Welfare Cuts Are Inevitable Because Congress Won't Touch Social Security

Until Congress is willing to acknowledge that it makes no sense to send monthly checks to wealthy seniors, everything else will be on the chopping block.

Amid the fractious debate over the federal budget, Speaker of the House Kevin McCarthy (R–Calif.) has outlined plans for cutting several prominent welfare programs in order to save about $150 billion annually.

According to The Washington Post, those cuts would affect a wide range of federal safety net programs including some—like food stamps and Meals on Wheels—that help feed needy families. Other cuts would affect Federal Pell Grants for low-income college students, grants that help families afford housing, and a program that helps offset high heating bills.

Regardless of whether you think the federal government should be in the business of funding any of those things in the first place, there's no denying the fact that sudden cuts to existing welfare programs can be disruptive to the individuals and families that have come to rely upon them. It's also true that, as Reason's Liz Wolfe points out in this morning's newsletter, the proposed cuts reflect the reality of a government that has been living beyond its means for too long. "It's not exactly a winning PR move to slash the programs that serve needy toddlers and first-generation college kids, but there's an important fundamental truth at the heart of the fiscal hawks' concerns: government spending simply cannot continue at current levels with no consequences," Wolfe writes.

That's true. But here's an element of this debate that doesn't get talked about enough: Cutting welfare programs for needy families is necessary because Congress insists that relatively wealthy senior citizens get paid first.

Budgeting is always, at its core, an exercise in priority-setting. That's especially true when your budget is wildly out of whack and you've been borrowing at an unsustainable rate, as Congress has done for years. When there's no longer enough money to go around, you're faced with a difficult proposition: Who gets paid first, and who has to wait at the back of the line?

In the federal budget, seniors get paid first. Everyone else has to wait.

McCarthy and his fellow Republicans are not proposing any cuts or changes to Social Security and Medicare, the Post notes. That's despite the fact that it's actually the two major entitlement programs that are driving most of the federal government's long-term deficit.

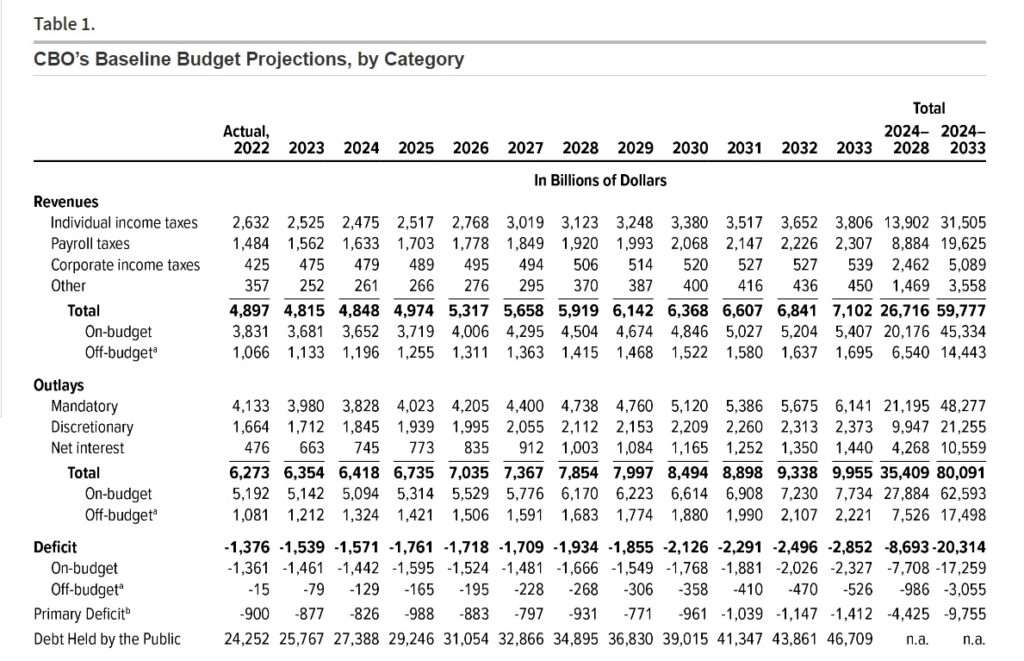

Over the next decade, discretionary spending—which includes those welfare programs the GOP is aiming to cut—is projected to decline relative to the size of the U.S. economy, according to the Congressional Budget Office's (CBO) projections. Meanwhile, Social Security and Medicare are growing, fast. By 2030, the CBO expects so-called "mandatory spending" on entitlement programs to consume more than 60 percent of the federal budget.

Of course, because those programs are funded with a separate revenue stream—payroll taxes—it would be complicated for Congress to cut spending on Social Security to offset cuts on welfare programs.

Even so, the ongoing refusal of either major party to consider any long-term changes to the two major entitlement programs tells you all you need to know about the priorities in Washington.

There is no shortage of alternative ideas out there. Congress could fiddle with the specifics of Social Security to make the program less expensive over the long term—raising the retirement age, for example, or changing how contributions and disbursements work. It could (and should) allow younger Americans to opt out of the system retirement.

It could means-test Social Security benefits to restrict payouts to wealthier retirees, in much the same way that welfare programs already do. That wouldn't save much money in the grand scheme of the federal budget, but it would reflect the economic reality that older Americans are generally wealthier. It makes little sense for the federal government to continue transferring cash from younger, working-age Americans to wealthy retirees—and it makes even less sense when there's a budget crunch.

Until some of these ideas are considered, however, the old-age entitlement programs will continue to be the primary drivers of the federal government's fiscal problems. As the entitlement programs grow more expensive over the next decade, they will continue to squeeze other parts of the federal budget. We'll be back in this same spot next year and the year after that—at least until the early 2030s, when Social Security will hit insolvency and more significant decisions will have to be made.

It is unlikely that any member of Congress will admit as much, but voting for a budget that cuts welfare programs while maintaining the status quo for Social Security and Medicare is a policy choice. It means that some struggling families won't get food stamps, but 70-year-olds with million-dollar nest eggs and vacation homes will keep getting monthly checks from the government.

Until those priorities change, everything else will be on the chopping block.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"It's not exactly a winning PR move to slash the programs that serve needy toddlers and first-generation college kids…”

But it’s a winning move to choose to slash those programs instead of, say, farm subsidies, and then blame the cuts on your opponents. It’s worked time and time again.

What?! Cut welfare payments!! Please understand - unless the printing presses broke down completely, and are anticipated to non-functional for the next month, there is no reason to cut welfare payments. Just keep'em running printing up $100 bills. It may be more efficient to pack the new $100 bill in 80 lb. bales (like alfalfa). Then the Joetato administration can simply order money by the semi-truckload, and schedule a truckloads of bales each month, and the bales can be broken up and scattered along the roadsides in favored (Democrat-voting) counties/parishes.

Or perhaps this is the Republicans' version of shutting down national parks to get the public's attention.

It wasn't the Republican Party that shut down popular attractions at national parks. It was the Interior Department, reminding everyone who really rules in D.C.

My favorite was closing down monuments in DC, as if you need a ranger there to look at a statue.

But it took a ranger - or someone else on the government payroll - to stop you from looking at the monument.

Makes total sense to cut payments to those who were forced to pay into the system as opposed to those who did not.

Right? What even is the argument here?

Social security and medicare absolutely need to be reformed. If the program is to continue then retirement age needs to go up and the rate or annual max of the program must be raised. The programs are a bit of a ponzi scheme built on a rapidly increasing population and an average life expectancy that's less than a decade post retirement. Boomers are too big of a retiring population as our growth declines. People are living too long past retirement. Health care keeps getting more expensive and innovations keep extending longevity. The structure of the programs is unstable and that needs to be fixed.

What I don't understand here is the argument to prioritize charity programs over ones that people paid into over their life for what is supposed to be subsistence benefits. This isn't a libertarian argument, it's a classist/marxist one.

If you've been reading Reason recently you know the proggie line is their only priority.

This is "Reason," right? The whole basis of Social Security was that it is NOT welfare, that every one who worked, would pay in, and everyone who paid in long enough, would receive a benefit. Consider that one solution proposed to get more revenue was to take off the cap on max earnings subject to tax. What high earner's going to go for paying in more but taking out less?

I was going to make the same point albeit from a slightly different perspective. SS recipients paid into a Ponzi scheme for their entire working lives through confiscatory taxation. The "needy" did the opposite. Could a significant share of them have also paid into the Ponzi scheme? I don't know. The government has been raising the retirement age for decades. Are we proposing a drastic increase to somehow balance the budget? Who will end up working till they're 80? Will they be physically able to work? Will anybody hire them? Having reached the magic SS retirement age that was already raised in my working life the odds of a Millennial hiring me look pretty close to zero. Despite the fact that I'm still working. Yeah the system should have been reformed years ago. I'd have been far better off saving my own money. But the whole argument that wealthy old people are canabalising their kids is past it's due date. If you want to blame someone FDR is the guy.

So after having more than my share of withholding I now should face a further decrease in payback? After the Dems have taxed SS and raised the retirement age? At least SS recipients put $ in , they weren't sucking on the govt tit all along. The reform that needs to happen going forward is for workers to have mandated savings and investment accounts that they own and control after retirement. Restricted to S&P 500 index funds and international index funds until they retire.

The full retirement age is 67. The suggestion is to raise it even further? At some point, you will be too old to work, unless you are a US senator or congress critter. Beating a tired, worn out horse to make him work harder is not a good look for anybody.

Taxing "high earners" more sounds more reasonable to me, though I recognize that those "high earners" won't like it.

Maybe privatize it ala Costa Rica (I think) might work but the socialists will howl with rage and point their bony fingers at all the "racists".

Your last sentence is indicative that you are a selfish, transphobic, homophobic, cis-gendered hetersexual (did I mention selfish?) HATER who thinks what you have (and own) really should be yours. All good people know that we have the right to reach into your pocket to get however much we need to feel good about ourselves, and while we're at it, there (to be fair) should be a lottery to pick your next sex partner for you.

And sadly, to comment on the state of our educational and political system, there will be some fool who takes the above post seriously because I didn't label it sarcasm, and even more sadly, those fools get to vote!!

"They" don't reach into our pockets to get however much they want. They elect a government to do it for them. It provides cover for them to do so. Lest we point out their greed and selfishness.

So, the government established a NO TOUCH lock box for social security and said they would never touch it. Some genius figured out that politicians didnt need any merit to get elected they just had to promise lazy people that the government would pay for them to stay home as long as they promised their votes in return. In order to pay for that scheme they had to unlock the untouchable box and raid the funds. Now they can't figure out a way to fix the very system that they broke. The masses are asses and get what they deserve: Nancy Pelosi, Chuck Schumer, AOC should be made to stand trial for their crimes against the American people.

I've been paying into SS for 45 years. I know that the money has not been "saved". It's been squandered and it's likely that no one my age will get the full SS income that we've been promised.

That's bad enough, but this recommendation is that some of us should get even LESS because a) we saved a lot and b) there's a welfare need.

Who will decide which retirees are too "wealthy" to get SS payments? We were told that the IRS was going to chase down "wealthy" households with over $400K income but the IRS has now defined "wealthy" as over $200K (and said that it's a flexible definition).

After several decades of experience, I finally worked up to an upper-middle-class salary. With careful saving in my early years and catch-up contributions now, there's a reasonable chance that I'll hit $1 million in my 401K by the time I retire. Will I be too "wealthy" to get SS?

Yes, you are too rich. Everybody must subsist on Alpo, and sleep in tents. Rich must hate poor and vice versa.

That seems to be the answer from the left.

Many good replies.

(1) Yes SS is a Ponzi scheme that we were forced to give money to.

(2) Yes SS needs changes:

(a) Suggest eliminating the "early retirement" option.

(b) Suggest gradually raising the retirement age.

(c) Suggest letting people redirect the part of their SS "contribution" into IRAs in exchange for lower SS retirement pay.

(d) Suggest shutting down said Ponzi scheme, laying off all SS employees, selling all SS assets, and distributing the proceeds to the surviving victims of the scheme, in proportion to the money they have paid in (minus any amounts received to date).

I mean, that's what law enforcement normally does when a Ponzi scheme is discovered.

^^^ THIS ^^^

One word not mentioned in the article: Boomers.

That generation gets their retirement and end-of-life medical care paid for by federal debt, and they'll all be dead when the shit hits the fan. That's the legacy they leave to their children and grandchildren.

They should have known better than to have all been born in the same era.

They've got the most seats in Congress and are the largest generation in the electorate. They're the ones in power and electing the people in power. They're the ones who could, but won't, change anything. Yeah it's totally fair to put a good chunk of the blame on them.

Boomers will be dead soon, then who will you blame for your problems?

If the "children and grandchildren" are anything like the current crop of "we are all victims except whitey" regressive progs, then basically that's the legacy they deserve.

O.K. Zoomer! Why be classist when you can be agist? Just keep everyone divided. Lest they start reviewing things at the macro level.

This baby boomer said long ago that he'd be happy to forgo any SS benefit while still paying in until retirement so that current recipients could continue to receive their benefit, while the entire program was phased out. Many others in my generational cohort were like minded.

Now that I am a recipient, I'd say the same thing: Take my benefit away. But, only if the SS system as it stands, is phased out completely. We certainly don't want to burden future generations with this defunct scheme that should have been done away with long ago.

"Welfare Cuts Are Inevitable Because Congress Won't Touch Social Security"

Works for me!

As it should be.

I'm probably in a minority, but I would take losing all that I've paid into SS in exchange for eliminating 50% of federal departments (and spending) and 50% off my taxes.

Counter offer: Lose all the money you paid into SS, keep paying 100% SS and taxes and we keep adding more federal departments.

You like to renegotiate as you go along don't you?

Pretty sure your argument wins.

Who’s going to manage the much smaller government? That requires new agencies and a lot of new hires.

An actual Constitutional Republic instead of a Democratic [Na]tional So[zi]alist Empire? Yeah; I would emphatically.

All the Nazi's are going to loose all their fake money sooner or later anyways; they just haven't come to terms with the treasonous leaders their Nazi predecessors have voted for.

Welfare Cuts Are Inevitable Because Congress Won't Touch Social Security

Keep dreaming. Trust me, we can fund both just fine.

[WE] can all get 'gun' robbed MORE!!!

The welfare class can get that they need using Phillie as a model,

https://pjmedia.com/columns/paula-bolyard/2023/09/26/breaking-widespread-mass-looting-in-philly-video-live-police-scanner-n1730165

“Throw that fucking chicken on up here!” – Philadelphia looter at Popeye’s in link (for real)

Probably my white privilege that kept me from conceptualizing stealing chicken from Popeye's as looting.

Cutting welfare programs for needy families is necessary because Congress insists that relatively wealthy senior citizens get paid first.

One has not one fucking thing to do with the other, and both welfare and means testing social security are immoral and moral hazards.

If you are concerned about people who have chosen to have children without being able to afford them, feel free to chip in out of your own pocket. Welfare encourages reckless decisions.

Social Security is not welfare. I have had a percentage of my income taken against my will for my entire working life, with the promise of a defined benefit. To advocate punishing me because I made additional sacrifices during these year in order to have an even better retirement is not only wrong, it will discourage people from living within their means. Punishing success encourages reckless decisions.

Fuck you, cut spending.

Social Security is not welfare.

What about disability? That seems like welfare to me. Lots of people who haven't paid in much are getting disability.

What about disability?

If you are talking about the D in OASDI, we are still forced to participate. Disability fraud is a huge problem, but a separate issue.

I was thinking swillfredo pareto meant SSI. Talk about a welfare program.....

Agreed!

Well said. I'm forced to contribute to a system with a promised payout. I want that back and even the inflation depleted SS payments are better than a FU. How about starting from a position of drawing down and eliminating all of these programs. Why does he choose to the more egregious program (from a libertarian perspective?)

He wants to complain about government not cutting spending while engaging in the same "not my pet project!" that prevents even the indefensible outlays from being reduced/removed.

Socialist Security is UN-Constitutional (illegal).

Well said. MeToo.

Point taken. But, "people who have chosen to have children without being able to afford them"? Not a good argument.

1) This will happen no matter what. Breeders being breeders and all. And, humans are the worst! From "God will provide" to "don't you be telling me what to do" to "I didn't know I'd get pregnant like that".

2) And, our income tax structure already encourages breeding. If it was what it should be, we'd each be treated as individuals. No filing status. No deductions for dependents. No child credits. Just taxable income and tax on said income.

Not just complicated, fraudulent. It can't be done without admitting the separate accounting of SocSec to have been a fraudulent promise and putting it on the regular budget, which they've always been afraid to do because with that stroke they'd be acknowledging it as discretionary welfare spending. And because that acknowledgment would be abhorred by those who stand to collect, the political favor of those who voted for it would crash.

But what else is new? Many states have been embezzling from their retirement funds. Probably other countries too, I'm just playing the odds.

Start means testing Social Security retirement benefits, and the whole thing becomes just another welfare program. That is not how it was originally sold and continually justified to Congress or the public.

It’s already partially means tested: how much is taxable.

Bingo!

I've manipulated my wife's and my "other income" for the last three years so that we didn't hit the 85% taxable threshold on SS. We controled our expenses to live on that and a bit more from savings that wasn't taxable.

But, starting in 2024, we're forced to take RMDs on our rather extensive retirement savings and, we'll be paying income taxes on those and 85% of our SS. All we can do then is manipulate our withdrawals such that we won't exceed the 22% bracket to minimize the tax rates on our savings.

But tell today's young people that we did this - delayed gratification - and they'll say we're "rich" and using "loopholes" to avoid income taxes. And probably that our punishment should be confiscation of our "wealth".

We could also consider significantly reducing our military footprint and expenditures around the globe. Won't get us all the way there, but it would help.

How about if we cut congressional pay, cut congressional expense accounts, cut congressional perks and cut congressional retirement funds.

In a couple of more years I will have paid into the system for 50 years. I am already getting ripped off becuse I'll never get what I paid in back let alone what I could have earned from that money had it been invested in a simple index fund.

Fuck pushing the retirement age out, that just continues to screw the following generation. Eliminate the income cap, problem solved. And then start systematically doing away with the ponzi scheme that never should have been inacted in the first place.

If you discard the income cap, you get more money now in exchange for paying out larger amounts later.

Not so. SS payouts are capped.

Fuck off Sullum.

Mr. Boehm, You surprise me when you speak of further socializing social security. Social security is already a means-tested forced annuity. It is not a government entitlement, but rather a return of our own monies that the government confiscated from us first, invests on our behalf, and then 'graciously' returns it to us in the form of a lifetime annuity. When a person pays 12% or so of their income into a fund for their entire working life, one would expect that get some of that back, more if you pay more over your lifetime.

The means testing and social welfare portion of that comes in when it's annuitized for me and my percentage of income that is replaced is reduced the more I have made. For most, the ROI for payments into social security is about 0.9% annually, only proving that the feds are lousy with our money whether they're investing it, or spending it (unless you're a member of Congress and trade in your own account).

They rightfully won't touch it because it's confiscatory... and that I applaud.

What did you think was going to happen when FDR put the "Entity of Justice" in charge of your retirement plan? Did you honestly think you didn't VOID your own Justice in doing so?

I thought FJB and his party were going to hook up all those “first generation college kids”,WTF?

Ha ha ha, just kidding.

Seriously, so this writer suggests that “relatively wealthy” seniors should get their SS benefits means tested, because it makes no sense to send them checks when Brandine and her five kids need the money more.

Ha ha ha, the writer is just kidding, right?

How about we start cutting Social Security payments to people who never paid into the system, first?

An ex-girlfriend of mine received several hundred a month in Social Security (because her kid had ADHD) and had yet to have ever paid into the system when she turned 40 (She had also never been married...)

Several years ago, the SS administration published a report indicating that about 50% of all $$$ paid were to people who had never contributed to the Social Security system. Doubtless, many of those people who the spouses of people who had contributed, but I am also familiar with lots of instances like that of my ex girlfriend who was simply mooching.

BTW...There is a reason she's an ex girlfriend.

What do you consider wealthy? If you say income over $500,000/year and assets greater than $12 million, then I agree.

I started with nothing but a good brain. I WORKED very HARD for 50 years to get to "income over $500,000/year and assets greater than $12 million". EARNED. And paid payroll taxes at the highesf level for over 40 years.

America is not going to get ahead by f**king the most productive.

Absolutely correct.

However, people have been brainwashed into this idea that "the rich" are lazy hoarders of cash that would otherwise be available to them. The single sized pizza theory of economics. And that justifies taking it. Which starts by practicing two minutes of daily hate of them.

The policies, the opinions and general public attitudes of the last two decades are rather indicative of this. As a society, we've failed to counter this with truthful economic understanding.

There are things that can be done, but since they are Republican ideas, they're off the table.

Sure, there are poor people who depend on the government to get by. How about winnowing out the ones who can work? How about doing a better job of auditing EBT card usage, and kicking out the ones that aren't using them properly? Limiting these programs to the ones who truly need the assistance will go a long way toward reducing the welfare portion of entitlement expenses.

As for Social Security: Do the same as is done to retired public safety officers who receive a defined benefit pension, which is to reduce the Social Security payment according to a formula - the more that a person collects from his pension or any other retirement funds, the smaller the SS payment.

There are ways to reduce entitlements and reduce the budget. Congress just needs to have the balls to do it.

Social security was never intended to be a retirement plan, only a supplement. Medicare is arguably the most successful social program in history. If you look at the data, you will see that it keeps on the order of 30 million seniors out of poverty annually. Prior to the Great Society programs, the poverty rate hovered around 25% even during the boom times of the 1950s & 60s. It has never gone above 15% since regardless of good or bad economy. Even today, most bankruptcies are due to medical bills & often enough it is for people who actually DO have insurance. However, a medical system that values profits above curing illness is a problem that transcends this article.

I know many workers who exceed the Social Security cap annually who have told me that they would have no objection to continuing to pay into the system at the same rate as before they reach the cap if it would keep the SS program viable. It is estimated that eliminating the SS cap would add 10 to 20 years to the solvency of the system. It has been proposed yet the current Congress is more concerned about culture wars than about solving problems because they understand that fear gets them votes.

Democrats claims the GOP is coming for your SS & Medicare while the GOP claims that drag queens are coming for your children (of course, entering a 9 year old into sexualized beauty pageants is perfectly ok)

"families that have come to rely on them" is the problem. Money was stolen from my paycheck my whole life. They now owe it back. Change retirement age, charge social security for ALL W2 wages, change the rules for people just entering the work force. But DO NOT change the rules on people that have followed the rules. And who decides who is wealthy? Making $5,000/month,$50.000/month, $100.000/month? Who decides? When we were on government assistance a long, long time ago, it was HELL. They wouldn't let you starve but it was terrible blocks of yellow stuff they called cheese and government peanut butter that came in paint cans with 5 inches of oil on top. You got off assistance as soon as you possibly could. It wasn't a lifestyle choice.

SO your plan is to take my SS contributions and give them to somebody else who never earned squat. A truly brilliant idea from a truly mentally incapacitated individual. I’d love to hear his plan to reduce Govt. waste and corruption, discard the overly generous pensions and life time healthcare given to politicians after ONE TERM (2 years for a House Member!), stop allowing all the politicians to add pork to every spending bill. etc. Before we allow our idiot political class to pass a bill taking away MY contributions to SS and medicare, they need to demonstrate some financial discipline of their own which they so far have not done.

The biggest threat to the the empire is not welfare or SS. There are in fact limits to the number of dollars that can be created to pay for this shit. Did anyone notice that the petrodollar scheme that Kissinger sold the Saudis on is collapsing? Did anyone notice that after the regime neocons decided that the dollar would make a great weapon BRICS became BRICS+11? Did anyone notice that the nations that collectively control the majority of the planet's natural resources and have by far the largest populations are openly trading in currencies other than dollars and creating new ones? Did anyone think that when Nixon "temporarily" defaulted on Bretton Woods in 1971 we'd get away with it forever? All of this crap about the national debt is theatre. When the rest of the world stops buying our junk bonds and tells us to shove our reserve currency up our asses we'll all be needy. But welfare and SS will be a distant memory.

So the disbursement of SS funds should have nothing to do with the agreement/basis in which these funds were contributed? Watch out 401k and IRA owners! You're advocating turning it into a welfare program - which then could be cut. Like many people of Boehm's age they were indoctrinated in college that the ends justify any means.

"Watch out 401k and IRA owners!"

Yep. One of this old farts greatest fears....if I live another 30 years. It took a lot of delayed gratification and personal sacrifice to say nothing of the abuse and name calling from friends and family alike for choosing to save rather than spend. But I arrived into and early retirement set for life......as long as they don't take it away. And truthfully, at an accelerating rate, every so often ideas about doing so are floated out there.

And, young people have been indoctrinated to believing this is O.K. It's just a romantic idealism of Robinhood theory. They won't even acknowledge that Robin Hood was a thief, no matter his motives. And, it wasn't the government he was stealing from; it was that evil sheriff of Nottingham.

I can't believe that this kind of crap would come from Reason. If the author isn't smart enough to understand the difference between being paid back for DECADES of theft from my paycheck and sending checks to those who have contributed nothing, he really shouldn't be pretending to be a journalist.

Sounds an awful lot like you are advocating, "From each according to his ability, to each according to his need."

When did Reason decide to start pushing Marxism?

Several writers at Reason have been for a while.

Those who receive social security checks PAID-INTO the system.

.

Social Security is a RETIREMENT PLAN and NOT "welfare."

.

Isn't that clear?

Who are you going to turn to make that case? The same entity who stole all your money in their ponzi scheme?

No. No it isn't/wasn't.

Since 1935, it was always a welfare program for poor seniors. And, a supplement for those not so poor.

Along the way, many things were added.

But, most importantly, it is an annuity supported by a Ponzi type scheme. And, the actuarial reality was never addressed once it was launched. Which is how we got to where we are today.

These politicians are not stupid. In order to save a few pennies they will not urinate on the very people who are CAPABLE OF and DO contribute to their campaigns for cushy office.

The last time there was a serious public discussion about reforming SS/Medicare was 1983. I was in college then. It still gobsmacks me that this country has managed to go what is now nearly two generations without any further discussion. I would never have thought that was even possible back then. Worse – it’s pretty clear to me that there is far more interest in ideological posing than there is in being serious about the issue. I suppose that’s what we can afford to do so it’s what we will do until we can’t afford to do it.

How stupid are Reason readers if the author gets away with presenting false choices and ignoring the easy fix? Eliminate the payroll tax cap, currently at $160k A hedge fund manager who makes a billion pays the same as a doctor making ‘$160k. The Walmart cashier akink 28k a yr pays the same rate as a ma worth 200 billion. Such a move has robust publi support and would solve 90% of the future shortfall. Adding a tint progressive increase in the rare ..like 1 o2% would totally solve the problem. Too simple? Too popular? Too reasonable for Reason readers?

Social security withholding is based on payroll, not other forms of income or wealth.

Oh, don't try and confuse an absolute idiot, bent on taking from those he dislikes for his own benefit.

First, you will never tax that hedge fund manager much because he will move to the Bahamas or Luxembourg or Costa Rica and carry on making money but beyond US tax authority.

There are lots of other US professionals and well-paid skilled technicians who would be caught in your tax web. You can increase the SS tax rate on them--i.e., remove the earnings cap-- but this is simply equivalent to raising all marginal tax rates beyond the cap.

So, your argument boils down to raising taxes on "high" earners. Congratulations, Walter Mondale.

I will also note that although there is a cap on income subject to SS taxes, there is a corresponding cap on benefits. So, people who earn beyond the cap do not receive benefits beyond those received by people just at the cap.

When accounting for both the caps on taxes and benefits, the whole SS program is highly progressive.

This writer must know that to cut Social Security is sure way to lose elections. Is this now a leftist site trying to get the right to lose big time? SS has so far cost the general fund not one dollar, there is a projected loss if changes are not made but this money was borrowed by congress and is being paid back now. You are barking up the wrong tree. This is a paid for benefit. Stop giving money away to Ukraine and all other countries. The one program that has always paid for itself and that is where you see a problem? Bullshit to you, this program is what has caused our seniors to not live in poverty in retirement. We PAY 40 to 55 years and of all recipients of government checks we are the ones that actually earned it.

Is this now a leftist site trying to get the right to lose big time?

Are you new here?

^+10

The mistake was putting the 'vote' (WE mob) in charge of everyone's assets.

"this program is what has caused our seniors to not live in poverty in retirement"

Uh, no. The perception of this program as a full retirement plan, has allowed many spendthrifts to delay paying the price for their refusal to take responsibility for themselves. It's taught them to be good subjects and dependent on government. It's anathema to what set this country apart from the many that came before it.

Because old people vote.

A lesson lost on libertarians.

I was forced to pay into social security for over 40 years. Am I going to to have to do without the payback of that money so the federal government can give it all to the welfare chiselers that jumped our border, squatted, and squeezed out a pup to get the free stuff? Or am I going to have to watch what was a mandatory ponzi scheme, be given to leaches, to pay for their queer studies degree? I don’t like either one of those.

"McCarthy and his fellow Republicans are not proposing any cuts or changes to Social Security and Medicaid, the Post notes. That's despite the fact that it's actually the two major entitlement programs that are driving most of the federal government's long-term deficit."

I think that you mean medicare. Medicaid is for poor people, not seniors.

And the SOCIALIST SECURITY nation begins to start FALLING…..

"When there’s no longer enough money to go around, you’re faced with a difficult proposition: Who gets paid first, and who has to wait at the back of the BREAD line?"

It still floors me people of so much history can just KEEP making the same mistake OVER and OVER and OVER and OVER and OVER again. And play so completely STUPID when it’s 100% proven consequences come around.

Paragraph #2 literally loaded with Gov-Guns makes sh*t mentality. How long are people going to keep believing a 'gun' can make sh*t for them???????? Government is nothing but a monopoly of gun-force.

Aren't you all so proud to have paid for all the *free* ponies your elders voted themselves? Welcome to the Democratic [Na]tional So[zi]alist Security nation.

Here's a better idea. A Constitutional USA that never allowed Socialist Security or Welfare by the Union of States.

The welfare defendant can ALL go to their LOCAL welfare office where there 'gun' theft career can get some LOCAL scrutiny involved.

SCOTUS has already ruled your SS payments were just a national tax.

How dare we discuss cutting

wealth distributionwelfare benefits!? We should obviously do everything in our power to ensure that people absolutely do not get back money that they had forcibly taken from them under the auspices of it being for their own protection later in life! How dare you! /sHow about this instead? Fuck you, stop stealing my money!

But, but, but......you didn't build that!

How can you claim it's your money?

So it is okay to withhold paying benefits for which an individual has paid throughout his or her working life if the individual has been financially successful?

Yep; You were just paying to shut down pipelines, kill the electrical grid, ban cars and subsidize laziness. Your money is already gone and you got a big fat debt to pay to go along with it.

The wonderful ?benefits? of voting for a [Na]tional So[zi]alist Empire to conquer the USA. Seriously; What did you think was going to happen when potential politicians promised to be lawless and STEAL for wealth-distribution and entitlements? Did you think that money came from a money tree or what?

People PAID IN to Social Security. Just like an IRA or 401k - so do you also suggest that, say, Charles Schwab, decrease earnings paid out to wealthy investors?

Difference being when private retirement companies lie, steal and cheat the government (justice) can fix it. You sold-out your own Justice by voting to make your retirement account in the same company/government in charge of ensuring Justice. You have no Justice to turn to.

Of course those are not the only two choices. You forgot the choice of giving back the trillions of dollars Trump and Republicans gave to the billionaires in 2017. Then you forgot about changing the 2017 law so that the rich begin to pay their fair of taxes. Now, we have billionaires paying $175 tax (Trump), huge corporations paying zero (Amazon), and huge corporations being gifted with government subsidies (giveaways, like to Walmart). The choice of fighting over the crumbs left after the rich are given trillions is not the only choice there is; it is the only choice for those who persistently press for taking money from the rest of us to give to the billionaires. No individual earns $1 billion. Only the productivity of workers does that, and the bribed politicians that provide that however much the rich take from the workers, it is never enough, and the rest of us must pay them even more, before anyone addresses the problems of the rest of us.

What Trillions of dollars Trump and Republicans gave billionaires? The Cares Act was written and pitched by House Democrats.

[Na]tional So[zi]al[ism]. Where crimes get legalized. Did anyone really think the halls of Justice was going to lock-up their own ponzi-scheme agency to protection your property in the name of justice?

That premise flew out the window when FDR thwarted the Supreme Law of the Land and SCOTUS (the enforcer) by threatening to stuff the judiciary with lawless criminals who really didn't care what the people's law over them was.

The sheep electing the wolf to be their care-taker..... What could possibly go wrong?

If the government reneges on its social security commitments to certain groups it should have to refund with interest what was taken from their paycheck. They should also get a portion of the contribution their employer made also . Anything else is theft.

Thank you for that link. It saved me the trouble of finding it for Sarc.