Social Security and Medicare Are Ticking Time Bombs

Even taking all the money from every billionaire wouldn't cover our coming bankruptcy.

Social Security is toast.

So is Medicare.

Too many of us old people live longer, so there are not enough working people to support us.

Soon both Social Security and Medicare will be broke.

Our politicians don't have the guts to do anything about it. Or even talk about it.

It's easy to see why.

Recently, France's president, trying to keep his country's pension system from going broke, raised France's retirement age from 62 to a measly 64.

People have been protesting ever since.

In America, politicians who even hint at such solutions get screamed at by misinformed seniors: "Don't touch my retirement funds! You took money from my paycheck for years; that's my money I'm getting back!"

But it's not. It's young people's money. People my age rarely realize that most of us now get back triple what we paid in.

When Social Security began, a government retirement plan made financial sense. Most Americans didn't even live until age 65. Social Security was just for the minority who did.

But now Americans live, on average, to age 76. I'm 76. Henry Kissinger is 100. Since most of us live so long, there are just not enough workers to pay for us.

Yet our vote-hungry politicians won't say that in public.

Even former President Donald Trump cowers, saying, "No one will lay a hand on your Medicare or your Social Security."

The most clueless, like Sen. Bernie Sanders (I–Vt.), even deny the obvious truth. He shouts: "Social Security today is not on the line going broke!"

But it just is. Reserve funds are projected to run out by 2034.

Medicare's reserves will run out even sooner.

Of course they will. When I first got Medicare, I was surprised how no one even pays attention to costs. Everything seems free.

"Get an MRI," says my doctor. I immediately do. I don't ask the cost. The MRI people don't mention it either.

Months later, I get a complex notice that says my MRI cost $2,625 and I must pay $83.65. Or sometimes, nothing. Who did pay? Blue Cross? Taxpayers? The paperwork is so complex that I don't even know.

Old people who scour supermarkets to save a dollar on groceries never comparison shop for MRIs or heart surgery. "Why should I? Someone else pays."

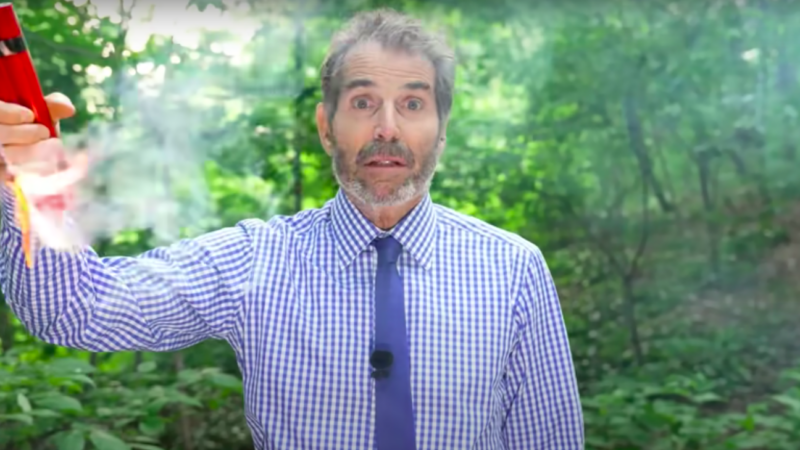

As my new video illustrates, Medicare is a bomb with a burning fuse moving closer.

"Sooner or later, it will blow up," says economist Dan Mitchell of the Center for Freedom and Prosperity. "Politicians figure oh, well, maybe it blows up in five years or 10 years or 20 years. I won't be in office anymore."

Some claim raising taxes on rich people would solve the deficit, but it won't. There just aren't enough rich people. Even taking all the money from every billionaire wouldn't cover our coming bankruptcy.

The only solution is cutting benefits, raising the age when benefits start (sensible, since we live longer), or, Mitchell's preference, privatizing retirement plans, like Australia and Chile did.

America's politicians won't do any of those things.

So what will happen?

"The only other alternative is printing money," says Mitchell.

"I suspect that's what America will do," I tell Mitchell. "We'll be like Zimbabwe." Zimbabwe's president printed money to fund his deficit spending. When the currency collapsed in 2009, Zimbabwe was printing hundred trillion-dollar bills.

Yet politicians don't learn. In the current debt ceiling deal, House Speaker Kevin McCarthy (R–Calif.) got President Joe Biden to "claw back" unused COVID relief funds and keep two years of non-defense discretionary spending roughly flat.

That's a little progress. But Biden wants to spend a record $7 trillion next year.

McCarthy said Medicare and Social Security were "completely off the table."

So the programs are still doomed.

"Sooner or later bad things will happen to senior citizens," explains Mitchell. "The government will either cut their benefits or all of a sudden start rationing health care. Or reimbursement rates will be so low that you won't be able to find a doctor or hospital to treat you."

COPYRIGHT 2023 BY JFS PRODUCTIONS INC.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I am making a good salary from home $1500-$2500/week , which is amazing, undera year earlier I was jobless in a horrible economy. I offer thanks toward Godeach day I was blessed with these instructions and now it’s my duty to pay itforward and share it with Everyone, Here is website where i startedthis……………..

.

.

EARN THIS LINK—————————————➤ https://Www.Coins71.Com

Money making home based work to start earning every day more than $600 simplydoing copy and paste work online. Previous month imade $18320 from this job andi gave this only 2 hrs from my whole busy day. Very simple to do work andregular earning from this are much better than other regular 9 to 5 jobs. Go tothis site right now for more info.

.

.

HERE ————->> http://www.pay.hiring9.com

I am making a good salary from home $6580-$7065/week , which is amazing under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it’s my duty to pay it forward and share it with Everyone,

🙂 AND GOOD LUCK.:)

Here is I started.……......>> http://WWW.RICHEPAY.COM

Google is by and by paying $27485 to $29658 consistently for taking a shot at the web from home. I have joined this action 2 months back and I have earned $31547 in my first month from this action. I can say my life is improved completely! Take a gander at it what I do.....

For more detail visit the given link..........>>> http://Www.jobsrevenue.com

I can’t remember when President George Bush wanted to privatize Social Security.

He was going to have everyone pay into an S&P 500 index mutual fund.

If that had passed, not only would the program not be bankrupt, but everyone would be getting triple the amount of benefits they get now.

Seems to me that’s the plan from both parties is just to reduce the benefits by 20%

You took my money by force, and I expect to get what was promised.

Maybe stop funding wars.

Since you were promised nothing, you will get what you expect.

Oh, you think you were promised something? It doesn't work like that. I was "promised" lower taxes, functional bridges, safer roads and all sorts of things that didn't come true. Social Security is just one more.

And let's note that for 30 years, everyone has been loudly exclaiming that the "Promise" had an asterix the size of the dinosaur killer next to it.

I'm kind of sick of people who have been voting for 50 years for people who have INSISTED that they will do nothing to reform social security, and now whine that their promise is being broken. The last president promising to do something about Social Security was Bush in his second term (after already fucking over Medicare with Part D). And his majority in Congress was swiftly eliminated before he could bring anything to the floor.

Many people will argue, "Oh, well Bush needed to be punished for his Iraq War debacle". Yes. He Did. And voters around the country made the decision that was more important than saving social security. And people decided it was more important to deform the health care market than fix social security. And people decided it was more important to stop immigration than reform social security. And people decided it was more important to punish the anti-immigration president than reform social security.

No one has cared about social security enough to support a politician willing to do something about it. And so surprise, no politician willing to do something about it has been elected.

I agree to an extent, as I have paid in over 40 years, as well, for both SS and Medicare at a high level. However, with Medicare, perhaps there needs to be more substantial deductibles, so that people will only go for treatment as they really need. The notion that expensive diagnostics or treatments come with little or no financial consequences to the recipient is an obvious recipe for disaster - no other industry operates in this manner. With Social Security, they should just cut benefits 20% across the board, if that is what current law says will happen. SS was never intended to be people’s sole retirement income, in the first place. And I don’t believe in raising tax rates on younger people over and above the rates I had to pay.

Don't you think young people should demand that their FICA taxes be raised (so that they can get SS when they retire) or eliminated because they're paying FICA taxes now knowing that SS will not be there when they retire?

I figure I'm paying for my mom's current SS, not my future SS. I feel bad for people who's only plan in retire is SS. I planned my owe savings. Cat food for all!

will always disavow future social security payments in exchange for the pretense of future social security payments

Social’ist Security in the USA?

Only a Democrat (FDR) could propose such a treasonous take-over the USA for a “New Deal” USSA 'socialist' USA. The enemy lives amongst us and the enemy has already conquered the USA. Now it’s onto the consequences of allowing that enemy to conquer this once great nation.

That's right folks. The US Constitution doesn't allow socialist security so whatever you think this nation is; it isn't the USA anymore by it's very definition.

But whether the Constitution really be one thing, or another, this much is certain - that it has either authorized such a government as we have had, or has been powerless to prevent it. In either case, it is unfit to exist. Lysander Spooner

I AM Making a Good Salary from Home $6580-$7065/week , which is amazing, under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it's my duty to pay it forward and share it with Everyone. go to home media tech tab for more detail reinforce your heart ......

SITE. ——>>> bitecoindollar12.com

Which clause or amendment prohibits Social Security?

You have the constitution backwards. Which clause grants them the power to implement it?

10th Amendment; If the power isn't granted it is prohibited.

As JeeseAz points out to you and I can't imagine anyone who wouldn't know this. What are they teaching in Commie-Education these days?

This is only news to lifelong blinkered normies.

"Too many of us old people live longer, so there are not enough working people to support us."

So make everybody under 65 get a job.

End welfare and use that money.

Tax all political contributions at 600% and confiscate all existing campaign funds.

There are many options.

weaponized cold viruses and their “vaccines” seem to help cull demand.

I AM Making a Good Salary from Home $6580-$7065/week , which is amazing, under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it's my duty to pay it forward and share it with Everyone. go to home media tech tab for more detail reinforce your heart ......

SITE. ——>>> bitecoindollar12.com

Give me the money I put in, adjusted for inflation, and I'll be on my way.

Not happening.

Just stop taking money from me *now*.

That's not happening either.

Didn't the pandemic kill off quite a lot of old people? Not just old people that were almost dead anyway, but lots of regular old people too? I read somewhere that the savings from all of these dead old people is significant.

Maybe some more pandemics before 2034 will save us all from the burden of old people living so damned long?

Libertarians hate these programs anyway, so even if the reserves where flush with cash, they'd find another reason to hate on them.

The way to see this is that they'll wave off long term climate change forecasts, but forecasts about things they hate, like welfare programs and national debt, they'll be first to raise the alarms about the long-range doom to come.

One man's program is another man's legal plunder.

One man's long-term climate forecast is another man's flaming pile of bullshit used to grab more power and money.

Logical fallacy known as "ad hominem fallacy" - when you can't muster any actual factual or logical arguments, always remember to attack your opponents with whatever personal traits you can think of, whether accurate or not. I wave off long-term climate forecasts because they are scientifically unjustified. I do not wave off fund insolvency forecasts because THERE IS NO SOCIAL SECURITY FUND to go insolvent. By the government's own system and their own forecasts they will have to cut benefits at some point in the future.

Per this chart, 75% (850,000 seniors) of all Covid-19 deaths in the USA were age 65 or older. See https://www.statista.com/statistics/1191568/reported-deaths-from-covid-by-age-us/

No, Covid didn't kill lots of regular old people, it only killed people that were very sick. The propaganda campaign was a fraud that was intended to sell Covid vaccines that work very well for the drug companies that run the government.

It was forecast that snow was a thing of the past. Thank God we don't get snow anymore.

obviously if we let in a bunch of destitute immigrants from central and south america ... they can fill the social security and medicare coffers with all of their "under-the-table" landscaping and housekeeping wages

Known elsewhere as "earning your own living" and "supporting yourself through gainful, productive employment" But by all means sneer at those who choose not to remain destitute while feeding your worthless carcass ...

Or maybe not:

https://www.thestreet.com/retirement-daily/social-security-medicare/social-security-is-not-going-bankrupt

Did you actually read the article you're linking to?

Half the article is on the point that SS can't go "bankrupt" because it's not a legal entity that can go bankrupt. Which is true but irrelevant because Stossel only uses the word once in a metaphor. What can and will happen is that the US will (eventually) default on the SS payments. "Default" is not legally the same as "bankruptcy" but it's close enough for this purpose.

The second half of the article agrees with Stossel's point (while quibbling that it's about the "Reserve Account") and has an entire closing section agreeing with the prediction that Congress will be unable to step up with a solution.

The government won’t even default. A default is when money legally owed isn’t repaid per the terms. These programs aren’t legally owed.

There already is a solution. Payments will be reduced.

SS has been a ticking time bomb for 30+ years. The time to reform/privatize it was then. The transition costs would have been minimal, but now we're fuckered.

It WAS reformed in 1983. The Greenspan Commission. Which was when SS payments began to exceed FICA taxes – and thus began drawing on the general account which violated the original promise of FICA. That’s the last time there was any discussion about it.

The reform was raising taxes – changing cost of living calculations – and the real shits meow the trust fund. And taking SS out of the anual budget. Apparently no one at the time really explained (not out loud at least) what the impact of that would be on interest rates, cost of govt funding, motivations to spend via debt instead of taxes and the slew of other shit that was happened. Honestly – 40 years later no one has even yet explained the impact of the trust fund on public finance decision making.

Both parties have benefited fro that shit immensely. The Democrats who have completely lost any incentive to restrain spending (D’s like Proxmire gave Golden Fleece awards about crazy spending ideas, it was D’s – not R’s or Southerns – who audited defense spending). It was R’s who kept driving the ‘lower taxes always at all times even if we increase spending’ bus.

The DeRp’s ain’t gonna change anything. They tried reform already and proved they are incompetent (at best). And after 40 years – there ain’t nothing else. No idea that is worth even a tiny little turd.

I will not be "f**ked" in any way by the implosion of Social Security. Although I paid into it for over fifty years, I never once counted on it being available in my old age.

No, social security and medicare are NOT "ticking time bombs" in any sense of the phrase. If The People (TM) let the politicians trick them into paying into a system that suddenly disappears because they refused to let those politicians make the necessary changes to keep it running, it's their own fault. It's not like people who realized the systems were not sustainable and are not now counting on them will be harmed any more than they already have been when the systems go bankrupt.

I always wonder in these articles how and why the REAL problem is never discussed. That problem is the TOTAL lack of competition for medical services ( physician prices) and medicines which has destroyed any kind of affordability regardless of who pays, government or private entities.

Brilliant! And what does your expert analysis reveal as the cause of the “lack of competition” for medical services? It wouldn’t perhaps have anything to do with the collectivization of medical care by the Centers for Medicare and Medicaid Services, would it?

Trustees have estimated that an up to 21% across-the-board cut in Social Security benefits for existing and future retirees may be needed in order to sustain payouts without any additional cuts through 2092.

While painful for many recipients, that's hardly "bankrupt".

Also, according to the 2023 Trustee's report, for the combined OASI and DI Trust Funds to remain fully solvent throughout the 75-year projection period ending in 2097, revenue would have to increase by an amount equivalent to an immediate and permanent payroll tax rate increase of 3.44 percentage points.

In other words, employee and employer SS taxes would each have to rise 1.72% to ensure solvency for the next 75 years. An increase from 6.2% to 7.92%.

The point is that the current politicians won't make those changes. They keep kicking the can down the street. When they finally have no choice but to make cuts there the people will howl and they will simply print more money to cover the shortfall. The problem, of course, is NOT the welfare programs, but the stability of the underlying economy. Everything they can do to avoid touching Social Security makes the monetary system itself shakier.

This is such obvious nonsense: the only solution is cutting benefits? When the trust fund surplus runs out in 12 years, SS will be short 20%. This can easily be remedied by simply removing the cap on payroll taxes, currently at $147,000. So a hedge fund manager making a billion a year pays the same as a doctor making $150,000. Repealing the cap would fund SS in the years ahead y about 4/5 of the shortfall; so a tiny raise of less than 1% of the payroll tax would make SS solvent as far as the eye can see....this solution has been known for decades.

As for Medicare, the solution is to enact Medicare for All, which will save money...."According to the Congressional Budget Office, Medicare for All would save $650 billion each year, improve the economy, and eliminate all out-of-pocket health care costs. Even a study done by the right-wing Mercatus Center estimated that Medicare for All would save more than $2 trillion over a decade."

John Stossel is over the hill, thinking we will not be aware of solutions other than cutting benefits for the elderly.

I have my preferred solution for you: deporting you to a modern developed western nation that currently suffers under "medicare for all" so you can enjoy it to the fullest. What did you not understand about the inescapable fact that revenues collected by the Federal government have remained fixed as a percent of GDP over the last nine decades regardless of the maximum marginal tax rate? Raising the cap will not result in more revenue for Federal welfare systems.

John Stossel is correct about SS and Medicare being time bombs. He is also correct that politicians are unlikely to do anything until absolutely necessary, as we have just seen with the debt ceiling debate. This is especially true in this time of partisan division where no one will stick their neck out.

I would suggest that better approach than looking to Congress would be to have a non-partisan group develop a solution, sell it to the public and then take it to Congress to enact. The group would have to be willing to set aside personal ideas, look at the goals of the programs and then ask how to reconfigure the programs to meet the goals in a sustainable way. Congress can't do the job, but could pass a new reconfigured program. I would think a group like No-labels, a group of ideological different think tanks could also do this cooperatively.

It is unlikely to happen, but I would suggest that starting now with a cooperative effort will be better than a last-minute push through Congress.

The poor need to start paying thier fair share.

Stossel says that most of us get back triple what we paid in. If that were so, then maybe more folks on S.S. would be willing to forego some benefits.

But, in my experience, it is more likely that most of us get back far less than we paid in, when compounded interest is figured in, when inflation is figured in, and when compared to investments over, say, 40 years in an S&P 500 Index Fund. And, if you died before your investments were used up, they could be

inherited by your heirs, unlike your S.S. which goes away when you die.

There are only two ways to 'deal' with a time bomb, defuse it. Or walk away.

The government stole the money, printed worthless IOU’s and it is not the workers fault, but they blame the workers, for living to long!

Oh, but people are living longer. That is not a new phenomenon, they had over 80 years to address people living longer as that is when the age of death started increasing was already 1940, only 5 year after SS was started.

Even if you look at the 1980’s they had over 40 years to address the issue. Instead they increased benefits, teachers, farmers, and disability fund for people that hardly paid in. Like all politicians, promise everything, deliver nothing, ignore the problems for decades, blame it all on the other party, and let future generations suffer the consequences.

Same thing they are doing with the debt ceiling right now. Just hoping and praying the other party is in power when the collapse comes.

government spent $8.7 trillion in 2022—an average of $66,617 for every household in the nation. The portion of the U.S. economy consumed by government spending has grown from 8% in 1929 to 34% in 2022

Rejoicing in welfare reform is like holding a party in Chicago because the number of your killed neighbors went down

Give me just 1/3 of that $66,000

There's a website https://socialsecurity.actuary.org/ that allows you to solve the social security issue. Here's my solution: 1) Add one percentage point to the annual COLA for seniors age 85 and older and 2) Raise payroll tax from 12.4% to 16%. If everyone wants Social Security, then everyone should pay for it. Think of it more like an investment than a tax. Yes, it will hurt employees and businesses but would you rather have ZERO SS benefits when you retire? I think not!

Bernie and the Democrats say it's fine. What's the problem? Like Shrike they never lay /sarc