America's National Debt Will Be Larger Than the Economy Next Year

The Congressional Budget Office says the deficit will hit $3.3 trillion this year. The national debt will exceed the size of America's gross domestic product for the first time since the end of World War II.

When the federal government's fiscal year ends on the last day of September, America's national debt will nearly match the size of the nation's economy for the first time since the end of World War II, according to projections from the Congressional Budget Office (CBO).

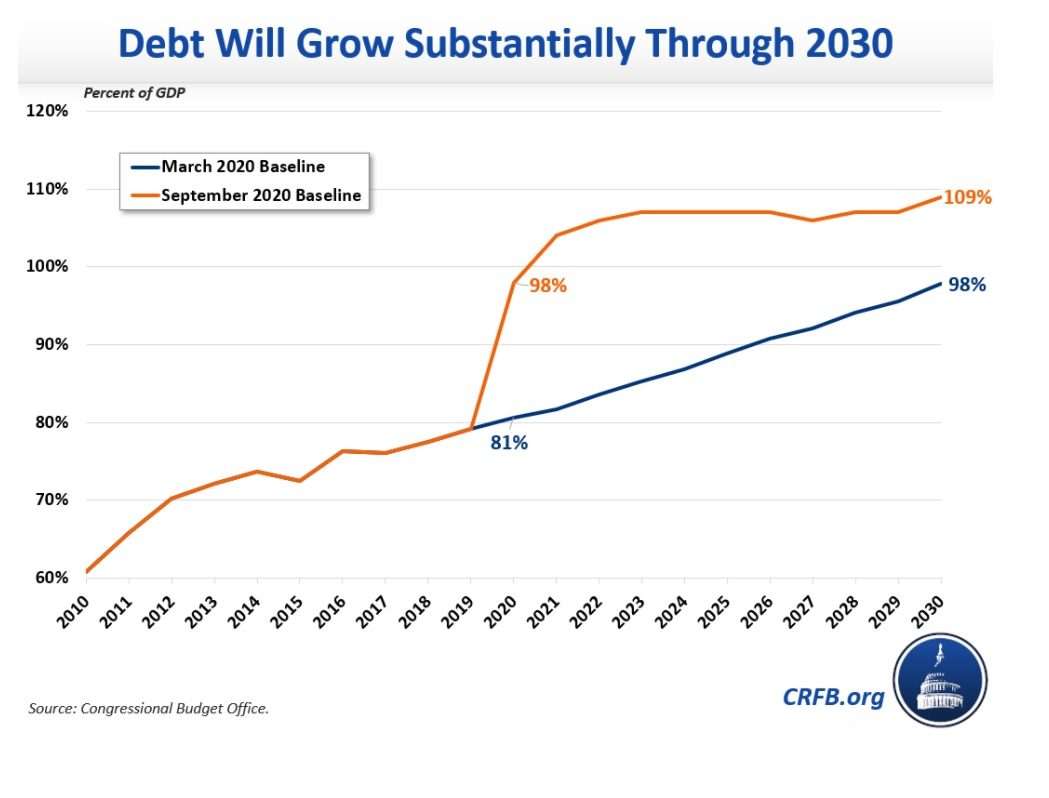

The national debt will equal 98 percent of America's gross domestic product, a rough measurement of the size of the country's economic output, by the end of the current fiscal year, the CBO says in an updated budgetary outlook released Wednesday. The debt will continue to grow and will exceed the size of the economy by this time next year before eventually reaching 108 percent of the size of the economy in 2030.

The national debt has been rising for two decades, but it surged this year as emergency coronavirus response spending caused the federal budget deficit—the gap between what the government spends and how much it collects in tax revenue in a single year—to explode. The CBO now expects the deficit for this year to hit $3.3 trillion. That's more than three times larger than the deficit for the fiscal year that ended in September 2019. The budget deficit for the month of June alone exceeded every annual budget deficit during the George W. Bush administration.

But while the coronavirus might have made the federal budget situation worse, it really only accelerated trends that were already well established. As Reason's Matt Welch noted last week, spending under President Donald Trump surged by $937 billion in less than four years—and that was before Congress authorized trillions in emergency coronavirus spending. The Trump administration's tax cuts, while well-intentioned, also added to the budget deficit because they were not offset by spending cuts. It's true that Trump inherited a budgetary mess, but he (and the Republicans who controlled Congress during most of his tenure) have undoubtedly made the mess worse.

And, again, that was all before the current crisis hit. Here's a graphic from the Committee for a Responsible Federal Budget (CRFB), a nonprofit that advocates for lowering the deficit, that succinctly demonstrates how the coronavirus pandemic has accelerated America's climb towards a 100 percent debt-to-GDP ratio:

Maya MacGuineas, president of the CRFB, calls the CBO's latest projections "truly eye-popping."

"The last time we borrowed this much, just after World War II, the country ran over a decade of roughly balanced budgets to get us back on the right path," MacGuineas said in a statement. "Today, we face rising health and retirement costs and have no plan to even avoid the looming insolvency of Social Security and Medicare."

Indeed, the main driver of America's debt problem is the federal entitlement programs—Social Security, Medicare, and Medicaid—which account for about half of all federal spending. In a separate report also released Wednesday, the CBO projected that the federal trust for those entitlement programs will fall by $43 billion in the current fiscal year. The economic downturn caused by the coronavirus pandemic has caused payroll taxes, which fund entitlement programs, to decline. Unless Congress takes action, those trust funds will be exhausted within 10 years, the CBO warns.

Meanwhile, Congress continues to debate the short-term question of whether to spend even more money in response to the coronavirus crisis. The House has passed a $3.5 trillion stimulus bill, but Senate Republicans have blocked its passage due, in part, to concerns over whether America can afford to borrow more heavily.

In short, the debt crisis is no longer a hypothetical future event but one that is very much starting to impact the day-to-day and year-to-year budget process. A persistently high level of debt may not be a death sentence for the American economy (though it will almost certainly slow future economic growth), but it has almost certainly reduced America's options for addressing both short-term and long-term crises.

America missed its chance to get the debt and deficit under control. Now, it is thoroughly out of control.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Indeed, the main driver of America's debt problem is the federal entitlement programs—Social Security, Medicare, and Medicaid

Unfortunately, these programs are called for in the Constitution and can't be discontinued. Oh, wait...

I make up to $90 an hour on-line from my home. My story is that I give up operating at walmart to paintings on-line and with a bit strive I with out problem supply in spherical $40h to $86h… DFv someone turned into top to me by way of manner of sharing this hyperlink with me, so now i’m hoping i ought to help a person else accessible through sharing this hyperlink…

strive it, you HERE?..... http://Cashapp1.com

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure “unbacked” fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $479 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

US Dollar Rain Earns upto $550 to $750 per day by google fantastic job oppertunity provide for our community pepoles who,s already using facebook to earn money 85000$ every month and more through facebook and google new project to create money at home withen few hours.Everybody can get this job now and start earning online by just open this link and then go through instructions to get started……….COPY HERE====Click Here

I am developing a first rate half of time financial advantage from home with the aid of using running my PC . I even have used an internet system and presently I clearly have created $8987 This month. all of us of you'll be Able to use this home income device and earn extra from intention Half Time. test this website for added data regarding developing cash.... but earlier than this you need to visist the following website online ..

Read More

US Dollar Rain Earns upto $550 to $750 per day by google fantastic job oppertunity provide for our community pepoles who,s already using facebook to earn money 85000$ every month and more through facebook and google new project to create money at home withen few hours.Everybody can get this job now and start earning online by just open this link and then go through instructions to get started……….COPY HERE====Flysalary

I Make Money At H0me.Let’s start work offered by Google!!Yes,this is definitely the most financially rewarding Job I’ve had . Last Monday I bought a great Lotus Elan after I been earning $9534 this Abq-last/5 weeks and-a little over, $10k last month . . I started this four months/ago and immediately started to bring home minimum $97 per/hr

Heres what I do...................................................... More INformation Here

STAY HOME AND STARTING WORK AT HOME EASILY... MORE AND MORE EARNING DAILY BY JUST FOLLOW THESE STEPS, I am a student and i work daily on this site and earn money..HERE? <a HERE? Read More

Is that a picture of Ted Wheeler's condo?

Make $6,000-$8,000 A Month Online With No Prior Experience Or Skills Required.FDv Be Your Own Boss And for more info visit any tab this site Thanks a lot just open this link…..

========== CashApp

Well, we got through the last numbered war, so we can get through this.

Unless, of course, the democrats win any national elections - - - - - - - -

And here we are 3 hours after this article was posted, 3 legitimate statements and a spam post in the comments.

This is why we cannot have nice budgets. Even the libertarians won't give a shit. I bet dollars to donuts that the traffic to this article won't garner 10% of the pageviews received for their latest hot take on Trump's latest tweet.

People are always ragging on Reason and politicians for not covering the important stuff, but our own behavior is what guides their actions, and they are acting as we wish. Good and hard.

I find it depressing, and there's little I can argue against in such articles.

Nor do I like engaging with "it's the other party's fault!"

There needs to be a news hook, a Perot-style candidate running on an anti-debt or debt-restructuring platform.

Or perhaps Rand Paul can run on a "WTF are we doing with the debt" platform.

Meanwhile, I can simply hope they've finally found a way to abolish what were previously considered the laws of economics. If not we're probably thoroughly screwed.

Eddy: It's a real dilemma. Who in their right mind is going to try and sell austerity to the electorate? As I recall, Mondale tried this in his run for the White House a few decades back. Very few people bought it back then and it will be an even harder sell now. We're doomed. I'm convinced it's going to take a collapse, and when it comes, it won't be pretty.

Ditto

Look on the bright side. Now I can tell Visa that my payments are not late, I am just running a budget deficit.

There is a candidate running on an anti debt program and cutting the size of government. Her name is Jo Jorgensen.

Maybe releasing at 1645 is like a Friday afternoon document dump. It isn't intended to be seen.

"This is why we cannot have nice budgets. Even the libertarians won’t give a shit."

Oh, I give a shit. But after watching the federal debt explode for the last twenty years or so, well, this is sort of old news. And, it's very predictable news. The only question really left, is how big it will get?

Spending originates in the house and is sent to the Senate for approval and goes to the White house to be signed? So what's your Fa huck ing problem? Look in your own house, dawg.

The house that was controlled by Team R for the first two years of Trump's term?

Spending originates in the house and is sent to the Senate for approval and goes to the White house to be signed? So what's your Farking problem? Look in your own house, dawg.

RTFA, moron.

Trump and the Big Spending GOP wanted the huge deficits and worked with the House to create the Trump Welfare and Handout Bill of 2020 so he could limp into the election with a chance of winning.

Google effectively work and google pays me consistently and consistently only $5K to $8K for accomplishing on the web telecommute. I am a universty understudy and I work n my low maintenance only 2 to 3 hours every day effectively from home. Presently every one can procure additional money for doing on the web home framework and make a decent life by simply open this site and adhere to guidelines on this page… …Heres what I do……Follow my page.

It's not that we in the peanut gallery don't care. We simply are too familiar with all arguments and counter-arguments, we have been making them for 25 years, no one listens, everyone is now feeding at the trough of the Treasury, and we are now resigned to watching the Titanic sink, since the crew didn't listen to us when we pointed out the iceberg and shortage of lifeboats. What's next, hold our breath? Riot? Stage a coup? John, Jane, and Trans Q. Public just don't believe it can happen.

Ho-hum. Nothing to see here. By 2030, if there is still a country here, the deficit will be well over $40 trillion and quickly closing on $50 trillion. As long as the Fed is committed to creating fake electronic pesos into eternity, there is nothing to worry about. Corruption seeks more and more corruption to keep the house of cards from caving in. If the Marxocrats get into control, well as the saying goes...you ain't seen nothing yet. The new greenie weenie reset will cost $40 trillion alone. And then another $40 trillion to get things back to the way they were after the reset fails miserably.

Now you’re talking real money.

GOOD!

That would set the blacks against Indians.READ MORE

Google effectively work and google pays me consistently and consistently only $5K to $8K for accomplishing on the web telecommute. I am a universty understudy and I work n my low maintenance only 2 to 3 hours every day effectively from home. Presently every one can procure additional money for doing on the web home framework and make a decent life by simply open this site and adhere to guidelines on this page.. Read More

The national debt will exceed the size of America's gross domestic product for the first time since the end of World War II.

LOL Debt/GDP has been >1 since 2012.

Start your work at home right now. Spend more time with your family and earn. Start bringing 85$/hr just on a laptop. Very easy way to make your life happy and earning continuously.last week my check was 24551$.pop over here this site....... Read More