California's 6-Figure Pension Club Has Doubled in Size Since 2012

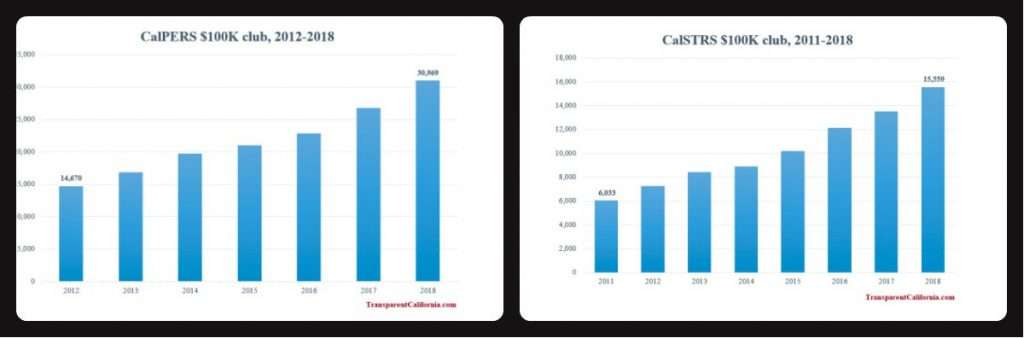

Last year, CalPERS issued 30,969 pensions checks worth $100,000 or more on an annualized basis—up from about 14,600 six-figure payouts in 2012.

Twenty years ago, California's pension system was riding high.

Investment earnings had averaged more than 10 percent annually for a decade, and most of the funds within the California Public Employees Retirement System (CalPERS) were running a surplus—meaning the funds had more than 100 percent of the assets needed to meet the projected liabilities as current workers retired. Lulled into a false sense of retirement security, state policymakers made the fateful decision to pass a law boosting pension payouts to public employees.

Supposedly, it would all be paid for by the ongoing, never-ending boom of the stock market. In an analysis provided to the state legislature at the time, CalPERS promised the new pension law would not cost "a dime of additional taxpayer money." A separate analysis conducted by the legislature itself found that taxpayers' contributions to the CalPERS system would "remain below the 1998-99 fiscal year ($766 million) for at least the next decade." said the Assembly floor analysis of SB 400.

The funny thing about pension systems, though, is that the liabilities created today—that is, the promises made to current workers—don't really become a problem for a few decades, until those workers retire.

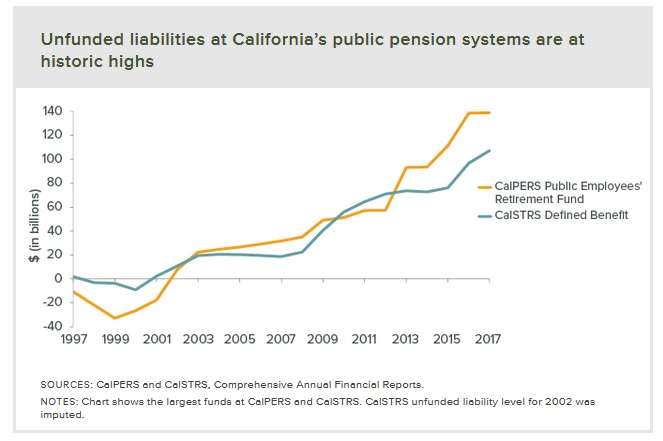

Which is why, in California's case, looking just 10 years into the future proved to be woefully myopic. Two decades later, the surplus is long gone and CalPERS is facing a $138 billion shortfall (that's according to the system's own rather sunny accounting; the actual total is likely higher).

But those higher pensions promised in 1999 must still be paid—and as a result, the number of retired California public employees getting six-figure annual pensions has doubled in just six years.

According to newly released data from Transparent California, a project of the Nevada Policy Research Institute, a free market think tank, the CalPERS system issued 30,969 pensions checks in 2018 that were worth $100,000 or more on an annualized basis—up from about 14,600 six-figure payouts in 2012. Of the $23 billion in pension benefits paid out by the CalPERS system last year, 17 percent went to the members of the state's six-figure pension club.

California's teacher pension system—the California State Teachers' Retirement System (CalSTRS)—has seen a similarly sharp increase in six-figure pensions as teachers affected by the 1999 pension boost legislation have started heading into retirement. In 2018, CalSTRS handed out 15,559 pension checks worth $100,000 or more, up from just 6,033 six-figure pensions in 2011, according to Transparent California's data.

Because of how public pension systems work, the new liabilities created by that 1999 pension boost will be haunting California's state, local, and school budgets for decades to come. In fact, the worst has yet to arrive. According to a 2017 report from the Stanford Institute for Economic Policy Research, the state will have to spend $19 billion on the CalPERS and CalSTRS pension plans in 2030—up from about $9 billion this year. Those increasing costs, the Stanford report says, cannot be covered without significant cuts to existing government programs.

Because some education spending is fixed under California's Prop 98 rules and public safety funding cannot be cut under other state rules, the state will likely have to slash spending on pretty much everything else—parks, social programs, housing subsidies—so it can continue cutting six-figure checks to a few thousand of its 40 million residents.

Contra what CalPERS said two decades ago, paying for all those lush retirement benefits is going to cost Californians a whole lot of dimes.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

“ Supposedly, it would all be paid for by the ongoing, never-ending boom of the stock market.”

These people really need to figure out whether they hate corporations or not.

bravo. comment of the day!

They can and will cut Social Security to pay for govt employee pensions. They can and will tax 401Ks to pay for them.

Anyone who claims we are the government and the government is us is blind.

They won't "cut" social security, they'll just allow the pensioners to receive social security payments to cover the shortfalls in their pensions

"In an analysis provided to the state legislature at the time, CalPERS promised the new pension law would not cost "a dime of additional taxpayer money.""

"But those higher pensions promised in 1999 must still be paid—"

It would appear that not all promises are equal.

Those numbers are absolutely eye-popping. Calexit can't come soon enough.

The progtards are welcome to GTFO of America anytime. They do not get to keep that real estate. Not one fucking square inch. It stays with the US.

I’d they don’t like that, then they are welcome to choke our rivers with their dead.

It would be nice if they'd all just move to Canada/Europe etc... But honestly, I'd cut loose the whole west coast in a heartbeat to be rid of these assholes. Even if a violent civil war comes along we'll just end up kicking their asses and being stuck with the 97.5% of them that don't get shot during the conflict. Secession is the far better solution.

Why shouldn't these state workers get more money?

After all, its not their money the idiots in Sacramento are spending.

Shiiiiit, I wish my grandmas Calpers payment was in the 6 figures! I'd be hitting her up for way better birthday gifts. But she just had a shitty clerical job 🙁

[…] …According to newly released data from Transparent California, a project of the Nevada Policy Research Institute, a free market think tank, the CalPERS system issued 30,969 pensions checks in 2018 that were worth $100,000 or more on an annualized basis—up from about 14,600 six-figure payouts in 2012. Of the $23 billion in pension benefits paid out by the CalPERS system last year, 17 percent went to the members of the state’s six-figure pension club. Read More > at Reason […]

I have a couple of questions about how these paychecks were counted. First, "pensions checks worth $100,000 or more on an annualized basis" would mean any check over $8,333, assuming pensions are paid monthly. If they are counting the checks instead of the pensioners, that says each person receiving six figures annually is counted 12 times, and there are actually just some 2,500 recipients of these large pensions. Assuming the pension is half the pay, that's 2,500 retirees who once earned $200,000 year. In private industry, that's low pay for anyone managing a few thousand employees, and it does not sound unreasonable to me that between all the different government units and police departments, there are about 2,500 retired city managers, heads of governmental departments, and chiefs of police who fit that description.

Second, many of those big paychecks may not reflect a large annualized pension amount at all. Many government employees can retire at a fairly early age from a government job, with their pensions vested, and then go back to work for the government in the same or a different job. (Sometimes that's another extra benefit of government work, and sometimes it is recognizing the reality that old men should not be working as cops, firefighters, or soldiers, so in at least these careers it is often necessary to retire before one is ready to quit working entirely. And in private industry, I am planning to receive Social Security while I keep on working for ten to twenty more years.) But as I understand it, CA is special in how it handles those who are entitled to both a pension and a paycheck from government(s): it holds the pension until they retire again, and then pay all those years out in one lump sum. So the guy that earned a $30,000 pension and then worked ten years gets ONE $300,000 pension check, but that's not his regular pension.

So, did they count the lump sum payments? And where there is a large regular pension, are they counting the recipients or the checks?