Trump's Trade War Has Hurt American Manufacturers More Than It Helped Them

That should be fairly obvious to anyone who has been following the news, but a new report from the Federal Reserve provides the empirical evidence.

President Donald Trump's trade war has been a losing proposition for American manufacturers, which have suffered from higher prices and reduced market access.

That is exactly what many economists predicted would happen when the Trump administration slapped tariffs on steel, aluminum, and billions of dollars of Chinese imports in 2018. And it's exactly what news reports and economic data have suggested for months, as the manufacturing sector has struggled to keep up with other, stronger sectors of the American economy.

But a new report from two economists on the Federal Reserve Board goes beyond the theoretical implications of tariffs and the anecdotal evidence that the trade war has not worked.

"We find that U.S. manufacturing industries more exposed to tariff increases experience relative reductions in employment as a positive effect from import protection is offset by larger negative effects from rising input costs and retaliatory tariffs," write Aaron Flaaen, a senior economist with the Federal Reserve's Industrial Output Section, and Justin Pierce, a principal economist with the Industrial Output Section.

In short, protectionism doesn't work.

Flaaen and Pierce say their research provides "the first comprehensive estimates" of how the Trump administration's tariffs have affected American manufacturers by warping global supply chains and increasing the cost of input goods—which makes American goods less competitive in the global market. While tariffs have benefited American manufacturers by reducing some foreign competition, they write, those benefits have been overwhelmed by the costs, which have resulted in a reduction in manufacturing employment.

"For manufacturing employment, a small boost from the import protection effect of tariffs is more than offset by larger drags from the effects of rising input costs and retaliatory tariffs," the two economists conclude.

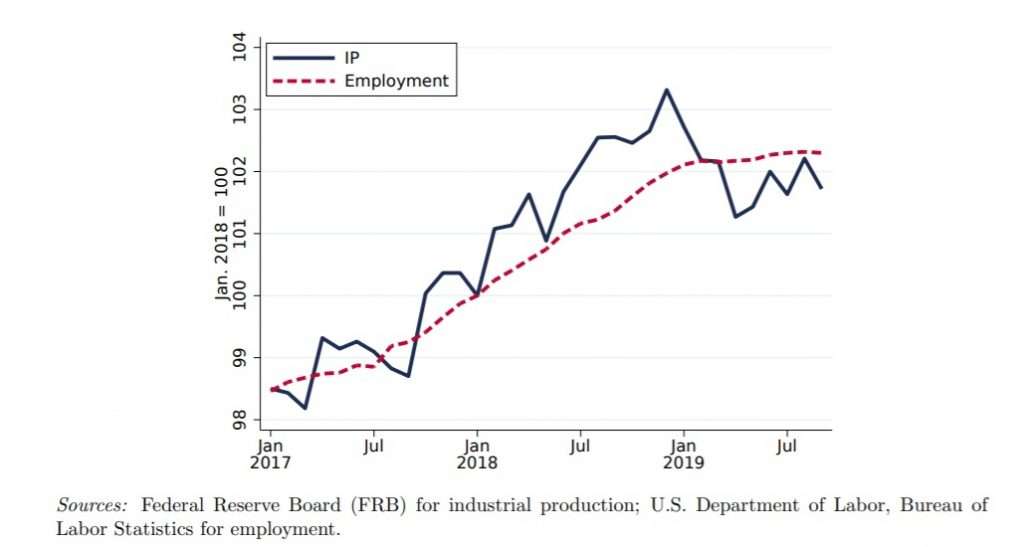

Indeed, the Federal Reserve's economic data shows a sharp decline in manufacturing output and a slowdown of job growth in the manufacturing sector—both beginning in mid-2018 as the tariffs were imposed.

The new report is an aggregate, comprehensive look at how tariffs have whacked American manufacturers, but it tracks with what many American companies have been saying and doing for months now. Thousands of domestic businesses have sought exemptions from the Trump administration's tariffs—effectively begging to be saved from the very policies Trump says are supposed to be helping them. The process for getting an exemption, as Reason has previously reported, is expensive, time-consuming, and lacks transparency and due process. Nevertheless, many businesses seem to have decided it is better to roll the dice on getting an exemption than to pay higher prices to import the manufacturing inputs they need.

Each time the Trump administration has sought to increase tariffs on Chinese imports, owners and executives of dozens of potentially affected businesses have made their way to Washington, D.C., to argue against the tariffs in byzantine hearings that have (mostly) been ignored by the administration and the general public.

Business owners aren't jumping through hoops to avoid tariffs because they have a faulty understanding of their own supply chains. They have a much better understanding of the consequences of the Trump administration's trade policies than the bureaucrats and ideologues imposing those tariffs.

The tariff-caused problems harming American manufacturers also mirror what's happened to other supposed beneficiaries of the Trump administration's trade policies. Tariffs on imported steel were supposed to boost domestic production, but this year has provided a steady stream of news reports about steel plants laying off workers, slowing production, and even suing the government to stop the tariffs. Meanwhile, the White House has quietly shifted its trade strategy to focus on China instead of Trump's promise to resurrect American steelmaking.

On the China front, Trump has tried to save face by recently striking a so-called "Phase One" trade deal that could result in tariff reductions next year and includes a promise that China will buy more American farm goods. If that means 2020 will be marked by the winding down of a destructive and unnecessary trade war, we should all be celebrating.

But one of the few benefits to come from the Trump administration's nearly two-year-long trade war is that economists got new, empirical evidence about why tariffs don't work—and why they fail especially in an economy that relies on global supply chains for both imports and exports.

"Our results suggest that the traditional use of trade policy as a tool for the protection and promotion of domestic manufacturing is complicated by the presence of globally interconnnected supply chains," Flaaen and Pierce write. "While the potential for both tit-for-tat retaliation on import protection and input-output effects on the domestic economy have long been recognized by trade economists, empirical evidence documenting these channels in the context of an advanced economy has been limited."

Trump's trade war hasn't done much for American manufacturers or workers. But at least it has proven, once again, that tariffs are bad policy.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

In short, protectionism doesn't work.

Even protectionism not for its own sake but in service of winning favorable trade treaties is a terrible idea. I wish Trump would get off of it so that we could see what the general economy under his administration could really become. Back off the tariffs and lean heavily into deregulation.

But proctectionism DOES work. It riles up his base and gets him votes and campaign contributions.

Ignoring market manipulation from foreign entities, including theft, does not work.

It is amazing how you econ 101 c students always manage to ignore reality.

Back to pre-Trump tariffs and trade restrictions.

What a plan!

You have the evidence right in the article above your comment, yet still deny reality. Trump supporters in a nutshell, folks.

Awww you're cwying again widdle baby!!!

Do you recall the awesome enchanter named “Tim”, in “Monty Python and the Search for the Holy Grail”? The one who could “summon fire without flint or tinder”? Well, you remind me of Tim… You are an enchanter who can summon persuasion without facts or logic!

"Do you recall the awesome enchanter named “Tim”, in “Monty Python"

1) thank you for inadvertently helping me prove a point to an idiot

2) no, I'm not a sad fucking boomer, and I like things that are funny. Like the idea of you fucking up "llama" and making a fool of yourself

You're fucking llamas again? AGAIN?!?!?

You pervert!!!

See that's the best part. You know you fucked up, and you know that I know and we both know it eats you alive.

I won. And you know it.

Yeah, like the time that your German knowledge was WAAAAY in the crapper, and you wouldn't even admit it, when I pointed out a web site that proved you wrong! Tulpa's ego is bigger than the known universe, and you will NEVER admit error!

Goddamn, you keep bringing that up. Repetitive idiot.

It is in response to repetitive idiots who just spout childish insults instead of facts or logic. When the childish insults are omitted, and at least ATTEMPTS are made at using facts and logic, then I don't call them on their non-sins. Sinners get called out, non-sinners don't. I for one would like to see less sinning!

You are only deserving of insults and derision. Your idiocy demands it. It’s a shame you’re too stupid to be able to grasp that.

Bottom line, you really aren’t worthy of a substantive response. Neither is Pedo Jeffy, Hihn, etc.. if you can somehow avoid being such a moronic shitweasel, then maybe we can talk. I’m generous that way.

"You are only deserving of insults and derision."

Shitsy's best attempt at using facts and logic! Typical!

Hmmmm, I dunno, maybe you shoulda saved that gem for another comment? “Enchantment”? “Persuasion”? What were you replying to?

Awww you’re cwying again widdle baby!!! . . . . . . Trump supporters in a nutshell, folks.

Check out this new sock troll comes in to backup known sock trolls.

Like i said before, LC1789 loves to give Trump routine colonoscopies!

^^This sock wearenotperfecthas nothing good to say, even with Hillary's dick in his mouth.

I mean, come on, at least tell us what Hillary is working with.

He has evidence from a small sliver of the market that ignores 99% of the rest of the market. This is known as cherry picking data. I can point to the full inflationary data sets and not pare data down until I get a set that agrees with my thesis.

+100; You beat me to it 🙂

"You have the evidence right in the article above your comment" -- Yes, yes he does.

The "TINY" magnified dip of Manufacturing (Center of Winter Season) is still even HIGHER than last years Summer and HIGHER than the year before which WERE BEFORE the Tariffs.

If you ran your stock portfolio the way you run your judgement calls you'd be one broke SOB..

Hey, I've showed people evidence for years that NAFTA hurt more than it helped, but free traders just denied reality.

Years, later there is a revolt from the people who lost jobs and Trump gets elected and the same people are either "wut happened?" or think these people are stupid bumpkins and lecture them that when their plant manager told them they were moving to Mexico, they were lied to, and they really lost their job to automation.

In any case, tariffs and trade wars aren't equivalent things -- there have been times with tariffs but no trade wars -- I don't think anybody has ever denied that trade wars are good; the question is whether they're justified and whether they can be settled in a way that will benefit everybody.

Nasdaq tops 9,000 on boosts from Amazon, trade optimism

Poor Boehm. NASDAQ EXPLODING!!

The equities market cycles in a fairly predictable way regardless of who's POTUS. You'd better start coming up with excuses to blame teh leftys if Trump's in office during the next downturn.

"Obama said it was his economy"

"And then people like Eric (blardo) repeated that"

Oh really? = "The equities market cycles in a fairly predictable way regardless of who’s POTUS."

That is just nonsense. Were the market predictable, we would all be billionaires.

When the stock markets go up, you brag on them as proof of Trump's work. When they go down, you deny ever having correlated the two.

Cry more Eric.

Trade optimism means that investors are optimistic that Trump will dump the trade war. Thanks for proving the point.

...and AMAZON there leo

You forgot Amazon doing well. You know.. domestic companies doing well, in spite of tariffs.

That's exactly right. They are doing well in spite of tariffs. Imagine how well they could do without tariffs.

Notice that you didn't claim they are doing well because of tariffs. Nobody who knows anything about economics would. Apparently you wouldn't either.

PreTrump trade restictions?

Yup. Amazon is doing great in spite of all those pre-Trump business costs and trade restrictions.

Yeah. The trade restrictions before Trump were bad. The trade restrictions Trump has imposed are just as bad.

ANALYSIS-Recession, robots and rockets: another roaring 20s for world markets?

Well, I am definitely cashing out into gold and silver come June 2029, if we dont have a market correction by then.

Good idea. Please do try and time the market. We need more suckers who buy high and sell low.

I like your De Opresso Libel sock better

I like that you probably bought gold when it hit $1,800 and then panic sold when it plummeted to $1,200. A fool and his money separated have an equal and opposite side too.

OK blardo, the Eric sock is growing on me.

I also like that you waste so much time trying to capture handles of people you think are socks. How many times in the past hour have you tried and failed to capture blardo or Eric?

I hate to break it to you but I've had Eric (my name and my only handle) for years. I just don't post that often because I generally have better shit to do. You should do the same.

Tl:dc blardo.

Yes you do. Trolling this site is likely the only thing you have in life dude. You care...and everyone reading this knows you care.

OMFG you're still crying blardo

WoW! I come back 4 hours later and reason sent in even more sock trolls like eric?

Hilarious how desperate Lefties and reason are.

Eric, it’s hilarious that you’re deluded enough to believe you are in any way intelligent.

You’re not.

Haha. Is that really something that you would “like”, on the minuscule possibility that your assumption is correct? Sad.

I agree. I don't generally like to make results-based judgements on what is proper for the government to be doing anyway. Bureaucratic deregulation (from the current overexpansiveness of the federal government) is a good thing in and of itself. That it has probably played a large role in a currently healthy economy is irrelevant to the positive view I have of cutting red-tape and technocracy.

It seems like there's some missed opportunity with the economic boom that's occurring. People, collectively, might be more amenable to enhanced economic freedom during good times*. More importantly, I think a prime opportunity* to curtail federal spending is being squandered.

*relative to periods of recession or stagnant economic growth

In short:

Boehm found 2 economists that agree with his original assertion and ignore any economist that doesn't.

There is still no inflation signal. In either consumer data or manufacturing data when you account full sets, not cherry pick special areas that can prove you right.

As I see it, this is not really a trade war. It is an attempt by the president to interfere with China's goal of knocking American down so that they can "rule the world". They have been clear and obvious about their intentions. They do in fact want to rule the world in time. Few people follow what China is doing to America and how truly insidious and damaging they are to the USA. But I suppose everyone wants to jump on the same narrative because bashing Trump is what sells. The real facts don't.

While many Americans and the media are trying to fracture this country and destroy our unity and ultimately make us a weak squabbling county, the people of China are laser focused on their goal. Their goal is to build and conquer, ours is the destroy and crumble.

Why isn't that ever discussed? Even for us Libertarians (who seem to like no one and nothing), we are not covering all aspects of what is at stake. And so it is.

It's *protectionism* when Emperor Xi's goods are taxed a penny. The horror!

But a free market when your neighbor's labor is taxed in every paycheck.

What Globalists call free trade is a set of trade, tax, and immigration policies that benefit foreigners and US corporate ownership over US labor.

Why should domestic *labor* be taxed when purchased, but not foreign goods?

Cui bono?

The international ruling class and foreigners.

Adam Smith is on Trump's side, favoring tariffs to offset local taxes on production.

https://ibiblio.org/ml/libri/s/SmithA_WealthNations_p.pdf

Wealth of Nations, pg. 356

"It will generally be advantageous to lay some burden upon foreign industry for the encouragement of domestic industry, when some tax is imposed at home upon the produce of the latter. In this case, it seems reasonable that an equal tax should be imposed upon the like produce of the former. This would not give the monopoly of the borne market to domestic industry, nor turn towards a particular employment a greater share of the stock and labour of the country, than what would naturally go to it. It would only hinder any part of what would naturally go to it from being turned away by the tax into a less natural direction, and would leave the competition between foreign and domestic industry, after the tax, as nearly as possible upon the same footing as before it."

Word

I think that if 18 year olds could storm the beaches of Normandy to win a war, I'm willing to sacrifice having less money until we can win THIS war. My gawd!

Thank you for the amazing info you share with us! Best, love a good book

list, and this is a great one with some I’ve read, some I’ve looked into and

many I hadn’t heard of before. The kindle is going to feel a little data

heavy soon…

Thanks youWhatsApp Status Video

But a new report from two economists on the Federal Reserve Board goes beyond the theoretical implications of tariffs and the anecdotal evidence that the trade war has not worked.

"We find that U.S. manufacturing industries more exposed to tariff increases experience relative reductions in employment as a positive effect from import protection is offset by larger negative effects from rising input costs and retaliatory tariffs," write Aaron Flaaen, a senior economist with the Federal Reserve's Industrial Output Section, and Justin Pierce, a principal economist with the Industrial Output Section.

More Boehm Propaganda.

Two economists at one of the most centrally controlled banks in the World are trying to argue that Trump getting lower trade restrictions is the problem.

Horseshit.

4Q 2019 stock returns are going to be above 25% for me. The highest in a long time.

Then just as the inevitable market correction happens, all US trading partners will have lowered their trade restrictions easing that market correction for Americans. Back to strong market returns.

Poor troll, can't even attribute his insults correctly (and watch; if he responds to this with his usual "poor alphabet troll", it will be as a reply to himself, which just confirms he can;t attribute much correctly). That isn't Boehm Propaganda, it's Federal Reserve Propaganda.

Poor alphabet troll trying to help reason spread propaganda.

Those bot programmers just dont like to manually sort thru comments. Its must easier with auto replies.

LMAO!

"Poor alphabet troll!"

"Reason is a progressive rag!"

"Aaaaanarchist!"

"Reason isn't libertarian!"

"You're a poo-poo head!"

I think that about sums up the lc bot program.

Oh shit sarc is drunk and bitching again.

I saw that thread where you made a fool of yourself pretending you knew something about nicotine. Now I guess you'll do money?

Shorter sarc - "I had some money once so I'm an expert"

sarc who knows he lost - "fuck off Tulpa"

No no, even better, do that thing where you link to people who present arguments you don't understand but find viscerally appealing.

“You’re a poo-poo head!”

Also, you kind of lose when you have to lie about what people say.

This from the drunk and homeless public library sock troll sarcasmic.

**Hiccup** my life is a wreck and I tell anonymous internet people because this makes me seem more real than a sock of reason staff.

*barf*

One things for sure, the more the bots swarm my comments, the more that I know that I am driving their programmers and reason staff crazy.

You certainly piss off all the right people lololol

You don't drive anyone crazy. You lack the intelligence. What you do do is drive intelligent conversation away. Which is sad, because this forum used to be an interesting place.

Then reason stepped up sock trolling to boost web traffic and ignored Libertarian causes.

The Glibbening happened.

"Which is sad, because this forum used to be an interesting place."

It's funny that drunky says that like it was you that caused the exodus, it explains why he is so bad with understanding cause and effect

There's more anti-sock trolling than sock trolling. Just count them. Oh wait, I forgot your arithmetical skills are non-existent.

Carry on. Reply to yourself and call me the alphabet troll, and add to the anti-sock trolling count.

Cry more about being called alphabet troll, alphabet troll.

"You don’t drive anyone crazy."

Say one of the guys he's driving crazy ahaahahaha

Protest more milady ahhaaaa then get drunker lolololol. BECAUSE HES CLEARLY DRIVING YOU CRAZY AHAHAHA

+1000000000000000000000000000000

Whoops! I forgot a couple

"Trump 2020!"

"MAGA!"

Not really your fault, excessive drinking destroys short and long-term memory

I never took sarcasmic as a Trump fan.

I mean Trump is no an Anarchist.

He is a MinMeanie.

He's fine sometimes. Then there are the days he shows his ass and needs a checking.

Poor Boehm.

MARKETS IMPLODING!

Arithmetic never has been your strong suit. For instance, you like to shout "Shall Not Be Infringed" every time gun control comes up; but the Second Amendment didn't exist in 1789.

"but the Second Amendment didn’t exist in 1789."

Wrong. It hadn't yet been ratified, but was drafted in 1789. No version of "it didn't exist in 1789" is factually accurate.

My right to Arms and self-defense are not dependent on the 2nd Amendment.

I would have pistols, grenades, armored vehicles, .50 cal rifles, Tannerite... whether there was a 2A or not.

Its fun to see the alphabet troll and reason handlers get so upset.

But you quote the Second Amendment before it existed.

Except you're wrong alphabet troll.

Pedant.... Pedant.... Pedant, pedant, pedant, pedant , pedaaaaaaant, pededededant.

So he's right but you just don't like it.

And really, what a strange place for you to flex.

What part of my reply to defend an attempt to delegitimize the 2nd got your panties in a bunch? It's not pedantry to reply as I did, when the long term strategy to do away with gun rights is to move the debate inches at a time and nibble at the edges. I'm fighting the battle exactly where it is happening.

They’re libertarians for gun control.

Since the 2A only restates what’s already implicit in the Constitution, it didn’t have to exist at all. The right to bear arms has been there from the beginning.

BOOM! Boehm has sicced the bots!

Even if #TrumpRussia and #TrumpUkraine weren't the two biggest scandals in world history, Drumpf would still deserve impeachment because of his abysmal economic record.

For example, Reason's billionaire benefactor Charles Koch is only worth $62.2 billion. When a self-made financial wizard like Mr. Koch cannot find a way to prosper, you know the economy is in terrible shape.

#DrumpfRecession

#HowLongMustCharlesKochSuffer?

Well, if the FEDERAL RESERVE says so...

+1000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000

Federal Reserve Board- Troubled Asset Relief Program (TARP) Information

The Federal Reserve recommended TARP bailouts.

Boehm, have a great 2020, you silly bastard!

I for one look forward to your tears after Trump gets reelected and the US economy keeps humming along stronger than ever, even with a market correction that will happen someday.

Poor loveconstitution1789. He's the most predictable Trump bootlicker in the Reason comment section, but he's accusing others of being bots.

I mean..if the immediate swarm of new socks fit.

It is pretty ironic.

Cry more. Into your drink. While you think of the guy parenting your kid in your absence and railing your wife.

I think these clowns have re-invented nuclear power. Every comment which upsets them trigger a half dozen replies denouncing Reason. Either they are splitting atoms (not to mention hairs) or they are soaking up frantic energy from somewhere.

Cry more Eric.

Sarc, have you ever really seriously considered suicide? Maybe you should give it a whirl and see what all the fuss is about.

He accuses others of being bots because he can't accept the fact that many of us are actually consistent. As expected he is now saying the two of us are the same person. Happens a lot. Whenever more than one of us say the same thing he goes on his "You're a sarc troll! You're a reason troll! You're a sock!" Should have put that on my lc bot program comment. Oh well.

You're not a sock. Blardo and the alphabet troll obviously are.

So, now what? Your premise fails. What now?

I mean, blardo is clearly De Opresso Libel, who had to bustcoutca new name because he lost control of himself and descended into baby talk. After pretending to want a real discussion, he spent and entire day shitting up threads with baby talk after he got crushed. Now, whenever he pipes up, he gets reminded he was always obviously a sock, that everyone called it from jump, and he LOST HIS MIND when he couldn't convince anyone otherwise, while proving the point.

So he made a dumb sock to avoid getting reminded of his shame. It failed.

See? One comment generates two, one of which is a reply to itself.

And then you cry about it Eric.

They are people who would have been welcome before the exodus. Actual, you know, libertarians. It's sad how low this forum has sunk.

You're remembering the forum through bourbon colored glasses.

It was almost always a bunch of assholes like you making stupid fucking jokes about boomer culture. Every thread had some idiot referencing Futurama or Monty Python, and brohugging each other.

Which explains why you thought it was better. Yo had people to shout your opponents down, and now you're on your own and can't hack it.

If you mean a bunch of intelligent, libertarian assholes putting people like Tony in their place, and making nerd jokes, I can definitely agree. Now intelligent, libertarian assholes are unwelcome. Yeah, I do miss it when people would back me up, or when I could back them up. Being in the majority is nice. Being a libertarian forum it made sense for libertarians to be in the majority. Oh well. Those days are gone.

"If you mean a bunch of intelligent, "

See? Bourbon colored glasses.

Cry more about not being able to hack it, boomer.

Boomer! Haaaaa ha ha ha ha! Jesus dude. I take back my 2:16 comment.

Cry more boomer

"putting people like Tony in their place"

They tucked tail and ran and he stayed. He won the long game.

Which, AGAIN, shows why you are so bad at economics.

Reading the Dow Jones average is NOT economics.

Which is why you're bad it.

Alphabet troll does not get onto Boehm when Boehm makes the ridiculous correlation between 500 point drops on the DOW Jones.

Its different when Boehm is make fun of when the DOW Jones goes to new highs. We get sock troll swarm.

The fact that you were the laughing stock, and are now more reasonable than most (yes I'm paying you a compliment, backhanded but a compliment nonetheless), shows just how low this forum has sunk.

This is exactly what I mean. You'd have a dozen motherfuckers lining up to suck to your dick for that comment, and now you're just a whiny boomer who lost.

Why would you think I'm a boomer? Never mind. You're just trying to bait me into defending myself. I'm not playing.

I'd like to say it was fun, but it wasn't. I'd also like to wish you a good day, but I'd be lying.

Later.

It's OK boomer, I understand you getting melancholy this time of year. I'm sure your drinking doesn't help, but your family being taken care of by a better man is the real killer for you, and I sympathize.

Why would you think I’m a boomer?

Because you sound like a really old white guy pining for the days he could get away with saying "nigger" whenever he wanted and have everyone back him up if things got ugly.

Poor sarcasmic. He really believes that he is consistent.

Blockquotes are the funniest way to make fun of sarcasmic sayings.

I mean, fuck dude, sarc is whining about the quality of the forum, then unironically analogizing the WORLD ECONOMY to a CAR.

How does anyone do anything but mock him for that?

+100

The world economy is not a series of pipes, it’s more like a dump truck!

No Line to Board Private Jets, but There Is a Line to Buy Them

Poor Boehm!

Wages for typical workers are rising at their fastest rate in a decade

Poor Boehm!

WAGES IMPLODING!

Lololol alphabet troll actually thought it wouldn't be obvious hes blardo ahahahaha

Just remember, if someone doesn't like you, it's a sock. It's the other guys who use socks - not you.

No just you.

I mean these sock operators dont speak American English well, so it's like they don't even realize that they are easy to spot.

Trump is clearly crashing the economy, right through the fucking roof.

It's like you all totally forgot the lessons of the boom bust cycle. We are living on credit cards right now. Biggest deficit in US history, and for no reason other than to get mouth breathing Trump supporters something to crow about.

God damn look how desperate you've become. The economy should shut you the fuck up, but no one ever accused you of having common sense Tones.

+100000

Discuss this article on Quora:

https://www.quora.com/q/sgrmlrcbxkjitfee/Trumps-Trade-War-Has-Hurt-American-Manufacturers-More-Than-It-Helped-Them

Quora is a vibrant community where everyone must use their real names and a “be nice, be respectful” policy is strictly enforced.

I'll discuss it here thanks, and you got flagged for blog whoring.

"Mike Laursen, Semi-geeky, libertarian independent

Admin "

Shorter jeffmike "I'm a pathetic fucking loser who needs to manage the discussion and censor people because otherwise I look like an idiot"

Still making taunts and threats from the safety of your online anonymity, you fucking pussy?

And blardo is neutral Mikey's new sock.

Interesting.... like the color of my shit is interesting.

He convinced me.

I'm actually Mike Laursen. From Idaho. Used to work for Adobe.

See sarc, THAT is irony.

So Neutral Mikey pushing the exact same Quora comment for a week is now officially spam.

REPORTED.

bye bye Neutral Mikey.

a “be nice, be respectful” policy is strictly enforced -- Towards all emotional but illogical Liberals and not-enforced at all towards common-sense statements or any reference to the Constitution.

I tried to share some "thoughts" of wisdom at Quora once - they aren't looking for wisdom or thoughts. Just mobster cheers.

Here's some important trade war information some of you may have missed from a few days ago:

"BEIJING—China will cut import tariffs for frozen pork, pharmaceuticals and some high-tech components starting from Jan. 1, a move that comes as Beijing and Washington are trying to complete a phase-one trade deal.

. . . .

The announcement comes as China and the U.S. are close to signing a trade deal aimed at putting an end to a tit-for-tat tariff war that has lasted nearly two years. Neither side has released a version of their draft agreement, but China said it would purchase more American products, including farm goods, while Washington said it would cancel plans for fresh round of tariffs while reducing some existing ones.

Monday’s tariffs cuts appear to pave the way for China to import more from the U.S. without violating international trading rules that ban managed trade. Chief U.S. trade negotiator Robert Lighthizer has said Beijing promised to increase imports from the U.S. by $200 billion over the next two years, including the purchase of at least $40 billion in U.S. farm goods annually.

----WSJ, December 23, 2019

":China to Cut Tariffs on Range of Goods Amid Push for Trade Deal"

https://www.wsj.com/articles/china-to-lower-tariffs-on-some-imports-in-2020-11577066316?

China is presumably cutting tariffs so that the government dominated companies that will be making these purchases won't need to pay tariffs on top, and, of course, China wouldn't be cutting these tariffs if they didn't expect Trump to come to final terms on phase one. It's impossible to tell how beneficial the terms Trump won from China will be until we see exactly what terms Trump won on intellectual property and the means of enforcement, but it's safe to say that if those terms are beneficial to the United States for the foreseeable future, surpassing the value of a couple years of tariffs may be easy.

I maintain that the trade war was a bad idea when no one, including Trump, knew how this would turn out--regardless of whether the intellectual property protections are iron clad. However, opposing trade wars in general and on principle doesn't require me to pretend that Trump won nothing with this trade war any more than opposing the Vietnam War required Jane Fonda to claim that American POWs were lying about being tortured. If Trump won some benefits from this trade war, we should all breathe a sigh of relief--and continue to oppose using trade wars to gamble with our economy in the future.

I for one look forward to American businessmen getting billions in licensing from the Chinese fro stolen tech.

The biggest benefit on intellectual property will be that it will stop being a barrier to trade. American companies won't need to share their proprietary technology with a competitor in order to get access to sell in China's market. Anybody who is pro-international trade should recognize that is a trade barrier and should celebrate getting rid of it--if that's what happened. Incidentally, that will also benefit Chinese workers and Chinese consumers--at the expense of the profits that were being enjoyed by CCP and PLA run companies.

Yup. Plus, at some point the Chinese will likely have to address having a tyrannical Communist government if they want to really compete in the World economy.

Yeah, I don't know where things go when they experience their first recession, but as their economy matures, they will have a recession eventually--and the fact is that all the businesses are owned by individuals who are politically connected to the CCP and the PLA. They've never had cyclical unemployment in China--not since they joined the WTO in 2001--but that will happen eventually, and when it does, the politicians will have a hard time deflecting responsibility by blaming it all on Wall Street, banks, and the rich like we do in the USA--since all those things are effectively the same as the government in China.

I don't know about the other tariffs, but they're probably lowering the frozen pork one because their domestic pork production has been absolutely annihilated by African Swine Fever: https://www.reuters.com/article/us-china-swinefever-archer-daniels/african-swine-fever-in-china-more-severe-than-previously-thought-adm-cfo-idUSKBN1XN2EE

They're having a really bad time, and despite heroic and, no doubt, Draconian measures, are unable to eradicate the disease from many of their production farms. They also eat a ton of pork.

I'm glad a large trade deal with them is imminent. I was unsure whether their economy could take this trade war much longer, and I was really unsure about whether their government would survive a continued downturn in their economy.

I maintain that the trade war was a bad idea when no one, including Trump, knew how this would turn out–regardless of whether the intellectual property protections are iron clad.

I must disagree here. We need to measure results of what has been achieved via POTUS Trump trade policy versus what would have happened with no change in trade policy. And this is why I disagree with you: We have an established trade policy track record pre-POTUS Trump, and it is pretty terrible, Ken.

I get that it is not 'libertarian' [trade war], but reality has a way of intruding on ideology. I submit this is one of those times. Our trade policy had to change because the status quo had to change.

"I must disagree here. We need to measure results of what has been achieved via POTUS Trump trade policy versus what would have happened with no change in trade policy."

If betting your entire life savings on a single roll of the dice was a bad idea at the time you rolled the dice, it was still a bad idea--even if you won.

The historian's fallacy is an informal fallacy that occurs when one assumes that decision makers of the past viewed events from the same perspective and having the same information as those subsequently analyzing the decision.

https://en.wikipedia.org/wiki/Historian%27s_fallacy

If Trump had a time machine and knew how events would unfold before he made his decision to initiate the trade war, that would be one thing, but Trump could not have known that events would play out as they did--certainly not over the course of years. I suspect he knew that his trade war was playing well with swing voters in rust belt swing states, but that's different from knowing that the Chinese would capitulate and that they would capitulate on intellectual property protections. It's probably also important to remember that we haven't seen the final terms of the agreement yet. I can't criticize Boehm for devaluing the terms of an agreement no one has yet seen, out of one side of my mouth, and then turn around and praise the text of the agreement, out of the other.

I know that I opposed the tariffs and that if those are coming down now, it's a good thing.

Ken, I reject your premise on historical fallacy, as I have no way (nor do you) of knowing perspective, and the analytic process used by POTUS Trump.

Nobody knows what is in the agreement. Time will tell. But I would have been content to do more damage to China's economy to extract better terms, by increasing tariffs even more. Now China gets a lifeline and will not be incented to come to a final agreement.

WRT Boehm's assertion that manufacturers were hurt more than it helped, the most charitable thing I can say is that it is premature to say one way or the other. My sense of the data Boehm presented is manufacturers are in the process of figuring out just what the hell they are going to do in the new trade environment.

Ken, not every competition is a "roll of the dice"

That is a stupid metaphor.

There are risks and rewards to everything, and everyone has strengths and weaknesses.

Is Trump gambling? Sure. Saying it's with the "life savings" of the US and an idiotically weak perspective. Even if everything goes wrong, the US can recover.

And it's not a roll of the dice (or blackjack), it's poker. Unlike dice, poker is gambling using skill to manipulate chance. You raise, call, fold, check, bluff, slow play, go all in, chase, bet the come, pot control, trap, etc. You play differently with a large stack relative to your opponent(s) vs an even or small relative stack. And if you want to win consistently, you learn how to apply and withstand pressure.

Start playing a skill game. You're intelligent enough to not restrict yourself to abstract dogma.

The purpose wasn't to help US manufacturing over an 18 month period. The purpose was to restructure some aspects of global trade to help US companies and workers for decades.

Objectively, saying it didn’t help over 18 months says more-or-less nothing about the success or failure of the tariffs.

It's like starting strength training for physical fitness and then complaining you gained weight the first two weeks.

Trump getting lower trade restrictions for the USA will help Americans and American business for decades.

So, Eric, you did notice that the graph you included to prove the idiot point you're trying to make shows a general upward curve right?

And that that one graph reveals that this is yet another example of your TDS nattering?

Eric is a Propagandist. Corrections are just if you get caught lying.

He seems to be bent on pushing for free trade when Trump is fighting a trade war, and he seems to be against whatever Trump is doing to end the trade war. It seems like he's more anti-Trump than pro-trade in that he's consistently anti-Trump--even when Trump is working to normalize international trade.

"Pay for the bottom 25% of wage earners rose 4.5% in November from a year earlier, according to the Federal Reserve Bank of Atlanta. Wages for the top 25% of earners rose 2.9%. Similarly, the Atlanta Fed found wages for low-skilled workers have accelerated since early 2018, and last month matched the pace of high-skill workers for the first time since 2010.

“A strong labor market makes the bargaining power of lower-paid workers more like the labor market higher-wage workers experience during good times and bad,” Nick Bunker, economist with job search site Indeed.com, said.

https://www.wsj.com/articles/rank-and-file-workers-get-bigger-raises-11577442600?

There are so many excellent reasons to oppose trade wars, and all of them remain so despite how good the economy has been for unskilled workers since Trump initiated the trade war with China.

When TDS gets a hold on people, it undermines everything. Trying to persuade people not to believe their own lying eyes because the writer hates Trump so much doesn't make more people support more trade, and libertarian capitalists like me hope people don't mistake the positions of TDS victims for real pro-trade positions.

It feels a lot here like it does with Dalmia and open borders.

Dalmia's TDS isn't indicative of what real open borders is about, and Boehm's TDS isn't indicative of what support for trade is about either. TDS + Position X = TDS and Nothing about Position X. Not being able to see the issues clearly because of their hate for Trump is what TDS is all about. I hope no one thinks what they read from TDS victims is really indicative of anything else but TDS.

Look how fast the economy can grow with the brakes on! Give it more brakes!

Poor sarcasmic is for pre-Trump *parking brake on* economics.

"The economy is a car!!!"

Reminds me of South Park and how they make fun of Canadian square tires.

I mean Canada is pretty decent except for the square tires.

And the flappy heads are weird, eh?

"The only thing that matters is right now"

""We find that U.S. manufacturing industries more exposed to tariff increases experience relative reductions in employment as a positive effect from import protection is offset by larger negative effects from rising input costs and retaliatory tariffs," write Aaron Flaaen, a senior economist with the Federal Reserve's Industrial Output Section, and Justin Pierce, a principal economist with the Industrial Output Section."

"In short, protectionism doesn't work."

Hahaha, no. Whether or not something works depends on whether it accomplishes the objectives it seeks to fulfill. If tariffs didn't impact prices in any capacity, then by definition they would not work. If tariffs didn't invite retaliatory tariffs, I would be shocked as well.

Tariffs are working precisely as intended. They have pressured non-free trade nations to improve their standards and negotiate with us. Our previous position was "trade freely...please?" and was super cucked. They have also protected American industries and created economic opportunities that would not have existed without some form of retaliation against non-free trade nations.

Decrying tariffs for job losses is like criticizing wars for killing people. Of course there are costs, but there are also benefits.

"empirical evidence documenting these channels in the context of an advanced economy has been limited."

"But at least it has proven, once again, that tariffs are bad policy"

Nice agenda you got there. Even the economists are sophisticated enough to admit that there are potential merits to tariff policies.

Also, when people keep finding new work opportunities and they're doing better and they keep voting for more tariffs, do you know what it's called when you tell them that they're voting against their own interests and that you know better than them? Elitism.

I was disappointed to see Trump signing this trade deal with China because I am such a big fan of trade wars, almost as big a fan as Trump himself, and we've been raking in the big bucks over how much winning we were doing, but after reading the text of the trade deal over at http://www.ShitTrumpSays.com I must say that this is the greatest deal in the history of the Universe. Anybody who wants to argue otherwise probably hasn't even read the details of the deal and has no idea what the hell they're talking about.

Me too. Haven’t seen a trade deal this good since the AOL / Time Warner merger.

Which one of you guys is James Harris Jackson?

Fuck off hicklib

Keeping America Great!

Happy New Year Trump and 4 more years!

So, the answer is to let China continue to flaunt "free"trade with us and the rest of the world?

How does playing by the rules work when the other side acknowledges no rules except winning?

Who said anything about rules? Really there are none. There are conventions and treaties but everyone cheats. Companies here cheat on each other all the time which is why the legal profession pays so well.

More or less open trade is not playing by the rules it is just how you chose to play the game. The other team is playing its own way. Remember though it is not a zero sum game.

You first have to define what you want. Where I disagree is that the US is “losing” with China by importing more than we export.

Secondly IP and copyright protection is not exclusively an issue between the US and China. There is a whole list of other places where that occurs and is increasingly an issue for China itself as they become more advanced. That would be better solved by international agreements and strengthening the WTO imperfect as that may be. Just making a unilateral “deal” is not going to work because they can cheat as they are doing now.

Tariffs are bad because they hurt our own people. I don’t care if they hurt Chinese people more that is not “winning” anything. They won’t accomplish anything except for long term negative consequences for everyone involved. Like any war there is no real winning there are only degrees of losing.

Yeah Echospinner!

Trade wars are cut-off-your-nose-to-spite-your-face contests. They only REAL way to "win" is to NOT play the game!

Except one side was already engaged in war, and we were ignoring it.

Tariffs meant as a temporary negotiating technique is utterly valid, particularly when you can hurt the other party more than they can hurt you. President Trump needs to maintain tariffs until a real deal including verification is agreed to.

I'm flabbergasted that libertarians of all people trust that those who set up trade policies with China did so with the best interests of Americans in mind.

They're otherwise corrupt and incompetent, except when they mouth words like "free trade"...

False premise. “Importing more than we export” is not the issue. That’s a given. I’m not defending tariffs, or anything else, but over simplifying the issue is lazy.

I keep seeing this term Trump Derangement Syndrome. I am always interested in emerging new diseases so I looked it up.

DSM- 29x

Trump Derangement Syndrome TDS.1204

A mental disorder first described by the Breitbart news organization in response to several seminal articles published in the journal 4chan between 2017-2019.

Characterized by 3 or more of the following:

1. Persistent belief in the delusion that Donald Trump is a person of low moral character who has engaged in questionable and deceptive business practices during his career. (see ref. 4 Trump U. ref 12 Trump charities, ref 5 pussy grabbing)

2. Pervasive tendency to disagree with specific policies of the Trump administration despite clear evidence that they are correct and beneficial. (ref 7 immigration policy, ref 20 trade and tariffs)

3. Displays uncharacteristic amazement or excessive head shaking behavior at statements or tweets made by president Trump thought to be rude, vulgar, inappropriate, false, crass or offensive ( see references 39-1215)

4. Expresses excessive concern about fitness for office of Donald Trump despite clear evidence that he was elected. (See also Bush derangement syndrome, Obama derangement syndrome, Clinton derangement syndrome and others referenced below)

5. Persistent delusions and doubts concerning Donald Trumps known expertise in a broad variety of subjects ( see refs 30-51 forest fires, steam-powered catapults, windmills, horse racing, etc.)

6. Expresses general distrust in the ability of elected government to solve complex economic and social issues despite Executive Orders and statements to the contrary. (see Libertarians et. al.)

7. Displays aversive behavior and distrust toward Donald Trump himself who is perceived as engaging in excessive self-aggrandizing and self-referential behaviors.

Most being entirely "emotional" reactions instead of logical ones.

I have all of those and am very happy with it. Happiness is an emotion.

I wrote it in the style of a DSM entry as a parody because I think calling something TDS is just hilarious and says a lot about the person using it.

"I have all of those and am very happy with it" -- sounds like something a crack-addict would claim.

"Drugs make me so happy -- I just don't understand why others get so mad at me for ripping them off, being a nuisance everywhere, pissing my pants and spreading STD's everywhere and making them so irritated. My happy drugs caused my wife and children to leave me too... "

"Awe Heck -- Well, screw them - its their own fault they're not on drugs too."

You do see that Trump is a lunatic, right?

lol... In the political world - I see President Trump as one of the least "lunatic-ish" of them. By his deeds; I "see" (not necessarily just "feel") that he is the most patriotic, responsible, honest, loyal and hard-working President I've ever seen in my lifetime. Every policy that stinks of favoritism I keep finding out he's already been working on cancelling. Every policy that was created by pure lunacy; he opposes.

Ya know Tony; not everything in this world is really what your knee-jerk "emotional" reaction to it deems it to be. Maybe its time you put your "emotions" aside and tally up the mans "deeds".

Tony considers Obama a non-lunatic even after that guy ordered the drone murder of an American and his son.

Tony has horrible advice and opinions.

My working definition has Trump Derangement Syndrome has two expressed symptoms:

1) The inability to see the world objectively when the issue is somehow related to Trump.

2) The compulsion to see every issue as either pro-Trump or anti-Trump.

If we can't see the trade issue objectively because Trump is involved or if we can't talk about trade independent of our views on Trump, then we have Trump Derangement Syndrome.

There was a perfect example before Christmas, when I wrote something speculating about why elitist progressives are so hostile to Christianity, and one of our regulars responded with four or more comments pointing out that Trump is a bad example of Christianity. If I'd pointed to a study showing that a disproportionate number of elitist progressives shun pumpkin pie, I'm sure the response from this individual would have been Trump related, too--because everything from the Sermon on the Mount to pumpkin-fucking-pie is either pro-Trump or anti-Trump in this sad TDS victim's mind, I'm sure.

Well asking people to see anything objectively is asking a lot. It is probably impossible. We are far less rational than we think and most of how we judge things is probably subconscious.

In the case of Trump he does bring out strong emotions. That is intentional and forms the core of his personality, style and appeal or the opposite reaction.

So I poke fun at the term because it is neither a derangement nor a syndrome. It is entirely normal.

"Well asking people to see anything objectively is asking a lot. It is probably impossible. We are far less rational than we think and most of how we judge things is probably subconscious."

I'm not asking for metaphysical perfect non-bias. If your views on trade suddenly change when Trump enters the picture, that's more than a little bias.

I was against the trade war before Trump started it, I opposed it while it was ongoing, and I continue to think it was generally a bad thing--even though I remain hopeful that Trump got something good out of it. Trump being anti-trade might have influenced my views on Trump, but if Adolf Hitler, Josef Stalin, Liz Warren, and Donald Trump all came out as pro-trade or anti-trade tomorrow, it wouldn't change my views on trade one iota. Meanwhile, people with TDS cannot deliver a coherent discussion of trade policy without discussing Trump. In their arguments, they only appear to be for or against trade insofar as taking one side or the other is pro or anti-Trump.

This became painfully obvious when Trump pulled our troops out of harm's way in Syria. Suddenly, all the anti-war, anti-neocon principles went out the window, from the question of whether Congress ever authorized the ground troops in Syria to the question of whether our troops commitments should be driven by the interests of the Kurds. In reality, their positions on all of these issues never would have changed if Trump weren't in the picture. If it were someone else arguing that we shouldn't leave our troops in harm's way in Syria, they probably would have agreed.

They don't really want the U.S. to commit ground troops to fight against Hezbollah and the Iranian Revolutionary Army in Syria, and they don't really think our troops should be involved in defending the Kurds from the Turks either. They just oppose Trump--and everything he does because Trump is the one doing it. That is TDS.

Nobody is saving the world here Ken.

At a certain point it is just tilting at windmills.

I think the reason dictators are scared to death of what their people are saying to each other is because they're rational. The chain of events that ends with their heads on a pike is always initiated the same way--with their people talking to each other.

In fact, the reason we made mistakes in Iraq, ObamaCare, TARP, Vietnam, the drug war, during the Great Depression, etc., were all the same--because there weren't enough people making the right arguments to each other to persuade their friends and family to see the the world and policy the way it really is.

Jesus of Nazareth took over the Roman empire, Gandhi chased the British out of India, MLK ended segregation, Lenin took over what became the Soviet Union, Hitler launched a war and a holocaust, and Hugo Chavez ruined Venezuela--all by way of persuading one person at a time.

We are saving the world here. The kind of world we live in depends on our ability to persuade others, and the upward bounds of the limit of our ability to influence others is even greater than what we see on social networks like Facebook--because social media is only one form of communication. The most persuasive conversations we have are undoubtedly the conversations we have with friends and family--people who already know we care about them.

If you don't want the United States to invade Syria, you better make that clear to your friends and family when the topic comes up--because whether your friends and family--and the friends and family of other people like you--support cutting spending, legalizing cannabis, or invading Syria is ultimately the reason those policies will or won't be implemented and sustained. Yeah, we're definitely saving the world, here.

Talking about this website Ken

That's what they're supposed to be trying to do!

This place is supposed to preach the libertarian gospel to the heathen.

They're here to save our souls. They're here to save the world.

I’m just here because...come to think of it I have no idea really.

I should have been more clear

Eloquently stated!

+1000000

Also the people who bother with this stuff, myself included are like hard core Star Wars fans or something. Most people just like or don’t like the movies. So of course they are going to jump on things most folks hardly notice.

This whole comment is a bunch of Trump apologist bullshit. Trump is the president of the most powerful nation in the world, and every time he says some of his ignorant, hateful rhetoric, it echos throughout the world.

He must be impeached for this reason, imho, but I’m open to discussion, in a neutral way, other reasons to impeach him.

We're not talking about hateful rhetoric. We're talking about trade policy. If you really can't tell the difference, then you may have TDS.

Mike, Mike, Mike....your alter ego dropped the 'neutral' label. He now self-identifies as Non-Partisan. 🙂

And now he just spams for a site that will censor opposing voices

I think a /sarc at the end of liar son’s comment might have provided more clarity.

I was referring to Laursen.

Just adding to XY's point

International Trade basics for 2nd Graders -

1990's "Free Trade" initiative = We negotiated to just give the Bully your lunch. No point in trying to stand-up for yourself with a wimpy muscle (military cuts).

President Trump's "Trade-War" = We will no longer just GIVE away our lunches but will stand up for ourselves.

How do we know to be true? Well, either the USA or China can just walk away from the negotiation table at the point they find the negotiation unfavorable. "No, We will not pay that much for a TV."

The very fact that China still want's to buy the TV (ain't walking away) pretty much proves the previous negotiation wasn't entirely "fair". Will we try to bully china with muscle (big military) into ripping them off? Most likely no. Will China try to bully the U.S. with muscle to maintain the stolen lunches? Who knows but at least we know we are equipped enough to make a decent defense.

“No, We will not pay that much for a TV.”

No, we will pay FAR MORE for the TV, in taxes (tariffs) and Trump and His Fed Buddies are going to pocket the difference, and use it to go on a pussy-grabbing spree!

Because the right economic policy according to you is to buy from Chinese slave labor while forcing productive Americans to pay for unemployed Low skill US workers. That’s free trade Democrat style. The overconsumption and lack of savings in the US are further “benefits”.

The right economic policy according to me is to maximize individual freedom, in each and every case where my freedom to swing my fist stops where your nose begins. Such individual freedom does NOT allow you (or Trump, or the Sacred Collective Hive) to decide, for me, which producers are arbitrarily deemed to be so-called "slave labor", and who is not. I should be left free to decide who to buy from, and who not to buy from. Just as I should be left free who to give charity money to, and who not to give charity money to. Democrats especially like to make my charity choices for me. Why are Trumpistas any better than Democrats, when Trumpistas want to decide for me, who I should buy stuff from? Who are YOU to decide for us, who to buy from, and what, exactly, shall be deemed to be over-consumption and under-saving?

You’re trying to maximize your freedom at my expense.

Just as soon as the Sacred Collective Hive stops enslaving me for 50% of my working life, I’ll support your right to buy whatever crap you want from wherever you want to buy it.

Until that day, I will insist that the state force you to comply at gunpoint just like it forces me to comply at gunpoint. Are we clear?

So... "Freedom" in your mind consists (among other things) of your being able to call anyone that you want to call such things, "slave laborers". Then, whoever decides to buy from the "slave laborers" is infringing on YOUR rights?

You'll magnanimously give up your warped "rights" as soon as others give up their warped "rights". THIS is how we make progress towards freedom?

I will admit that "individual freedom" is often like beauty... It's in the eyes of the beholder, to some extent. It's not math, actually. It's more squishy. But IMHO, your definition of "freedom" is pretty severely warped!

We certainly don’t make progress towards freedom by you trampling all over my freedoms while demanding that the state doesn’t inconvenience you in any way.

Well, this below is one of several examples of your supposed "path towards freedom"... Use Government Almighty to cause problems, and then use Government Almighty yet again, to fix the problems caused by the previous round of Government Almighty "fixes"! Thus, Government Almighty almost always gets BIGGER! And individual freedom gets SMALLER!

The collective hive mandated WAY too many licenses, before we're allowed to earn an honest living... Too many min wages and other mandates. Put too many of us into poverty. To "help" with this poverty problem that The Collective Hive created, The Collective Hive gave us welfare. Welfare then attracts too many illegal sub-humans, sometimes, so to fix THAT problem, The Collective Hive now wants e-verify and giant border walls and giant border armies… And now also property confiscations for wall-building… So I suppose The Collective Hive will next fire up the military draft to fix THAT problem! (Lack of a large enough wall-and-army forces).

I didn’t lay out a path to freedom, I simply rejected your selfish policy proposals.

And Trump's trade wars have caused economic distress for American farmers. To "fix" this Trump-caused problem, Trump GROWS "welfare for farmers". Yet again... Government Almighty gets bigger, to "fix" the most recent rounds of troubles cause by... Government Almighty "fixes" to a previous round of troubles caused by (or exaggerated by) Government Almighty!!!

So? What’s your point?

Trumpist "solutions" cause more troubles that then subsequently call for more Trumpist "solutions"... It is pretty plain and simple! Read the above, about trade wars and farmers!

And you and your lusting after Trumpist policies to cause more and more troubles... YOU are NOT being selfish, because your (and Trump's) motives are ALWAYS pure and good! Right?

I’m not “lusting after Trumpist policies”. You’ve failed to make an argument that it “causes more troubles”. I simply don’t know. I’m happy to wait and see how it turns out.

That's a lie SQRLSY; The farm bill was just a renewal; It didn't grow it just didn't get "vetoed" as planned. Needless to say it had complete left-support and 13-right voted against it.

Second; you do have a point though. Tariffs aren't the permanent or even the correct cure. Repealing minimum wage, regulation, hand-outs, subsidized foreign shipping costs and a whole slew of other anti-productive and "favoritizing foreign produce" legislation is.

But until the citizenry and congress will "allow" the correct cure - a simple Tarriff to balance the account isn't actual a "bad" approach.

Come to think of it --- How exactly would any President bring trade negotiation to the table without some form of disruption.

"Uh, we'd like you to respect our IP and stop making us subsidize your shipping to us."

"No sorry; we like it just the way it is" - China

"Oh, okay then... Sorry for bothering you", Says the Wussy looser (betcha can't guess who the 'looser' was?)

It is a good question TJJ2000.

Trying to look into the whole issue it is enormously complex and very much international in scope. I see that you agree that tariffs alone against one country cannot possibly resolve the issue.

I think we could agree that one man using such a simple approach will not. Take 20 experts with PhD level expertise and ten years experience each in international law and trade you will get 20 different answers.

In negotiation of course you need leverage. That much you and I and Donald Trump knows. Don’t know if you have children but ever negotiate with a 5 year old? Even they know that.

I see you agree that tariffs are a blunt instrument.

To my uneducated mind on the subject it is like trying to remove an appendix with a baseball bat.

Here is something I found. Official report from the office of the president listing countries with concerns about IP protection. I assume also that the US overall is not innocent in this respect.

https://ustr.gov/sites/default/files/2019_Special_301_Report.pdf

Economics PhDs are irrelevant here. China is a hostile nation threatening the US economically and militarily. IP and Chinese protectionism is only a small part of it.

"I see you agree that tariffs are a blunt instrument.

To my uneducated mind on the subject it is like trying to remove an appendix with a baseball bat."

Ok.

Propose alternatives.

Oh and BTW; I farm (don't use subsidies). We had the BEST year we've had in the last decade just this year because the price of crops were up -- so I'd be extremely weary of any media claiming that farmers are hurting. And Yes; I also vote to end farm subsidies and think other farmers who use them but don't need them are crooked.

Relevant link FYI...

https://www.forbes.com/sites/eriksherman/2019/12/27/trump-china-tariffs-farmers-subsidies/#754beed45b39

Here’s The Crushing Truth About American Farmers Under Trump’s Trade War

Well lets start with "Forbes" first line "Income inequality comes in many forms"............ If that's not a leader for propaganda; I don't know what is...

Digging under the "fake-news" we have

https://hayandforage.com/article-2725-It%E2%80%99s-back-up-the-price-ladder-for-alfalfa.html

You are still free “to decide who to buy from, and who not to buy from”. Nobody is forcing you to do anything.

You don’t understand this concept, do you? Everything is so terrible and unfair.

Haha.

I do understand a few concepts:

Concept #1: Some people are power pigs, and LOVE to exert their power (individually or collectively) over others, for various reasons. Greed, self-righteousness, the love of power itself, and even raw, naked cruelty.

Concept #2: They then love to crow, smirk, and make fun of those who do the unjust suffering.

random insults against elected officials aren’t good arguments for your preferred policies

What? Pointing out to readers, that politicians (among others, such as EISTAU Gree-Vance) are power pigs... Isn't going to help my preferred policy of giving far less power, to far fewer power pigs? How does your logic work? Should I be singing the praises of power pigs, if I (as I do, VERY sincerely!) wish for less power piggishness?

The fact that someone likes power doesn’t automatically make them illiberal our a bad politician.

And you’re not advocating for giving less power to politicians. What you advocate has the consequence of making my life worse and limiting my liberties further. You’re just advocating regulatory capture for your own greedy, selfish, self righteous purposes.

“Because the right economic policy according to you is to buy from Chinese slave labor while forcing productive Americans to pay for unemployed Low skill US workers. That’s free trade Democrat style. The overconsumption and lack of savings in the US are further “benefits”.”

First nobody is forcing you to buy anything. You can easily buy only “ made in USA” products (good luck at the grocery store)

Rather you are promoting a policy in which government has control of the labor market and hence production cost. Trump has clearly stated the goal of “forcing” industry to shift production to US. That is not actually happening. Instead industries are shifting from China to places like Vietnam and India.

Competition drives industry to lower production cost in order to compete in the market by offering the product at a lower price. It is the socialists who want to fix labor costs and prices.

You may as well be complaining about robotic assembly, more efficient packaging to reduce shipping, or any innovation that reduces labor costs.

There used to be a low skilled job as elevator operator. That job went away when elevators improved and you could just push a button, How is that “forcing” you to pay for unemployed labor any more than outsourcing does.

Then I don’t know what overconsumption and lack of savings have to do with it. You want to tell me to buy less and save more because I have too much money by driving up prices? And this has what predictable effect on the labor market?

Fact is we are at near full employment because demand for stuff is high. Consumption is what drives markets and creates jobs. Lower cost more affordable products allow workers to have a better life.

Better explained here:

https://cafehayek.com/

In terms of “slave

^+1

No, but I am forced to pay taxes to deal with the destructive consequences of imports from China. US workers can’t compete with Chinese workers due to US labor regulations and costs.

Bullshit. Consumption destroys wealth. What creates wealth is savings, capital investments, and eliminating debt.

Consumption in the US is even more destructive because it is financed so much by debt, printing money, and redistribution.

Sorry, but that analogy doesn’t work. Robotics etc. increases US worker productivity, thus justifying higher salaries for US workers. Furthermore, robotics is a capital investment in the US that yields a return. Chinese imports do not improve the productivity of US workers and do not represent a capital investments with a return.

It has in my experience. Technology came which allowed each skilled worker to increase production.

So in basic supply demand terms. If productivity per worker capable or willing to do a certain job increases you need fewer workers. That does not mean you need to pay each worker more it means the opposite because you have more willing or capable to do the job.

If you cannot find enough workers to do the job you need to pay more or other trade offs to fill the positions.

None of this is bad. The only problem is when government tries to interfere in the market economy. Politicians have a very different agenda.

Yes, both robotics and Chinese slave labor allow stuff to be produced at lower costs; that way they are the same. We agree. Now address all the ways in which they are not the same.

The other thing.

Importing goods and services is not a capital investment. I agree about that. It is stuff. I buy things at a better price in the market because of trade. This is not new in human history it is as old as recorded history.

All nations and tribes trade. The return might have been frankincense, metals, microchip technology, food, medical drugs, anything. So it has always been.

I can agree about useless taxes to fund nonproductive enterprises such as bailouts or subsidies.

So Echospinner, let's apply your assertions to your world in medicine. How long before IBM's Watson displaces clinicians? I see physicians, outside of surgeons, getting phased out. We will consume more and more healthcare services, but have fewer and fewer physicians. And a lot more semi-skilled ancillary support.

How does your consumption point work here?

I am all for it. Telemedicine is a great innovation. Computer aided diagnosis is another promising tool. More jobs are now done by PAs, Nurse practitioners, nurse midwives (my niece is one) and anesthesia.

Even surgery has telemedicine applications in pre and post operative care and real time subspecialty consultation during procedures along with robotics.

For patients it improves access, reduces wait times, and reduces cost. For many primary care problems you do not even need to leave your house.

I would advise young people today who want to go into medicine to seriously consider nursing rather than the years and debt needed to get an MD. Especially if you get into one of the clinical specialties. It is in high demand, more centered on direct patient care, and increasingly pays well.

I recently had a conversation with an Interventional Card. His attitude was that Watson could never supplant a clinician. I fear he is in for a rude shock. Combine Watson with machine robotics like DaVinci and why do you need a surgeon?

The world of medicine is about to undergo a profound change.

And sometimes trade is against national interest. For example, selling nuclear bombs to the Taliban would be a bad idea. Likewise, borrowing a trillion dollars a year and spending it on Chinese imports is a bad idea.

Currency debasement, sovereign debt, selling vital IP and real estate to communists, and bread and circuses are also a bad idea. That’s what you are advocating, because tariff free trade with China isn’t even remotely similar to what would happen in a free market.

Consumption does drive markets and increase the GDP, but you can have an increasing GDP and still have diminishing purchasing power because of increased cost of living and stagnant wages -- which is what was happening.

No complaining about competition with markets that have different regulatory regimes is not the same as complaining about robotic assembly, because you're not talking about a laissez-faire environment, but one with government interference, but where two markets have two different standards for government interference. "Free trade" doesn't magically create "free markets." And no, you don't want to be competing with an authoritarian government that restricts union organizing and uses the army to fire on labor strikers.

Read the Wealth of Nations, btw. Adam Smith argues the one area where he considers tariffs a good idea is where government policy like taxation or regulation disadvantages an industry, and tariffs are used as an offset measure to reduce the burdens to local industry from government policies. Next, you'll be calling Adam Smith a socialist.

“Pussy grabbing” requires no stolen loot.

Please investigate how much pussy grabbing the homeless guy under the bridge gets to do, when he makes $5 per day by panhandling, v/s how much pussy-grabbing can be done by the bank robber who just got away with stealing $54 million, and get back to us.

FFS, a trade war is not protectionism. Among many differences, the trade war is with a specific country, China, only.

Next thing you’re going to tell us that a regular war is not good tourism, or that a hunger strike is a bad diet plan.

The other part is China is a well-guarded in its protectionism as well.

The U.S. economy is much more open than China.

In a trade war, I like America's odds in the long run.

Now, of course, the adventure Mr. Trump has launched was always going to be long term and looking at it in this short of a lens is foolish. Alternatively, the president frequently sold this as an instant benefit likely both for political value (if you like your doctor you can keep them, weapons of mass destruction etc) and because he isn't as bright about the difficulty of things in the government/foreign relations sphere.

But if the esteemed writer thinks an 18 month evaluation of a long term policy shift attempting to restructure international trade with China focused on one industry in particular is relevant or proves some point about whether or not the tariffs on China are succeeding or will succeed then he is dumber than Trump and also simply trying to score whatever meager political points he can from bleating to the choir.

The whole premise of this article is infantile as to what the evidence provided shows in reference to the policy attacked based on the evidence. Putting aside the fact that China is actually only at the table for tariffs and already bargaining away at least some of their privileged position to stop increases in tariffs shows they are working at some level to get China to negotiate lowering overall trade restrictions between the two most powerful economies on the planet today.

The article only has a point at all, if and only if, it tears down a strawman that tariffs on China were supposed to produce only benefits and no costs to the domestic manufacturing sector in both the short and long term. That has NEVER been the argument by any reasonable person defending the President's position and this is an academic exercise. I think anyone would concede that the President's public articulations are inartful and politically motivated to maintain support for a undeniably successful leverage point to motivate China to discuss these issues at all.

So if the strawman burning is the only point or the other point of the article is that there are short term costs to the tariff policy of the President then bravo to the writer. But this is entirely irrelevant to debating in good faith about what the strategy is for using tariffs as a means of bringing China economic practices in line with the interests of the United States.