Tax Reform Is on Track to Add $1 Trillion to the National Debt, Even After Accounting for Economic Growth

The GOP tax plan looks like it could pass, but should it?

It's not yet a fait accompli, but Thursday was a good day for supporters of the GOP tax proposal. The bill, however, still doesn't come close to paying for itself.

Sen. John McCain (R-Ariz.), considered a crucial swing vote on the measure, said he will support the bill. House leaders are reportedly preparing for a vote on Monday to go to a conference committee to iron out differences between their version of the tax bill (passed earlier this month) and the Senate bill. All that comes less than 24 hours after the first vote on the Senate tax bill—a motion to proceed to debate, a procedural step that's been anything but simple on other major GOP initiatives this year—including a drama-free "aye" from all 52 Republican senators.

The only thing that slowed the tax bill's momentum was a new analysis from the Joint Committee on Taxation (a number-crunching cousin of the better-known Congressional Budget Office) showing, once again, that the GOP proposal will add about $1 trillion to the federal debt. This, even after accounting for increased economic growth from cutting corporate income taxes.

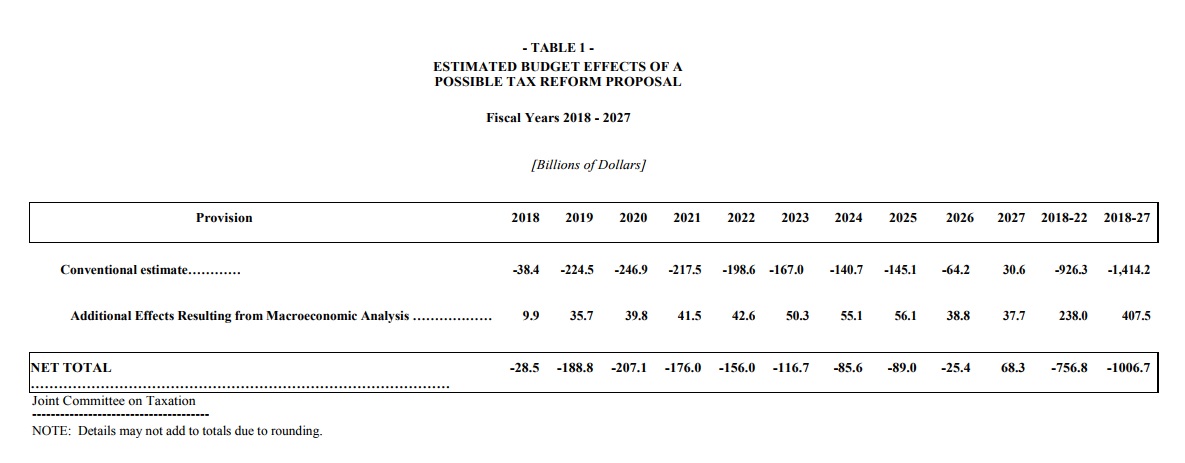

Here's how the JCT spelled it out:

All of those minuses show the one glaring flaw in the plan. Republicans mostly seem willing to ignore the defect, claiming increased economic growth will cancel out an estimated $1.4 trillion blow the plan will deal to the federal budget. The JCT report shows clearly that is not going to happen. Increased economic growth cancels out about $400 billion, leaving a $1 trillion shortfall.

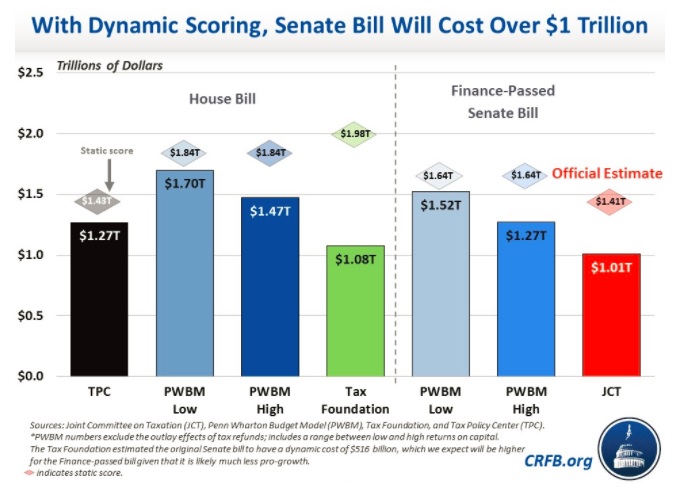

That's roughly in line with other estimates. When forecasted economic growth is factored in, the Republican proposal will cost about $500 billion, according to The Tax Foundation, a nonpartisan think tank. A separate analysis by the Wharton School at the University of Pennsylvania says the cost, including projected growth, will exceed $1.3 trillion.

Here's a neat summary of various estimates, compiled by the Committee for a Responsible Federal Budget, which opposes the current tax plan because of how it will add to the debt.

Projections are tricky things, with lots of moving parts. No one knows for sure what dynamic effects the tax changes will have on the economy, or what outside factors could drive growth—or trigger a recession—in the coming years. There are, however, no estimates, even from Republican sources, showing that tax bill cuts would fully pay for themselves.

Instead, Republicans have responded to the estimates much the way Sen. John Cornyn (R-Texas) did today after the JCT analysis was released.

.@JohnCornyn tells me re: JCT score "I think it's clearly wrong." Says growth projections are too conservative

— Seung Min Kim (@seungminkim) November 30, 2017

In other words, close your eyes and wish really hard for the Economic Growth Fairy to make everything okay. It's a vision that you're tempted to believe in because it means you get all the benefits with none of the costs—which, in this case, are the tough political decisions about cutting spending—but it's not one that tracks with the real world or the economic and political history of the last 30-plus years.

This isn't new. It's the same thinking that drove the passage of the Reagan tax cuts, properly understood as "tax deferrals," since the debt has to be paid back someday, as National Review's Kevin Williamson wrote in a memorable 2010 piece. The same thinking that drove the passage of the Bush tax cuts. Correcting this view, as Williamson wrote at the time, requires equating "spending" and "taxes" so that every dollar spent today means a dollar in taxes must be raised, either today or tomorrow.

Unfortunately, that's not where we are right now.

When the Bush tax cuts passed in 2001, the nation's debt-to-GDP ratio was 31 percent. Today, it's 77 percent. And Congress is about to add another $1 trillion to future Americans' tab.

Show Comments (238)