Pelosi Rejects Plan to Cut Spending by Less Than 0.3 Percent

The federal government will spend $57 trillion over the next 10 years and run an $11 trillion deficit. But cutting spending by $150 billion is too much to ask?

Speaker of the House Nancy Pelosi (D–Calif.) rejected a White House offer on Friday to cut $150 billion in federal spending over 10 years as a part of a possible deal to raise the debt ceiling.

Now, $150 billion might sound like a large amount of money. But relative to how much money the federal government is set to spend over the next 10 years, the White House's proposed cut is roughly equivalent to deciding you'll eat one fewer Chipotle burrito per month for the next decade. That's not going to pay off a maxed-out credit card.

The fact that Pelosi rejected such a comically small reduction without even giving her colleagues the chance to consider it tells you all you need to know about the state of fiscal responsibility in Washington right now.

Bloomberg reports that the White House provided House leaders with roughly $500 billion in possible budgetary offsets on Thursday night, asking that the Pelosi find $150 billion in cuts that her members would support. Both sides are continuing to negotiate in advance of a planned vote on raising budget caps and the debt limit next week. The Treasury has been using so-called "extraordinary measures" to deal with the debt limit since March, when the U.S. surpassed the current limit of $22 trillion.

It's possible that spending cuts will be part of whatever final deal is reached, but it's still worth stressing just how absurd a negotiating position Pelosi is taking here—if she does indeed stick to saying that $150 billion is too steep a cut.

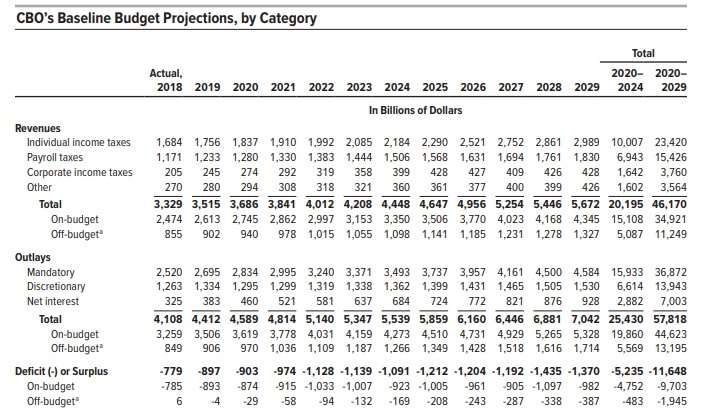

The Congressional Budget Office (CBO) projects that the federal government will spend more than $57 trillion over the next decade. A $150 billion cut amounts to less than 0.3 percent of all spending during that time. In the context of a $50,000 annual household budget, that's like cutting about $150 per year—the cost of a single lunch each month.

That's hardly enough to get the federal government out from under $22 trillion in debt. The CBO projects that if current policies stay in place, the government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, breaking a record set during World War II. If a recession hits, those numbers could be worse.

"It's hard to believe there is resistance to finding just $150 billion of offsets over the next decade," comments Maya MacGuineas, president of the Committee for a Responsible Federal Budget. "If Congressional leaders don't like the options suggested by the administration, they should propose alternatives and additions."

MacGuineas points out that $150 billion isn't enough to cover the expected cost of raising the budget caps—meaning that whatever Congress passes next week is almost guaranteed to add to the deficit.

Not that Congress seems to care. There's no political appetite for cutting spending or balancing the budget right now. That's true for both Democrats and Republicans. The latter have finally started admitting publicly that they don't care about deficits anymore, while the former are increasingly pushing for new entitlements that will only make existing budgetary problems worse.

But if Congress and the White House can't agree to cut a relative pittance, there's practically no hope that our elected officials will meaningfully address the debt crisis barrelling our way.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

There's going to be a painful reckoning. I'm not looking forward to it.

Nothing left to cut!

Maybe the Republicans should have thought about this $150B cut before they gave corporations and the mega-wealthy a tax cut of $1 TRILLION last year.

Cut spending to the bone.

Wow I didn't know I was mega-wealthy

Neither did I. Stop trying to steal our money Kate.

Your money?!? Its the government's.

When someone comes into my house and tries to stop teal my money it tends to go poorly for them. We should react similarly when the progtards do it too.

More from the Libertarians for Confiscatory Tax Punishment, You Didn't Build That, The Governement Owns Everything and Gves to You crowd

"they gave"

Snort!

Haha!

You had me up to the cutting spending part.

Fuck you, that’s my money I worked my ass off for it.

Spoken like a true authoritarian. letting people keep their own money is really just government spending. How benevolent of them. Fuck off.

Haha. You’re starting on the wrong side of possession. Taking less is not giving anything. We all pay for bloated, wasteful government. It is not a gift to pay less.

Unless you really believe that all money belongs to government and we’re damn lucky they let us keep anything at all.

So much grievance and resentment. Sad.

Kate, you DO understand that our corporate income tax rate is the now the same as Sweden's, and we all know the Swedes are the smartest, most sensitive caring people on earth. The Corporate Income tax cut is the primary reason so much capital was repatriated to the US and why unemployment is at a record low for my entire lifetime (72 years). Kate, do you think our government does not spend enough money?

Might I perhaps humbly suggest that we eliminate the mere few tens of billions of dollars that we spend on punishing people for blowing on cheap plastic flutes w/o proper permission? I know it's not much, but, if those horrible flute-blowing criminals were de-criminalized, SOME of them might become hard-working, tax-paying, productive citizens, instead of being money-sucking jailbirds!

To find precise details on what NOT to do, to avoid the flute police, please see http://www.churchofsqrls.com/DONT_DO_THIS/ … This has been a pubic service, courtesy of the Church of SQRLS!

Hilarious!

Except... if you don't comply with their law they shoot you. Is martyrdom part of the church or SQRLS catechism?

Haha. Martyrdom is at the heart of an entire ideology.

If the voters do not punish legislators for overspending, and do punish them for trying to rein in spending then nothing will change until it has to on reckoning day.

And remember, the Tea Party is now white supremacist to the Left and dolts who Did Not Know How Politics Works to even the NeverTrump leaning GOP intelligentsia.

Well, as long as we have the resentful loser half of the population screaming “they should get even more!” (of other people’s money) there will never be an incentive for government to be responsible, much less shrink. Sad.

Why am I not surprised? The Senate, the House, the Presidency, are all out of their freaking minds, and have been, totally so, for. basically, the last 18 years.

Same-same...but different.

That crazy president!

https://thehill.com/policy/finance/411860-trump-to-request-5-percent-cut-from-cabinet-members

These 10-year CBO predictions are fantasy, so I'm not sure making cuts to the fantasy really means much.

"If Congressional leaders don't like the options suggested by the administration, they should propose alternatives and additions."

The administration proposed these cuts?

Yeah, I'm a bit aghast at this notion too.

Is that because you're willfully ignorant?

50 bucks says that Mulvaney proposed the cuts and Trump is completely unaware.

Funny, one of the other articles I was commenting on today, the progtards and anarchists all claimed Trump was trying to raise spending. And it was all his fault there were no cuts.

Was about to just say... not even 2 days ago reason pushed an article blaming the president and conservatives for deficits without mentioning congress at all.

Orange Man Bad!

Goodness, there are already millions of bodies rotting in our streets due to the wickedness of Trump and the GOP. How many more bodies do you want to add to the pile if Federal spending is slashed by $15 billion per year?

Yeah, like what if the money comes out of the cage-building budget?

the White House's proposed cut is roughly equivalent to deciding you'll eat one fewer Chipotle burrito per month for the next decade.

How will I lose weight and save money on solid food without the violent diarrhea every month?

Now I want chipotle.

"The federal government will spend $57 trillion over the next 10 years"

Is that all? Honestly that seems low. I mean, the government owes tens of trillions just in reparations for slavery.

#LibertariansForReparations

Your right, when you tack on unfunded mandates, the numbers is about 10x that figure. You want to pay off Great great great great grandchildren, some of whom may have actually been descended from slaves, some of which happened to have been slave owners themselves, some both, thats fine.

...I have a solid base of crypto currency when your ideas crash the world economy.

57 trillion? that's barely enough to stop global warming.

The finances, spending and cuts to spending are constitutionally the sole responsibility of the house of representatives. Period.

And oh by the way, notice the revenue side of that chart. (2020-2024)

16,950 billion from individuals 84%

1,642 billion from corporations 8%

1,602 billion from 'other' 8%

('other' ? what is left after individuals and corps?)

User fees and assets sales?

It is in fact fees. The hidden tax that doesnt require congress.

Nancy Pelosi is a shit-weasel, but whoever replaces her will be an ebola carrying shit-weasel on a crusade to infect their world with his or her shit-weasel disease. The shit-weasel is dead. Long live the shit-weasel!

Why do we need to raise the debt limit?

Furlough a bunch of Democrats who work for the feds. And blame Pelosi.

This isn’t hard.

Sadly, until we crash, and at this point crash hard, this will not change.

Don't blame me, I voted for Gary Johnson. Trump spends like Democrats on a bender.

Ignorant? Trump has actually directed the executive to spend less dummy.

I don't get a sense of what Speaker Pelosi's position is here and I will assume it is a long standing opposition to anything other than a clean bill to raise the debt limit. If that is the case I will support her position. Congress has a process to cut spending, it is the budgeting process. I have seen this before attempts to address budgets in non-budget bills or address non-budget items in budget bills. It is a recipe for complicating the legislative process that should be avoided.

How cute. You confuse budgets with appropriation.

Bah humbug! This must be fake news!

After all, the respected Reason Magazine just published an article saying "Republicans are THE party of the trillion dollar deficits." So it must be the Republicans' fault!

Poor Pelosi is probably being threatened by Trump's black-clad thugs to do this!

Maybe she's upset he won't grab her by the pussy?

[…] rejected that idea out of hand. Instead, The Washington Post reports, a new deal is approaching […]

[…] rejected that idea out of hand. Instead, The Washington Post reports, a new deal is approaching […]

[…] rejected that idea out of hand. Instead, The Washington Post reports, a new deal is approaching […]

Remember folks, Democrats are on the 'right side of history'.

Didn't they also refuse emergency funding for sick 'kids in cages' on the border?

[…] in budget cuts—only $7.5 billion per year, less than 0.2 percent of all federal spending, and only half of what the White House originally […]

[…] in budget cuts—only $7.5 billion per year, less than 0.2 percent of all federal spending, and only half of what the White House originally […]

[…] Pelosi Rejects Plan to Cut Spending by Less Than 0.3 Percent […]

[…] Pelosi Rejects Plan to Cut Spending by Less Than 0.3 Percent […]

[…] rejected that idea out of hand. Instead, The Washington Post reports, a new deal is approaching […]

[…] soared past $22 trillion. The Congressional Budget Office estimates that current policies will add another $11 trillion by the end of […]