To Cut Taxes Now, Republicans Promise to Raise Them Later

Will Congress tackle entitlement spending and agree to raise taxes in the mid-2020s? If not, the deficit will get even bigger than some projections show.

Votes are expected Tuesday in the House and Senate on the final version of the Republican-crafted tax reform bill. Unless there's a truly shocking final twist, it appears that the bill will be headed to President Donald Trump's desk within the next 24 hours or so.

The president is understandably excited.

As the world watches, we are days away from passing HISTORIC TAX CUTS for American families and businesses. It will be the BIGGEST TAX CUT and TAX REFORM in the HISTORY of our country! pic.twitter.com/EvcAkjuf8w

— Donald J. Trump (@realDonaldTrump) December 18, 2017

But the GOP tax bill comes with a big price tag. And after peeling back a few layers, that price tag gets even bigger.

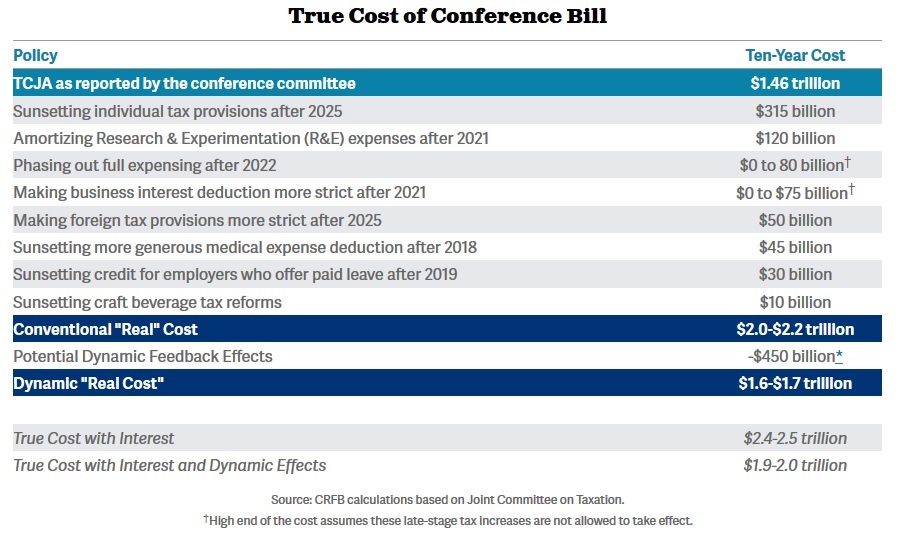

Officially, the tax bill is expected to add about $1.5 trillion to the national debt over the next decade, though the "cost" of the tax reform effort is about $1 trillion once expected economic growth is factored into the equation.

There has not been a single estimate released by Congress, the White House, or any independent tax policy group that suggests the tax bill will "pay for itself," as Republican leaders for so long promised it would.

One thing all those estimates have in common is that they say the tax bill will add to the national debt. Another thing they have in common is potentially under-estimating how much will be added to the debt by taking certain parts of the bill at face value.

The GOP tax plan attempts to game those projections in a few significant ways. The personal income tax cuts included in the bill, for example, are set to expire in 2025, two years before the end of the 10-year window used for budget projections. There's an important practical reason for the $1.5 trillion threshold too, because the tax cuts must comply with the Senate's Boyd Rule that prohibits passing bills with a simple majority if they add to the long-term deficit (Republicans cleared about $1.5 trillion in budget space earlier this year, with tax reform intended to fill that gap).

But to meet that threshold now, the GOP has to promise to increase taxes later.

Getting a better sense of what the tax bill will actually cost requires gaming out what future congressional majorities and administrations might do when faced with the prospect of raising taxes on all Americans in 2025. Business friendly tax cuts for so-called "bonus depreciation" will begin expiring as soon as 2022. Other future tax increases included in the bill include the end of tax breaks for craft brewers and for employers who offer paid leave.

Taken together, these gimmicks could add as much as $600 billion to the final cost of the tax plan, according to the nonpartisan Committee for a Responsible Federal Budget. That brings the final price tag of the tax plan up to about $2.2 trillion, before factoring in potential economic growth.

Republicans are saying, essentially, is the tax bill costs only $1.5 trillion as long as future Congresses agree to follow through with the parts of the bill that would trigger big tax increases near the end of the next decade. There are good reasons to be skeptical that will happen. Congress is generally far more eager to cut taxes than to raise them.

The current tax reform bill is an exercise in avoiding fiscal accountability. Republicans like Speaker of the House Paul Ryan (R-Wis.), who have talked for so long about the danger poised by our $20 trillion national debt and stressed the importance of cutting spending, are now essentially saying that they'll get around to fixing the debt right after adding to it.

In its assessment of the tax plan, the Treasury Department waved away concerns about increasing the debt. The tax bill will be paid for by "a combination of regulatory reform, infrastructure development, and welfare reform," the Trump administration says, as if passing any of those things will be an easy accomplishment. If you're going to believe Congress is that close to a complete overhaul of the welfare system, then I suppose you might as well believe it will raise taxes in the mid-2020s, too.

There is still a very real ethical argument against increasing the debt. "Borrowing now pushes costs to the future," Chiris Edwards, the Cato Institute's director of tax policy, told Reason TV earlier this month. "From a libertarian perspective, you can see the pain is moved to the future when the government borrows more now, and that's unethical."

Letting people and businesses keep more of the money they earn is undeniably a positive outcome of the Republican tax plan, of course. The big picture, though, is far less sunny.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Officially, the tax bill is expected to add about $1.5 trillion to the national debt over the next decade...

Seems like the various spending bills would actually be the culprit here.

But the bill does nothing to fix that spending.

This is like a family drowning in debt, who can't get their spending under control, where the dad quits his job to write that novel he's always wanted to write. FIX THE SPENDING FIRST! Sheesh.

I haven't met a tax cut I didn't like, but on the flip side I haven't met a deficit that I did.

Deficits are fine if they take the fedgov closer to insolvency. Tax cuts mean less stealing.

Insolvency results in bad things happening. None of which lead to the AnCap libertopia.

LOL anarchists. Cap and Lib, both are a founded on shitty concepts of humans taking care of one another and not putting a bullet in each other's heads to get what they need.

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

I disagree that these are analogous, although I suspect many here would love for dad/government to put in its two weeks notice.

It would be analogous if the Dad's job is stealing money.

"But the bill does nothing to fix that spending."

Do tax bills address spending? This is a sincere question. (My first ever)

They could. They could also address cancer. bigotry, & the heartbreak of psoriasis. So the fact this bill doesn't is not a knock as I see it.

You can earn more than $15,000 each month from you home, and most special thing is much interesting that the job is to just check some websites and nothing else. Enjoy full time and money freedome, also an awesome career in you life.... ?

just click the link given belowHERE??? http://www.startonlinejob.com

You can earn more than $15,000 each month from you home, and most special thing is much interesting that the job is to just check some websites and nothing else. Enjoy full time and money freedome, also an awesome career in you life.... ?

just click the link given belowHERE??? http://www.startonlinejob.com

You can earn more than $15,000 each month from you home, and most special thing is much interesting that the job is to just check some websites and nothing else. Enjoy full time and money freedome, also an awesome career in you life.... ?

just click the link given belowHERE??? http://www.startonlinejob.com

"The tax bill costs only $1.5 trillion"

Does the word "only" seem appropriate?

If you were to disappear anything remotely connected with "welfare" ($300 to $400 billion) you still have to cut Social Security, Medicare, Medicaid and defense to make a dent in the deficit.

The word "costs" is the one that's inappropriate. It doesn't cost anything to steal less from people.

Indeed. While I'm pissed that no one in Washington D.C. is interested in cutting spending, I'm glad that they're at least going to steal less while we plunge unchecked towards oblivion.

Higher taxes were never going to change the trajectory, but leave it to Reason to miss the forest for the trees.

But they're not stealing less. They're deferring the theft until a more politically viable time.

If you could defer a crime, wouldn't you? Wouldn't you defer a disease, or anything else bad?

There has not been a single estimate released by Congress, the White House, or any independent tax policy group that suggests the tax bill will "pay for itself," as Republican leaders for so long promised it would

and that no one has the slightest idea the meaning of.

Hopefully they don't raise taxes later.

We're libertarians, right?

#spendandborrowthisthingintooblivion

Am I missing the part of the article that talks about our unfunded liabilities?

Unfunded liabilities are the IOUs we write together.

It seems that Reason.com fired anyone that actually knew how fucked we were so they could crank out this meaningless drivel. Sure am glad I didn't give them a dime, I must say. It takes a pretty big retard to vote 'no' on lowering taxes because of deficit reasons, but hey Reason is willing to take that stance.

Still no word on how receiving less revenue in taxes hurts an entity that issues currency, or how there is any chance whatsoever that we're actually going to pay down what we already owe but, haha, that stuff is totes boring.

Lets just circle jerk, it would be more productive I'm sure.

So do you believe that they should never mention the deficit or is it only in regards to taxation that you think it's meaningless?

"or how there is any chance whatsoever that we're actually going to pay down what we already owe"

I believe that is an appeal to mentioning the deficit.

I think it should be mentioned constantly whenever we are talking about spending.

I don't see any point in mentioning it when we are talking about tax reductions.

Maybe when the federal government is operating within strict constitutional bounds and unicorns have replaced our cars.

"From a libertarian perspective, you can see the pain is moved to the future when the government borrows more now, and that's unethical."

I see. & taxing now is ethical?

I doubt that's what he meant.

Actually I wish they would cut taxes now and default on the debt later. Then the government would lose its ability to borrow, which would be an additional bonus.

We should double our deficit while tripling our defense. Then, we should default. Then we should wave our big penis shaped missiles in China's face and say "What are you going to do about it, and oh by the way, thanks for the awesome military you paid for".. Har har har.

That is logically consistent, which is more than I can say for most of the discussion about taxes and spending.

The right opportunist arguments re the effects of a tax cut here or there, tax raise whenever, and cut spending bitch are gratifying in themselves, but they do not point to a radically free alternative. Unfortunately, the only other Libertarian arguments re the US INDIVIDUAL INCOME TAX, (I love that in all caps because that's the heading for the 1040 Form, which is the TYPE OF TAX you all are paying.) are strictly left sectarian, appealing to insane ideas about repealing the 16th Amendment, or returning to the Articles of Confederation. Pie in the Sky Utopianism. HEY, KIDS, WHAT KIND OF TAX WOULD YOU LIKE? Flat, fair or no? Gillespie fantasizes about being able to check off just what you want your tax money spent on!

No one, including Eric who has been cc on more than one email expressing similar sentiments, wants to look into the merits of the so called INCOME TAX as it was understood and collected after the passage of the 16th Amendment. It was understood to be the American version of the British classical liberal public office duty. Government taxes itself, and its agencies and instrumentalities. Did Eric even hear of such a tax? Find out more- http://www.losthorizons.com

"Will Congress tackle entitlement spending and agree to raise taxes in the mid-2020s? If not, the deficit will get even bigger than some projections show."

Every time Reason questions the commitment of the GOP to cutting entitlement spending, I'm reminded, again, of them leading the charge against cutting entitlement spending--only six months ago!

Here it is again:

https://www.cbo.gov/publication/52849

Reason staff, far as I can tell, across the board, opposed that bill--and it cut $772 billion from Medicaid, $1.022 trillion in entitlement spending, and $321 billion from the deficit.

Donald Trump promised to sign that bill--don't blame him for not cutting entitlement spending.

Paul Ryan actually passed a similar bill through the House--don't blame him for not cutting entitlement spending.

The Republican establishment in the Senate voted for that bill, too. The reason it didn't pass is mostly because of six senators from mostly deep red states, led by Rand Paul, who voted against it--not for what it did but for what it didn't do.

Don't blame "the Republicans" for refusing to cut entitlement spending. That's inaccurate. The establishment voted to cut $1.022 trillion in entitlement spending. Blame Rand Paul and his merry band of five idiot followers, and blame people like the staff of Reason for cheering on his opposition.

Reason has no standing to complain about "the Republicans" being slow to cut entitlement spending.

"The Republicans" already voted to cut entitlement spending.

Reason opposed it.

And I won't forget it anytime soon.

Reason is arguably worse than the GOP in this regard--because Reason is supposed to be different.

Reason is arguably worse than the GOP in this regard--because Reason is supposed to be different.

I'm starting to agree with you, as far as this goes.

Why are our ostensible leaders leading the wrong way? What's in it for them? Rule or ruin?

This is why we need populism. Even libertarian bosses are bad, it seems.

They were just wrong. It happens sometimes.

Also, there's a difference between writing about football and being a football player.

David Weigel, et. al., wrote about libertarianism.

Brian Doherty, Jacob Sullum, et. al. are libertarians.

The other thing to keep in mind is that we should be leaderless. If you need to believe in someone, believe in yourself. We've gotta think for ourselves.

It's not a matter of "just" wrong. There are adverse incentives in leadership. That's one of the reasons I left the Libertarian Party. Actually just about any activist organiz'n I've been involved in turned sour after long enough?which really wasn't that long in some cases.

republicans: we can't raise taxes, democrats must agree to cut spending.

democrats: we can't cut spending, republicans must agree to raise taxes.

Reason: we can't cut spending, republicans must agree to raise taxes.

The fuck?

And anyone who thinks that the republicans are as bad on spending as the democrats are, is just wrong and clueless. Look at the actual congresses that were in power, not the presidents.

As any introductory macroeconomics text worth its salt will tell you, once a level of federal spending is determined, it doesn't matter, on a macro scale, whether it's funded currently with taxes today or by taxes tomorrow (via debt today). To the extent that this bill's impact on debt scares politicians into reducing spending in the future, and that's a big if, than it is a positive. What really matters in terms of misallocating and wasting of resources is the level of spending.

Suppose you could go back in time and convince the Red Sox not to sell Babe Ruth's contract to the Yankees. How would that have affected baseball as we know it?

See, there's a discussion every bit as meaningful as discussing anything politicians say as if anything they say can or should be taken at face value. They're all lying sacks of shit and nothing they say has any meaning worth thinking about more than about 3 seconds.

It's not rational for any individual to care about the deficit or the national debt.

Even if I were personally liable for my share of the national debt, it would be rational to borrow money at government security rates and invest that money in the stock market.

But, of course, I'm not actually liable for the national debt; that debt is effectively unsecured, and it is certainly not secured by me or anything I own. So, I care even less.

You still believe you "own" shit?

Yes. Why wouldn't I?

No, the pain is simply moved to foolish lenders who will be unable to collect. Of course, a lot of those "lenders" are simply other parts of government. The whole thing is a gigantic shell game.

From my point of view, and from a libertarian point of view, the less I am forced to pay into the system, the more ethical it is.

From Reason's new Volokh partners - did Reason cover this independently?

"? Pine Lawn, Mo. cop displays incumbent mayor's campaign sign in convenience store window over the objections of the owner; the opposing candidate removes the sign (which has her mugshot from a past arrest on it). The officer threatens to frame the store owner for drug possession if he does not help frame the opposing candidate for theft; he then arrests the candidate, has local TV film a perp walk. Eighth Circuit: The officer's conviction is affirmed. (Related: He was not a good cop.)"

the tax bill is expected to add about $1.5 trillion to the national debt

Fuck you, cut spending.

-jcr

Same shit in the 80s. Reagan's tax cuts weren't to blame for the deficit, the ramp up in spending was

the deficit will get even bigger than some projections show.

Like the projections that Hitlery Kkklinton would be elected president?

"Hitlery Kkklinton"

Oh, SIV! How..............

pathetic you are.

So Reason has removed the mask entirely and is now just out and out rallying for higher taxes. I guess the Kochs have enough of their money offshore that US rates don't matter so much now.

Our history of tax cuts from the Bush era cuts, Clinton era Tax Relief Act of 1997, Reagan era tax reform, JFK's tax cuts all resulted in higher revenue. As Milton Friedman said if you cut taxes and revenues go up you have not cut them enough.

What is this stupid argument that a policy most likely to increase economic activity and the resulting tax revenues will add to the deficit? If we have passed the point to which Friedman refers and it actually reduces revenues it will be a valid point but no economist outside of Krugman would be foolish enough to suggest it.

The projected $1.5 Trillion that it is claimed to add to the deficit is not taking into account that there will be growth in the GDP which over the last year (even before the tax reduction became law) has shown that there is growth even now and with the law passing there will be even more. So that would lower the $1.5 Trillion short fall if that is the correct number.

The GOP tax plan attempts to game those projections in a few significant ways. The personal income tax cuts included in the bill, for example, are set to expire in 2025, . . .

The sunset on the tax cut is because that budget reconciliation had to be used since NO DEMOCRATS signed on to the bill. The ten years will give enough time for the law time to be extended so the expiration date is at this time meaningless.