Biden's Tax Plan Means 60 Percent of Taxpayers Will Pay More

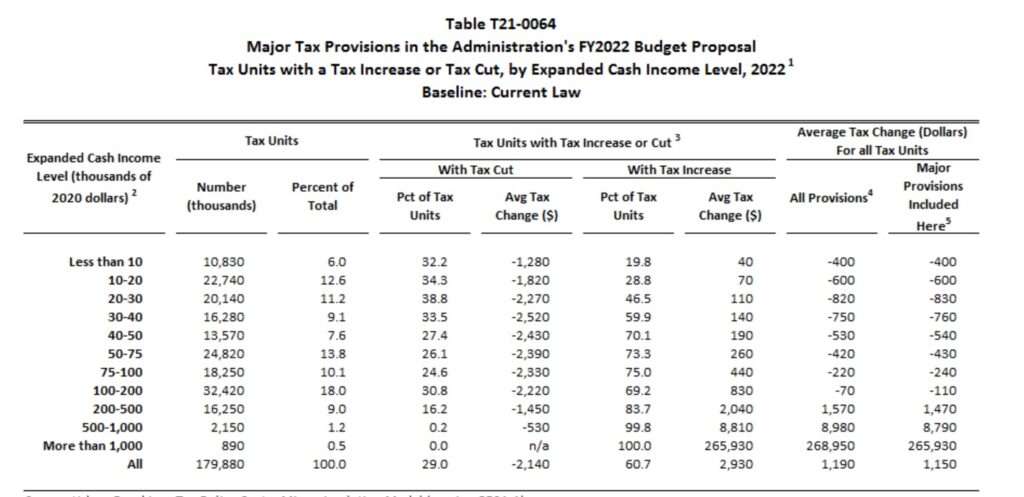

And as many as 75 percent of middle income households face a tax increase under Biden's plan, even though the highest-earning households will pay the vast majority of the costs.

President Joe Biden's pledge not to raise taxes on American families earning less than $400,000 annually was a centerpiece of his campaign and of his first months in the White House. But a new analysis suggests that more than 60 percent of taxpayers will face a higher burden under Biden's first budget plan.

The Tax Policy Center (TPC), a center-left think tank based in Washington, D.C., reports that "nearly all" of Biden's proposed tax increases would be borne by American households earning over $800,000 annually. But while the tax increases are undeniably concentrated in the upper echelons, most taxpayers would see at least a small increase in what they owe the federal government via income, payroll, and corporate taxes. In fact, three-quarters of households earning between $75,000 and $100,000 annually would face higher taxes under Biden's budget—with an average tax increase of $440.

The tricky thing is that those higher taxes would be somewhat hidden for most individuals and households because they would be the result of higher corporate taxes.

Biden has called for raising the corporate income tax to 28 percent, up from the current level of 21 percent. His budget also calls for raising the top marginal income tax bracket—which applies to individuals earning over $452,000 and couples earning over $509,000—to 39.6 percent, up from the current level of 37 percent.

That means, for example, a worker earning $80,000 annually would not see the government extract a larger share of her income via payroll taxes, which fund Social Security and health care entitlements, or via income taxes. But the higher taxes that Biden has proposed on corporations would, under the TPC analysis, be passed along to shareholders and workers in the form of lower investment earnings and compensation, respectively. As a result, many middle- and low-income individuals and households could end up with a larger tax burden even without seeing their taxes hiked directly.

"For those looking to see if Biden kept his promise to not raise taxes for those making $400,000 or less, the answer is: Mostly, but not entirely," writes Howard Gleckman, a senior fellow at the TPC. As Gleckman explains, it depends whether you evaluate Biden's pledge as a promise not to raise taxes directly on Americans earning less than $400,000 a year or whether you consider the full consequences of higher corporate taxes, which are ultimately paid by people.

If enacted, Biden's tax policies would raise federal revenue by about $2.1 trillion over 10 years, according to an earlier TPC analysis. The corporate tax hike alone would reduce long-term economic growth by about 0.8 percent, kill 159,000 jobs, and reduce wages, according to a separate analysis by the Tax Foundation, a nonpartisan think tank.

Of course, a tax-focused analysis of Biden's plans ignores the other side of the ledger. While most middle- and low-income families might face a higher tax burden in Biden's budget, the president is also proposing a massive expansion of taxpayer-funded benefits that would certainly redistribute income downward. And the top 1 percent of earners, in TPC's analysis, would end up paying on average $213,000 more in annual taxes—a far larger increase than what lower-earners would face.

It's also true that any clear-eyed assessment of America's fiscal status must leave room for tax increases as part of an overall strategy to balance the budget. The national debt now exceeds $28 trillion, and annual budget deficits will exceed $1.6 trillion every year for the rest of the decade under the sure-to-be-overly-rosy assumptions contained in Biden's budget.

Still, as a matter of politics, the distribution of Biden's tax increases matters because of the promises Biden has made.

Instead of promising that it's possible for America to deal with its current fiscal mess and massively expand the size of government by merely taxing the rich, Biden should be honest about what he's proposing. A more expensive government means higher taxes on almost everyone.

Show Comments (180)