America's Huge Pile of National Debt Makes Combating Inflation More Difficult

A one percentage point increase in interest rates translates into a $30 trillion increase in interest costs on the national debt.

The optimistic scenario goes like this. America shakes off what remains of the pandemic in the coming months without the need for trillions in additional borrowing, Congress doesn't pass any more deficit-busting spending plans while also allowing the 2017 tax cuts to expire in 2025 as planned, and the economy performs consistently well for the next, oh, three decades as we dodge recessions, wars, climate issues, and anything else the world might throw our way.

Under that set of circumstances, the national debt will merely be twice the size of the entire U.S. economy by the middle of this century.

If the last two years have taught us anything, of course, it's that crises can appear with little warning. The federal government was already more than $23 trillion in debt in early 2020, but it has borrowed about $6 trillion more since then—much of it to fund pandemic-era stimulus bills. Pandemic-era debt isn't the main cause of the debt tsunami that's threatening to wash over the government in the next few decades—Social Security, Medicare, Medicaid, and decades of spending more than the government takes in are the real culprits—but so much borrowing in so short a period of time has heightened the stakes.

Now, it's also creating more complications.

With inflation running at a 40-year high, the Federal Reserve has indicated that it will consider raising interest rates early next year. That's standard-issue monetary policy and basic macroeconomics, but America's high levels of debt make the maneuver more fraught because higher interest rates will reverberate through the government's own debt.

"Fiscal policy has hamstrung the Federal Reserve," says Brian Riedl, a senior fellow at the Manhattan Institute and a former Senate budget staffer. "For the Federal Reserve to do basic, commonsense macroeconomic stabilization, it's going to hit the national debt hard because Congress has been so irresponsible."

In a new report, Riedl outlines the fiscal and monetary trap facing federal policy makers and central bankers. In short: Rising interest rates will make the national debt a bigger problem. And the already-huge national debt makes it more difficult to combat inflation—inflation that has been triggered, at least in part, by debt-financed spending.

While the overall amount of debt matters too, the more important consideration here is how much the federal government spends each year to make interest payments on the debt. As Bruce Yandle, an economist at the Mercatus Center, explained last month (and again in the current issue of Reason), a combination of falling interest rates and low inflation allowed the government to stock up on debt without facing higher annual costs for much of the past two decades. "The interest cost of the national debt in 2008 was $253 billion and remained at about that level through 2015," he writes, even though the overall amount of debt doubled in those years.

In effect, a decade of low inflation and low interest rates taught politicians that there was no immediate budgetary reason to limit borrowing. The long-term risk of massive debt was always there, but politicians are nothing if not good at ignoring problems that won't metastasize until they are out of office.

This is likely no longer the case. In the same way that a high-interest credit card is more expensive to pay off than a lower-interest car loan, higher interest rates will add to the annual cost of servicing the federal debt. Even if Congress didn't authorize another penny of borrowing—it's OK to laugh—annual payments on the debt will grow if interest rates rise.

And because every dollar spent on financing the debt is a dollar that can't be spent on anything else, higher interest payments on the debt will force Congress to do one of two things. It will either have to cut other parts of the budget to pay for growing debt payments, or (more likely) it will have to drain even more revenue out of the economy in the form of higher taxes.

Wait, it gets worse. The federal government's debt is particularly susceptible to rising interest rates, Reidl argues, because so little of it is locked into long-term interest rates. If you have a 30-year fixed-rate mortgage on your house, rising interest rates won't bother you much. But the federal government overwhelmingly relies on short-term debt, with an average maturity time of just 69 months.

"If interest rates rise at any point in the future, the entire national debt will roll over into those higher interest rates" relatively quickly, Riedl tells Reason.

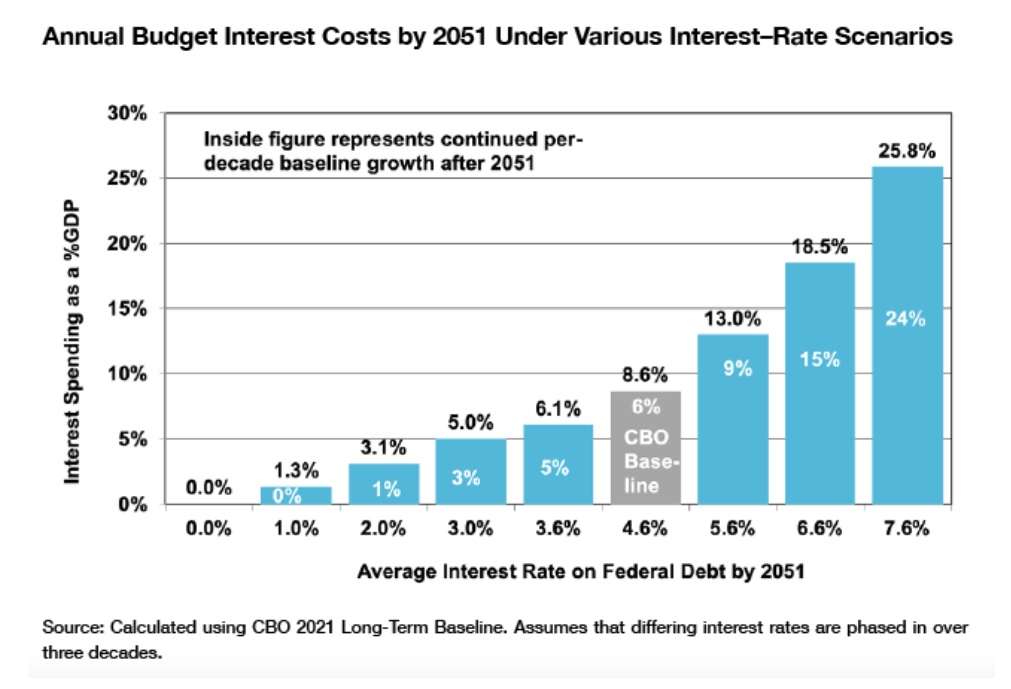

The Congressional Budget Office's (CBO) long-term budget outlook, which serves as a baseline for projections regarding future debt costs and other budgetary matters, assumes that interest on the national debt will rise to 8.6 percent of gross domestic product (GDP) by 2051—that's about $1.9 trillion in today's dollars. That's the rosy scenario I described at the beginning—a future where there are no unexpected borrowing splurges and no massive economic disruptions. Even so, this scenario means that interest on the debt would be the largest portion of the federal budget, and would consume about half of all projected tax revenue.

What if interest rates exceed the CBO's projection? A one percentage point increase in interest rates translates into a $30 trillion increase in interest costs. That's roughly equivalent to what the country expects to spend on the military over the same amount of time. It would cause interest costs to consume 13 percent of GDP by 2051, equal to about 70 percent of all projected tax revenue in that year.

If interest rates average two percentage points above the CBO baseline, interest costs on the debt will be equal to 100 percent of tax revenue by 2051, Reidl calculates. Every single dollar of tax revenue (based on the current tax code) would be directed to paying for money already borrowed and spent. That means nothing left over for the military, social programs, entitlements, or anything else.

"Once the debt surges, even modest interest-rate movements can impose stratospheric costs," Riedl says.

It's those stratospheric costs that the Federal Reserve must consider before deciding to raise interest rates. That's not supposed to be part of the Federal Reserve's purview, but years of fiscal profligacy from Congress have created a mess the central bank is ill-suited to solve.

The central bankers may decide that it's better to let inflation run its course than to risk precipitating a debt crisis, but that's a decision that would have dire consequences too. Consumers will pay higher prices, workers will see real wages depressed, and anyone trying to save for retirement will see those savings eaten away by inflation.

For too long, federal policy regarding the national debt has been driven by a sense that the good times would never come to an end. Low inflation and falling interest rates may have lulled politicians into a false sense of security, and poor budgeting left the nation's balance sheet vulnerable to a coming crisis of the government's own making.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Bohem 2020 "in order to return to normal we need to elect a totalitarian corrupt pedofile!"

Bohem 2021 "whhhaaaaaaaa the corrupt pedi file that was a career polititions did what he has done the last 50 years how did I see this coming"

Bohem 2022 "we need to vote for only progressives because we all know the Republicans ar icky, just ignore their policies track record and personal lives.."

I have received dfy exactly $20845 last month from this and home job. Join now this job and start making extra cash online nam by follow instruction

on the given website........... Visit Here

Ummmmm is that "totalitarian corrupt pedofile [sic]" a reference to Matt Gaetz?

The article speaks of hobbling the Federal Reserve. That institution does not need to be hobbled, but eliminated. It is no coincidence that 1912/1913 saw the founding of the Federal Reserve, income tax and the inflection point in the exponential growth curve of the national debt.

Can you show where Gaetz raised the debt ceiling?

If only Republicans did not smear Democrats as wanting to starve children and old people merely because Democrats wanted to decrease the rate of growth in spending...

If only the media actually did their job....

The media do their job, and they do it very well. Their job just isn't what you would like it to be.

This is why we need to somehow get the BBB passed. According to the administration’s numbers not only is there no cost, but it will actually reduce the national debt.

I know it sounds odd, but I saw Jen Psaki say it on CNN and all of the journalists agreed.

Asshole, we got what YOU deserved.

Your sarcasm detector may need some adjustment.

So one percent of 30 trillion is... 30 trillion? Must be the new math.

A rate hike of one percentage point on 30 trillion in debt actually requires a 300 billion dollar increase in annual spending to cover it.

Common core. Plus, math is racist.

It turns out throwing gasoline on a fire is a bad idea, who knew?

Except at Burning Man - - - - - - - -

And the already-huge national debt makes it more difficult to combat inflation—inflation that has been triggered, at least in part, by debt-financed spending.

Yet more stupidity. Fact is - excessive national debt is the BEST way to combat inflation. Because new debt ceases to be an option to finance spending and that new debt is the definition of inflation. The most accurate cause of deflation (as in the true opposite of inflation) is existing debt that can't be paid

Now maybe what you're saying is that that excessive debt is gonna make it really difficult to keep house prices and stock prices propped up as interest rates rise to normal (or even higher than normal). But house prices and stock prices and all the other stuff that is financed by debt IS INFLATION TOO.

Americans are gonna find it really difficult to pay their own way. Haven't really had to do that for generations.

Only thing affected is the mere 10¢ increase in the price of spittin tobaccy.

HAPERINFLATION!!!!!!

#DefendBidenAtAllCosts

the price of spittin tobaccy

will you let me in on this inside joke?

The issue now is there are no bond vigilantes anymore. The Fed buying debt directly will ensure they never raise rates to fight inflation enough...this is going to be one hellva ride. What the govt will do most likely is take your 401K and Demand Deposit Savings and leave IOU's..believe me the Dems will be pushing for this soon.

Why do that when you can simply print more money?

They cant. They dont have any more paper.

Hunter and I had a 5 alarm rager at the Mint and it all got burned up with some primo stuff that Jen got for us.

You wouldnt think she was ' that way' s innocent as she pretends to be.

Think that Congress will pass legislation to let that happen? The Fed only can buy debt on the secondary markets now.

What this analysis conveniently neglects to mention is that the Fed itself bears a large measure of responsibility for the mess they’ve put themselves in by enabling our government’s insanity for far too long. In the wake of the 2008 financial crisis, perhaps it was necessary to have quantitative easing for a while to dig out, but after a couple of years they should have said “The crisis is over and we’re done now. If you need to borrow trillions and trillions more dollars you’re going to have to raise it from legitimate independent investors.”. This would have either caused a dramatic rise in interest rates or forced our insane government to be less insane, but we’d e far better off now.

The Fed was the fiscal equivalent of the dumb hausfrau who eats an entire chocolate fudge cake every single day for about 13 years straight because cake was on sale, and now belatedly realizes she’s in serious danger of dying of a heart attack and doesn’t know what the hell shes going to do about it.

So you go into massive debt and when the debt comes up you can't pay it and have to roll it over. Higher rates means higher interest on the debt. Oh and you want to keep running up new debt too?

I'm sorry any idiot knew this was a problem 10 years or more ago when that stupide moron Bernanke started this crap. And you are just figuring it out now?

Seriously Reason writers are not libertarians..they just are wanna be Salon/Slate/NYT writers who couldn't get a job there. Just go away

I remember Ross Perot raising this as a central issue 30 years ago, during his first presidential run. He specifically said we needed to stop financing the debt via short term bonds, because that made us excessively vulnerable to interest rate rises.

10 years or more ago

30... Perot ran on this issue in '92 and took 20% off the vote putting Clinton into office.

Who ironically was the only President to run a balanced budget.

There were some good Reason writers. Maybe a few left. Boehm is not one of them.

Well, if Biden and crew can eliminate student debt, why not national debt?

(some staffer somewhere is probably working on a focus group about this)

We can borrow our way out of this problem!

You laugh, but the trillion dollar coin idea is actually floating around for exactly this reason.

They need about 30 of them.

There IS a way out! Simply refuse to renew the Federal Reserve's charter. POOF! No more Fed, which holds the vast majority of the debt. As Lindbergh said "Congress can as easily create a note as a bond". For whatever reason, Congress chose to create bonds and be in bondage to the Fed. but the Fed must be authorized by Congress. Its like being in charge of your landlord.

end the fed is clearly the best option for myriad reasons.

Bullshit. Fed holds 16%.

America's Huge Pile of National Debt Makes Combating Inflation More Difficult

HAHA you dont say? It's going to all burn down we all just need to prepare for it.

Shit article. A Currency Sovereign can pay ANY interest rate, even 100%! Higher interest payments add growth $ which a growing economy needs & the federal govt creates at the touch of a computer key. Federal taxes DO NOT pay for federal spending! EB + BR = 2 economic illiterate CLOWNS

How do you maintain these levels of stupid?

Anyone else wanna take him on?

What pays for federal spending?

There is a huge pile in DC alright.

One cannot separate interest rates from inflation... while QE has greatly clouded the issue, it is worth noting for a new generation that the Federal Reserve DOES NOT set interest rates, markets do. Negative real rates of return, the real Dem fiscal objective, bail out borrowers and screw lenders (aka savers). And who pray tell are the biggest borrowers? Fed, state and local governments...Pay off those debts with the New American Peso... er... dollar.

The only way out is hyper inflation and that's the route they'll always choose because it is the least politically costly in the short term.

I love the US of old (even late 20th century seems like utopia by comparison to today). Now, we as a whole absolutely deserve to collapse into Venezuelan style economic collapse. The American work ethic is ancient history, as is our national grit, as is our ingenuity, as is our resolve, as is our manufacturing output, as is any semblance of believing in the free market or limited government, as is any sense of paying our way or economic frugality.

I would absolutely love to leave and denounce my US citizenship and never come back but there is nowhere to go that's any better. Despite all the technology available to us these days and how little actual labor is required of every American to sustain a high standard of living, we're at the doorstep of abject poverty and unfathomable chaos. I feel like vomiting just thinking about all this, I really do.

The key sentence in your post is "I would absolutely love to leave and denounce my US citizenship and never come back but there is nowhere to go that's any better."

Last time I was in Mexico a guy I met there was the son of a father from Peru and a mother from Venezuela who both entered Mexico undocumented and worked there with no papers (at least till they died from COVID). Nico was convinced that the cartels were more honest than the official Mexican government who he and most of the other peeps distrusted. As bad a shape the US is in it is still the tallest midget in the circus.

Czech Republic is doing well.

Hungary, too.

They are maintaining a judeo-Christian culture of work and saving.

Pretty good on private gun ownwership.

Refusing mass immigration.

Consider moving there

The average worker in the US earns $34,000 a year. The poverty line is a little over $12,000. These people do work, every day to earn their tiny pittance. Fast food employees, Grocery employees, roofers, lawn maintenance ect, ect. Many work more than one job so Mom can watch the kids. I don't see the lack of work ethic out that 50%. Sorry. Maybe you are referring to the top 50%.

Inflation is hitting really hard

There is an election in 2022 and I can predict that of the many topics discussed, reducing the national debt will not be one of them. In the same way that SS and Medicare are third rails in politics, so too is cutting spending and raising taxes. There is simple no one serious about the subject because it is hard, and it is a loser.

What is need is suicide troops. People who will run, do what is necessary and accept that they will be defeated at the end of their term. Unfortunately, not many of those people are around.

It’s not that hard. Privatization of the U.S Postal Service is a bipartisan idea that Manchin will never ever get on board with. The rest of us have to prop up rural areas, even though private investment would change the areas to functional economies. Changing social security to allow investment in low fee index funds, not actively managed. Those indexes pay more in dividends than bonds. It should be bi partisan, it’s not. “The Republicans want to starve grandma and privatize social security” is the war drum call. It’s not hard, Democrats like government. Republicans like private investment, with exceptions for rural areas or farm belts.

I have to disagree with you on saying "It's not that hard". It is hard because it means that someone has to lose, and no politicians wants to make people unhappy. They can talk like they don't care but their actions betray an unwillingness to actually do something.

It would need to start with crossing their party leadership and working on compromises with the other side and that is a big hill to climb.

"Privatization of the U.S Postal Service is a bipartisan idea that Manchin will never ever get on board with. " If it's bipartisan, why do you need him? There would be enough Democrats+Republicians to pass it.

What we need is the destruction of the democrat party and the elimination of all the Marxist true believers.

Totally agree with you. No-one wants to run on "We all are going to suffer for a while and our standard of living will have to decrease or stay the same. We have to live within our means".

People like the easy way. Look at Greece and the riots when they tried to get it under control.

Both sides suck here

I'm confused Reason, who exactly in the Federal government is trying to combat inflation? Names please?

All I see is people trying to stoke the inflation fire, to enlarge the bubble.

The Marxists claiming that government spending will reduce inflation are essentially saying that by shifting wealth around, the unproductive will become productive (i.e. Karen will suddenly start cranking out widgets after I pay for her childcare). However, I believe that on some level these people don't believe it themselves. If they really believe it, then why aren't they seeing all the untapped productivity as a profit-making opportunity? The Marxists could give Karen a loan and Karen could pay for the childcare with her loan, then go on to produce some widgets and finally pay back the loan with her new income. If Marxist economic theory is correct (it isn't correct) giving out these loans would really cost society nothing.

Of course the Marxists do try the loan giving thing from time to time. This is what student loans are all about. Now they're talking about forgiving them. Also, for a brief while Marxists were were telling us all about the virtues of "microloans" to third worlders, but now we hear only silence about that. Why? Because the the debtors couldn't pay, creating a mess for everyone involved. When I think of it, I doubt that the Marxists ever used private capital to finance the microloans. Marxists seldom put their own money where their mouths are.

Historically, Marxists have spent a lot of money funding revolutions, but that's just vote buying. The Marxists intend to come out on top when they do this.

Should I invest in a wheelbarrow?

You should definitely invest in the wheelbarrow manufacturing sector.

But when it gets nationalized out from under me, will I still get a wheelbarrow?

You will be provided with your very own wheelbarrow and shovel, as soon as you arrive at the gulag.

Pete Buttigeg likes Salted Nuts.

Why did I hire him?

Oh yeah, " Affirmative Action."

It certainly wasn’t competent action.

I suggest torch and pitchfork stores... franchise them as one-stop insurrection centers... uniforms and accoutrements for any occasion!

Inflation has already heated up and will continue to do so. That's the plan as it will continue to eat away at the value of the dollar. Think of someone who's 20 years into a fixed rate thirty year mortgage. Inflation has made his original fixed payment much easier. The more inflation rises and the borrower's income along with it, the easier to pay the mortgage.

Just not things like food, energy, transportation, etc..

If only a rocket scientist had made this “discovery” before the US racked up $30 trillion dollars of debt. Thanks for the heads up Captain Obvious / Captain Hindsight.

Dont blame me. Obama and Trump caused this mess. I just got here.

Hells Bells kids, Jill wont even give me the check book because I kept signing the checks " Corn Pop" and the bank woudnt accept them.

Do you have any idea how many dollars $3 x 10^13 is? If the national debt were a dire problem in need of addressing, it should be destroying us all by now.

And if it's such a problem to you, then vote for politicians who will raise taxes. If you want to redirect money away from old people's food and shelter instead, that makes you a monster. Life's about priorities.

Grandma and Grandpa had a whole life to live and save. I think stealing from the youth makes you the real monster.

Social security will prob have to make cuts in 2035 or just print to keep benefits and destroy the youth some more through asset inflation. But hey we will own nothing and be happy right?RIGHT??

Ah, so we only end up punishing the youth who aren't sociopathic enough to let their parents starve in the streets.

People used to be able to expect a guaranteed income in retirement, such as in a pension. Capitalist vampires took that away too.

Is the entire project here just to make the old, poor, and disabled suffer for your amusement?

it's not a taxing problem, it is a spending problem. If they taxed double, it still wouldn't meet spending. You have to be able to see past the end of your nose. How long can you spend beyond the gross national product? Remember the old USSR? They collapsed because of just this reason. People didn't get paid for months. Coal miners, Armed Forces, pensioners. People foraged for food. Don't kid yourself, this is serious.

One trillion = 1000 billion. We are 30,000 billion in debt.

We could start with raising taxes though, right? How about as a show of good faith?

Yeah, we have a limited national capacity. A limited global capacity. Thus, we make priorities. If you prioritize Jeff Bezos's space dildo over three squares for old people, you are, I repeat, a monster.

Tony, have you even read Liberty Lover's reply? Raising taxes isn't going to do a darn thing if the government continues to spend wantonly. If they just stopped doing that, current taxes won't be an issue.

Tony's idea is popular in Texas right now. Bounty hunters can track and sue pregnant ladies with government subsidies and immunity. If that's not taxation, what is?

Let's do away with the SALT write-off .... I mean 10,000 helps the rich. Why is your side complaining about that?

30 trillion isn't an issue huh? What is in your mind?

Those Capitalist vampires took that away too! Unlike those socialist murders right? You didn't have to worry about retiring because they killed you. Good times.

it should be destroying us all by now.

It is. Have you noticed the inflation?

Not really. Have you noticed all the dead people from the pandemic?

https://www.logicallyfallacious.com/logicalfallacies/Red-Herring

Pay attention better, Tony. I mean, I could easily say "have you noticed Biden's botched withdrawal from Afghanistan?" and other threats comparable or greater than Covid.

Biden said he was going to stop it. More have died under his watch then Trump! Biden promised not to shut down the economy.

What is your point with inflation? The only tie is the pump of money.

How about sticking to the top? Ask mom and dad about prices while we wait.

The USA seized $400,000,000 in German property. Congress found in January 1922 that if it were returned to German nationals, 95% would be confiscated in German postwar taxes. Same result if the US were to convert it to paper marks and give it back. This was a year before France occupied the Ruhr. Six months after that news articles marveled that large cardboard boxes had replaced cash registers in Germany as the Reichstag tried to use paper money to pay off war reparations.

A year is about pi x 10^7 seconds, so Totalitarian Tony's dollar figure is pretty close--without reaching for a calculator--to a million times as many dollars as there are seconds in a year. At a dollar a second with no interest, how many years to pay it all off?

Class?...

Now, let's not see the same hands every time...

Math is racist!

Happy New Year wveryone!

Im sure 1975 will be a great year!

you wrote:

"Social Security, Medicare, Medicaid, and decades of spending more than the government takes in are the real culprits"

That's a lie...the real culprits are the drag on the welfare state & educational system created by a certain racial minority, a race prone to crime and shiftlessness....affirmative action and disparate impact mandates forced upon us by the elites, racial division created by the elites in order to wage war on white working class labor...etc etc...THESE are the real culprits...

No shit, Sherlock. Yet somehow the cretins in charge have been steadily and decisively rolling us into this mess for 50 years.

C'mon Eric, let’s not over-dramatize. Germany owed $32 billion in war reparations in 1922, about $640 billion in what legal tender laws call money nowadays. That must not have been such a big deal; after all, Germany is still there, isn’t it?

Wow you beat me to that...I was waiting for that one to drop. You realize now if you say culture is a bigger cause of "disparities" and not systematic racism you are now a racist? Seriously the left is now saying if you point out any differences in culture and how these differences lead to different outcomes..your a racist. No matter what you are a racist and anti-semite it seems now..unless you just accept the cultural marxists and statist taking over. Shut up you racist..ha ha

The irony being the left are rabidly racist and anti Semitic themselves.