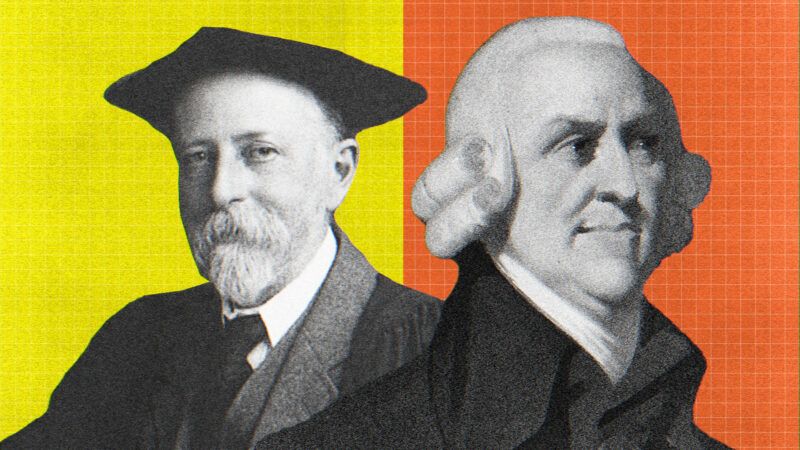

Adam Smith at 300: The Gospel of Mutual Service

A 1926 lecture captures timeless truths about the Scottish thinker.

In 1926, the 150th anniversary of The Wealth of Nations, British economist Edwin Cannan delivered a lecture titled "Adam Smith as Economist" at the London School of Economics. The lecture was published in Economica in June of that year and in 1928 in Cannan's An Economist's Protest. (It was there that Cannan added the subtitle "The Gospel of Mutual Service.") What follows is excerpted from the lecture. – Daniel Klein

Adam Smith may fairly claim to be the father, not of economics generally—that would be absurd—but of what in modern times has been called, with opprobrious intention, "bourgeois economics," that is, the economics of those economists who look with favor on working and trading and investing for personal gain. We are apt to forget that the idea that a wage-earner, a trader, or an investor may be, and indeed generally is, a very respectable person is very modern. From Homer we learn that the people whom Odysseus visited on his travels thought it all the same whether he was a trader or a piratical murderous marauder. Primitive people are said to have regarded exchange as a kind of robbery rather than as a mutual giving. Greek philosophers thought wage-earners incapable of virtue, and money-lenders have been objects of antipathy throughout the ages. In Smith's own time Dr. [Samuel] Johnson and [Malachy] Postlethwayt very seriously considered whether a trader could be a gentleman.

Smith came forward as the admirer and champion of the man who wants to get on. Probably, like many another Scotch boy, he had learnt that gospel on his mother's knee. … Regard, he said, for "our own private happiness and interest" is often a laudable principle of action:

The habits of economy, industry, discretion, attention, and application of thought are generally supposed to be cultivated from self-interested motives, and at the same time are apprehended to be very praiseworthy qualities which deserve the esteem and approbation of everybody. … Carelessness and want of economy are universally disapproved of, not, however, as proceeding from a want of benevolence, but from a want of the proper attention to the objects of self-interest. [From Smith's The Theory of Moral Sentiments]

Far from making people inclined to cheat, he held, commerce made them honest and desirous of fulfilling their contracts. He told his Glasgow students, according to the report of one of them:

Whenever commerce is introduced into any country, probity and punctuality always accompany it. These virtues in a rude and barbarous country are almost unknown. Of all the nations in Europe, the Dutch, the most commercial, are the most faithful to their word. The English are more so than the Scotch, but much inferior to the Dutch, and in the remote parts of this country they are far less so than in the commercial parts of it. This is not at all to be imputed to national character, as some pretend; there is no natural reason why an Englishman or a Scotchman should not be as punctual in performing agreements as a Dutchman. It is far more reducible to self-interest, that general principle which regulates the actions of every man, and which leads men to act in a certain manner from views of advantage, and is as deeply implanted in an Englishman as a Dutchman. A dealer is afraid of losing his character, and is scrupulous in observing every engagement. When a person makes perhaps twenty contracts in a day, he cannot gain so much by endeavouring to impose on his neighbours as the very appearance of a cheat would make him lose. When people seldom deal with one another we find that they are somewhat disposed to cheat, because they can gain more by a smart trick than they can lose by the injury which it does their character.

They whom we call politicians are not the most remarkable people in the world for probity and punctuality. Ambassadors from different nations are still less so. … The reason of this is that nations treat with one another not above twice or thrice in a century, and they may gain more by one piece of fraud than lose by having a bad character. … But if states were obliged to treat once or twice a day, as merchants do, it would be necessary to be more precise. … A prudent dealer, who is sensible of his real interest, would rather choose to lose what he has a right to, than give any ground for suspicion. [From Smith's Lectures on Jurisprudence]

In The Wealth of Nations, Smith says, like a true bourgeois: "Bankruptcy is perhaps the greatest and most humiliating calamity which can befall an innocent man." Throughout the book, he treats prodigality with bourgeois contempt; it is a kind of mental aberration—Sane men save:

With regard to profusion, the principle which prompts to expense is the passion for present enjoyment; which though sometimes violent and very difficult to be restrained, is in general only momentary and occasional. But the principle which prompts to save is the desire of bettering our condition, a desire which, though generally calm and dispassionate, comes with us from the womb and never leaves us till we go into the grave. In the whole interval which separates those two moments, there is scarce perhaps a single instant in which any man is so completely satisfied with his situation as to be without any wish of alteration or improvement of any kind. An augmentation of fortune is the means by which the greater part of men propose and wish to better their condition. It is the means the most vulgar and the most obvious; and the most likely way of augmenting their fortune is to save and accumulate some part of what they acquire, either regularly and annually or upon some extraordinary occasions. [From The Wealth of Nations]

All this approval of the man who wants to get on in life, succeed in business, or whatever you like to call it, would have been a very poor gospel if such success were only purchased at the cost of depressing other people. But in Adam Smith's view, it was not. On the contrary, he held that commerce and investment having been introduced, each man by trying to help himself, in fact, not only helped himself but all others.

So, in his opinion, when "the butcher, the brewer, and the baker" provide us with our dinner, not because they love us, but because they wish to benefit themselves, they need not be ashamed of the fact. Let them go on doing their best to serve their own interest, and they will serve us and society generally better than "if they affect to trade for the public good" and better than if the State tries to regulate their prices.

He pictured the vast multitude of persons in various parts of the world cooperating in the production of the modest coat of the laborer; he showed how their specializing in their respective occupations increased their product; he described this division of labor as the greatest cause of the superior opulence of civilized mankind over their primitive ancestors and their uncivilized contemporaries. And he pointed out that the cooperation was not due to any effort of collective wisdom, but to men's natural propensity to serve their own interest by "truck, barter, and exchange of one thing for another." He described the increase of capital as another great cause of prosperity and said very truly that it was not the result of government foresight, for governments were generally prodigal and profuse, but of the frugality and good conduct of individuals desirous of bettering their own condition….

International trade is still looked on with quite primitive suspicion: Each country imagines that it must be very careful not to allow its subjects to buy and sell across the national boundary as freely as they do inside it. There is no confidence that the fact that they find it profitable indicates that the country as a whole will benefit by it.

Adam Smith could see no sense in a country's refusing to let its inhabitants buy from abroad what they could buy cheaper than at home. No prudent head of a household, he said, has anything made at home when he can buy it at less expense outside, and what is prudence on the part of the householder can scarcely be folly on the part of a nation. Why, then, this persistence of fear of cheap imported goods, rising almost to panic when the price falls to zero, as when a defeated enemy consents to pay reparations and it is realized that the reparations will be paid not in paper money or gold but in goods?…

[Smith] elevated the conception of gainful occupation and investment from a system of beggar-my-neighbor to one of mutual service. The new conception has steadily gained ground in the more advanced countries of the world. It is true that there is a numerous sect which tries to convince the wage-earners that they are working not for the public and not for the consumers of the things or the services which they produce but for the capitalist employer who gets what is left after wages and other expenses have been met; but their sour propaganda loses force as the old theory of the iron law of wages drops into oblivion in face of obvious facts….

So we do not now think of work being done as by a slave for a master, and of business being engaged in as by a gambler to win gain at the expense of other players. We work for our wages and our salaries, and even for those residues which are called profits: We save and invest for our interest and our dividends knowing full well that the more successful we are, the better not only for ourselves but for the consumers of our products.

I hope that no teacher in the [London] School [of Economics] will ever give any countenance to the pernicious belief that steady and honest service in satisfying the demand of the people for the necessaries and conveniences of life is something to be ashamed of because it is profitable. The modern workman and the modem trader can practice virtue as well as a Greek philosopher, a medieval begging friar, or a 20th century social reformer.

Show Comments (18)