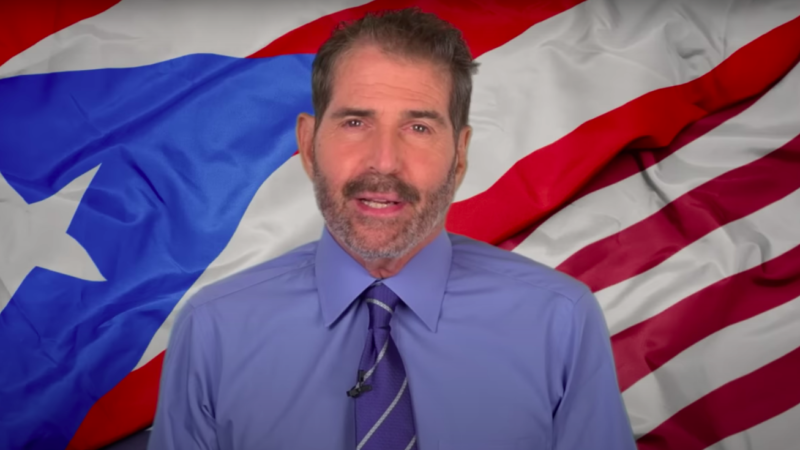

The Easy Way To Avoid Federal Income Tax: Move to Puerto Rico

Wherever markets are free, new wealth gets created. Then almost everyone wins.

Want to pay no federal income tax?

Move to Puerto Rico.

Really. If you move to the island, you can legally pay none. There's also no capital gains tax.

You just have to give 4 percent of your income to Puerto Rico.

The tax break was started by a Puerto Rican politician who'd watched years of high taxes fail to improve life on the island. He decided to try something different.

Obviously, it's a popular idea when people learn about it.

Tens of thousands have applied for the exemption, and applications tripled last year.

YouTube star Logan Paul moved his show from California to Puerto Rico to take advantage of the tax deal.

Investor Peter Schiff says, "I did it for the obvious benefit of being able to keep most of what I own…It's too bad that Puerto Rico didn't do this decades ago. They wouldn't be in the economic trouble they are today."

"A lot of people are moving down here," says social worker Melissa DaSilva in my newest video. Two years ago, she ran a therapy business in Rhode Island. Now she runs it remotely from Puerto Rico. "I'm saving 25 percent of my income."

She loves her new life.

"I wake up, and I have the ocean in front of me. I go out my back door, the rainforest is off in the distance. It's just a magical place to live."

Given that this tax break is so big, it's surprising that most Americans haven't heard about it.

"People just don't really talk about it much," says DaSilva. "There's this fear that people from the state side are going to come down and take over everything."

Given Puerto Rico's history, she says, that fear is justified. "The Spaniards came and decided it's going to be their island and decimated all the native people. Then the United States comes down, and they decide it's going to be their island."

But these new Puerto Ricans aren't exactly conquerors.

They're a mix of entrepreneurs, tax haters, crypto millionaires, and ordinary people who just want to keep more of their money. By bringing wealth and skills to Puerto Rico, they create opportunity for Puerto Ricans. One report says they have already created 40,000 new jobs.

"If you don't pay taxes, aren't you hurting Puerto Rico?" I ask DaSilva.

"I do pay taxes," DaSilva replies. "I provide other things as well." She sells digital art and donates part of her sales to local nonprofits.

Billionaire Brock Pierce moved to Puerto Rico and now helps run the charity Toys for Tots. He also is renovating a hotel that was abandoned after Hurricane Maria. That's expected to create 300 jobs. Others are building hurricane-resistant farms, tech companies, and schools.

But some people always see such investment as a problem. Rep. Alexandria Ocasio-Cortez (D–N.Y.) calls the tax incentive "horrifying."

"It's an example of the continued colonization of the people of Puerto Rico," she complains. "We are essentially importing a ruling class."

She seems to think that if someone makes money, others must lose, as if there are only winners or losers. This is zero-sum thinking.

It's true in politics. But it's not true in most of life. Wherever markets are free, new wealth gets created. Then almost everyone wins.

DaSilva has an answer to Ocasio-Cortez's zero-sum thinking: "All ships rise with a tide," she says. "Let's all grow with this."

Puerto Rico has tried big government, strict regulations, high taxes on businesses, handouts to favored groups, heavy borrowing, and declaring bankruptcy.

I bet tax breaks work better.

COPYRIGHT 2022 BY JFS PRODUCTIONS INC.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Hadn't heard of this. Don't like hot climates, my Spanish is rusty AF, but 4% tax rate? Hmmmm. I wonder how long it will last.

I made $30,030 in just 5 weeks working part-time right from my apartment. When I lost my last business I got tired right away and luckily I found this job online and with that I am able to start reaping lots right through my house. Anyone can achieve this top level career and make more money online by:-

Reading this article:>> https://oldprofits.blogspot.com/

Transparency is always desirable. Are there any requests that you refuse to perform in your webcam shows? Do you shave your pubes before the show, or do the shaving "on cam"?

This Is so disingenuous.

I sailed my boat to Puerto Rico, fell in love with the place and even got my Puerto Rico medical license.

First off, while there is no Federal income tax, there is a local income tax of up to 33%.

With an extra 5% for high wage earners.

Second off, wages (at least for doctors) are laughably low.

At least one third of what one would earn in Florida.

The place has been run by Democrats for years and it is everything you would expect from a blue run place.

The medical job market is completely controlled by a small group of corrupt doctors.

You cannot work unless they give the o.k.

I assume it is the same in all other professions.

Crime is rampant in San Juan, you take your life in your hands there at night.

Work ethic is non existent and regulations onerous.

You will note that all the people mentioned in the article do not have a brick and mortar presence in P.R.

Because corruption and regulations stifle every aspect of doing business there.

And don’t forget, as a Democrat run territory, they have gun control.

May issue carry permits, permit needed to have a gun in the home, spouse can prevent getting a permit.

Don't kid yourself. AOC is perfectly fine with a ruling class, as long as she's in it.

Hey, did she ever get her Grandmother a new roof?

Why should she fix the roof when she can exploit her grandmother?

Well what she really wanted was for you and me to fix it along with the rest of American taxpayers.

There are no temperature extremes in Puerto Rico. Roofs cast out of a long slab of concrete painted with Thompsons shed water like a duck in torrential downpours. The same roof would crack into many pieces in less than two years in Matamoros or Nuevo Laredo.

Yes. Lolita Lebrón 2.0 has done a lot better for herself than her predecessor did during her brief stint in Congress.

So... Puerto Rico is a bastion of freedom and prosperity- that's the example you're going with?

No I am pretty sure he is going with "Puerto Rico is a way to avoid federal income taxes"

"The Easy Way To Avoid Federal Income Tax: Move to Puerto Rico

Wherever markets are free, new wealth gets created. Then almost everyone wins"

I'd go with Puerto Rico is attracting new people with new skills, benefiting the local economy far more than would otherwise occur without the tax break.

A tax-free zone would be a great way to fix Detroit as well.

I hope this works for them. I know very, very little about Puerto Rico.

If you move to the island, you can legally pay none. There's also no capital gains tax.

That's why Nardo was going back to San Juan.

There's only one downside to moving to Puerto Rico. It's swarming with Puerto Ricans.

When you're a Jet you're a Jet all the way...

Cool it, Action.

Excuse me, but that's Queens, and those AOL impersonators are NOT puertorriqueñas but Nueva Jork!

Aren't they still c up from all the hurricane and flood damage they got earlier?

I love the idea of zero income taxes, but as part of an overall copacetic package.

Correction: Aren't they still cleaning up.

Probably, but I knew a guy who went to PR after one the big ones and he said everything was hunky dory on the private villa of one of his friends. My take don't be poor in PR.

We lost the oo and the reconcentration camps in the war against caudillo Spain. But PR is way better without the oo. The problem with PR now is that to the gringo Postal Monopoly, PR means Puerto Rico. But to the brasileño Postal Monopoly it means Paraná. So mail sent to PR meaning Paraná gets intercepted, fogged open and tampered with by gringo Customs, IRS and DEA prohibicionistas in Puerto Rico. You have to write out Paraná with no abbreviation if you want the mail to arrive at 25º South Latitude.

The downside is that communist-cultivated superstitious fear of 20th-Century power plants burdened La Isla with bird-killing windmills and useless solar panels that dissolve faster than Imperial Pure Cane Sugar whenever there is a tropical storm. So there is no electricity on the island except for burocratas in La Capital until nuclear Navy ships connect up. See the video: (https://tinyurl.com/3ec3w9bk)

To Hell with this then. I want my zero Income Tax with my lights still on!

I may have to look into this. How would that work with an existing 401K?

It will be fine as long as you never come back...

You wouldn't like eet, gringo viejo. We have roving Lolita Lebrón militias patrolling to keep down eembasions from Red-Necked-Prohibicionistas. They are much tougher than those milk-white, corn fed Kansas ladies that just kicked nazi ass from Topeka to Texas.

I’m sure you busted a nut when you found out more babies would be murdered.

I have been watching this for quite awhile. Property prices in the cities are already going up substantially.

If you are interested in doing this, I highly recommend visiting first. There are many parts of the cities that you don't want to live in, even though the house is really nice, unless you have bodyguards and a driver.

All that said, it is definitely on my short list in 7 years when the kids are out of the house.

Yeah, but its Puerto Rico. Like telling me I could move to Uganda and save on my taxes.

You'd love Uganda. They have Mohammedan birth control laws to keep females from getting uppity and individualistic. There is worshipful grovelling five times a day--more even than in Tennessee--and women who are not performing their "duty to the party" are, of course, kept at home till they can get knocked up for Allah. Search "Idi Amin Is My Yard Man" by the Uranium Savages, recorded live at the Soap Creek Saloon in Austin during better days.

my lifelong dream of being mayor of San Juan is that much closer. PR is beautiful

Hmm, what could go wrong?

Option 1: PR gains statehood, and then all the rest of the typical US bullshit catches up with you.

Option 2: PR gains independence, and then the possibilities are wide open, including any one of the typical Latin America freak shows.

If option 2, can we ship AOC off to her "homeland"?

I look forward to the imminent news of Reason and it's many writers relocating from California to Puerto Rico.

They will be most welcome and appreciated. So, how's the view from Birmingham? Can you make out the Atlanta Federal pen from there?

You know, folks here tend to make a lot of weird assumptions about me, most often framed in a way to be insulting. So I've read a lot of weird claims about my person.

But points for originality, this is the first time someone has tried to insult me by suggesting I'm from Georgia.

One of the above-mentioned tax benefits of Act 60 also has further qualifications. To be eligible for zero taxes on capital gains, interest, dividends, and royalties, individuals need to purchase a primary residence in Puerto Rico and make an annual charitable donation of $10,000 or more.

Ref: https://www.loc.gov/classroom-materials/immigration/puerto-rican-cuban/migrating-to-a-new-land/

Hey Stossel, lose the beard or grow it out.

Having lived in PR for a number of years, there's a big problem with this that Stossel doesn't mention: residents of PR don't get this tax break, and it's essentially creating a two-tier class system in PR, that will generate resentment among the natives, if it hasn't already. It only applies to a businesses' income, for businesses that move to PR, while any personal income is taxed under PR law at higher rates than almost any state (and PR has higher tax rates at all levels of income compared to the mainland). Further, this tax break is limited to 20 years at which time, I'll bet the company moves out of PR.

What business owners who are taking advantage of this do, is pay themselves a minimal salary (they are required by the IRS and PR to pay themselves a reasonable salary), get the company to pay for personal expenses (tax evasion in PR is a national sport) as much as possible, grow the company, then leave when the break goes away. And they do have to pay PR income taxes, where you're in the 33% tax bracket if you make over $60,000.

Also, don't believe the value of "I wake up, and I have the ocean in front of me. I go out my back door, the rainforest is off in the distance. It's just a magical place to live." I'd bet DeSilva lives on Ashford Avenue in the Condado neighborhood of San Juan, where, like most of PR, the property has high fences (often with embedded glass to discourage thieves), electric gates, and burglar bars over the windows. Just look on Google street view. It's a very high crime island, with corrupt police and corrupt government that went bankrupt. During my time there, we had two stolen cars, were robbed at gunpoint, and also assaulted. Things I've never experienced on the mainland (admittedly they do happen here, just far less often).

But think about the taxes! It's the only libertarian thing to think about!

You're forgetting pot, Mexicans, and butt-sex...And so I understand many Puerto Ricans don't like Mexicans.

We have tormenteras to protect us from nuclear fallout if Cuba again threatens Florida or Texas. Tornado shelters are better than nothing, but mainlanders have been neglectful of their upkeep. After the next war, rednecks may have to learn a second language!

No, we think about what the taxes are used for. Often in deference to any real benefit for us.

Ooooo. The coño-envy is strong in this leetle one.

Nothing easy about moving to Puerto Rico. And just to avoid paying taxes? If you think that's a good idea then we don't need you here anyway

Pay no attention to the National Socialist with the paper bag over its head. Puerto Rico needs extra libertarians, not least to legalize South American home remedies and interpret for stammering mono-gringos seeking to buy.

The only downside is that you have to live in a shithole like Puerto Rico. Even Puerto Ricans don't want to live in Puerto Rico.

The day they get rid of their absolute shit tier weapons laws I'm in. Otherwise no way. Even if there are no income taxes.

If this sockie masque is hiding Sheldon Richman, you wouldn't be welcome anyway. You run along back to yo mamma, white lamb.

Another place tried heavy regulation and high taxation rates on the books. The United States of America from the '40s to '70s. How'd that work out?

I hear they beat Christian National Socialism, tried and hanged a bunch of those volkegnosse. Then Nixon imported Positive Christian National Socialism all over again!

Puerto Rico respects the 1972 Libertarian Party plank on abortion: “We further support the repeal of all laws restricting voluntary birth control or voluntary termination of pregnancies during their first hundred days.” Puerto Rico's current politicians forbid such coercion prior to the 154th day, so better by half already. We do not much care for girl-bullying Republican Prohibitionists or National Socialist U-boats in the Caribbean.

Alexandria Ocasio-Cortez (D–N.Y.) calls the tax incentive "horrifying."

I'm horrified that the taxpayers give that commie bitch a six-figure income and she whines that it's not enough.

-jcr

I assume you still have to pay 15% payroll tax for your free healthcare and retirement package.

Travel Agent gave me a deal, "6 Nights in Puerto Rico!"

No days, just nights, I said to him "What do I in the Day?" He said "Do whatever you want, just keep out of Puerto Rico!"

So, John, where in Puerto Rico do you live? Or is this just more 'reason' hypocrisy, like Fiona weeping over illegal aliens but not inviting them to live with her?