Who's Ready for Some Trillion-Dollar Republican Deficits?

Fiscal hawks, from their perch in the wilderness, predict we may again see 13-digit deficits as soon as next year

From 2009 to 2012, the federal government of the United States ran an annual deficit north of $1 trillion. The figure was shocking—Washington didn't get around to spending $1 trillion in a year total (in 2009 dollars) until 1975. Coming on the heels of the debt-doubling during the presidency of George W. Bush, which candidate Barack Obama in 2008 characterized as "unpatriotic," the new recession/bailouts/stimulus deficit-spending triggered a stampede of national anxiety.

The Tea Party arose in 2009 partly in revulsion at the Bush/Obama binge. Joint Chiefs of Staff Chairman Adm. Michael Mullen famously warned CNN in 2010 that, "The most significant threat to our national security is our debt." The president himself acknowledged the problem, predicting in a major 2011 speech that the debt "has grown so large that we could do real damage to the economy if we don't begin a process now to get our fiscal house in order." After the passage of the Affordable Care Act, the main topic of American politics was the long-term debt and the short-term trillion-dollar deficits exacerbating the problem.

And now, after another Obama-era doubling of the debt, and the successful removal of Democrats from federal power, Republicans are ushering in a new era of…would you believe trillion-dollar deficits?

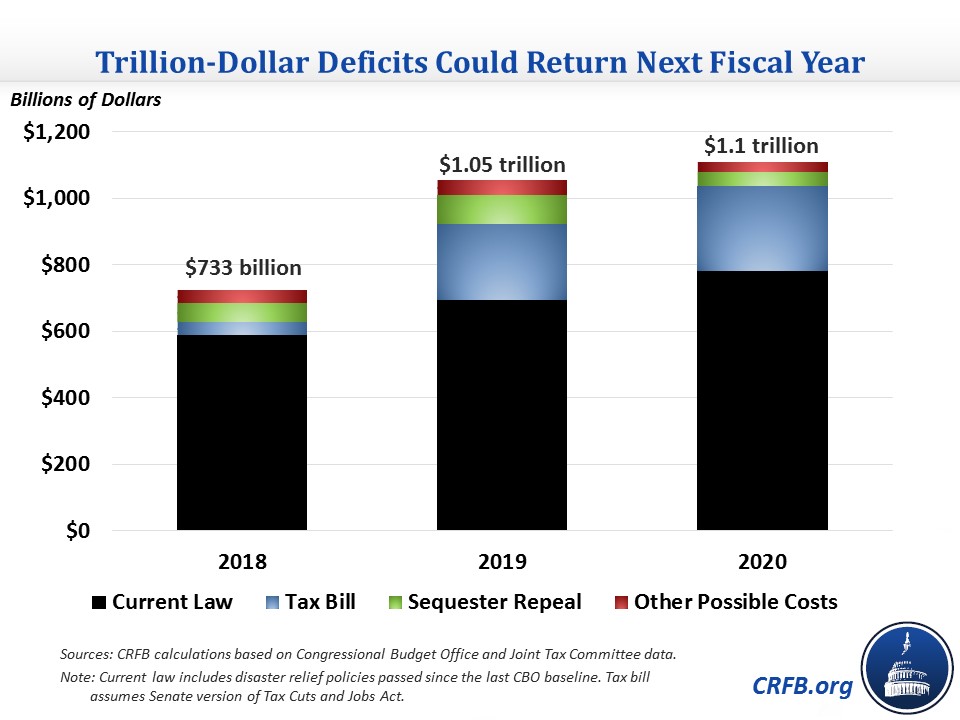

That's what the grumps over at the Committee for a Responsible Federal Budget (CRFB) are saying today. "By our estimate, a combination of tax cuts, sequester relief, and other changes would increase deficits to $1.05 trillion by 2019 and $1.1 trillion by 2020," the CRFB found (emphases in original). "Tax cuts and sequester relief alone would be enough to bring back trillion-dollar deficits by 2019, and tax cuts by themselves would bring them back by 2020." More, from the organization's press release:

"As we wrap up 2017, the last thing we need is for Congress to go on a tax cutting and spending spree with the national credit card," said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. "It's like Santa Claus in reverse – parents and grandparents spending on themselves and handing the bill to their children and grandchildren."

"If Congress doesn't get its act together soon, we will end up with trillion-dollar deficits in the next few years," MacGuineas continued, "and debt as a share of the economy will be as high as it has ever been in U.S. history."

December in contemporary Washington, alas, is not a time for getting acts together, but rather smashing together the annual cromnibus/continuing resolution/debt ceiling monstrosity, which is more indigestible than Aunt Ruthie's fruitcake at a cajillion times the cost. We are poised to re-climb that trillion-dollar debt summit, only this time without the excuse of a preceding financial crash.

That this is happening with Republicans firmly in charge of Washington should surprise no one who has been paying attention. As I recounted in my December-issue column, the GOP's governing debt milestones come so quick it's hard to keep track:

On September 6, in the wake of Hurricane Harvey (Irma and Maria had not yet hit), only three members of the House of Representatives—Justin Amash (R–Mich.), Andy Biggs (R–Ariz.), and Thomas Massie (R–Ky.)—voted against spending $8 billion on hurricane victims because the bill did not include offsetting cuts. That compares to the 179 Republicans and one Democrat who voted against a $60 billion aid package after Superstorm Sandy back in January 2013.

On September 8, Trump signed into law a deal he forged with Democratic congressional leaders to raise the debt ceiling from $19.84 trillion to $20.16 trillion.

On the grim anniversary day of September 11, the nation's debt clock crossed the ominous $20 trillion threshold. Most economists agree that growth becomes dampened after a country's ratio of debt to gross domestic product creeps higher than 90 percent; we've been north of 100 percent for some time now, and the Congressional Budget Office estimates that we are on pace to soon break the all-time record set at the height of World War II.

On September 18, the Senate passed the $700 billion National Defense Authorization Act, showering more money on the military than even the pro-buildup president had sought. "It's a grandiose spending plan," Sen. Dick Durbin (D–Ill.) observed to The New York Times.

Conclusion?

Let us stop pretending to know Republicans by the words they speak while in the opposition. When the GOP holds power, what matters is its fruits.

And they're rotten.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

A trillion is a million millions. Think about it.

One definition may be found here.

That second definition seems needless. I don't know if one should attempt to define every word that can be used hyperbolically.

One might even say it seems wrong. Trillion is a number with a specific meaning. It doesn't just mean lots. The second definition is an appropriate definition of bazillion or gajillion.

Then again, wasn't Merriam Webster also the one to offer a second definition of "literally" as a synonym for figuratively.

Then again, wasn't Merriam Webster also the one to offer a second definition of "literally" as a synonym for figuratively.

God, I hate english....

Consider this:

1,000,000 seconds ago - 11/25/17

100,000,000 seconds ago - 10/7/14

1,000,000,000 seconds ago - 3/31/86

10,000,000,000 seconds ago - 1/17/1701 (the USA wouldn't declare independence for another 2.37m seconds)

100,000,000,000 seconds ago - 1/22/1151 BCE (the Hebrews left Egypt ~3.15m seconds ago)

500,000,000,000 seconds ago - 7/25/13,827 BCE (half-way there! Moog the Hairy invents the wheel)

1,000,000,000,000 seconds ago - 3/13/29,671 BCE Neatherthal dies out, all CroMags look like they're from an Arkansas trailer park.

So what about 20 trillion seconds ago?

Bless her heart, Ms. Dorothy Morrell, of Seattle WA, beat me to the punch by roughly 985,219,200 seconds.

Well done Dot - sorry no one listen to you back then, dear.

You SF'ed the link ^_-

I waaa? Hey, why doesn't my link work? a href, right?

I've been working for this company online for 2 years, now i get paid 95usd/per hour and the best thing is cause i am not that tech-savy AGi ,It's been an amazing experience working with them and i wanted to share this with you, .

Visit following page for more information>> http://www.startonlinejob.com

My Whole month's on-line financ-ial gain is $2287. i'm currently ready to fulfill my dreams simply and reside home with my family additionally. I work just for two hours on a daily basis. everybody will use this home profit system by this link......... http://www.startonlinejob.com

I believe the sad truth is that people don't particularly care about debt and deficit. It is too abstract, it has no obvious consequence to the average person, and every possible pullback is fought tooth and nail.

I don't believe this to get better, it will continue until something happens. Maybe we default? I don't know. But I just don't see people really giving a shit. The average voter only cares about it until anything related to them comes on the chopping block. There is no actual will.

As long as people keep buying bonds, the deficit and debt truly don't matter.

That's the shit of it. America's position as the global reserve currency underwrites the government's drunken sailor spending philosophy. The only reason America doesn't get its comeuppance is because all the other national governments are even worse at fiscal discipline.

We can all take some joy that we are not Japan.

BUCS will never forgive the Japanese for pixelating the genitals in their porns.

To be fair to BUCS, in the genres of porn that he enjoys that translates to about 75-80% pixels on any given image.

Their porn is super awful for many reasons, that being relatively low on the ladder. The worst thing is that they seemingly manufacture everything to make it feel like rape. I really, really dislike that a lot. Next is that Asian women are pretty eh to me.

Their porn is super awful for many reasons, that being relatively low on the ladder. The worst thing is that they seemingly manufacture everything to make it feel like rape. I really, really dislike that a lot.

You seem to be very knowledgeable on this subject. Do you have a newsletter I could subscribe to?

Just search for JAV. That's stuff actually produced in Japan. It's all super gross. Most porn fails my preference of having some sensuality in it, some romance, but Japanese porn is super obsessed with straight up debasement.

Unless long term interest rates go up from 2 percent to 8 percent or so. Then the budget pain really starts.

It will never be the single issue for a sizable group of voters. Medicare cuts, or seeing a military base close down, or losing government subsidies, those can be single issues that motivate voters against a politician. As is raising taxes, of course.

So the only hope is that some legislators commit to reducing the deficit as a matter of personal principle. In other words, brace for the eventual default.

The budget was the single issue for Perot voters like me. He got 19 million votes in 1992. I would call that a sizable group.

A bizarre fluke indeed. He has a pretty neat museum here in Dallas, too.

It is too abstract

Debt is a major problem until it gets to 10 trillion or so, then it becomes abstract and you don't have to worry about it anymore.

It's 2 major problems now than.

I dunno... I'm more of an optimist. In my personal experience (i.e. I don't have any statistics or facts to back this up), baby-boomers are generally much less fiscally responsible than folks in both older and younger demographics. Maybe because they were raised in an era of American financial dominance and seemingly endless growth. I think that as younger generations assume the reigns of power, there will be a slow and gradual reversal in spending trends. Or maybe we all end up as Chinese speaking, Wal-Mart employees/slaves.

I don't know what happens. In the end, the debt is part of the American government. It is probably not good if it defaults. But that doesn't remove everything else we have. It doesn't remove our industry, it doesn't remove Silicon Valley or our Film Industry. It doesn't remove our farmlands and the millions of people working all across the US.

What happens is that there is a default on a fiat currency that is already largely wishful thinking and poor impulse control. I don't think the results of that are good, but what exactly they are I don't know.

[stands, hums "America the Beautiful" as an eagle screeches overhead]

I learned my rhetoric style from Oliver Douglass on Green Acres.

"What happens is that there is a default on a fiat currency that is already largely wishful thinking and poor impulse control. "

you think we're gonna let let bitcoin be the least real money forever?

Or maybe we all end up as Chinese speaking, Wal-Mart employees/slaves

Pretty sure we'll nuke Beijing first.

I'm serious. What happens if we default? No one's positioned to come after us.

Who knows? As much as people bitch about us the world over I don't actually think that many Europeans want to follow China or Russia. And the EU is not a country, no matter how much they wish themselves to be.

The American people might come after the government. After all, they're essentially defaulting on us.

Probably foreign banks/states stop lending us money, hyperinflation, soaring crime rates, govt - such as it is - scares away foreign investors, at least that's what's happening in Venezuela.

But we have lots & lots of guns, so maybe the union falls apart, too.

OK, is there a down side?

What happens if we default? No one's positioned to come after us.

You can't default if you incur debt in your own currency.

So your question is more - what happens if no one needs/wants dollars to buy 'stuff' somewhere else in the world?

And the second you ask that question, the answer is - well that depends entirely on what IS going to be used to buy 'stuff' somewhere else in the world. Because at that moment we know exactly what (not really who) is positioned to come after us.

If the dollar collapses with no replacement, then you are simply saying there is no global trade anymore (or more accurately an 80% or so reduction).

If we defaulted we would certainly default on ourselves (Federal Reserve) , that is where most all the debt resides. So don't worry about taking the Chinese lessons.

But do take Chinese lessons because it's a cool language to learn.

They're reins of power, not reigns. When you reign you hold the reins of power.

"I believe the sad truth is that people don't particularly care about debt and deficit. It is too abstract, it has no obvious consequence to the average person, and every possible pullback is fought tooth and nail."

That's what I don't get about the average person. Most of us average people have at some point in our lives gotten into a bit of trouble with a credit card. So you went a little nuts one Christmas buying stuff for others and a bunch of stuff for yourself, then you maybe had a some unplanned car repair, a medical bill not covered by your insurance, etc. Next thing you know you are making barely the minimum monthly payment and getting socked with interest every month so that balance is stuck where it is?

Most people, even the idiots who vote democrat or republican, realize on some level that the answer isn't to just go out and spend some more and run that card up even higher, and then maybe call and plead for the card issuer to raise your credit limit because now you're getting hit with over-the-limit fees as well.

So what part do they not understand when it comes to government? It's still THEIR money (newsflash: politicians don't use their own salaries for spending); they have zero say on how their money is being spent, unlike with their own charge cards; and they will be on the hook for it, not the politicians, at some point. Do they really need a degree in economics to understand what a shitty deal that is and to start being genuinely angry about it?

I think it's just a matter of out of sight, out of mind. There is no consequence on their end to have debt pile up. But there is very possible consequence to them if spending is cut.

That's why I think the best hope if for simplification of systems, but even then the entrenched bureaucracy gets hit, and they are more powerful than people realize. Still, I can't imagine how much we could save on entitlements if we got rid of 90% of the infrastructure and just transferred lump sums to people who qualify. No bullshit, cut out all the tremendous systems required to administrate this bullshit.

Not a pure libertarian stance, and I'd prefer to just phase it out entirely, but I think it would probably be better than what we have now, and would treat people on welfare slightly more like adults responsible for their own lives.

There is no consequence on their end to have debt pile up.

It wasn't all that long ago that the big story was that the debt clock in NYC wasn't big enough to handle $10T. Now we're at $20T and what's happened? Well, what's happened is the stock market is at an all time high.

NO CONSEQUENCES

No one is going to give two shits about the debt until the system of fiat currency implodes. When that'll happen is anyone's guess.

"Still, I can't imagine how much we could save on entitlements if we got rid of 90% of the infrastructure and just transferred lump sums to people who qualify. No bullshit, cut out all the tremendous systems required to administrate this bullshit."

I used to think the same thing. Want to help someone on welfare, etc.? Just give them a lump sum! Sure, some will be broke again before too long, but you might also have the occasional oddball who goes and gets a technical degree or starts a business or something. Like you say, it's not particularly libertarian, but it might actually help, at least in some cases.

Then I realized there's a whole system, both public and semi-private (non-profits) built around CONTROLLING how those po' folk should spend that money they receive.

You can't go around handing out lump sum checks to po' folk because then -- God forbid -- some of them might start thinking for themselves instead of relying on their enlightened intellectual betters to help them with all those pesky life decisions. And next thing you know, you'd be out of your cushy government or foundation job, and you'd find your social work or public affairs degree isn't all that marketable in the private sector.

If you just hand out cash to the needy, how do the government administrators earn their pensions?

Well, that gets you probably 80% to the idea behind Universal Basic Income. The only extra step is cutting out the infrastructure and bureaucracy to find out who "qualifies" by just cutting everyone a check.

That said, if you look at the history of welfare in this country you'll see we (broadly speaking) went through such a period. Eventually the busy-bodies and moralists said "these poor people are spending it on women and booze! We have to control them!"

Paying people not to work is the surest way to make sure that no one does.

If we could get the MSM to kick over a corpse laying face down in the gutter and have them proclaim, "Well, we tried to help him out, but sometimes it just doesn't work. And now for the weather", I'd be half-willing to give it a chance. But we all know society will always be "responsible" for the irresponsible.

That's the ticket.

What you do is: Universal Basic Income, but then figure out the people who really need more help than that.

You get the best of both worlds: everyone on the dole, plus, for those special people/places/circumstances/deserving, people get more welfare and supplementary benefits, and the spending just goes higher and higher.

It's a win-win all around.

""So what part do they not understand when it comes to government? It's still THEIR money (newsflash: politicians don't use their own salaries for spending); ""

Question and answer.

They think it's the governments money, or someone else's, but not theirs. When they talk about a single payer health care system, which would be supported by taxes. They think it's free.

No, people don't give a shit. No matter what. You can explain to them that interest payments on the debt are about 7% of the total budget and will be up to about 10% in a couple of years. They don't care. Point out that for every $100 that they pay in taxes, that means they are paying $7 towards the debt. They don't care.

It's because the concept of paying it off is irrelevant to them. They know full damned well that the debt will still be there when they die... and many generations after that. So, fuck it. Print more money and buy more crap. There are no consequences to running up your credit card bill as long as you can open another credit card or loan to pay the minimum payments.

And, realistically, the minimum payment on the credit card is now greater than the amount we have left over from our income, after taxes, electric, water, rent. There's no way to pay off the credit card, at this point. So why deny ourselves cable and cell-phones on the ride down?

True, it is like they do not realize that if the debt continues to grow and grow the interest will eventually consume all of tax revenue. Head in sand syndrome.

Damn right, because I am retired and do not pay taxes anymore.

Send the bill to my grand kids.

Oh, wait. I don't have grand kids. Is that sticking it to the man?

That timely Dr. Evil reference is 2 legit 2 quit, Matt.

Yeah, it's almost like when Dick Cheney said "You know, Paul, Reagan proved that deficits don't matter", he wasn't joking.

If you thought that Republicans actually cared about deficits, rather then finding it a convenient talking point, that's your own fault. They told you and showed you how they really felt a long time ago.

Why blame "Republicans" for not caring about spending when the establishment Republicans all voted to cut $1.022 trillion in entitlement spending--and the Tea Party/libertarian types voted against those spending cuts?

Fiscal conservatism is as fiscal conservatism does, and Rand Paul and his merry band of five followers voted against the bill to cut $1.022 trillion in entitlement spending.

https://www.cbo.gov/publication/52849

I'm not blaming Republicans for anything.

I'm blaming anyone that bought their lies for being an idiot.

People buy the lies of politicians every time they vote.

The House Republican passed a bill to cut almost a $1 trillion in spending--over the objection of Democrats.

The Republican president promised to sign that bill, something his Democrat opponent would never have done.

The Republicans in the senate voted to cut $1.022 trillion in spending over the objections of the Democrats. The difference was that six ostensibly fiscally conservative libertarian/tea party Republicans (led by Rand Paul) voted against the bill--not because of what it did but because they wanted it to do more.

. . . and you think anyone who supports the establishment Republicans are idiots for thinking they're serious about fiscal conservatism?

Voting for Democrats if you're serious about fiscal conservatism is absurd. Voting for Rand Paul because you believe he's a fiscal conservative--after he voted against cutting $1.022 trillion from entitlement programs--is idiotic.

Voting for the establishment Republicans who voted to cut $1.022 trillion in entitlement spending because you think they might be fiscal conservatives isn't idiotic at all.

Republicans love debt more than Democrats do, you moron. Just look at this new tax bill or RTFA.

Democrats love big spending of course but they also are willing to pay for those programs by raising taxes.

Democrats gave us the welfare state and they never paid for it. Their tax increases just allow them to spend even more.

Cutting taxes is a constraint on future spending.

If you really want to cut spending, then voting to cut $1.022 trillion from entitlement spending is a good start. The Republicans went after that.

Rand Paul and his five followers voted with Bernie Sanders, Al Franken, and Liz Warren against cutting $1.022 trillion in entitlement spending.

Fiscal conservative is as fiscal conservative does. Cutting taxes so the government can't spend that revenue--isn't the same as spending more money. And if Rand Paul and his five merry men want to get back on board the Republican establishment with cutting Medicaid, all it takes is a phone call.

P.S. Tax cuts mean more money spent by individuals and businesses and less by government. That means more of the economy is governed by markets and less of it is subject to central planning.

P.P.S. This is a better response than you deserve, Shrike. I didn't realize it was even you until now. I usually ignore you because in addition to being a troll, you're also a fucking idiot.

Cutting taxes is a constraint on future spending.

That could be the case, but it could also mean a few different things. It could mean tax increases down the road. More likely it means continuing to add to our outstanding debts. Anyone who has looked at contingent liabilities going forward realizes my latter scenario is the much more likely outcome unless something majorly bad happens.

contingent liabilities

That should be unfunded liabilities.

We shouldn't spend less than we would otherwise through lower taxes now because it might increase spending and taxes in the future--that's a circular argument, is it not?

I favor lower taxes and lower spending both now and in the future, but cutting taxes now means we'll spend less in the future than we would have otherwise. Even if the government takes on more debt, that is not the same as taking on more spending--which increases the basis of our debt.

Incidentally, raising taxes so the government can comfortably spend more isn't the solution to inflation either. When we find ourselves in that part of the economic cycle, we should oppose tax hikes and stimulus.

We shouldn't spend less than we would otherwise through lower taxes now because it might increase spending and taxes in the future--that's a circular argument, is it not?

That would be circular reasoning, but that isn't what I was saying. I apologize if my post led you to believe that is what i was saying.

We should spend less at every given opportunity. But I just don't see any tangible evidence that tax cuts now lead to lower spending in the future. I don't see any reason the government will reduce our spending now or in any near-term future.

"But I just don't see any tangible evidence that tax cuts now lead to lower spending in the future."

It leads to lower spending--than there would be otherwise.

Maybe that's the part that's not getting across. We might spend more in absolute terms--if the government borrows more money and pays way more in interest. However, the government spends every penny it gets.

We haven't had a surplus for any length of time . . . ever. The government will spend every penny they get, no marginal propensity to save, but they can't spend what they can't get.

They can continue to float debt, but at reduced revenue streams on more debt, the market will ask for a higher yield (subject to pressure from other currencies). When the government needs to pay a higher yield than they would otherwise. Ultimately, there are two breaks on deficit: the voter's willingness to pay higher taxes and the willingness of investors to buy U.S. debt.

Yes, if the government can't raise taxes to get more revenue, they will turn to debt. And the more debt and dollars they flood the market with, OTBE, the higher the cost of financing NEW SPENDING! Being able to keep taxes high takes some brake off of new spending.

Short of the political will to restrict spending, tax cuts are the only way to put more break on new spending.

And think of the converse argument. Imagine that there is a fictional government that becomes so flush with cash that it decides not to spend it, but to pay off its debt instead. We've got all this extra money--but we're not going to spend it getting reelected! Oh no. We're just going to pay down our debt.

When Gingrich was elected in the wake of Perot's Reform movement, and Gingrich went on his budget cutting spree, interest rates were around 8% on the ten year treasury. Four times higher than they are now? That surplus lasted a minute or two. It was spent again as soon as somebody could think of something to spend it on.

Point being, there will never be a time when taxes are so high that we pay off our debt. That is a fantasy that will never happen. If you think that taxes being higher means that the government will spend less money, you're working on an assumption that have no basis in the real world. It simply doesn't happen.

They're going to spend every penny they get in taxes--plus whatever they can float as debt. We can't stop them from floating debt if that's what the market wants to buy, but we can cut off their ability to get their hands on our taxes.

Furthermore, when you cut into their tax revenue, it undermines their ability to finance more spending. The smaller the revenue stream relative to the size of the debt, the more the market will demand for new debt--more than they would otherwise. Therefore, cutting taxes necessarily and always means less spending in the future--not in absolute terms but less spending than there would have been otherwise.

Cutting taxes is a constraint on future spending.

False. Absolutely false, in fact.

Ronald Reagan's tax cutting was a constraint on future spending.

NOT

That 800 ship navy isn't going to pay for itself.

From the Washington Examiner:

Paul said he won't support the Senate Republican healthcare plan because it keeps too much of the Affordable Care Act and doesn't fix the main problem with the law that's causing it to go into a so-called "death spiral."

Paul said he couldn't support the Better Care Reconciliation Act because it doesn't repeal enough of Obamacare's taxes, mandates, and regulations. He added that Republicans who have written the bill haven't fixed the essential problem: Not enough healthy, young people are signing up for the exchanges to subsidize the sick and older people who need insurance.

"The Republican plan admits it will continue, it just says, 'Hey guys, we're going to subsidize it,'" he said.

Paul added, "This bill keeps most of the Obamacare taxes, keeps most of the regulations, keeps most of the mandates and creates something Republicans have never been for before and that's an insurance company bailout super fund."

CBO said it would only reduce the deficit by 321 billion dollars over 10 years.

Nice. Keep rooting for your Dog Shit team to triumph once and for all over the Cat Vomit team. And then keep wondering why nothing ever really improves when it comes to how terribly messed up government is and how the average IQ of the major party candidates seems to keep going down.

I suspect the buttplug your handle references is actually your own head. How about trying to actually read through some of these articles and learn, like I did years ago, that choosing between Rs and Ds is a fool's errand?

that choosing between Rs and Ds is a fool's errand?

I have no loyalty to either team since I generally vote libertarian or for gridlock. I do notice that our fiscal situation worsens when the GOP controls the government and that the last two Dem presidents actually lowered the deficits drastically.

And once again (as the article states) the GOP wants larger deficits.

Lowered it so much that he added more debt than all of his predecessors combined.

Lowered it so much that he added more debt than all of his predecessors combined.

And as you know he inherited the Bushpig's $1.2 trillion deficit. It is difficult to not add debt when handed record deficits and 750,000 job losses per month.

But even then, his deficit spending was higher on average than Bush's. This doesn't make Bush good, Bush was shit on spending. But also saying that Obama's deficit was less than the one generated by the singular event known as TARP is also dishonest.

The Bush 1.2 trillion dollar deficit was due mostly to the one time TARP bailout of 800 billion dollars (which I opposed). Instead of going back to pre-TARP spending levels, Obama took them as the new baseline.

The Bush 1.2 trillion dollar deficit was due mostly to the one time TARP bailout of 800 billion

No it was not.

The swamp votes overwhelmingly D-they know where their bread gets buttered.

Now pay your bet!

The "swamp"? Go back to polishing Trump's little penis at Bratfart.com.

Yeah-that's a rebuttal for what I said. It is what it is and the fact that that was what you yowled about shows how closely it hits home. Defend D.C corruptocrats all you like Shrike, but don't pretend that it is a libertarian position.

You didn't know? PB is the 'only true libertarian'. I mean, they say so themselves so it must be true.

Definitely not a full-throated lying Democrat operative though. Definitely not that.

No.

I think anyone that thinks that Republicans are serious about fiscal conservatism are idiots. Support is incidental.

Republicans are totally serious about fiscal conservatism, dude. Ask any of them next time the Democrats hold Congress.

Haha good comment.

On this we agree. There are way too many examples going back at least 30 or 40 years to ignore the trend. That said, they are a lesser evil than Democrats on the subject. Marginally, perhaps, but demonstrably.

I don't see how they are the lesser evil when they run up bigger deficits.

I don't see how they are the lesser evil when they run up bigger deficits.

Fair enough I guess, but with Democrat spending no amount of taxation would be enough. Fiscally I hate them both. Actually, in most other ways too. I used to think Republicans would leave me alone more, but that was before 9/11.

Maybe they voted against it because it didn't actually repeal Obamacare, which is the sole reason many of them got put in Office in the first place?

Yeah, so instead of getting rid of 95% of ObamaCare, they got rid of none of it?

Does not compute.

ObamaCare increased the Medicaid rolls by 11 million. Any "repeal" of ObamaCare that doesn't cut Medicaid is a false repeal.

Medicaid is a safety net for the needy. Obamacare (and Medicare) are socialist health care for the non-needy.

So you think that people could actually retire without Medicare? Most retirees are certainly needy when it comes to health care and could never afford market health insurance. They are not non-needy.

So you think that people could actually retire without Medicare? Most retirees are certainly needy when it comes to health care and could never afford market health insurance. They are not non-needy.

This is true, and it's why in any single-payer healthcare system they will be ignored. They use close to all the healthcare in America, and most of that is end-of-life. There is no way single-payer can pay for them. It's also true that the elderly, having lived a whole life, are far better off than 'the young' who are being asked to subsidize their care.

That, on the back of the certainly the next generation isn't likely to have it in anything like it's current form. Do you see the legislatures we've had for the past twenty years doing something about it soon, if even at all?

We're already broke today, I don't see it ending well.

So you're against cutting socialist programs?

We could do far better for our poor than a socialist healthcare program, and Medicaid is a big part of the socialist problem that's strangling our healthcare system.

It is not a mere coincidence that our healthcare problems got worse when ObamaCare added 11 million more people to the socialist Medicaid rolls.

Why is it hard to convince my fellow libertarians that the problem with our healthcare system is socialism?

Is it because you've been reading Suderman?

"By our estimate, a combination of tax cuts, sequester relief, and other changes would increase deficits to $1.05 trillion by 2019 and $1.1 trillion by 2020," the CRFB found (emphases in original).

The ObamaCare replacement bill that Rand Paul voted against would have cut $1.022 trillion in spending--$772 billion of it from Medicaid, an entitlement program.

https://www.cbo.gov/publication/52849

It's hard to take the deficit reduction criticism of the tax reform package seriously when it's coming from people who were also against the biggest cut to entitlement spending we're likely to see in our lifetimes.

Bob Corker, for instance, voted against cutting $1.022 trillion in the spending bill I linked above--and then voted against the tax reform package because it increased the deficit. What a jackass!

We should keep in mind, too, that limiting the government's access to tax revenue is effectively making it harder for them to spend more money. Certainly, the solution to drunken sailors spending all our money is not to give them more tax revenue to spend. In fact, the suggestion that drunken sailors will someday become so flush with tax revenue that they decide to cut spending is patently ridiculous.

If Prop 13 were repealed, Sacramento would not have used that money to balance the budget. They would have blown even more money on bullet trains and outrageous pension benefits for state employees. Prop 13, like other tax cuts, is therefore a limit on spending.

Ken, once again you're dumb to compare state governments to the federal government. The state governments have balanced budget constraints and cannot print their own currency. The federal government doesn't have to deal with these limitations.

I'm not arguing for tax increases, or even that the feds wouldn't react to tax increases by further increasing spending. I'm saying that it's beyond naive to think that they'll react to tax cuts by cutting spending in order to limit the deficit.

I was comparing the spending restriction ability of tax cuts.

California floats debt under the same constraints as the federal government. They may pay a slightly higher interest rate than the federal government for their inability to print money, but the interest rate the market charges California in a function of the size of their revenue stream--just like it is with the federal government. Do you imagine the interest rate on U.S.treasuries never rises because the federal government can print money?

California is facing a deficit, right now, and they'll make it up by floating debt and raising taxes, just like the federal government, and whatever spending and debt they can't finance because of political resistance to tax hikes or the higher interest rates the market charges them for their debt will necessarily come, first, from not spending as much money as they would otherwise--just like with the federal government. If it gets bad enough, they might even have to cut spending--just like the federal government.

If you don't understand that, after the third time it's been spelled out for you, then you're the one that's dumb.

The debt borrowing and money printing abilities of California and the federal government are not at all comparable just because you say so. Also, politicians react differently to tax increases (such as repealing Prop 13) than tax cuts. Tax increases make it easy to justify new spending because the tax increase itself is the politically costly/risky move. Tax cuts don't make it any politically easier to cut spending.

Please give an example at the federal level where the feds cut spending in reaction to tax cuts. Did it happen after JFK/LBJ cut taxes? Reagan? Bush II? None of the above.

Even if they got to a point where they had no other choice than to cut the deficit (which would probably be a pretty dire situation that I would like to avoid), why on Earth would you think their first choice to address that would be spending cuts rather than tax increases?

Please give an example at the federal level where the feds cut spending in reaction to tax cuts. Did it happen after JFK/LBJ cut taxes? Reagan? Bush II? None of the above.

Correct. Ken points out some voted down bill that would have cut over $1 trillion over time. That's nice, and it was good to see a little effort, but that is chump change compared to the massive hole we've dug for ourselves.

We won't ever see any real reductions in the outstanding debt (not the deficit) unless something horrible happens. Tax cuts by themselves almost certainly will not.

It wasn't chump change--it was the first time anyone would have cut Medicaid ever. It would have cut $772 billion from Medicaid directly. The reason it isn't more is because that bill Rand Paul voted against also cut the penal tax along with the individual mandate, cut the other taxes associated with the employer mandate, etc. too. Still, it cut spending more than taxes--along with a ton of regulation, as well. Cutting spending, taxes, and regulation--that's the very definition of making the government smaller.

Cutting $321 billion from the deficit isn't chump change either. That's a third of the way toward $1 trillion in new deficit this bunch is complaining about.

Regardless, I never said we'd only get lower spending through tax cuts or that cutting taxes was the only way to reduce spending. Tax cuts just mean the government will spend less than it would have otherwise. To cut spending in absolute terms requires actually cutting spending.

Rand Paul and his five cohorts voted against cutting $1.022 trillion in spending and $321 billion from the deficit. If you want to complain about people who refuse to cut spending, blame them. The rest of the Republican establishment voted for those spending cuts.

It isn't chump change in aggregate, but it is chump change relative to our current and future financial position in regards to unfunded liabilities. We're going to have to do a lot more than that for future interest rate hikes to not have an enormous detrimental effect on our budgets.

I agree with you, that that bill would have absolutely been better than nothing. There is no debating that. But really to get out of this mess we are going to have to look some extremely difficult policies.

Where I disagree is your assertion that tax cuts mean that the government spends less than it normally would have. I haven't seen any direct evidence to that idea. Tax cuts are easy and politically popular. Really reducing spending across the board isn't, and the government doesn't really have any political incentive to reduce spending.

I would be glad to be proven wrong though. Can you tangibly show me where these tax cuts will lead to the government spending less?

And the health care bill only reduced the deficit by 321 billion dollars over 10 years (32 billion a year, whoopee), according to the CBO, and kept most of Obamacare. It would have been a major defeat. (Though maybe not as bad as the defeat of doing nothing turned out to be.)

When you say it "kept most of ObamaCare", what do you mean?

It got rid of the individual mandate and the penaltax.

It got rid of the employer mandate.

It got rid of the subsidies.

It cut $1.022 trillion in spending, $772 billion of it from Medicaid--a socialist entitlement program.

The reason it got rid of "only" $321 billion in deficit is because it got rid of the stupid taxes in ObmaCare, the penaltax, the medical device tax, etc., etc.

It didn't keep most of ObamaCare. It got rid of almost all of ObamaCare.

Am I to understand that you're against cutting spending because it's only $321 billion in deficit reduction? Is that what you're saying?

Are you against making the government smaller by getting rid of 95% of ObamaCare, cutting $1.022 trillion in spending, and cutting $701 billion in taxes because it only results in $321 billion in deficit reduction?

Are you a libertarian?

Because making the government smaller by cutting regulation, spending, and taxes is what I mean when I say I'm a small government libertarian.

Because guaranteed issue and community rating were left in place and Paul clearly said he had a problem with a death spiral, which was left in place under the Republican plan.

We've talked about this.

That is not keeping "most of ObamaCare".

And we certainly aren't better keeping 100% of ObamaCare because that little piece of it stays.

If Rand Paul voted against cutting $1.022 trillion from entitlement spending, eliminating the individual mandate, and eliminating the employer mandate--because of that--then he's a buffoon.

Keeping most of ObamaCare or not, it's leaving in place a socially and politically destructive force on purpose. Maybe Republicans should be punished, although we both know they never had the votes to keep that promise. It's been posturing since they failed to get enough of the Senate.

What's so sad is that it's a foregone conclusion that Democrats can't recognize what they've done and try to help fix their mess. I blame them both, though, far less than I blame Paul. Not that it matters, he's not going to win the Presidency this next time around and neither of us live in Kentucky.

*Since they failed to get enough seats in Congress and the Senate, I should say.

*Sheesh, I'm getting off. I can't type. I blame Paul less than Democrats and Republicans in general.

"The debt borrowing and money printing abilities of California and the federal government are not at all comparable just because you say so."

I never said the money printing abilities of California and the federal government were comparable.

That's something you made up in your head while you were calling other people "dumb".

Fine then, at a minimum you're ignoring the importance of the difference when it comes to the ability of a government to run large, long-term fiscal deficits. I never claimed that was the only difference between the two before you respond with that.

I was comparing the spending restriction ability of tax cuts.

But since this doesn't exist...then?

Yeah, my analysis of federal spending and borrowing shows that taxes have been cut several times, but the last time spending was cut was in 1801.

No, I mean even if taxes were zero the government could literally create money to spend. Sure, it would be a giant disaster but inherently Ken's statement is blatantly false. Tax cuts can not inhibit spending as a basic function of our system of currency.

God bless Iowahawk.

Crusty hit hardest.

Don't worry: once you factor in inflation, everything is awesome.

Prepare your nuts for some gentle caressing.

Ex-cop Michael Slager sentenced to 20 years for shooting death of Walter Scott

I love how they never fail to repeat that he is a former cop and not currently a cop.

I'm angry because this contradicts my previous statements that nothing ever happens to these cops.

It's still absurd that he got a mistrial in his state trial. He shot an unarmed guy running away in the back, tried to cover it up, and there was video of it. And yet 1 asshole in the jury refused to convict - whether that was because of cop worship, racism, general assholery, or some combination thereof (probably the most likely scenario), I'm not sure.

I don't know. He was essentially be tried twice for the same crime. The outcome was probably just but I don't like using multiple jurisdictions to skirt double jeopardy restrictions. If they can use it against killer cops, they can use it against you. And all levels of prosecutors have unlimited funds. You don't.

Unless I'm misunderstanding, it went higher as a Federal Civil Rights Violation (Which we can probably discuss entirely on it's own) and the defendent pled guilty to that charge.

THEN the judge further ruled he committed Second Degree murder. After already being acquitted for murder at the lower level. Beyond the fact that this not having a jury is suspicious, I agree that trying multiple times in different jurisdictions is very suspect indeed.

So is a cop being acquitted of murder with video evidence of said cop shooting a man in the back while he was running away.

And I will side with you on this. It's certainly not something to cry over. I have no love for cops in general, murderers even less, and those who abuse their power least of all. But that still doesn't mean that Fist's concern that precedent set here and now is precedent that can be abused later any less valid.

If the precedent mostly applies to cops and if cops will no longer feel like they'll be protected by their buddies in the local court system, that's a good precedent in my eyes.

And you have no evidence whatsoever that the precedent will only or even mostly apply to cops. In fact, everything we know about the system shows the opposite. Like how tactics of asset forfeiture was originally done to fight organized crime, but quickly became a way to fuck people with consequence.

I don't know what country you live in, but in the USA, where I live, precedence set is precedence abused; whatever is used against your opponent today will be used against you tomorrow, bank on it.

"...shooting a man in the back while he was running away."

Dammit, Jim -- he was a cop, not Jesse Owens!

If you expected him to be able to run more than 12 feet to perform his job without risking a coronary, then you shouldn't have paid for all those delicious donuts with ticket-writing quotas and civil asset forfeiture.

As I said below, he was not acquitted of the murder charge. It was a mistrial with a deadlocked jury that could not return a verdict. He was set to be retried before he plead guilty to the federal charges.

Here is where I am ignorant. Do mistrials often lead to trials occurring at a higher level? If a case keeps leading to mistrial does that mean they can keep doing trials in different jurisdiction until some result is reached?

Mistrial usually results in either another trial or the prosecution deciding not to retry. There usually is not the state/federal dynamic, that was a part of this case because Slater was a cop and thus had crimes that could be tried at the federal level.

He was indicted on federal charges before the state trial even started. And the state was going to have another trial to resolve the prior mistrial, until Slater plead guilty to the federal charges.

I'm not a huge fan of trying at the state and federal level for reasons discussed here. That said, Slater was not free on grounds of double jeopardy even if the feds weren't involved. He would have had another state trial, and it was 11-1 in favor of conviction the previous time. Also, if there was a rule that you could only be tried at one level, I'm sure the feds (under Obama at least) would have stepped in and made sure they were the ones who got to try him.

So he "should" have only been sentenced to 10 years (for the civil rights violation), but he got 20 years (for murder), when he should have got life without parole for the murder.

He was essentially be tried twice for the same crime.

Which was caught unambiguously on video. I'm not going too upset about it.

He wasn't acquitted, it was a mistrial. He was set to be tried again at the state level until he plead guilty to the federal charges.

There has been only one serious attempt to address the debt/tax issue - Simpson-Bowles (which Obama heartily supported) and the Tea Party assholes helped kill that (along with progressive assholes).

The plan released on December 1, 2010, fell short of a supermajority on December 3, with 11 of 18 votes in favor,[3] Voting for the report were Bowles, Coburn, Conrad, Crapo, Cote, Durbin, Fudge, Gregg, Rivlin, Simpson, and Spratt. Voting against were Baucus, Becerra, Camp, Hensarling, Ryan, Schakowsky and Stern.

Wikipedia

If barry had accepted the house budget from 2014 that would have put us in a path towards balance. Barry never submitted a plan that would balance the budget even at an infinite future date. Not once.

He could have also kept his promise to pull out of expensive foreign quagmires instead of doubling down on them and bombing the crap out of even more brown people at weddings. That might have saved a few billion.

He could made good on his criticisms of his predecessor's domestic surveillance apparatus by putting an end to it and shutting down all those alphabet soup agencies with nothing better to do than read people's emails and listen in on their phone sex. That might have cut another few billion. But noooo, better to ramp that up even more!

But hey, what's a few billion, or even a few hundred billion, between your politican and cronie friends, amirite? Especially when it belongs not to you but to those plebes you and your people have power over?

Barak never met a dollar he didn't want to spend.

Barak never met someoneelse's dollar he didn't want to spend.

FIFY

Correction accepted, lol

Well hollleeee shit, the cockroaches are scattering under the glare of the kitchen light.

Good people in the media are getting hurt!

We're disarming ourselves!

This reminds me of that article defending Franken the other day. It was basically "Yes, he did it. But he's OURGUY"

This reminds me of that article defending Roy Moore the other day. It was basically "Yes, he did it. But he's OURGUY"

Both sides now and always.

This article was much more specific.

This one was pretty much, "Progressive ladies, if you get molested by a democrat, shut up and take one for the team."

Or, in short, we must excuse sexual impropriety in order to punish sexual impropriety!

It is impossible to lampoon someone like that.

A dude was fired from a prominent position because of beliefs he privately held, which were only betrayed by someone digging up a relatively small donation he made.

It's a circular firing squad. They've got each other surrounded.

Imagine how bad the deficits will get when the next recession hits and/or when interest rates rise.

Irrelevant compared to the unfunded liability of the welfare state.

???

It seems exactly related to it.

It is.

Leave it to you to make a semantic argument.

They are related but it's panicking over a leak in your sink while your home is being flooded by a raging river.

If you can't control spending, than there is no way to 'fix' the problem at all. Deficits will necessarily go up, as there is a finite amount of money you can remove from the economy through taxation but no functional limit on how much you're spending.

Unfunded liabilities are so far outside of the conversation that it makes the conversation that is occurring look like a joke.

This seems to be an impossible concept to grasp for most people. And for buttplug.

In fairness, most people have not actually taken an economics class.

And in most of the economics classes, the professor doesn't laugh out loud when he reads Keynes' theories.

Fortunately my economics professor was not a fan of that bastard.

Recessions are nothing compared to the 100TT in unfunded liabilities. It isn't the dip in revenues that are the problem, it is the increase in spending. The only one of the two items he listed that sorta does that is rising interest rates, and given that the fed has demonstrated plenty of "accommodation" over the last ~15 years and that inflation actually helps monetize the debt, where do you think that merry-go-round is going to end up?

That doesn't make them unrelated though. Spending and Income are related, even if the bigger problem is how much one is spending.

As BYODB pointed out, you can always spend more than you take in if you're sovereign. Revenue has never solved the deficit, only spending restraint. A recession here or there won't matter over the long run unless they turn into the socialist utopia that anal blockage dreams off. Interest rates also won't matter because the fed will just accommodate them away. And if interest rates were to be allowed to float and matter then they would actually result in spending restraint. Again, it all comes down to the spending and more specifically the mandatory spending of the welfare state.

Spending and income are related for normal entities, but not for the Federal Government. It's bizarre and counter-intuitive, but frankly that's why it was designed the way it was. It's a vast Rube-Goldberg machine that pretends infinite money is possible. And in truth money is infinite but in this type of scenario what actually happens is that the currency loses value which is more or less what the plan appears to be. Devalue the currency which 'reduces' the debt as well as all Americans savings.

They try to shore that up by moving production oversea's for cheaper domestic goods, but there is a logical limit to how long that will work.

I'm not smart enough to lay it out better than that off-hand, but that's the short and very likely incorrect in some parts version.

Relax, I wasn't making an argument about the structural or long-term causes of the deficit. I was just making light of how (potential) near-future events like a recession or interest rate increases would cause even a $1 trillion deficit to look small. Unless you think the feds will actually cut spending in reaction to those events.

Recession no, but a sustained interest rate hike would probably cause some restraint eventually. But that assumes that the fed would allow rates to get that high for long enough that the weighted debt yield reflected those rates. It's more likely that they would just allow more inflation (the sign of a healthy economy, you know) which would screw everyone without ascribable blame. That's the almost guaranteed scenario now.

Interest rate hikes could cause spending restraint at some point depending on how the feds react. But they would not resolve it immediately, thus there would be sky high deficits at least until some action to alleviate it was taken.

I think they would prefer inflation to the alternatives, but I assume they'll try to solve it (and inevitably fail) with tax increases before that.

It's more likely that they would just allow more inflation (the sign of a healthy economy, you know) which would screw everyone without ascribable blame. That's the almost guaranteed scenario now.

Pretty much this, which is why most of the advice I've been hearing seems to be 'own assets' like property or commodities. You can't devalue a tangible asset nearly as easily as you can devalue a currency.

I would not put all my eggs in commodities (or property), there's a lot of volatility, and in the long-term I think the stock market with hedges in those sort of asset classes is still the best option. If the long-term stock market goes to shit there's probably bigger things to worry about.

Inflation can increase asset prices along the way. Real return is another question, but even just matching inflation in high inflation times is undoubtedly far better than holding cash. Outside of the oil crisis years of 73 and 74 that had large negative returns, the stock market tended to outperform inflation even during the high inflation years of the 70s and early 80s. Even with those two years, the S&P 500 had a 8.5% annual return from 1970-1980, while inflation was 8%. And if you look at the longer-term picture, the real return was much better. Gold had a great return in the 70s, much better than the stock market, but it had a negative (nominal) return in the 25 year period between 1980-2005. And after the surge in the late 2000s and early 2010s, it's lost over 20% of its value in the last 5 years.

I do keep a portion of my portfolio invested in commodities, but there's too much volatility and unpredictability to make it the basis of it. Stocks aren't immune to that by any means, but in the long-term they've been much less volatile and more predictable, and in the short-term you can use hedges and diversification in fixed income and other classes to account for that.

Sorry, I wasn't trying to say put all your eggs in one basket I mean one should invest at least partially in things that will retain their value regardless of the value of the dollar, whatever that might be.

That's super common advice though, even if it's usually sold as a hedge against market volatility as opposed to currency issues (although it works for both), so you might have thought I was being more specific which I could totally understand.

Yeah I get what you're saying, I think I did take it more specifically than you meant it.

when interest rates rise

This is going to be the thing, because it's coming.

Oh, relax. Just like student loans, I'm sure the government will bail them out.

From Michael Tanner, CATO:

Start with the debt. It is wonderful that Democrats, who previously considered the national debt somewhere below lawn mold on their list of priorities, have now been reborn as deficit hawks. And there is reason to be concerned that the tax bill will add to the debt.

But to keep things in perspective: Under current law, the federal government is expected to collect $43 trillion in taxes over the next ten years, while spending $53 trillion. That will increase the national debt to $30 trillion by 2028. If this tax bill passes, the federal government will collect $42 trillion in taxes over the next ten years, while spending $53 trillion. That will increase the national debt to $31 trillion by 2028.

Worse? Absolutely, like a drunk asking for one more drink.

But it would be nice if everyone got this worked up about the first $30 trillion.

In fact, even after this tax cut, the federal government will be collecting 17.6 percent of GDP in taxes, more than the post-war average of 17.4 percent. The problem is that we will be spending 22.2 percent of GDP, considerably more than the 20.3 percent that we've averaged since World War II.

We don't tax too little ? we spend too much.

We don't tax too little ? we spend too much.

Yep. Darn accurate stuff. Notably no Democrat would vote for a spending reduction, and it's clear neither will Republicans, so it's a moot point. The deficit will go up no matter what, they're just arguing on Massive Scale A or Massive Scale B. They're not even talking about a non-massive scale at all.

Coming on the heels of the debt-doubling during the presidency of George W. Bush, which candidate Barack Obama in 2008 characterized as "unpatriotic"...

What he meant to call it was "child's play. Watch this."

The president himself acknowledged the problem, predicting in a major 2011 speech that the debt "has grown so large that we could do real damage to the economy if we don't begin a process now to get our fiscal house in order."

And that process was to continue to increase federal spending without end, and then cut taxes?

You see, it was George Bush's fault that Obama was a fan of Keyes.

You can't do anything to the deficit unless you do something about entitlement spending, and anyone who suggests that will be derided by both parties as "killing grandmas".

Half the country thinks the 50-70% of the budget is on defense and fighting wars. That prompts people to say "less bombs, more books". Unless people are informed about spending, nothing will change.

You can't do anything to the deficit unless you do something about entitlement spending, and anyone who suggests that will be derided by both parties as "killing grandmas".

Half the country thinks the 50-70% of the budget is on defense and fighting wars. That prompts people to say "less bombs, more books". Unless people are informed about spending, nothing will change.

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,..... http://www.startonlinejob.com

There is always bi partisan agreement to spend more. More than the rate of inflation, more than the rate of population growth. The only debate is over whose favored groups get the money.

The best part is that of the $10 trillion obutthead added to THEIR debt (not mine), we have ABSOLUTELY NOTHING to show for it, NOTHING. He fuc*ed America good. How can one person spend/waste that kind of money and have nothing to show for it?

Maybe we'll finally get Hillary in 2020 and then Reason can forget about deficits again.

I have received $18234 in one month by working online from home. I am very happy thay i found this job and now i am able to earn more dollars online which is better than my regular office job ABe. Everybody can get this job and earn more income online by just follow this link and instructions there to get started.......... http://www.startonlinejob.com