Who's Ready for Some Trillion-Dollar Republican Deficits?

Fiscal hawks, from their perch in the wilderness, predict we may again see 13-digit deficits as soon as next year

From 2009 to 2012, the federal government of the United States ran an annual deficit north of $1 trillion. The figure was shocking—Washington didn't get around to spending $1 trillion in a year total (in 2009 dollars) until 1975. Coming on the heels of the debt-doubling during the presidency of George W. Bush, which candidate Barack Obama in 2008 characterized as "unpatriotic," the new recession/bailouts/stimulus deficit-spending triggered a stampede of national anxiety.

The Tea Party arose in 2009 partly in revulsion at the Bush/Obama binge. Joint Chiefs of Staff Chairman Adm. Michael Mullen famously warned CNN in 2010 that, "The most significant threat to our national security is our debt." The president himself acknowledged the problem, predicting in a major 2011 speech that the debt "has grown so large that we could do real damage to the economy if we don't begin a process now to get our fiscal house in order." After the passage of the Affordable Care Act, the main topic of American politics was the long-term debt and the short-term trillion-dollar deficits exacerbating the problem.

And now, after another Obama-era doubling of the debt, and the successful removal of Democrats from federal power, Republicans are ushering in a new era of…would you believe trillion-dollar deficits?

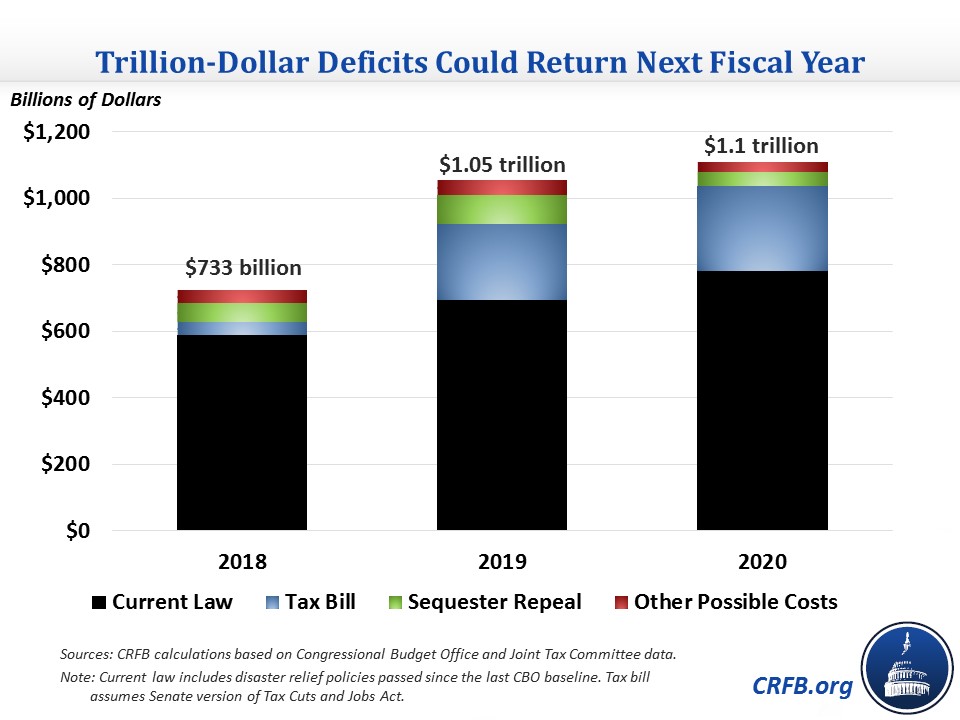

That's what the grumps over at the Committee for a Responsible Federal Budget (CRFB) are saying today. "By our estimate, a combination of tax cuts, sequester relief, and other changes would increase deficits to $1.05 trillion by 2019 and $1.1 trillion by 2020," the CRFB found (emphases in original). "Tax cuts and sequester relief alone would be enough to bring back trillion-dollar deficits by 2019, and tax cuts by themselves would bring them back by 2020." More, from the organization's press release:

"As we wrap up 2017, the last thing we need is for Congress to go on a tax cutting and spending spree with the national credit card," said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. "It's like Santa Claus in reverse – parents and grandparents spending on themselves and handing the bill to their children and grandchildren."

"If Congress doesn't get its act together soon, we will end up with trillion-dollar deficits in the next few years," MacGuineas continued, "and debt as a share of the economy will be as high as it has ever been in U.S. history."

December in contemporary Washington, alas, is not a time for getting acts together, but rather smashing together the annual cromnibus/continuing resolution/debt ceiling monstrosity, which is more indigestible than Aunt Ruthie's fruitcake at a cajillion times the cost. We are poised to re-climb that trillion-dollar debt summit, only this time without the excuse of a preceding financial crash.

That this is happening with Republicans firmly in charge of Washington should surprise no one who has been paying attention. As I recounted in my December-issue column, the GOP's governing debt milestones come so quick it's hard to keep track:

On September 6, in the wake of Hurricane Harvey (Irma and Maria had not yet hit), only three members of the House of Representatives—Justin Amash (R–Mich.), Andy Biggs (R–Ariz.), and Thomas Massie (R–Ky.)—voted against spending $8 billion on hurricane victims because the bill did not include offsetting cuts. That compares to the 179 Republicans and one Democrat who voted against a $60 billion aid package after Superstorm Sandy back in January 2013.

On September 8, Trump signed into law a deal he forged with Democratic congressional leaders to raise the debt ceiling from $19.84 trillion to $20.16 trillion.

On the grim anniversary day of September 11, the nation's debt clock crossed the ominous $20 trillion threshold. Most economists agree that growth becomes dampened after a country's ratio of debt to gross domestic product creeps higher than 90 percent; we've been north of 100 percent for some time now, and the Congressional Budget Office estimates that we are on pace to soon break the all-time record set at the height of World War II.

On September 18, the Senate passed the $700 billion National Defense Authorization Act, showering more money on the military than even the pro-buildup president had sought. "It's a grandiose spending plan," Sen. Dick Durbin (D–Ill.) observed to The New York Times.

Conclusion?

Let us stop pretending to know Republicans by the words they speak while in the opposition. When the GOP holds power, what matters is its fruits.

And they're rotten.

Show Comments (184)