As Markets Tank and Opposition to Tariffs Grow, Trump Stays the Course. Where is Congress?

"It's all working out great," Trump said in South Carolina. Few people seem to agree with that assessment.

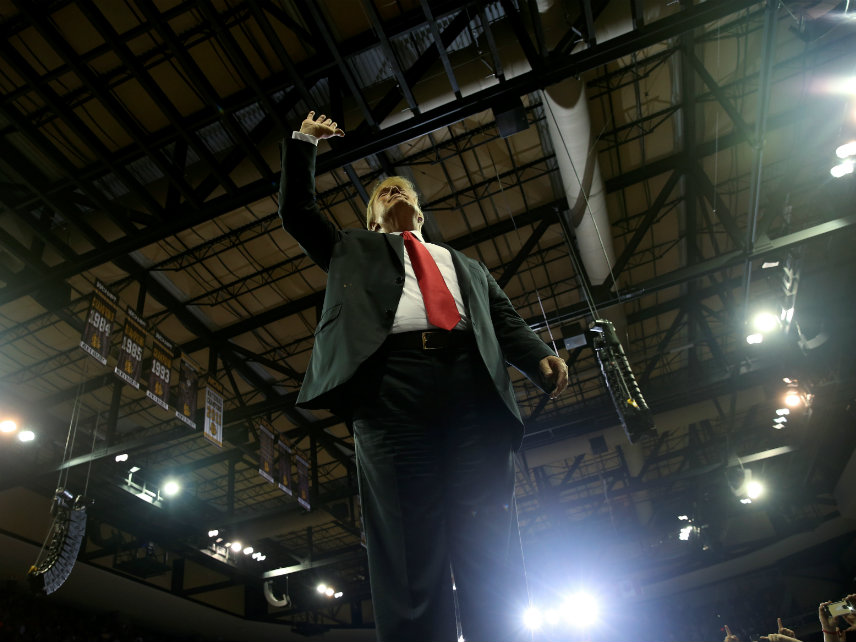

Just hours after the stock market absorbed a big hit on Monday—major indices dropped by more than a full percentage point—President Donald Trump took to the stage in South Carolina to assure everyone that his trade policies were not to blame.

"It's all working out great," Trump told thousands of his supporters at a campaign rally for Gov. Henry McMaster (R).

That assessment is not widely shared. If the signals from the stock market were not strong enough, more than 200 state and local Chamber of Commerce chapters sent a letter to senators on Tuesday condemning the White House's anti-trade policies. Meanwhile, Republican lawmakers in Congress are signaling that they might be ready to limit Trump's ability to unilaterally impose new trade barriers.

None of that, though, seems to be giving Trump pause. On Monday, the president took the opportunity to threaten a further escalation of his trade dispute with the European Union. In response to the Trump administration's decision to hit steel and aluminum exports from the E.U. with tariffs, the European government slapped a number of iconic American products like motorcycles and whiskey with retaliatory tariffs. The consequences of these tit-for-tat tariffs are becoming obvious, with Harley-Davidson announcing on Monday that it would shift some manufacturing jobs to Europe.

On Monday, Trump suggested once again that his administration could slap tariffs on cars and trucks imported from Europe. The Commerce Department is already engaged in an investigation of such a policy.

"They send the Mercedes, they send BMWs, they send everything. We tax them practically nothing," Trump said. "I told them, 'here's what we're gonna do. We're gonna charge a tariff on steel until such time as you straighten out your act.'"

Someone should probably have told Trump that BMW's largest manufacturing facility in the world is right there in South Carolina. The automaker's Spartenburg plant employs more than 9,000 people and produces more than 40,000 vehicles every year.

Fact-checking aside, Trump's determination to press forward with an unnecessary, counter-productive trade dispute is now facing greater headwinds from the markets, special interests, and from Republican members of Congress.

If Congress needs another reason to act, Trump gave it to them last night. The president's promise to "charge a tariff on steel until such time as you straighten out your act" belies the White House's claim that steel and aluminum tariffs are a matter of national security. This isn't just semantics. Under the terms of the Trade Expansion Act of 1962—the federal law that Trump has invoked to impose steel and aluminum tariffs—the president has the authority to impose tariffs without congressional approval, but only for national security purposes.

Trump's comments on Monday night reveal (again) that the president clearly sees the tariffs not as a national security matter, but as a means of gaining leverage over America's trading partners.

In a letter to the White House on Tuesday, more than 200 state and local Chamber of Commerce chapters said they were "deeply concerned" by Trump's use of those unilateral trade powers. Such actions, they warned, "may not be in the national interest."

"It is now also increasingly clear that the way the steel and aluminum tariffs have been used will result in retaliatory tariffs from our largest trading partners and closest allies, and that retaliation will have serious negative economic impacts on the United States," the letter states.

These groups are urging lawmakers to back a proposal by Sen. Bob Corker (R-Tenn.) that would require congressional approval of all tariffs—including those imposed on supposedly national security grounds. Corker tried unsuccessfully to get that proposal attached to the National Defense Authorization Act earlier this month, and now is trying to rally support for including it as an amendment to the Farm Bill, Politico reported.

He might have a better shot at it this time, as opposition to the tariffs is mounting.

"We've crossed the Rubicon," Sen. Pat Toomey (R-Pa.) told Politico earlier this week. "It's going to do and is already doing real damage, so I think we've got a responsibility to stand up and push back."

Trump clearly is not going to back down from a misguided trade policy that risks American jobs and prosperity. Getting to 60 votes in the Senate is never an easy task, but it might be the best hope for stopping the administration's ill-informed protectionism.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I don't like this trade war thing at all. Congress isn't going to do shit.

So long as most of the people losing jobs and business are Trump voters in Trump-supporting areas, I will focus on growth in the popcorn and tiny violin sectors.

Let them eat their Trump hats. After that, if the Chinese toxins haven't killed them, perhaps the president will be nice enough to offer personal tips on navigating bankruptcy to his fans.

Hey weibo, how is your animes going? Genki desuka?

Short term market moves are essentially meaningless.

Unless you're leveraged and on the wrong side of them but that's your own damn fault

They are back up .4% today. I don't think a one percent drop on one day is quite "tanking".

"Just hours after the stock market absorbed a big hit on Monday?major indices dropped by more than a full percentage point?"

But you just said it was a big hit, make up your mind.

But you just said it was a big hit, make up your mind.

And it's also a bit of "What we totally expected would probably happen... kinda happened a little bit!" If there are price fixing, currency manipulation, and production controls at play here, the free market may well be smaller and represent what's happening when both sides aren't gaming each other.

July 6 is the date that everything happens.

The closer we get to that date, the more bravado we'll hear from both sides, the more pressure there will be to come to an agreement.

I disapprove of Trump's goals and tactics here, but right now, it's all about what happens on July 6.

And what is that?

For those of you who are getting your information about this from Reason, there are two new rounds of tariffs that have been announced. The first batch is set to go into effect on July 6. If Trump goes through with them on that date, Emperor Xi has promised his own round retaliatory tariffs.

The way Reason has been reporting this stuff, some of you have, no doubt, come away with the idea that all of these tariffs have already gone into effect--and China has retaliated. That isn't so.

If China doesn't come to an agreement on Trump's latest demands, then there's a batch of tariffs that go into effect on July 6, with the second batch not yet set to go into effect on any date yet at all. China has promised to retaliate if the tariffs go into effect on July 6. So, if there's a trade war (rather than a war of words), it will probably start on July 6.

While it's true that the anticipation and risk of a trade war has hurt stocks internationally, there's still a difference between the anticipation of tariffs and actual tariffs. If those tariffs actually go through on July 6, we'll see the difference between the anticipation and the actual event. Stocks will take a deeper hit after the tariffs happen.

Re: Ken Shultz,

--- The way Reason has been reporting this stuff, some of you have, no doubt, come away with the idea that all of these tariffs have already gone into effect ---

No, that's not true. You're merely guessing it is so.

--- If China doesn't come to an agreement on Trump's latest demands, then there's a batch of tariffs that go into effect on July 6 [...] there's still a difference between the anticipation of tariffs and actual tariffs ---

The market is anticipating that ANY agreement, or no agreement, to Trump's demands, will invariably result in higher prices and less demand, regardless of who caves first. This is because Trump's demands are meaningless, the raving rants from an economically inept individual who sees trade as a zero-sum game. Any 'appeasement' given to such a lunatic would be as meaningless as this piece of paper that Herr Hitler signed at Munich.

That is why the economy and employment are tanking, right Mexican? Tell us more about the horrors of the Trump economy.

It works that way with a lot of things, maybe the most obvious example being an arbitrage play on a merger. When two companies announce a merger, the acquired company typically rises to something near the value of the acquirer's offering price, and the acquirer's stock typically drops to reflect the cost to the acquirer's shareholders. Ultimately, if the deal closes, both company's stock will be the same--but it doesn't happen immediately when the merger is announced. So, fund managers will typically short the acquirer's stock and go long on the acquired company after the announcement--and profit from the difference once they merge.

That's where we are with the trade war. If it happens, it happens no sooner than July 6. We're seeing the market price things with more risk of a trade war in mind, but there's still a big difference between anticipating the risk of something happening ad something actually happening. To treat them both the same is to make an ass of you and me. Mergers get shot down all the time for all sorts of reasons, and there's no guarantee that Trump and Xi won't come to their senses before July 6, too. In fact, the closer we get to July 6, the more pressure there is on them to compromise.

Ken, god damn any man who would want to make an ass of you. Shame on him.

This is what I wanted to know in the earlier trade war post you didn't come on. Thanks much, Ken!

(Also sorry for thinking it was July 9 rather than July 6.)

As Markets Tank and Opposition to Tariffs Grow, Trump Stays the Course. Where is Congress?

Looking for a restaurant that will have them.

As Markets Tank

The S is ~4.5% from all time highs, which it hit only a few months ago. With that said, markets may be looking a bit shaky at the moment (summer has just begun) and they could drop 5-10% from here by fall, but to say markets are tanking sounds a bit too gloomy.

It is not gloomy, it is just not true. Maybe markets will tank. I have no idea and if I did, I would be very rich right now. Reason cannot seem to resist overplaying their hand on this issue. Is it too much to ask that they just tell the truth?

Reason's recent position (since Trump) is at odds with Virginia Postrel's conception of the present and future as being one giant cornucopia of goodness and wonderfulness.

Well, the usual summer market doldrums might start to take effect right when these tariffs are instituted, so who knows what's about to happen. The headline was still mistaken about markets tanking as we speak. We'll have to wait and see though. I'd like to see a contrarian market reaction where everyone's expecting a downturn only to see a face ripping rally back to all time highs.

That was supposed to say the S(ampersand)P500. Not sure why it got effed.

When did Reason morph into Mother Jones?

Dow:

Up .12% today

Down 1.69% for week

Down .32% for month

Up 1.78% for qtr

Down 1.76% for year

NASDAQ:

Up .39% today

Down 2.12% for week

Up 2.23% for month

Up 7.89% for qtr

Up 9.53% for year

I see NASDAQ doing great, Dow with no real net effective movement, and certainly no "tanking"

Doesn't Eric know that "we are winning like we've never been winning before.?" [1]

Doesn't Eric know that "we are winning with trade?" [2]

Doesn't Eric know that "we are winning at the border?" [3]

Doesn't Eric know that "we are manufacturing more than we ever have before?" [4]

Doesn't Eric know that "we are creating so many jobs, it is unbelievable, like you have never seen before?" [5]

Notes:

[1] Presidential address of Donald J. Trump, June 25, 2018, West Columbia, South Carolina.

[2] Id.

[3] Id.

[4] Id.

[5] Id.

None of the predicted horror stories of Trump's Trade War, whatever that is, have come true. Maybe they will. Time will tell. But reason should stop pretending they have and wait until they actually do before claiming they have.

That is true.

Did you see his rally last night?

His performance was brilliant. Just like last week's rally in Duluth. Only better. I can't say it enough: in these campaign / rally type of events, he outperforms both Reagan and Clinton in their delivery of prepared speeches.

He is a very entertaining speaker and politician. His opponents do themselves no favors pretending he is some kind of bumbler. How many times does he have to hand them their asses before they admit he knows how to play this game?

But unable to answer simple questions under oath.

Shocked he had one. Bad storms in the area that night.

Trump and the governor both referred to the storms.

Re: John,

--- None of the predicted horror stories of Trump's Trade War, whatever that is, have come true. ---

What THE FUCK are you talking about? The 'predictions' made by Trump and his merry band of economically inept buffoons said there would be NO trade war because the whole world needs 'Murica. But there IS a trade war going on already. What Wilbur Ross and that nonsense-peddler, Pete Navarro, have been touting was pure BULLSHIT.

We currently are looking at 4.5% growth and record employment. The facts are what they are. I understand you are dumb as post and bigoted as hell. But could you at least try and not be delusional on top of that? Is that asking too much?

If it bothers you so much to not be delusional, try making up for it by being angry. Stupid and angry is a good role for you.

CNBC says it was 2.2% growth in the first quarter of 2018. Where'd you get 4.5%? And 2.9% in 2017.

You're referring to this quarter and it's an estimate and there were other estimates at 3.5%. Inflation is also rising which eats into gains and consumer debt was near record amounts.

John has no use for elite indexes. He swears by the Trump Index, which indicates not only 4.5% growth but indeed the sweetest, most beautiful growth any person has ever seen.

As opposed to Kirkland, who has frequently been mistaken for a cancerous tumor.

4.5 is what is expected in the second quarter/.

I just want to know what is considered a trade war from Ken. What would be his conditions of a trade war. Please draw a explicit line in the sand.

"American Money Is Returning To America At A Record Pace. With a few notable exceptions, American CEOs are bringing manufacturing and investment back at warp speed."

I'll oppose the tariffs on general principle, but I'm curious to know how many Progressives support boycotting EU products and disinvesting from the EU until Catalonia achieves independence.