Trump's Tariffs Will Cost More Than Obamacare's Taxes

If Trump presses ahead with plans to tax all Chinese imports, the added costs would cancel out the economic benefits of last year's corporate tax cut.

We're not there yet, but President Donald Trump's escalating trade war with China is threatening to completely cancel out the economic benefits of last year's tax cuts—cuts that the president and his supporters have often credited for the growing economy.

Put another way, the potential costs of Trump's trade war could be even more difficult for the president to swallow. The import taxes imposed by the Trump administration will end up being a larger burden for the economy next year than all the taxes associated with the Affordable Care Act—a law that Trump has often described as "a disaster" for Americans.

While Trump has described tariffs as being "the greatest" and promised that his bellicose trade policies will ultimately benefit American workers and the economy, these two new assessments of the costs of those policies should raise questions among Republicans, who largely favored the tax cuts and opposed the new taxes created by Obamacare.

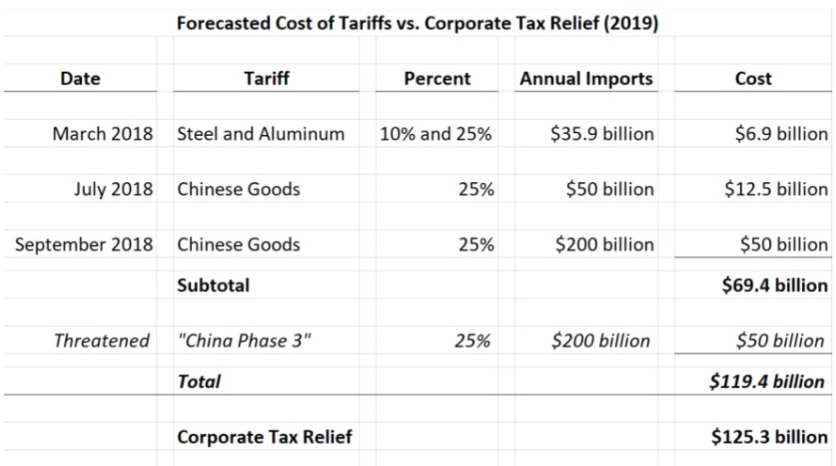

And both assessments come at a pivotal moment in the trade war. On Monday, Trump announced a new round of tariffs targeting $200 billion in Chinese imports, on top of about $50 billion in goods already subject to tariffs. It is a clear escalation of the trade war, and Trump has already signaled a willingness to go further. "If China takes additional retaliatory action, which is almost certain, we will immediately pursue phase three," the White House said in a statement, "which is tariffs on approximately $267 billion of additional imports."

China has already announced plans to retaliate.

We're probably at least several months away from all that coming to pass. The new tariffs announced this week will take effect on September 24, ramping up from 10 percent to 25 percent after the holiday season passes. (The timing seems like a deliberate attempt to shield American shoppers from some of the consequences of the trade war during retailers' most wonderful time of the year.) Any additional trade barriers are likely to remain only threats until after that.

For now, the economy continues to grow—at greater than 4 percent in the last quarter, as Trump likes to remind people. Last year's tax cuts, which reduced the corporate income tax rate from 35 percent to 21 percent, are widely credited with adding significant fuel to the economy's fire. Estimates of the value of those tax cuts vary, but the Joint Committee on Taxation pegs the corporate tax cuts as saving American businesses $125 billion annually.

Those gains could be at risk, if the trade war continues on the course Trump has threatened. Here's how Max Gulker, an economist with the American Institute for Economic Research, breaks it down:

"Tariffs already on the books that will likely hit corporations first have cut into this relief by over half," Gulker writes. "Add on the extra phase of tariffs threatened this week, and corporations can essentially wave goodbye to their 14 percentage-point tax cut."

Of course, these numbers look only at the aggregate. Individual businesses might see greater savings from the tax cuts than what will be lost in higher costs from tariffs, or vice versa. But this analysis makes clear what everyone outside the White House seems to know: Tariffs are taxes too, and higher taxes create a drag on economic growth.

That's part of the reason why economists have been warning the White House for weeks against a further escalation of the trade war. The Federal Reserve says more tariffs will create a "consequential downside risk" for the American economy, and none of the 100 economists polled by Reuters last month said the president's trade policies will benefit the economy in the long-term.

The comparison to Obamacare's taxes is also an unflattering one for Trump.

A new report from the National Taxpayers Union Foundation, a fiscally conservative nonprofit, highlights this comparison. During the effort to repeal and replace Obamacare in 2017, the Congressional Budget Office projected that Obamacare's myriad taxes—not including the individual and employer mandates—would cost $67.2 billion in 2019 and $609 billion over 10 years.

Trump's tariffs targeting steel, aluminum, washing machines, and solar panels will soak the economy for more than $9 billion in new taxes over a full year, according to NTUF's analysis. Tariffs against Chinese-made goods had already totaled about $12.5 billion annually, and the new round of Chinese tariffs announced this week will cost Americans another $50 billion over a full year.

Do the math. Trump's tariffs are more costly than Obamacare's taxes.

What remains to be seen is whether Trump's signature policy and its associated tax increases will generate the same sort of political backlash as President Obama's signature policy and its associated tax increases. Writing in Bloomberg View, Tyler Cowen makes a compelling argument that Trump's trade taxes are sufficiently hidden inside the prices of so many goods that voters won't make the connection between higher prices and the man in the White House.

"It can be said that the new Trump policy makes the high prices salient, but the underlying tariffs not very salient at all," writes Cowen, a professor of economics at George Mason University. "This is the worst possible scenario. The higher prices will reduce consumption and output, yet the invisibility of the tariffs will limit voter pushback."

Many of Obamacare's taxes were also less direct than property taxes or gasoline taxes—examples of taxes with high degrees of political salience, in Cowen's view—and Republicans had little difficulty finding reasons to object to them. If conservative voters don't rebel against Trump's tariffs, then, it probably has more to do with who is taxing them than with how much they are being asked to pay.

The great irony here is Trump continues to flog the benefits of the tax cuts—on Wednesday morning he tweeted again about the economy's growth spurt under his watch—as proof that his economic policy is working, while he's simultaneously escalating a trade war that could very well eliminate those gains.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

But Trump's intentions are better than Obama's!!

Plus he promised us a wall! And jet-packs!

the wall is being built in AZ as we rfgvvTERHTEHEGERTGERT to each other..

Jesus. Tariffs are not taxes. They are a negotiating tool. Don't you fake libertarians know anything?

Mandates are taxes! Taxes are negotiating tools. Our betters built this new world. We just get to live under it, like Atlas.

Is a government taking money from you? That's a tax.

Tariffs are taxes.

Fines are taxes.

Taxes are taxes.

Is the government taking the money from overseas?

Then it's not a tax.

Is Overseas taking money from us? Then that IS a tax.

And yes, China will fold.

The tariffs are paid by us. Tariffs most certainly are taxes.

No, they are taking the money from the people who buy the goods. Seriously, if you can't even understand the most basic aspect of tariffs -- which, clearly, you cannot -- then please shut the fuck up

tar?iff

?ter?f/

noun

1. a tax or duty to be paid on a particular class of imports or exports.

The comments to these "Trump is a big meanie on trade" articles are pretty much a retard circle jerk with a few rational observations by you, me, and a few others.

What I get out of all the snarky babbling is that tariffs are just fine, as long as they are unilaterally leveled at the US. And we dare do nothing about it, or we may anger them further. And apparenty, Trump is a big poopy head.

He isn't a big meanie on trade. He is a big fucking idiot on trade. There's a difference.

Really depends on whether we win and get improved, less restrictive trade deals. Either we will or we won't. According to every analysis I've heard, we ultimately hold all the cards since Europe and China need us ore am we need them. So Trumo is likely to get results.

So we will have to wait and see. But you're free to not like him all you want either way.

I stole this from the Internet:

Negotiate Anything

Don't be afraid to ask for what you want. ...

Shut up and listen. ...

Do your homework. ...

Always be willing to walk away. ...

Don't be in a hurry. ...

Aim high and expect the best outcome. ...

Focus on the other side's pressure, not yours. ...

Show the other person how their needs will be met.

Don't give anything away without getting something in return

Don't take the issues or the other person's behavior personally.

Good tips.

I do a double walk out on vehicles all the time.

I typically get the salesman begging to sell the car on Dec 31.

You can get some good deals if you are flexible and have money to buy the week after Christmas.

Tariffs are worse than taxes. At least there is some badly depreciated, inefficient 'benefit' associated with taxes. Tariffs are an unforced error, moving everyone one inch more toward macro-poverty.

Here's the math. Trump tariffs have already cost $500 to every household in America. And he threatens to double that

The latest round is a 10% tariff on $200 billion = $20 billion .

Divide that by 122 million households = $160 tax increase for every household in America.

But it jumps to 25% next year, so 250% of $160 = $400 for every household.in America.

We already have a 25% tariff on $50 billion. That's 1/4 the recent one. So add 25%, he's already at $500 for every household,. He threatens tariffs on ANOTHER $250 billion of Chinese goods, which would double that to = $1,000 per household. Every household in America.

This is Bastiat's broken window fallacy, famously used by liberals. Show the steel jobs, and ignore the consumer prices. Trump's blue-collar base is taking the worst hit.. He'll blame Hillary's email server. (lol)

Trump is not draining the swamp; he's pumping more shit into it!. Trump has already added more new 8-year debt in less than two years, than Obama added in eight years. (current forecast vs Obama actual)

He campaigned on paying off the entire debt in 8 years. Instead of $0 by then, he's taken us near $35 Trillion,.

Trump was Democrat most of his life. Now we know what a Republican New Deal looks like ... If we just keep looking only where he tells us to ... will his base keeps chugging the Kool-Aid.?

will his base keeps chugging the Kool-Aid.?

Of course! That is what political cults do. Just like how Obama's base, who were supposedly drawn to him because of his opposition to Bush's wars, had no problem with his drone strikes or sending troops to Lybia.

More horseshit from Reason. Obamacare almost destroyed the private medical insurance industry.

Those losses are incalculable. They also never count all the taxpayer money that goes to insurance companies to in bailouts each. These bailouts dont include subsidies paid to cover low income recipients.

Look, tariff policy is exactly the same as nationalization and making it an individual right to the fruits of other people's labor. Exactly the same!

Doesn't mean I'm in favor of tariffs, it mean's it's a shitty argument.

"Tariffs already on the books that will likely hit corporations first have cut into this relief by over half,"

That's a weird way to say that people and corporations are still getting a tax cut, even after the tariffs. Oh, my! *clutches pearls*

Absolutely- Reason is slowly shifting left of center...

Sooo? who is your hero?

I'm not a cult member, but I support this negotiation. Even Trump knows that free trade is good for America- but there is no reason to not look at your trading partner in the eye and say," I want the same deal I've been giving you."

+1

Wasn't it Bastiat who said that instead of doing tariffs we might be more efficient and simply destroy the rail lines used to transfer the goods?

Sounds like him. Even if Mendacious Tony made it up, good one!

Does this account for massive increases in insurance premiums that were a direct result of the act to lower insurance costs?

If only your gullibility could be exploited for good instead of evil.

Nah, I'm not one of the suckers who bought the exchange policies with inflated premiums and deductibles that were touted as "affordable."

A guy I know was sidelined by cancer, and now he's wondering if he should go back to work. Disability isn't enough to pay the bills, but it pays the health insurance. If he works he doesn't have enough money left over to pay the bills after paying for health insurance. He's screwed either way.

Something a risk pool would be totally inequipped to deal with, single payer it is then. We can all die sooner.

He should have paid into a catastrophic health insurance plan.

Then when he got cancer, the insurance paid much of it.

Lefties hate these plans because they want medicare/ObamaCare/etc.

He's cancer free, but isn't sure if he wants to go back to work.

Thing is, it's all catastrophic health insurance now. And it still costs what it costed before.

In his case $1400 a month if he works, with a $4000 deductible and $10000 max out of pocket per year. So he doesn't have enough left over to pay the bills.

If he doesn't work then medical is covered, but disability isn't enough to cover the bills.

No matter what he can't pay the bills.

Bummer. Plus, he had cancer as a pre-existing illness, so his rates will be super high.

Lesson to young people, get catastrophic health insurance when rates are low for you and keep it for 50+ years.

Lesson to people- idiots/sadists like lovecon care for you not and if you get some random disease through no fault of your own then you can just go screw yourself and die.

Socialists like wearingit spread the propaganda as more and more Americans are calling that propaganda bullshit.

Is it better to be penniless and alive, or rich and dead one might ask.

The thing about healthcare is that after people get it, they never want to pay for it and you can't repossess it.

In terms of insurance, your friend is going to have higher prices in the future (or should) because after you've had cancer you're almost certainly going to have it again. As an insurance company, that's a bad investment.

If people want to reform insurance, the best solution is to make insurance illegal not expand it to a human right.

Work under the table. That's what this kind of system does to people. I ended up losing my private policy thanks to Obama, that cost me $247 per mo. In 2013. If I buy their platinum plan, which is inferior in al ost every way to the mediocre Assurant policy I used to have, it will cost me around $800 per month. Fuck that. So no health coverage for me. Fortunately I'm still relatively young and healthy.

This is one of the many reasons I have no problem bringing pain and horror to all the progtards who voted in the faggots who passed that legislation. They deserve all the suffering and death due them for what they have done to this country.

Any accounting of costs relating to Obamacare are bold face lies.

ObamaCare caused:

-incalculable losses to health insurance systems

-bailouts of insurance companies

-subsidies for low income people

-increased premiums for Americans

-costs associated with creating, passing, fighting in court, and partially repealing the unconstitutional law

You forgot about all the costs to healthcare providers trying to meet ambiguous government mandates like so-called "meaningful use" requirements.

It also caused incalculable suffering to people like my father who couldn't get an epidural shot for his back in a timely manner. The pain forced him into an exceptionally sedentary regimen that nearly ended up killing him.

That's what happens when the turnaround for that sort of treatment changes from five weeks to twenty months.

Just another reason progtards should be made to suffer and pay for what they have done.

Tariffs ARE taxes.

And so it the minimum wage.

"None of the 100 economists polled by Reuters last month said the president's trade policies will benefit the economy in the long-term."

tHe sCIEncE iS SetTLEd

I love it when social scientists (economists) make predictions as if they were describing the trajectory of a rocket.

Excuse me if I don't care to get bent out of shape over the opinions of a bunch of dweebs with physics envy.

Re: phandal,

That's not what they're doing. Economic Science is based on a strict logical aprioristic epistemology which does provide testable predictions and one prediction that is testable and has provided time and again the same result is that tariffs do NOT translate to an overall increase in wealth but results in forced wealth TRANSFERS from consumers to the state and its preferred cronies.

What he said, minus the six bit words. Economics is not anywhere close to the kind of social pseudo-sciences like political science, sociology, psychiatry, psychology, gender dynamics, and all that other pablum. It may not be a hard science like physics or chemistry, but it does make testable predictions which have been confirmed over and over.

There are also two main branches of economics. One is the crap which classifies money in a zillion different categories, fusses with decimal points and interest rate calculations, and otherwise has some basis in reality but has been finessed to a faretheewell and has little practical meaning. The other deals with big picture things like supply and demand, tariffs, incentives, and other topics where calculus has little bearing. If you want to learn more about that, especially incentives and how to think like an (incentives minded) economist, you could do worse than read Freakonomics.

(meant for phandaal)

...it does make testable predictions which have been confirmed over and over.

Hmm...you are aware that economics is basically just applied mass psychology, yes? It's bizarre you say it's 'not like psychology' when it literally is. In fact, it claims to be predictive psychology.

Who the fuck buys things, and who the fuck sells things? Surprise, it's people!

I believe economics is a hard science like chemistry and physics. Even in those fields, the ease and success of research depends on the subfield. Take climate...hey, let's inject x ppm of CO2 into the global climate, control global temperature and humidity to y and z, micromanage the sun's rays, and see what happens in two years. Poorly understood sciences are, by definition, poorly controlled ones. In such cases, and this is precisely why I didn't choose this sort of field, one must rely on intelligent and unbiased data-mining. In economics and climate, we have precious little of this, particularly if Nobel prizes are any indication.

I agree in most cases. Here is a question. How high could a trading country raise tariffs on its products before you would impose a tariff? How many new steel jobs are there. What is the gross economic impact of tariffs on the steel industry alone? They are building new mills, roads, increasing production at mines. Trucks are hauling and the steel makers are spending money, paying ta.xes They are no longer using food stamps

It's hard to take anyone seriously when they assert that 100% of all tariffs are always 100% passed on to the consumer, no ifs, ands, or buts.

They're not a tax on citizens. They're a tax on foreign companies that, like every other tax on a company, gets passed on to the consumers as much as possible.

If tariffs are a tax on the people, then so too are any taxes on any business. Funny that the people who are so against these tariffs were also against the reduction in the corporate tax rates (and in fact think they're too low).

Please, continue to tell us how totally against taxes you are.

Tariffs are a tax on all imported products and services. Tariff costs can be distributed among all company products and services or tacked onto only imports.

Some one pays for them.

But don't be na?ve- we have the economic leverage to force them to give us the same deal- which is rightfully ours. If you never have the courage to walk away from a deal, then you will always be a loser.

Yup. There is a new trade offer out there. American trading partners can take or leave it or make a better offer.

Of course someone pays for them. My issue is in the false claim that they are 100% passed on directly to the consumer.

"It's hard to take anyone seriously when they assert that 100% of all tariffs are always 100% passed on to the consumer, no ifs, ands, or buts."

Tariffs are not 100% passed along because goods are fungible. If China was the lowest producer of product X by 5% and you put a 10% tariff on the good, the price will Not go up by 10%. Sadly enough Paul Krugman of all people wrote a NYT's article pointing out that the likely effect of this Trade War is likely to be negligible.

Yes, yes. All of what has been said.

But isn't the idea of these tariffs to get China and Europe to play fair? Unilateral free trade is not free trade.

Once China and Europe make the desired changes toward a more level playing field, Trump will cancel these tariffs...they're not about making money, they're about punishing the bad behavior of the other players.

Exactly- people crying about this have never negotiated business transactions.

Which is most of the commentariat. When you're doing business with weasels, you often have to apply duress to get the needed leverage to get those weasels to knock off the bullshit.

"If Trump presses ahead with plans to tax all Chinese imports, the added costs would cancel out the economic benefits of last year's corporate tax cut."

As stated, you get two thumbs up from me.

I'd much rather have import taxes than corporate taxes.

The winning continues.

"Trump's Tariffs Will Cost More Than Obamacare's Taxes"

Depends on what you are calling the Obama Care taxes.

I consider the 300%+ increase in my premiums in less than 10 years mostly due to ACA.

Trump leveling the tariff playing field is not going to cost me thousands of dollars per year more like ACA does.

Then go live in a country that he hasn't hit yet..

Why would we analyze this in aggregate? We didn't do that for the SALT deduction cap, which is a clear-cut tax increase when viewed from that perspective.

What we have now is piecemeal free trade that exposes some people to foreign competition while protecting others. The former group has the indignity of being paid in competitive (and low) global wages and billed for professional services at an uncompetitive domestic rate.

The people who really benefit from a low-wage, low-price economy are rent-seekers, welfare recipients, career swindlers and sugar babies. It's a wash for a lot of other people.

If we use a results-oriented analysis (as with the SALT cap), well-chosen tariffs could be a groin kick to some of the worst leeches in the economy. And like Janus, they could kill the funding stream that supports the regulatory apparatus that feeds the leeches.

The incredible point that escapes the free-market traders, of whom I am an ardent supporter, is: this is negotiation, not ideology. There is no reason why the trading partner should NOT extend the same policy towards our exporters- and we should not blink first. We will get that concession if we are steadfast in our position.

$125 billion or so may seem like a lot of money, but its chump change compared with avoiding the foolish waste of $125 trillion (worldwide) on foolish decarbonization expenses.

Devil in details. soetoro's health care tax hikes, and all in higher individual and family health care costs, go on until it's repealed. The all in obam?a?care costs (tax, higher premiums, higher deductibles etc) are much higher than $67.2 billion annually. It will likely take a lot more time to repeal obamacare than amending or withdrawing a tariff. Time will tell.

Wow, who the hell do you get to run the numbers. Even a 12 year old can see through this crap. First off, not having tariffs just because those that abuse you in trade will then have them is like saying you shouldn't stand up to a bully cuz he fight back against your fight back. What a joke. Besides, those taxes are not directly passed on and you know it. With higher prices, comes competition, and more will look for alternatives to the now more expensive, less quality Chinese goods. You are right in that it has an affect, even a negative one, but shoveling bullshit to make your point actually loses most people who freely think.

+1, Trump's tariffs may well hurt, but comparing what's most likely a temporary tariff of no more than 2 to 3 more years against Obamacare taxes which are largely permanent, is transparently stupid.

Furthermore, a tariff of 10% does not automatically raise the price 10%. It's the upper bound of the new limit. More than likely many of the goods that are hit with a tariff are available from another source at less than the new price.

How does a carbon tax differ from a tariff?

A carbon tax removes jobs. Tariffs add jobs

"The import taxes imposed by the Trump administration will end up being a larger burden for the economy next year than all the taxes associated with the Affordable Care Act..."

That conclusion represents a fundamental misunderstanding of how tariffs work. For a century and half the USA was the most tariff protected economy on earth and consumers hardly noticed. Every social science who ever studied why consumers seldom complain to about tariffs have come to the same conclusion they do not complain because tariffs are too small to notice. Economist Vilfredo Pareto put it this way:

"A protectionist measure provides large benefits to a small number of people, and causes a very great number of consumers a slight loss. This circumstance makes it easier to put a protectionist measure into practice."

Note that those doing the complaining are corporations and theirs shills not consumers. Protective tariffs are designed to inhibit imports in favor of domestic production not to raise revenue. As imports decline so does the tariff revenue. A perfectly designed protective tariff raises zero revenue.