government debt or a stealth repudiation of government obligation by Weimar type inflation and full central control of production, wages, prices, and perhaps longevity? Really??

No, that outcome is what is coming. It's too late to change course.

Yeah SS taxes are paid directly into the US treasury an institution that by any measure is bankrupt. The danger of SS collapsing doesn't approach the certainty of the whole house of cards economy collapsing. Of course that will solve that whole trust fund problem that Reason obsesses about.

Sure that great if your young and haven't paid in all your life. For most of us we have been stolen from all our lives and it's our money. The only way to fix the problem is to put everyone back to work at livable wages. End the corporate welfare and make employers pay the full cost of their employees.

How do we accomplish that?

Define livable wages.

Too many subsidies ie: farm and corporate.

“Welcome to Walmart! Get Your Shit And Go!”

–Jeff Dunham’s Doppelganger Walter.

🙂

😉

If I were allowed to say that as well as beat up shoplifters with a Transhuman, bionic, Robocop body that lives off of baby food and an AI-enhanced brain that never goes senile, that would be payment enough for me.

Requiring employers to pay the full cost of SS for their employees would mean that employees would immediately get a pay cut equal to this amount.

Turning 60 this month, I am no longer willing to sacrifice it given how much I have paid and how it is almost time to receive the benefit. I do favor reforms including: (i) eliminating the cap on earned income that is subject to the tax. Every year I maxed out around May and I know my boss maxed out in January. For people with this income level (including myself), there is a big bump in take home pay once the cap is reached -- a bump that I would not notice that much if it never happened. This is a way to increase the pay-in of the wealthy with less obvious impact. (ii) raise the age for benefits by 1 year every 5 years starting with those that are under 40 now. One issue was as longevity increased, the age for receiving benefits did not go up (as it should have). (iii) eliminate the benefit for those with income over $1M and index that to inflation. (iv) Allow anyone under 40 (raising 1 year every 5 years) to invest 50% in mutual funds or other investments. These changes would provide a stop gap for a few years until we figure out how to eliminate it completely.

So you're fine with not paying on earnings you yourself received but you're happy if those who are younger than you get to? But then you complain about how you had to pay in but others wouldn't? Funny how you'll demand sacrifice from others but are unwilling to do so yourself.

Eligibility needs to be ousted out a few years. I don’t think there’s any way around that. At a minimum. The better solution is to sunset the program and have a privatized or at least partially privatizes system. But the Marxist democrats will never allow that.

That's a no-go right from the start.

Nowadays people think retirement is an entitlement and everyone should be able to quit working and cruise around the country in an RV at 62 - just 'other people' need to pay for it, not them.

To be fair, if they put the money into social security, getting it back (with a reasonable return) is a reasonable ask.

And it's a reasonable ask not to saddle the young with paying for entitlements the old (who tend to be significantly better off financially) voted for themselves.

While I don't disagree with you, it's not going to happen. Like Dillinger said above Americans are econ stupid.

Most people didn't put money in their 401k till it was done for them. I would say a majority don't every change the allocations or rebalance.

Now how many of those people do you think would save anything let alone enough for retirement.

I know Reason likes to harp on "Retirees are the riches blah blah" . I just know anecdotally that my mother and her friends just barely make it with SS (and her 401K she had saved).

Have you looked at the prices of senior leaving homes etc? Some want 300k upfront.

With all that said, I'm 52 and I don't expect it to be there. I'm paying for my mom now.

I’m in the same boat. I doubt it will be around long term.

It's hard to save when every time the Democrats get a trifecta the entire economy goes to shit and you have to dip into your savings just to survive.

True. I've had to borrow against the 401(k) twice in the past 7 years. The jack-up in rent during COVID-19 and getting hit by twice by catalytic converter looters were the big setbacks for me.

Great article, Mike. I appreciate your work, I’m now creating over $35,900 dollars each month simply by doing a simple job online! I do know You currently making a lot of greenbacks online from $28,900 dollars, its simple online operating jobs.

.

.

Just open the link——————————>>> http://Www.Pay.Salary49.Com

They forced in onto us. They forced pepole to pay into it. That's not an entitlement. That's our monies. I never wanted to pay into it. I have other savings, retirement, and union retirement funds, so I wouldn't starve to death by them stopping it. But a lot of folks will. If you are looking to piss off the boomer generation, that would do it. And you think there are shootings now? You better get the coroners ready.

87% of Americans Want Politicians To Do Something Before Social Security Runs Out of Money

Yeah, like Fuck Off, get out of our wallets, and let us take care of our own damn retirements!

Sometimes, it takes touching a “third rail” to defibrillate something back to life.

*CLEAR!*. *ZAP! CLEAR!*. *ZAP!*…

At least that's what this American wants!

And 95% of them want the gov to take the money from someone else.

Ding ding ding. No points for a correct answer, though. That’s always the right answer.

May god have mercy on my soul, at least?

Your "soul" is fine since it doesn't exist, but our wallets, minds, and bodies are still in danger here and now.

Social security doesn't run out of money. It's paid from the General Fund.

What about abou Al Gore's lockbox?

A massive grift?

5 golden Guineas a month!

Al Gore's "lockbox" is the Congress' rock box and they've smoked them all up.

Is that a suggestion? It's not currently paid from the "General Fund".

Yes, by law the Social Security Trustees invest the spare cash in the Trust Funds in Treasuries rather than, say, in gold bars or shares of Enron, WebVan, Solyndra, or Evergrande.

The weighted average interest rate and maturity of Treasuries held in the OASI Trust Fund is currently 2.392% and 5.669 years respectively.

When the Trust Fund redeems these Treasuries they are no more "being paid from the General Fund" than when one of my TBills reaches maturity and a wad of cash appears in one of my brokerage accounts. Both are simply a return of borrowed money.

If the Trust Funds were not investing in these Special Issue Treasuries, the "general fund" would have to borrow more from other sources to meet withdrawals which might drive up interest rates, and hence drain on the "general fund".

Both are simply a return of borrowed money.

And where do you think it comes from? Government debts are fungible.

Paul has pointed to what will likely happen: the government will create as much money as necessary to pay benefits, resulting in high inflation. Everyone will get the dollar amount they were promised in benefits, but the dollars will be tiny. Welcome to Zimbabwe.

Exactly.

Ah, the financial whackbat handwave.

Can anyone here think if a set of conditions that might come into play that would cause Congress to continuously, or extent into perpetuity a situation where the Social Security Trust Fund needs to be 'reimbursed' from the general fund? I mean, there's a ceiling! You can't raise the ceiling! It's a hard ceiling! That's why we have ceilings, so we don't go above that!

The ceiling is where voters no longer believe SS to be separate from general revenue and expenses, at which point they see no reason to support it for their future benefit. It's been sold that way from the beginning as a self-funding program that would neither be used in the long run as a cash cow nor be funded as a welfare program; it would probably not have been politically possible to enact otherwise. So it's off-budget.

As soon as it's seen otherwise, then all SS payouts become discretionary, and seen just as payoffs to influential interest groups rather than the fulfillment of a deal. What had been FICA just becomes another income tax.

The SS Trust Fund consists of IOUs from the General Fund to the SS fund. Repayment for those IOUs must needs come from the General Fund.

At least the trust fund wasn't run by SBF.

Are you saying a diversified portfolio wouldn't do better than T bills? Odd that you only pick loser stocks. History has shown that a balanced portfolio including a mix of stocks, bonds and, yes, some government bonds for upcoming obligations, will do MUCH better than T bills.

But the "general fund" is already running a 13-figure deficit, and at most a handful of members of the legislature question whether that's a permanently tenable footing for the country.

Dems used to get multiple layers of clothing in a twist over the fact that the national debt went up by almost $2Trillion 8 years under Reagan (with Tip O'Neil's Dems in Congress approving the spending). Now they mostly seem to whinge that the evil misers in the GOP, especially the "Freedom Caucus", won't let them plan to borrow more than 70-80% of that amount in a single fiscal year.

“Medicare's main trust fund will be depleted by 2031 and Social Security's reserves will be gone by 2033.”

2030 and following years may see a decline in people running for Congress or the Presidency.

Medicare is the easiest politically.

Eliminate the wage cap for the Medicare taxes.

Democrats have to vote for it because 'it only hits the rich'.

Republicans have to vote for it because 'it benefits medical corporations'.

So what's the problem? A one page bill with total support from all sides.

Could it be that both sides want to keep the funding problem as a campaign tool against the other?

Medicare has no wage cap.

https://www.investopedia.com/ask/answers/081514/why-there-cap-federal-insurance-contribution-fica-tax.asp#:~:text=Income%20tax%20caps%20do%20not,gets%20adjusted%20annually%2C%20reflecting%20inflation.

Income tax caps do not apply to Medicare taxes, but Social Security taxes have a wage-based limit—meaning, they don't apply to earnings above a certain amount.

Social security is more of a problem, because it cannot be done easily.

But it must be adjusted to reflect the rise in longevity, and the income as well as the benefits have to be adjusted for inflation.

One big help would be to split out all the non-retirement spending from the disability programs, if only to track the impact on the finding of adding so much to the "retirement" program.

The only other thing I can think of would be to replace all congressional retirement programs with social security alone. (members and staff)

That would at least focus their attention, as they say.

But it must be adjusted to reflect the rise in longevity

We're in the process of fixing the longevity issue.

Oh, yeah; right.

'Mandatory' vaccines for all. I forgot.

Lots of vaccidental deaths.

Problem there is that the side effects hit teenagers mostly, and if they die before making much wage income, then they're not benefiting the system by paying taxes in but never collecting benefits.

All the extra sugar and corn syrup that's been added to the US diet over the last 40 years could have created a culling of sedentary (white collar) men in their 50s and early 60s, except that stents, staten drugs, and bypass surgery have become way too advanced to rely on that making the difference.

The only other thing I can think of would be to replace all congressional retirement programs with social security alone. (members and staff)

I've been saying that for years, Medicare too. If you want to sell us on "Medicare for all" then lead by example.

it must be adjusted to reflect the rise in longevity

The problem is that the lengths of our lives are increasing, but the duration of our employability is not.

A rise in longevity does not equate to a rise in employability.

If only that were true in politics

First of all there is no such thing as an "automatic cut" when you're talking about government programs. Second of all what people want and what they're likely to get are two completely different things. And finally, "doing something" is as American as mom and apple pie. Doing something specific that is likely to have the desired effect is also something completely different and much less likely regardless of what people think - if you can call what they do thinking.

Automatic cuts in other federal programs, usually planned years out, always get rescinded.

Was "Let me keep my money and invest it myself" an option?

We call that: privatization.

Wondering why a libertarian publication failed to even mention that.

Because the article was about the results of a poll. Usually when they fail to mention something it's because that's not what the article was about. Seems like really stupid criticism to me.

sarcasmic 6 hours ago

Flag Comment Mute User

Have you ever considered telling someone you disagree with why what they say is wrong, as opposed to telling them that they as a person are wrong? You don’t change minds by attacking people. That just puts them on the defensive.

I said the criticism was stupid, not the person, stupid.

Have you ever considered telling someone you disagree with why what they say is wrong, as opposed to telling them that they as a person are wrong? You don’t change minds by attacking people. That just puts them on the defensive.

All you’re doing right now is embarrassing yourself by showing how incredibly stupid you are.

In that quote I was talking about, when arguing with someone, addressing their comments not them as a person. You obviously cannot understand that, which means not only are your comments stupid, but you are stupid as well.

Ignore the clown. He wants a fight.

Also, most of the "privatization" options I've heard about still included the money being taken away via taxes. The difference was what happened next.

That part is true, sarcasmic. Even in a 'privatized' model, there will be some form of Federal regulation. Things like fund selection and type, taxation of inherited funds from SSA, etc in a private model.

Insurance companies sell annuities. Even Vanguard and Fidelity are getting in on the annuity act. Privatization is possible.

As long as the politicians and bureaucrats decide where the money is going to go, they will abuse that power.

Yeah I suppose it's possible. They do it in other countries. Just seems to me that things that work elsewhere won't work here. Don't know if it's political culture, economy of scale, or what.

Double all outstanding student loan debt and give it to the olds. No? I thought young people liked redistribution.

Just bring back slavery.

Phase it out by raising the retirement age 1 year every 3 or so, while dropping benefit levels at the same time. Give everyone an opt-out in the mean time.

I would love to opt out. It’s a shitty program that would never be legal if it were private. If a democrat politician encountered a private retirement program that was structured like SS, they would call for it to be shutdown and prosecute the people behind it.

That would be interesting.

Note that we have just taken 40 years to raise the retirement age for full benefits from 65 to 67.

“the vast majority of Americans believe policymakers should make changes … and avoid possible benefit cuts that will hit in the early 2030s”

The “changes” that Americans believe policymakers should make would almost certainly involve benefit cuts.

The “possible benefit cuts” that will hit in the early 2030s would not be avoided, the cuts would just be enacted earlier. Although, perhaps differently.

Either way, there would be cuts. Probably those taking the poll thought that policymaker action would avoid cuts, not accelerate their implementation. And that “saving these programs” means the programs as they are now, not a cut version of the programs. “Saving” a cut version of the programs is really not saving anything, it is just killing the old program and implementing a new, less generous, one.

Americans believe policymakers should make changes as soon as possible to extend the life of America's two old-age entitlement programs and avoid possible benefit cuts that will hit in the early 2030s if nothing is done.

And as soon as an honest policymaker explains to them that extending the life of these programs without benefits cuts will involve huge tax increases, these same Americans will throw the same tantrum they have been throwing for 50 years and nothing will be done.

We've got to hit rock bottom before things can get better, and we aren't close to rock bottom yet.

There is no bottom. You name it, you can always go lower.

Can we at least make a law that isolates SS taxes from going into the general fund? Completely isolate it so there is an actual "trust fund" As long as it's just mixed in with all the rest of the Kool Aid, it's impossible to see what's going on without a bunch of wild conjecture. I'm all for privatizing it over time, but it would be nice to see what the actual numbers are. And yes, I know I'm wailing into the whirlwind...

As below, NO.

SS must always be paid out of wealth produced by the economy in the year of the pay out. You can save up dollars, but you cannot save up the nation's wealth as a whole to pay it out in later years. When the law was written, they understood that. But to make it politically acceptable, they disguised SS as a "Trust Fund." The Trust Fund is a fake-out. It moves the tax from one column to another, but the benefits must be paid every year by the country as a whole.

So, just shrink the dollars so they stay in proportion to real wealth production.

87% of Americans want government to "do something" but virtually none of them believe that any action which might actually address the problem (either reducing benefits or raising taxes on everyone) is in any way acceptable.

There's only one other option: Fire up the printers!

It’s the path of least resistance.

I agree. Look at the responses to the surveys. Most people just want "somebody else" to pay for the problem.

solution: have bigger families

my mom has a lot of kids in same city and all help her out in some way She’s over 90 and has taken waaay more in benefits than she ever paid in… if they went away her kids would make sure she was looked after somehow – though it might mean some sacrifices here and there

The anti-population baby killers NEVER get this. Why do they have so many kids in India and kill so many baby girls, it's their social security. The murderers need to learn to think.

Want an improved society? Support big families.

It's probably necessary for sustained economic growth as well. We could be in drastic trouble if the depopulation trend plaguing Japan, China, Europe, etc. extends to the US.

Do something - but don't touch my check. I earned that money. Don't let people use an alternate form of retirement savings either - they might make a bad choice and end up with no money;)

In other words - do something, but not anything that would be effective.

There is no possibility, in reality, of taking action now to "save" Social Security. SS has always been, and must always be, pay-as-you-go. Why? Because the country must always produce in any year what it consumes in that year, regardless of any sort of accounting. You can save up dollars, but you cannot "save up" healthcare, or "save up" nursing homes, or any other thing people consume in their old age. So whether you tax people regressively to pay into a fake out Social Security Trust Fund, or progressively into the General Fund, the wealth sucked out of the system in any year must pay for that year's SS outlays.

BUT: Congress regularly 'borrows" from that pile of money. And YOU get robbed when the payback comes due

"The Government Has Borrowed $1.7 Trillion From The Social Security Trust Fund. The government has borrowed the total value of the Trust Fund to pay for other government spending. Beginning in 2017, the government had to begin backing up these paper promises with real money."

Anyone know the reason behind stopping the SS tax at 168k? I would think this would be one of those "raise the tax on the rich things"

"The Social Security tax rate is 12.4%, and is divided evenly between employers and employees, on a maximum wage base of $160,200 ($168,600 in 2024)."

Anyone know the reason behind stopping the SS tax at 168k?

Yes...AWI (Average Wage Index); ssa.gov will tell you the math.

High wage earners will want compensation shifted from wages to other forms of income not subjected to ss withholding.

Every action causes a reaction.

Likely because it was thought that the benefits resulting from that wage level would be sufficient for a modest retirement and that people earning more than that probably had other forms of income in retirement should they want a less modest retirement lifestyle.

As well politicians probably realized the unfavorable optics of retirees who were high wage earners the "top 35 years" of their careers getting a $100K monthly benefit check from Social Security.

We should all be so lucky = a $100K monthly benefit check from social security 🙂

Like I stated above, I don't disagree with getting rid of it - but what do you do for the people that only planned on that because they were told they would get it for the last 50 years? You know the ones that are living paycheck to paycheck? (Again, I'm at 52 and don't expect it to be there. I plan for zero)

If I was promised something for 50 years, I would want it to. You know Democrats always tax a good tax game but you can actually pay more to the government than you tax bill. How many do you think do that?

How about we keep SS, Medicare, Defense - get rid of sec of Energy, Education, and whatever else our 4 trillion dollar budget doesn't need?

You just phase it out, or even simply make it opt-in/opt-out. If people want to have government lose their retirement for them, they should be allowed to do so. Just don't include me on the scam.

I heard someone say though that the stock market scandal of the early 2000's wiped out half of their privately-administered savings.

There is no isolating the effects of an Obama or Biden foolocracy

Stop giving monies to other countries. Period. All that has done is made enemies for us. Trillions of dollars paid out to other countries. It's way past time to call the cash cows home. Let those other countries fend for themselves. I really never gave a fuck about any of those countries anyways. We have serious issues at home. Time to fix our own problems.

Tax rebates for drinking and smoking will in the long run lower SS payouts.

Social Security is already, in effect, heavily "means tested".

First, due to "bend points", the first dollar a low wage earner and their employer "contributes" to Social Security returns (roughly) six times the retirement benefit that the last dollar a high wage earner "contributes" will return to them in retirement benefits. (I say "roughly" as only the highest 35 years of eligible annual wages are considered for the retirement benefit so those who work the "standard 45 years" before collecting benefits end up with 10 years worth of contributions being, effectively, discarded).

Second, a portion of Social Security retirement benefits are taxed if, and only if, one has a combined income (including 50% of the SS benefit and tax exempt interest income).

Increasing the means testing component yet more will make the program more like welfare and, hence, more popular to cut to control the deficit/debt.

Welfare is the mid-term solution. Replace SS with a means-tested welfare program for the indigent and poor elderly. Fund it by replacing SS "contributions" with increased taxes. Not gonna happen, though.

But it will never be tested. Look at the state unfunded liabilities for PUBLIC pensions.

After New Jersey (20.2% of personal income), unfunded pension obligations were highest in Illinois (19.4%), Hawaii (18.0%), Alaska (16.3%), and New Mexico (15.7%).

SEPT 12, 2023 ...here is Illinois

Pension debt grows to $139.7 billion

But govt punishes you if you are on SS and happen to get a real job. Is not Biden the stupidest human being ever to reach high office 🙂

100% of politicians don't won't and couldn't care less about the 87% or when and if it goes broke. Incumbents will be still get elected at a 90% rate even if 10% of all SS recipients end up with the migrants in tents.

I'll be there. Already have a nice tent and camping gear.

"Incumbents will be still get elected at a 90% rate even if 10% of all SS recipients end up with the migrants in tents." Don't bet on it. If this was true, S.S. would not be the 'third rail' that it is now.

The OP screws the pooch from the very beginning of the article. Social Security retirement benefits are not an entitlement. You pay into the program your whole working life and when you retire you get a payment for the rest of your life in return. Welfare and SSI are entitlements. Social Security retirement benefits are not.

I sympathize with how Snowjob Sneakurity should not be an entitlement but FDR had other ideas. Here's an article on it:

https://www.nationalreview.com/2013/11/social-security-fable-andrew-c-mccarthy/

Our language is corrupted by politics. Social Security is an entitlement; one is entitled to receive back from a program they have paid into for years. The same for most VA benefits; they are part of the contract between the enlistee and the government. Welfare and programs like it are charity. The recipients are not entitled to the money; society simply gives them the money, some would say in exchange for votes.

Not a entitlement. It was taken from our checks. You could only refuse if you were in certain union type trust funds. IE, teachers union. By stopping payments, that would be theft. Millions of boomers are ready, and willing to slowly remind those in office of that fact.

Sure, sure... That's why it has to pack gov-guns.

Government isn't anything but a monopoly of gun-force. If 'guns' aren't needed then government isn't needed.

Harvey you understand nothing about how the social security program works.

The [Na]tional So[zi]alist Empire creeps closer to collapse?????

Yeah; It'll never happen. Just ask Venezuela.

It's Socialist Security!!! /s

F'En Nazi's like FDR.

I don’t think this poll means what they think it means (or want to pretend what it means.)

87% of Americans are in favor of Congress “doing something” so their own benefits won’t get cut. Where “doing something” means cutting benefits for wealthier people who paid in more than they did, or raising taxes on people who make more than they make, or raising the retirement age for younger people (provided they are already retired themselves or the new age doesn’t affect them.)

Democracy for the win. 13 wolves and 2 sheep have 87% voting for mutton for dinner.

But the core problem was the destruction of so many business pensions by the govt letting them off the hook.

California (before Biden bailed them out with dishonestly apportioned "Covid money" was the harbinger of the horror in store:

"CalPERS' unfunded liabilities roughly translate to over $4,000 in debt for every Californian. The California Public Employees' Retirement System, the retirement system for California's state, school, and public agency workers, suffered investment losses of almost $30 billion in 2022."

Didn't Reason about a decade ago report on a country that had managed to reform its old age benefits program away from a similar looming crisis? New Zealand or Canada or Argentina or El Salvador or Czechia or someplace? Has that reform managed to hold?

lol nothing can stop this train, Eric. And no one has the will.

It's going right over the cliff. End of story.

Well, I think it's all well and good to do polls and surveys and such, and to put up headlines that say folks are worried about Social Security and Medicare. I know I worry about them.

But here's the thing: Congress will do nothing before the Entitlements Armageddon strikes. They will then either let them fail, which would be political suicide, or simply print humongous piles of cash and pour it in the crater. I predict the latter.

it will definitely be the latter. They will print gazillion trillion dollars until we are like zimbabwe, then there will be a financial revolution of some kind. no idea what form it will take but it will be something.

Suicide is not the word millions will call it.

For one thing we can save lots of money by doing the following:

1: Close the more than 800 foreign military bases abroad and bring our people home. That also includes secret bases, prisons and bio-warfare labs.

2: Stop the endless wars and costly foreign policy interventionist disasters.

3: The military industrial complex is not a sacred cow.

4: Stop interfering in other nation's politics and society.

5: End all foreign aid, that means Israel as well.

6: Reinvigorate America's economy by allowing renewed drilling for oil and natural gas development.

7: Take a number of American troops returned and put them on the border to secure against the invasion of unwanted and possible dangerous immigrants.

8: Reduce the size of government by 90%. America will not only remain functioning but will improve greatly.

9: Impeach and remove both Biden and Harris.

10: term limits for congress.

Make 10 recommnedations like that and you offend everyone in some way, poor strategy indeed. Talk principles and you will contrbute to a solution.So, look at no 8, this is purely the principle of Progressivism -- to expand, to recruit 'experts', to corral the masses.

Simply cutting by 90% does nothing.--Oh, wait, it does do something: I enshrines the President and others who talke money from US enemies so they can live like the Shah

what a nice fantasy list this is. sadly none of this will ever happen

Jefferson said something interesting; Jefferson believed in the principle that “the earth belongs to the living and not to the dead” which meant that previous generations could not bind the current generation to pay their debts, or require them to work in their father’s occupation, or to accept the laws and constitution drawn up by their ancestors. In his mind, “no society can make a perpetual constitution, or even a perpetual law”. The only “umpire” between the generations was the law of nature.”

But notice, a politician who does the right things about SS is doomed by doing that whereas people like Biden and Pelosi destroy the future of your children, they smile doing it, and then when the grim harvest comes they are dead.

From the "Libertarians for Popular Progressive Government Programs" desk!

Yeah, normally when you uncover a Ponzi scheme you shut it down, jail the perpetrators, sell off the remaining assets and distribute them to the victims in proportion to what they lost.

The first step is for politicians to admit that SS is a TAX, which is essentially what it always has been, and not a fund people pay into to be held in trust for the taxpayer (or in the words of Al Gore, a lock box). SS was never a pension fund. And has failed completely as a pension fund.

SS Administration has never been unclear about the problems that the program has when the ratio of workers paying in to retirees collecting benefits gets too low.

Amazingly, they also have explained that what separates SS from a Ponzi sceme is that a Ponzi operation requires multiple people paying in for every one taking money out in order to keep operating.

They pretend that the fact that everyone who pays in is promised that they will someday be able to collect benefits is the part that somehow distinguishes the two structures; as if the last round of "investors" (and really the main victims) in a ponzi scheme aren't promised that they'll also be able to recieve the kind of returns that the early people got (if they also cashed out before the wheels come off).

The only real difference is that SS is the one ponzi scheme that's operated by someone who doesn't have the ability to vanish with a bunch of money when it becomes untenable, and who can actually legally print money (although that's ultimately a very bad way to ensure the solvency of what's supposedly a "safety net")

I just don't get it. I asked the 'halls of justice' to bank-roll my retirement savings and now they tell me they've lost all my $ on their own pet projects? /s

How dumb do people have to be to put their own justice system in charge of their bank accounts? Yeah that's right dumb*sses. They drained your accounts and unless you wanna take matters into your own hands you have ZERO.... I repeat ZERO, NONE, NODDA legal paths to your own justice. You stupidly lobbied to make the bank the all powerful means of justice and now you have none of your earning and none of your justice.

Stupid, stupid, stupid.

The so called "Social Security Trust Fund" has NEVER been anything more than an accounting entry on the government's general ledger. Social Security ran out of actual money the INSTANT it was enacted.

In addition, it is IMPOSSIBLE to create a defined benefit system that is even theoretically sustainable. Even without "cost of living" increases, the information needed to determine required contributions does not exist until years after the contributions must be made.

There is one answer to these problems, and that is bankruptcy of the US. Nothing else will happen, so stop deluding yourself that this or any other congress can "fix" this problem that was written into the process itself

Do they even teach people the history of these "financial markets" any more?

I’m making $90 an hour working from home. I never imagined that it was honest to goodness yet my closest companion is earning 16,000 US dollars a month by working on the connection, that was truly astounding for me, she prescribed for me to attempt it simply. Everybody must try this job now by just using this website…

More infor... http://Www.Smartwork1.Com