Biden's Tax Plan Means 60 Percent of Taxpayers Will Pay More

And as many as 75 percent of middle income households face a tax increase under Biden's plan, even though the highest-earning households will pay the vast majority of the costs.

President Joe Biden's pledge not to raise taxes on American families earning less than $400,000 annually was a centerpiece of his campaign and of his first months in the White House. But a new analysis suggests that more than 60 percent of taxpayers will face a higher burden under Biden's first budget plan.

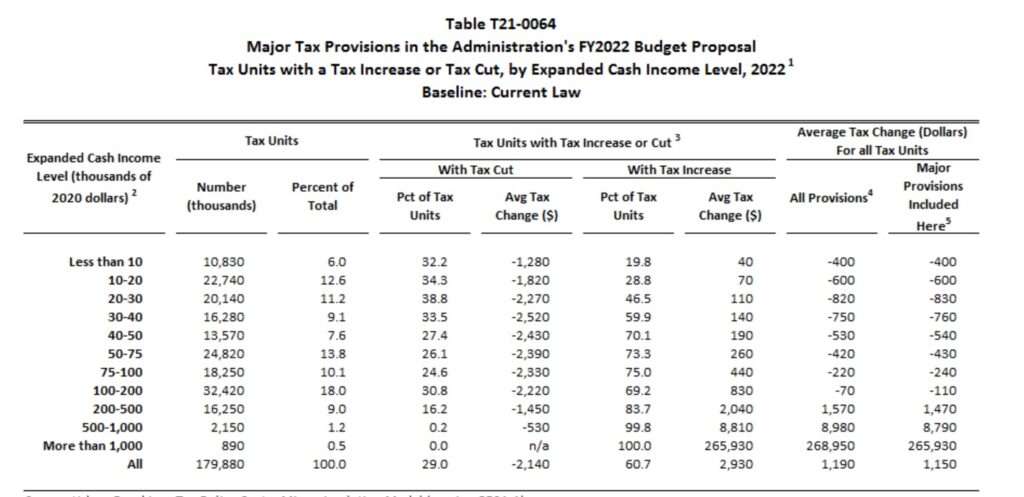

The Tax Policy Center (TPC), a center-left think tank based in Washington, D.C., reports that "nearly all" of Biden's proposed tax increases would be borne by American households earning over $800,000 annually. But while the tax increases are undeniably concentrated in the upper echelons, most taxpayers would see at least a small increase in what they owe the federal government via income, payroll, and corporate taxes. In fact, three-quarters of households earning between $75,000 and $100,000 annually would face higher taxes under Biden's budget—with an average tax increase of $440.

The tricky thing is that those higher taxes would be somewhat hidden for most individuals and households because they would be the result of higher corporate taxes.

Biden has called for raising the corporate income tax to 28 percent, up from the current level of 21 percent. His budget also calls for raising the top marginal income tax bracket—which applies to individuals earning over $452,000 and couples earning over $509,000—to 39.6 percent, up from the current level of 37 percent.

That means, for example, a worker earning $80,000 annually would not see the government extract a larger share of her income via payroll taxes, which fund Social Security and health care entitlements, or via income taxes. But the higher taxes that Biden has proposed on corporations would, under the TPC analysis, be passed along to shareholders and workers in the form of lower investment earnings and compensation, respectively. As a result, many middle- and low-income individuals and households could end up with a larger tax burden even without seeing their taxes hiked directly.

"For those looking to see if Biden kept his promise to not raise taxes for those making $400,000 or less, the answer is: Mostly, but not entirely," writes Howard Gleckman, a senior fellow at the TPC. As Gleckman explains, it depends whether you evaluate Biden's pledge as a promise not to raise taxes directly on Americans earning less than $400,000 a year or whether you consider the full consequences of higher corporate taxes, which are ultimately paid by people.

If enacted, Biden's tax policies would raise federal revenue by about $2.1 trillion over 10 years, according to an earlier TPC analysis. The corporate tax hike alone would reduce long-term economic growth by about 0.8 percent, kill 159,000 jobs, and reduce wages, according to a separate analysis by the Tax Foundation, a nonpartisan think tank.

Of course, a tax-focused analysis of Biden's plans ignores the other side of the ledger. While most middle- and low-income families might face a higher tax burden in Biden's budget, the president is also proposing a massive expansion of taxpayer-funded benefits that would certainly redistribute income downward. And the top 1 percent of earners, in TPC's analysis, would end up paying on average $213,000 more in annual taxes—a far larger increase than what lower-earners would face.

It's also true that any clear-eyed assessment of America's fiscal status must leave room for tax increases as part of an overall strategy to balance the budget. The national debt now exceeds $28 trillion, and annual budget deficits will exceed $1.6 trillion every year for the rest of the decade under the sure-to-be-overly-rosy assumptions contained in Biden's budget.

Still, as a matter of politics, the distribution of Biden's tax increases matters because of the promises Biden has made.

Instead of promising that it's possible for America to deal with its current fiscal mess and massively expand the size of government by merely taxing the rich, Biden should be honest about what he's proposing. A more expensive government means higher taxes on almost everyone.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

It's just not right that the greedy bastards who make a lot of money won't pay their fair share in taxes to an impoverished government that takes in trillions of dollars in taxes and just wants a measly few trillion more.

USA Making money online more than 15$ just by doing simple work from home. I have received $18376 last month. Its an easy and simple job to do and its earnings are much better than regular office job and even a little child can do this and earns money. Everybody must try this job by just use the info

on this page.....VISIT HERE

I just Love this Song.

So interesting

My last month's online job to earn extra dollars every month just by doing work for maximum 2 to 3 hrs a day. I have. joined this job about 3 months ago and in my first month i have made $12k+ easily without any special online experience. Everybody on this earth can get this job today and start making cash online by just follow details on this website.........Quick Earn.

https://www.linkedin.com/pulse/video-marketing-plr-review-review-oto/

Corporations don't pay taxes. They pass those on to consumers in the form of higher costs and fewer services. I'll never get why this is so hard to understand.

+

No, sometimes they can't pass the costs on. It depends on what competitors in lower tax jurisdictions do.

Well, then they might pass on "costs" when they close local production. Remember another economic maxim that most idiots don't understand: the true minimum wage is zero.

Making money online more than 15OOO$ just by doing simple work from home. I have received $18376 last month. Its an easy and simple job to do and its earnings imj are much better than regular office job and even a little child can do this and earns money. Everybody must try this job by just use the info

on this page….... Home Profit System

You are dumber than a back of hammers. Pass that on.

Those on the margins will close.

Beat me to it...

Especially if there's a compact between nations for a minimum corporate tax rate...

Naked shorts will prevail.

Yes. China vs U.S.

Actually, U.S. vs world.

Asymmetrical warfare. Why bother with bombs?

They pass those on to consumers in the form of higher costs and fewer services.

No no no don’t you understand?

With the right people in charge, the taxes will be paid by the greedy executives

on Saturday I got a gorgeous Ariel Atom after earning $6292 this – four weeks past, after lot of struggels Google, Yahoo, Facebook proffessionals have been revealed the way and cope with gape for increase home income in suffcient free time.You can make $9o an hour working from home easily……. VIST THIS SITE RIGHT HERE

>>=====>>>> payhd.com

Cuz most people (and voters) are idiots?

"...I’ll never get why this is so hard to understand."

Those who don't get this are those who think the government can provide "free" stuff.

I don't get it either. But, to make people understand is liking pissing up a rope. Been trying for something like 40 years.

"as many as 75 percent of middle income households face a tax increase under Biden's plan"

Now Mr. Boehm, don't lose faith in the guy you wanted to win. Remember, we Koch / Reason libertarians aren't concerned with middle income households. Our philosophy exists to serve billionaires, especially our benefactor Charles Koch. And when it comes to helping billionaires the Biden economy is a smashing success.

#LibertariansForBiden

#InDefenseOfBillionaires

These are the moments in which OBL truly shines.

Yeah, this was classic OBL.

It's called "buyer's remorse".

Or "schadenfreude" in the event that you were warned over and over and over and over and over that you weren't going to want what you get when you get what you want.

He got exactly what he wanted. A smug sense of moral superiority and approbation from the in crowd.

IOW, he's a bog standard useful idiot.

"...IOW, he’s a bog standard useful idiot."

Who, like that other asshole Brandy, will lecture you on how Trump didn't measure up as a well-spoken day-time TV star, and therefore shouldn't be POTUS!

Boehm should be made to suffer for supporting Biden. The rest of us should not.

Hence the recent tariff exemption agreements for wine, cheese and aircraft.

Sadly backwards, as we could achieve true economic stability with a heavy tax on whine production...

Higher corporate taxes means 100 percent of people will pay more, it is just hidden better.

Yeah it is a broken promise, but it isn't a promise that anyone paying attention took seriously from the get-go. It was obviously a lie from the beginning.

The real problem is the massive, runaway spending. Coming up: 1970's style inflation and interest rates.

+

+++

From someone who actually lived through the 1970's inflationary period.

Including having to get up at 4:-00 AM to go get in line to get gasoline.

Youth of today have no idea.

As I type this, we're suffering a heat wave in the western states. Nothing new.

I spent north of $30 grand on new A/C systems back in January. Went with high efficiency of course.

But, by tomorrow, which will be hotter, the grid central authorities tell us they won't be able to meet the demand.

In the meantime, the CA Energy Commission is "Leading the State to a 100% Clean Energy Future".

Yeah, the state with the 5th largest economy in the world.

Go figure!

People are such suckers!

"...In the meantime, the CA Energy Commission is “Leading the State to a 100% Clean Energy Future”..."

Further, we're treated to insulting LIES on TV ads about how CA has "abundant" solar, wind and hydro power!

How "abundant"? Turn off your A/C; that's how "abundant"

Think we can get You Tube to de-platform CA.gov?

"For those looking to see if Biden kept his promise to not raise taxes for those making $400,000 or less, the answer is: Mostly, but not entirely,"

Or in fewer words, "No".

Like being a litttle bit pregnant.

Touché

If this surprises anyone, they're brain dead!

Just like the current resident in the White House.

"Coming up: 1970’s style inflation and interest rates."

Which means that any homeowner not prepared to stay in their home for the next decade the time to sell is now. Especially so for those hanging on in forbearance or any other sort of mortgage extension. They really should have sold already.

If interest rates even tick slightly upwards affordability is going to plummet, and valuations will follow shortly thereafter.

Well, I've got to disagree. At least in a market by market basis.

Demand and supply play an important role. And, in many markets, due to lack of supply, interest rate hikes will perhaps calm the madness, but won't suppress the demand enough to reduce prices. Just stagnate them.

I live in one of those markets. BTDT

Housing prices skyrocket recently as people with cash buy homes to hokd value while inflation occurs.

Don't worry about the politicians driving this. Inflation benefits borrowing, which benefits re-election. Their corruption intake will continue. Do not worry about the politicians.

If there's anything left after Blackrock is finished.

I don't think we'll get high interest rates. Though, a fiscally sane government that actually wants America to survive would be massively raising interest rates right now (while shutting down all covid era freebies overnight and phasing out 90% of welfare programs in a very short matter of a year or 2).

First, the federal government is so ridiculously indebted and simultaneously is running massive deficits, it can't afford to pay anything but bargain bin interest rates. If interest rates went high, we'd have to take huge austerity measures and that would cause riots in the streets that would make both Greece and George Floyd look tame. Second, CPI is a lie designed to underscore the true level of inflation but most of the populace is dumb enough to actually think CPI is fairly accurate. Why would they try to control inflation when most people are too stupid to look at reality with their own eyes? Now that even the lie of CPI is high, the new lie that the moron populace is buying into is that inflation is transitory.

Wait, wait, wait.

"Free shit. Fee shit for everbody."

That's the ticket. There is no downside. Now that Slate has told us how awful those megarich are and not paying, "their fare share". the revolution shall begin. All through the magic of illegally obtained, individual income tax information while mixing it up with wealth.

All we have to do is seize those rich bastard's assets and all will be well.

+

You can make a good case that raising taxes on the rich ONLY hurts the poor.

The rich don't change their lifestyles, they just invest less, and that means some poor people lose their jobs, or fail to get raises, or don't get a new job that they would have gotten otherwise.

This^^^^^^^^

Yeah. Convince the proletariat of this.

They "know" that Bezos just doesn't pay his "fair share" even while they work for cash under the table on side jobs.

That's the proven strawman now. The "rich". Just tax them more and all will be well.

This has been coming for years. And, they don't teach it in college economics 1A either.

Corporations will tax us if we tax them so surrender and never ask for raise. Thanks Reason!

Corporate taxes are an implicit consumption tax. It would be more direct to just pass one of those.

LoS =/= logic.

Do not forget that LoS is a Reason writer.

I truly hope your support of Biden ends up ruining your life. It’s a small part of the horrors you deserve for your progtardery.

For the best sexual chat experience and free casual contacts with hot ladies in United Kingdom you must to visit Sex Chats West Midlands

Boy, that's a back asswards way to say you'll pay more in taxes. Corporations will and sure, you'll see some of the fallout of that. But I've never considered it as "my taxes" going up because a corporation is paying more.

Do we say tariffs raise my taxes too? I pay more because of them but no honest person twists words like that.

God, you're dumb.

That's exactly what we say, and have been saying, for the past four years about the Trump tariffs. It's the same principle. Tariffs raise the cost of consumer goods, so consumers end up paying for the tariff in the form of higher prices.

Reason JUST did an article about this, regarding the cost of lumber.

"God, you’re dumb..."

Please don't insult dumb people by comparing this dimwit to them.

The price of lumber dropped by 8% last week. Not much of a reduction but as the mills continue to return to production hopefully the prices will return to near normal before the fake pandemic.

That is, I said near normal.

Lumber shipments are continuing to rise.Train loads of lumber are being seen in Fort Madison, Iowa and elsewhere.

However the price of OSB and even framing lumber may remain high for a while.

Prices will be forced down sooner or later as sticker shock will continue to suppress new home construction.

Is it still corporations "paying their fair share" if they just turn around and make you pay it?

No, no, no, no. They will just take some gold coins from the executive swimming pool.

And they'll quit using $1000 bills to light their fat cigars.

Plus corporate profits will fall, which will hurt your 401k plan or IRA.

Plus inflation will erode the value of your savings, if any.

"Do we say tariffs raise my taxes too? I pay more because of them but no honest person twists words like that."

Reason has.

Even in instances where there was no inflationary signal.

Uh, that's not twisting words. Not even close.

It's just like minimum wage.

You can pay directly or, pay indirectly.

Those are you're only two choices when government spending isn't on the table.

At least these taxes will balance the budget. This administration won’t be fiscally irresponsible like Trump was...all that deficit spending. It wasn’t just mean tweets like all the jerks in this comment keep prattling on about - it was deficit spending, tariffs, and immigration - all of which Biden has proven to be much better at, these taxes being a prime example.

This is almost as high quality sarcasm as OBL!

Are you sure it's sarcasm?

funny if so, Yankee Stadium level stupid if not.

I refuse to think that it's not. 😉

Spending up 6 trillion. And only two of those three 2-trillion-dollar bonus spending plans was partially offset by new or higher taxes, which will undoubtedly bring in less than advertised.

If you double spending you can't just raise taxes by 50%.

86 billion in new taxes pays for 6 trillion in new spending. What don't you get?

Back in the early '80s, Reagan had to persuade people that "trickle down economics" was a real thing, and that keeping taxes low on corporations and the wealthy had real benefits in the real economy.

40 years later, most of the growth in the U.S. economy comes from industries that didn't even exist in 1980--and only exist now as a function of private investment and discretionary income.

Anyone who doesn't believe that economic growth, upward mobility, and improved living standards are a function of private investment and increases in discretionary income (among other things) is an ignorant idiot.

I sure do miss my job at the buggy whip factory.

Creative destruction happens; if it doesn't, we all ride horses to work, right?

And the streets are covered with fleas, flies, and horseshit.

Yeah, but what about all those shovel ready jobs cleaning up horseshit?

The San Francisco treat.

Not to mention used needles, human shit and O.D. homeless.

And yet, I see "expert" snide remarks in the media every day about "trickle down economics" being a failure. And blaming, the Reagan administration.

Tell a lie often enough, and it becomes the truth.

"...Tell a lie often enough, and it becomes the truth..."

To those who wish it to be true...

Is there any point in doing these "Biden promised X, but now X isn't happening" articles? We get it: Biden lied about literally everything. I get that you guys have to fill you article quotas but at this point "Biden lied" is at the same level as "Sky still blue, film at 11".

He didn't lie, he just forgot.

No. Worse. He, along with all the leftists, actually believe this BS.

And, they have a very willing audience. The voters.

That is what makes this scarier than the actuality.

I love you brave new world!

The point is to try and reclaim some credibility with their readership. Accordingly, these kinds of articles will continue. Maybe with an ironic quote or two concerning Comrade Stalin obviously not knowing this sort of thing was going on.

Pretty sure all of the people whose livelihoods will be destroyed are the biggest losers, and few of them are rich.

According to MMT, Biden is trying to shrink the economy.

And that, as I understand MMT, is the purpose of taxation; to inhibit consumer activity in an overheating economy, right?

But, according to this article, that really isn't happening. Sure, we will all incur the cost of the corporate tax hikes, but in mostly covert ways. So spending will remain unrestrained?

Glad I am in my forever [last] home and not going anywhere; I can only imagine what the interest rates will be, and how the housing market [and pretty much everything else] is going to crash, only much bigger this time.

Perhaps that is truly what his handlers are shooting for? What better opportunity than a genuine crisis to even further expand government power?

My first mortgage circa 1982 was at 12%. And, that was through a special program of the time and a Godsend.

Of course, I could actually earn 12% return on a MM account at that time too.

Inflation is insidious. Like a cancer.

Too bad most don't understand it.

Why the surprise or confusion? The main target Democratic voter does not pay (net) taxes. The secondary target is those who have been conditioned to feel guilty about their material success.

"President Joe Biden's pledge not to raise taxes on American families earning less than $400,000 annually was a centerpiece of his campaign and of his first months in the White House. But a new analysis suggests that more than 60 percent of taxpayers will face a higher burden under Biden's first budget plan."

*does some proggie math*

That means...60% of families now make more than $400K/year! BEST PRESIDENT EVER!!!!

So what's the complaint? Higher and more (or more and higher) taxes = more better, bigger, caring and inclusive government programs. When the take by govt hits 100% we will be in harmonious harmony with something something.

Who was the last president to agree to tax increases in his first term?

And how did his re-election campaign go?

Joe knows. Happened 'round the time he got all law-and-order-y with the pot smokers.

Read my lips...

Come on Reason. This article is a cheap trick. If higher corporate rates translate into lower wage growth and you are deeming that an "indirect" tax then let's include ALL the indirect taxes. So when your employer does not allow sick days and caps your hours at 30 a week so as not to give you benefits - because they CAN, then isn't that an indirect tax because you need to buy diapers? Or how you need 3 jobs to make ends meet and all the extra commuting that entails - indirect tax! And so on.

Or how about the corporations stop buying back shares and paying exorbitant salaries to executives and not do the indirect tax route?

"...Or how about the corporations stop buying back shares and paying exorbitant salaries to executives and not do the indirect tax route?"

How about steaming piles of lefty shit like you keep your noses out of other peoples' business?

Fuck off and die, slaver.

I have no money to pay for goods therefore it's a tax.

" So when your employer does not allow sick days and caps your hours at 30 a week..."

When your employer does that you CAN choose to say no and go find somewhere else to sell your services.

You assume this pile of shit has salable skills; not sure.

Getting rid of "non-taxable benefits" would be one of the best first steps we could make towards getting people in sync with taxation and government spending. As well as get health care in sync with the rest of the world.

For income taxes: Compensation should be compensation. Full stop.

See how that works?

Further, get rid of withholding.

Come 4/15 every year, sign a check for 30% of what you earned last year, or go to jail.

Tax revolt 4/16, the year of implementation.

No, it isn't. But you clearly have no understanding of WHY it isn't, so elaboration is pointless.

Can we please stop with the Obamacare health insurance benefits hyperinflation talk. What happens when crony’s get into bed with socialists..the ACA=hyperinflation of health insurance, better known as workers utopia.

Gee, I dimly remember a POTUS who cut my taxes. Wonder what happened.

It seems to me that billionaires are going yeah, I remember that too. And he cut the deficit by ~60%.

https://obamawhitehouse.archives.gov/blog/2012/02/22/president-obama-signs-payroll-tax-cut

Strange, our 2013 taxes went up, while Trump's tax cut gave us a handy return.

Ya think that lying POS Obo lied once more, while the lap-dog media and idiotic lefty assholes like you ought it?

Yes, I'd say that's what happened.

Fuck off and die, shitbag.

You will never get honesty out of that piece of garbage. The plus side of things escalating to a hot civil war is that traitors like him will likely be executed for their crimes.

And now he lives where and how?

Pretty "successful" for a socialist with no real assets when he started.

Bet you he votes anything but Biden in the next election. Got to protect his ill begotten gains.

I am making 7 to 6 dollar par hour at home on laptop ,, This is make happy But now i am Working 4 hour Dailly and make 40 dollar Easily .. This is enough for me to happy my family..how ?? i am making this so u can do it Easily…Visit Here

Was this spam bot supposed to be posting this in Mexico?

I think it's one of Reason's new illegal alien interns posting from the basement of HQ.

Of course Biteme lied once again, and his stupid voters bought it. But really let's admit that sleepy Joe was just mouthing words he heard through his earpiece and has no idea what any of it means.

Anyway enjoy the higher taxes koch reason liberaltarians!

You spend an extra 6 trillion bucks, someone has to pay.

Yeah, the good news is that only people/couples over 400K will see rates rise. The bad news is that with the hyperinflation the spending and borrowing will generate, anyone with a job will be making 400K soon.

What hyperinflation?

Have you been online lately? Have you been to the grocery store? How about COSTCO?

It is right before your eyes.

Better yet stop by your local Home Depot, Lowes or Menards and price out lumber.

Take some smelling salts with you.

A month ago or so I bought 7/16 X4X 8 OSB for $33.00. It is now $40.25.

The current price of 5/8X4X8 is $32.48

Hmm... I don’t make $800k/yr so I’ll basically pay a penance to watch a bunch of douchebag billionaires pack up and haul off to some Caribbean island where they can go and be douchebags somewhere else. I’m willing to hear my burden. Bon Voyage Elon Musk... Mars awaits you.

"...I’m willing to hear my burden...

So long as there isn't any, right, parasitic piece of shit?

We already knew you were an unproductive sack of festering squirrel mucous, you didn't need to point it out.

Makers and takers. We know where you lie.

And, neither do those you disparage.

Wealth - on paper and at risk - is quite different than taxable income.

Learn the difference. You might be surprised.

Your burden? Like the way you pay your mortgage?

Nigga, please.

Boy, this comment page is like False Consciousness 101. And they say Marxism is dead. Please.

Question begging.

But at least there are no mean tweets.

>> "... in which case I will vote strategically and reluctantly for Biden."

how's the strategery working out?

>>Biden should be honest about what he's proposing.

I can't even.

Why are only White people’s taxes expected to pay for their assimilation out of existence by unlimited third-world immigration and FORCE integration into EVERY White country and ONLY White countries?

Nobody demands that the Chinese must pay for their assimilation out of existence by breeding with millions of non-Chinese in their own country.

Diversity is a code word for White Genocide.

Oh fuck off.

That was sarc..

Damn good too!

WOW! Sixty percent of American taxpayers earn over $400,000 dollars. I know because Joe promised if you didn't earn over $400,000 dollars you wouldn't pay one cent more! (sarc)

Amazing all the fools that fell for that one from a guy telling you he would have trillion dollar liberal policy bills and yearly budgets.

You forgot the inflation. That is the tax on our saving. I heard Paul Krugman, an idiot who won a Nobel, use term "money hoarding". That is also known as "saving". Krugman said that the inflation is good because it "disincentivizes money hoarding". In other words, you are not allowed to save for the rainy day.

And we're all paying this tax right now. It will only grow.

I never forget about inflation. The hidden tax that devalues everyone's money and hurts the poor and those on fixed incomes the most. It just wasn't pertinent to this story.

Krugman channels some long defunct pseudo-economist....

Do you thing Slate can get a line on HIS income taxes and personal net worth and publish it for the world to see?

Inquiring minds want to know.

Especially those among the "herd".

This can all be so,fed by reducing the number of excess progs in our country. Our rights are worth more than their lives if they choose to live those lives in the service of propping up an authoritarian regime to enslave us and take everything we own.

Scrape them off as fast as we can.

He should be forced to return his Nobel.

I wouldn't trust him to run a check out at a dollar store.

It's about time that the richest 60% pay their fair share, as determined by always hungry and ever larger government.

"Biden's Tax Plan Means 60 Percent of Taxpayers Will Pay More"

No.

Everyone will pay more because when you increase taxes and regulation on businesses prices go up as ALL costs of doing business are part of the pricing structure, thus Biden is hurting everyone who makes and then spends money regardless of how much or how little they are making and spending.

But can you guess who will feel it more?

Yeah. Let's get a forced integration - equality and all of that - of pro sports and see how much ticket prices decline so the "fans" can better afford them.

This is how it always works. They say Tax the Rich, then they just re-define what "rich" is.

Oh, the definition of "rich" hasn't changed much over time.

Anyone who has "more" than I do, or earns more than I do, is "rich".

It's a universal definition.

It probably started with the original humans when the tribal leaders got the breeding rights to all those women.

Non- sequiter.

The Govt are spending TRILLIONS more than can ever be paid back. So taxes can never pay the debt.

This is political Grandstanding to make Marxists feel like Joe is their man bc hes retaliating against corporations.

Hate and retaliation arethe mark of the Childish Left.

Remember Leftists, when Govt runs out of money to steal from the rich, YOU STARVE.

Most popular and competent executive, & administration ever!!!!!!

I get sick and tired of hearing that wealthy Americans don't pay their fair share.

What is a fair share?

Further, is it really the end of the world that some very wealthy people pay little or no taxes? The benefit to society from businesses that wealthy people found or run, the benefit from charitable contributions, and the wealth that people like Warren Buffet and Bill Gates have created for shareholders is far greater than the benefits people might get from government programs that might be funded through higher taxes.

At the same time, my taxes went up, after Donald Trump limited the SALT deduction to $10K. Between my property taxes (on a 3BR, 1.5 bath house) and state income taxes, I used to take a deduction larger than $10K.

Yeah. Me too.

But, don't you know, if we just took all those rich people's assets........

No, wait. Total net worth of "the rich" < government deficit.

Just define everyone who actually works and reports to the government as "rich" and take it all.

Isn't that what winners do?

Sorry for posting twice, but a reload redirected my reply away from its intended attribution as a reply.

A fair share means a reason to pay for something by getting something in return.

For example, if you buy a toy that ends up killing, or harming, your child (such as this one):

https://www.news.com.au/national/queensland/news/seaworld-theme-park-toy-has-been-blamed-for-child-being-on-life-support/news-story/362786974f6895b49f0ad82183ab3452#

… if you had bought a certain tag at point of sale, then you would not have to pay court costs to prosecute by the rules & regulations against dangerous toys. In other words, you could elect to pay a tax and get a promise in return. Which would be government insurance that provides support for critical infrastructure. And you don’t have to pay if you prefer absolute confidence.

Similarly, you could elect to pay a toll getting on a highway by deliberately driving over to a toll lane, and if any incident occurs on that highway and police see you have displayed the toll tag, then they may elect to handle you first, before the other driver, which may save time and get you back on the road sooner.

Little things such as these options could render money to pay necessary debts taken on by government for road repairs or judgment repairs between two parties.

Well this is a reach. By these standards, I guess we can't increase taxes on anyone because that's an increase for everyone, somehow.

These taxes on the rich will be invested in the American people and we will all see the dividends from that.

The rich will shelter their money off-shore, or creatively use the tax codes to by-pass paying anything. The corporations, owned by those rich guys, will just pass their tax burdens on to you. The government will misspend it like they always have!

The only one's being hurt will be the little guys in the form of higher prices. We're already seeing that, and his tax hikes haven't even gone into effect, yet!

You know, thrives share the same philosophy...they will see dividends from the loot they spend...

GenoS is the new parody account?

Or a new fucking lefty ignoramus?

Translation: If you wanna be technical, no, we're not going to directly tax you more if you're below a fairly high income threshold. Are we gonna drastically reduce your purchasing power and standard of living? You bet your ass! It's just gonna come in the form of lower incomes and higher price for goods and services. You're most likely an economic ignoramous (this is overwhelmingly true for the bottom half of America's wage earners) who won't put 2 and 2 together and will blame those evil rich people while we at the government will laugh our asses off.

It doesn't matter if you want to call them tax hikes, or anything else. Every citizen (and non-citizen) living here is already paying more for almost everything. Gas prices are up over 50 % Groceries are going up. Lumber has quadrupled! I'm at a loss to think of anything that DOESN'T cost more, and his tax increases HAVEN'T EVEN GONE INTO EFFECT!

BTW, corporations don't pay taxes. They just collect them from the end consumer and pass them on to the government. Raising corporate taxes only hurts the little guys! (I'm sure you will be reading this multiple times in this thread!)

I worked in government for half of my career (about 20 years). And, you know what? I never met a government employee who understood this.

No, I was often told that government mandated costs are absorbed by the entity and NOT passed on to their customers.

How many government employees, Fed, State and Local are there in the U.S. today?

Who said giverment employees understand economics?

Most of them are graduates with a degree that ends in "studies".

As in "Gender Studies" or "Wymyn's Studies".

It's like being in academia, where those with the least talent become self sequestered in their little castles away from the real world.

What are you complaining about? This is exactly what YOU voted for so fuck off.

If you believed any of the litany of lies listed (not broken promises but things known to be lies at the time) then you're a moron. Again, fuck off with the crocodile tears here, this is what you chose.

I'm not surprised Biden wants to raise taxes on the 60% of people who didn't vote for him.

Oh, just let them have at it. They're hastening the collapse, and it's going to take that before enough folks figure out the scheme and insist it ends. The important thing is to make sure that the narrative options include the truth - elites in DC will never be as smart as the aggreegate decisins of 325 Million people in free, or at least relatively free, markets What do the Great Depression and the Great Recession have in common? They both had a root cause of the Fed's policies. Central planning doesn't work. Make it a scientific experiment: you want to increase the percentage of GDP that's government activity? Ok, but let's pick some key metrics you say you're ging to improve, and track them. Remember that the Fed was originally intended to maintain the value of money, which, since the Fed took on that responsibility, has lost over 97% of its value. Central planners spend around $40,000 for every homeless person in America, possibly more (they don't make it easy to figure it out), and they have utterly failed at even slowing down the growth of the problem. Let them fail visibly.

Eliminate the fed? Return to a gold standard?

Come on. Owning the currency printing presses is tantamount to controlling the masses. What pol could resist that?

Seeing straight through Biden, his plan looks to be cashing in on anything from god simulator video games to empire-building populace games from Bullfrog's old Populous series to Microprose's Civilization series and the Colonization game later (re-)released by Firaxis (as were later Civ games, too).

Maybe Biden bluffs that we won't see through his perfect plan to complete his most masterful set of moves, yet this time by actual human experimentation sort of like Outlast's championed utopia looks, where everyone must apparently be an obedient Democrat calling for real reform and political change 😉

http://game-insider.com/2014/02/07/outlast-review-the-scariest-video-game-ever-made/

And yet, it seems to me that gamers could hypothetically challenge Biden's moves with better moves and question the expensive ones.

A fair share means a reason to pay for something by getting something in return.

For example, if you buy a toy that ends up killing, or harming, your child (such as this one):

https://www.news.com.au/national/queensland/news/seaworld-theme-park-toy-has-been-blamed-for-child-being-on-life-support/news-story/362786974f6895b49f0ad82183ab3452#

... if you had bought a certain tag at point of sale, then you would not have to pay court costs to prosecute by the rules & regulations against dangerous toys. In other words, you could elect to pay a tax and get a promise in return. Which would be government insurance that provides support for critical infrastructure. And you don't have to pay if you prefer absolute confidence.

Similarly, you could elect to pay a toll getting on a highway by deliberately driving over to a toll lane, and if any incident occurs on that highway and police see you have displayed the toll tag, then they may elect to handle you first, before the other driver, which may save time and get you back on the road sooner.

Little things such as these options could render money to pay necessary debts taken on by government for road repairs or judgment repairs between two parties.

Good for you, Joe Biden.

Finally, we have a President that is telling us what we don't want to hear but should have been told a long time ago.

Taxes are the price we pay for living in a civilized society. For decades now, we as a country have not been paying for what we get and we have the greatest budget deficit in history as a result. It is time for ALL OF US to start paying for we get...and that means, paying higher taxes, whether directly or indirectly. We definitely need to stop subsidizing the CEO's and shareholders who are pocketing fat profits as our infrastructure crumbles, our education system falls further behind, and our children are suffering for lack of sufficient food and shelter.

Quit whining and start acting like adults, America. Be responsible for your actions. Use less fossil fuels. Waste less of our food and other natural resources. Think about the next generation, not just the next day or next earnings statement. And PAY TAXES to sustain the system that we benefit from. In particular, corporate America has paid far less than it's share in comparison to the benefits it receives. It's time for this to stop.

Absolutely. In fact, give up your gas guzzling cars, stop eating meat, and don't fart.

Next, it will be ten families in a single home or a dozen homeless people, your children, particularly white children, will be brainwashed into hating themselves for being white, people will stand in long lines to get their daily ration of bread and soy and of course the viewscreen will monitor everything that is said and done inside every home in America.

For travel, you will only be allowed a little three wheeled electric cart with a basket to carry your meager daily rations.

As Bill Gates will own every acre of farmland, the raising of cattle, sheep, pigs and chickens will come to an immediate halt. No more chicken dinners, steaks or spare ribs for you. Only soy based proteins and a couple small potatoes.

In fact, you will own nothing and be happy.

You VILL eat ze bugs und you VILL rike it!

Good Decision

What does this administration expect to gain out of raising taxes? The collapse is going to happen whether they raise taxes or not. Borrowing trillions from the Fed for special programs that go nowhere and the Fed itself is attempting to head off a monstrous inflationary event by printing even more fiat money is only prolonging the agony.

The economy will not collapse overnight. It will be in stages and many will not even notice it until it stares them in the face.

Someone inside the Obiden Administration came up with that one. Most likely one of the communists.

The collapse started long ago, and continues under all administrations, but has regularly accelerated at a greater rate under republican ones for the few decades.

Not to suggest to the taxers an idea, but simply to point out where this all ends, how 'bout this:

All households who have total income (from all sources) greater than average will be taxed at a rate to bring them to that average. All households who have total income (from all sources) less than average will receive a "rebate" to bring them to that average. Warren, Sanders (et al.) can claim "it's not socialism, it's just taxation", but their endgame will be fullfilled.

I am making 7 to 6 dollar par hour at home on laptop ,, This is make happy But now i am Working 4 hour Dailly and make 40 dollar Easily YDF .. This is enough for me to happy my family..how ?? i am making this so u can do it Easily…Visit Here

I wish there was more focus on the argument I always hear from leftists. They get that these taxes are passed on to consumers and that there's really no such thing as a tax that "targets" the wealthy, but my friends constantly bemoan corporations for not eating the tax.

Similar to I Pencil, we really need to explain in thorough detail the following truths:

1. The work done by executives deserves higher pay. The reason they don't eat these taxes is because their job is genuinely demanding and worth the pay they receive.

2. The profits retained by corporations are for the benefit of their shareholders. Corporations have a LEGAL obligation to maximize shareholder profit. It's not like this money disappears into the 6th Yacht slush fund.

3. Taxes that target the wealthy and corporations don't trickle down. They come in a heavy downpour and the magnitude of the effects are incredibly complicated to identify and measure.

LOL are you unable to see the contradiction in your claim that the consequences "come in a heavy downpour" and that they are "incredibly complicated to identify and measure"? If you can't measure them you have no basis for your first assertion.

That is one dishonest headline. By the logic of the artcile, even though there is no higher taxes on someone, if a corporation pays higher taxes they ay charge a consumer higher prices and therefore it's an increase in tax. A more direct line could be saying that any president who creates a good economy accelerates inflation (and therefore higher prices) and is responsible for higher taxes. Or if a government policy increases the value of your home it was a tax hike because your property taxes are based on home value. Or even if a policy made the economy go better and you got a raise, the policy was a hidden tax hike because you pay more tax as your income goes up. That is some first rate 1984 double think bullshit.

"It's also true that any clear-eyed assessment of America's fiscal status must leave room for tax increases as part of an overall strategy to balance the budget."

Fuck you. Cut spending.

The decline began many years ago and continues under all governments, but it has increased at a faster rate under Republican administrations during the past few decades.

^ Donald might return back 2024 USA youths protest click and read " programs that go nowhere and the Fed itself is attempting to head off a monstrous inflationary event by printing even more fiat money is only prolonging the agony.

The economy will not collapse overnight. It will be in stages and many will not even notice it until it stares them in the face.

Someone inside the Obiden Administration came up with that one. Most likely one of the communists

I've been screaming at friends and family for over a year that Biden is lying when he says people making under 400 won't pay more. Everyone with a 401k to a Robinhood account will pay more. Thanks for writing this.

At the rate of inflation from Democratic spending the average annual salary could be over $400,000 a year before he leaves office, of course that will be below the poverty line at that time.

At the rate of inflation from Democratic spending the average annual salary could be over $400,000 a year before Bideb leaves office, of course that will be below the poverty line time by then.

At the rate of inflation from Democratic spending the average annual salary could be over $400,000 for years before Biden leaves office, of course $400,000 annually will be below the poverty line time by then.

But, they won't get that.

It's a self inflating circle. They'll just demand more.

After all, it's "fair".