Taxing Human Waste Won't Get Chicago's Pension Fund Out of Deep Doo-Doo

Residents of the city will pay $57 annually as part of a rescue plan that hinges on several questionable assumptions.

Residents of Chicago already pay for water and sewer services—like anyone else does.

Starting next year, though, they'll be paying an extra 30 percent for the privilege of having indoor plumbing.

Draining those dollars out of resident's wallets isn't a response to a sudden increase in the price of water and won't pay for upgrades to the city's sewers. In fact, not a single dollar of revenue from the new tax will be spent on any aspect of Chicago's public infrastructure.

What it will do—maybe—is shore up a municipal employee pension system that's woefully underfunded and in danger of going bankrupt within the next few years. Right now, the Municipal Employees' Annuity and Benefit Fund of Chicago has only enough assets to cover 32 cents of every dollar owed to retirees and current employees. Since the Illinois Supreme Court ruled in March that retirement benefits are sacrosanct and cannot be reduced, Chicago is left with only one option: find a way to pay for promises that probably never should have been made in the first place.

Mayor Rahm Emanuel pushed the tax through the city council with the promise that it would, within 50 years, close the pension plan's deficit. It's going to cost the average Chicago household about $53 in 2017, but will increase over the next four years.

"Chicago's pension funds are now off the road to bankruptcy and on the path to solvency," Emanuel declared last week after the city council approved the new tax.

Before getting into how the money will be spent and whether it will do what Emanuel says, you have to understand how the city got into this mess in the first place.

The short answer: lots of bad decisions made over many years.

The longer answer requires a bit of math, but I've tried to simplify things as much as possible.

Chicago finds itself here because the city has failed to adequately fund the cost of its municipal pension plan. Going back to at least 2006, Chicago has never come close to fully funding its annual pension obligation—in most years, it hasn't even put in half of what would be required to keep the fund stable.

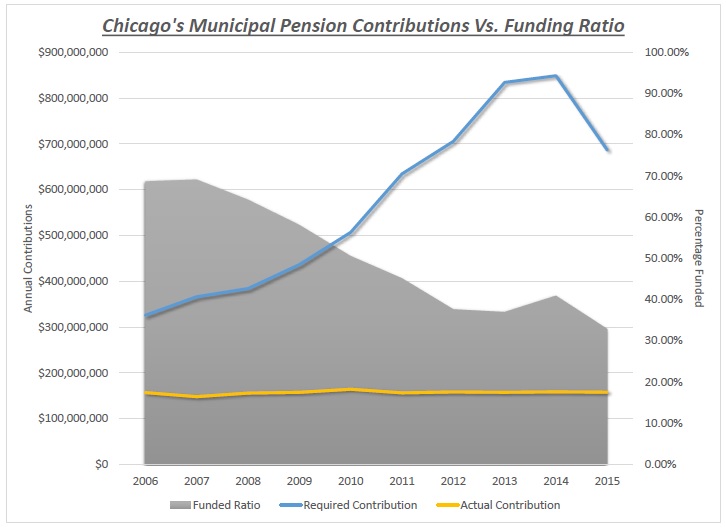

Here's what that looks like. The blue line on the chart below is called the ADT—that's the amount of money the actuaries say the city should be putting into the fund each year. It's based on a lot of different factors, including investment performance, benefits due to retirees and benefits promised to current employees who will one day retire and have to be paid.

If anything, the blue line represents the bare minimum that a city should be paying into the pension fund each year to keep up with its long-term obligations. It's the mortgage bill.

The yellow line represents how much money Chicago has actually put into the pension fund each year. As you can see, the gap is huge.

The big grey wall in the background represents the level to which the pension system is funded. A system funded at 100 percent has all the money necessary to pay for the retirement benefits promised to all current employees and living beneficiaries. Chicago isn't even close to being able to do that.

It's not hard to see the relationship between the contributions and the funding level. There are other factors that affect the funding level—like investment returns—so it's not exactly that straightforward, but there's no doubt that failing to meet your annual obligations results in larger future obligations and a retirement system that is less well funded than it ought to be.

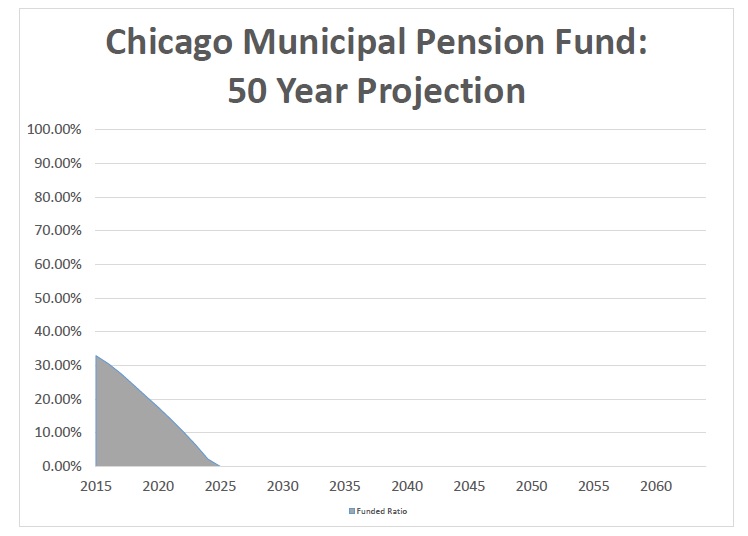

If you enjoy gallows humor, you might get a laugh out of the MEABF's 50-year projection. This is something the fund is required by law to produce each year, but last year it was actually more of a nine-year projection because the fund is on pace to be completely out of money by 2025. (If you want to see this spelled out in black and white, it's on page 48 of the fund's 2015 annual report.)

As you can see, the system isn't going to pull out of this funding nosedive anytime soon—and the ground is getting close.

City officials say the new tax on water and sewer service will refill the pension fund to 90 percent within 50 years. Instead of running out of money in the mid-2020s, the extra revenue will keep the retirement plan running for future generations. Whether that's worth $53 per year to you probably depends on whether you're someone who is only paying the tax or someone who is both paying the tax and getting a pension from the city (or hoping to get a pension from the city in the future).

Either way, it's important to note the many ways in which that claim is based on questionable assumptions.

None of those assumption are bigger than the 7.5 percent annual rate of return—known in pension parlance as the "discount rate"—that's baked into the system. The influx of new tax revenue will only get the pension plan back to 90 percent funded if the plan earns at least 7.5 percent every year for the next 50 years, says Jesse Hathaway, a research fellow at the Heartland Institute who has been tracking Chicago's pension problems.

When the returns are short of expectations, even a good year can turn bad.

During 2015, the fund realized a 6.8 percent return on investment. That's not bad—actually, it's pretty good in a year when the S&P 500 Index dropped by about 2 percent and more than 70 percent of investors lost money—but because of the unrealistic expectations, the fund actually finished the year $30 million deeper in the red.

Over the past 10 years, the Chicago municipal pension system has earned an average return of 4.6 percent. That's nothing to sneeze at, of course, but it's also not good enough to meet the expectations that form the basis of all the system's long-term projections. Achieving 7.5 percent isn't impossible—the fund returned 11 percent in 2013 and 9.3 percent in 2014, for example—but growing at that rate for half of a century seems like a bit of a stretch.

"If they get anything short of that 7.5 percent rate, they're not going to hit their numbers. If that happens, they're going to have to go back to the taxpayers and say 'we need more money,'" Hathaway said in an interview this week with Reason.

That's not the only rosy assumption built into Chicago's projections for the new tax.

Remember the first chart—the one with the lines showing how much money the city's accountants said should be contributed over the past decade versus how much the city's elected officials actually paid?

The reason for that gap is almost entirely political. Elected officials don't score points for adequately funding a pension system because every dollar spent on pensions is a dollar that can't be spent on higher profile things like schools, cops or tax breaks for Donald Trump. There's no ribbon-cuttings and no giant checks, no press conferences and no photo ops.

On the flip side, there's no political pain from underfunding pensions. Even now, when the pension system is less than a decade from running out of money, it's a problem that can be pushed off to next year or after the next election. Try taking a few million dollars out of the school budget or the police budget to fund the pension system and see how quickly the political consequences set in. In this environment, politicans do what comes naturally and take the path of least resistance. Unfortunately, they've run out of road to kick the can down.

Getting back to being 90 percent funded would require 50 years' of discipline on the part of Chicago's budget-makers. Do they have what it takes? History suggests they probably don't.

In the most optimistic scenario—one in which city officials overcome the political incentives to shortchange the pension funds, somehow find a way to pay for everything else while making those massive annual contributions and manage to avoid a serious economic recession for the next five decades—Chicago residents are looking at the prospect of paying this extra water and sewer tax until today's high schoolers are getting ready to retire.

Withdraw any of those rosy assumptions and the tax will do little more than postpone the inevitable collapse.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Lie in the bed you made, Illinois voters! (Just hoping those of us in other states don't have to pay for your generosity toward your public "servants" - many of us have our own ludicrous pension plans for our "servants.")

You do mean "Chicago" right? I wasn't aware I got to vote in elections in a city I do not live in...

The ruling that the city couldn't get out of pension obligations was from an Illinois court.

Start working at home with Google! It's by-far the best job I've had. Last Wednesday I got a brand new BMW since getting a check for $6474 this - 4 weeks past. I began this 8-months ago and immediately was bringing home at least $77 per hour. I work through this link, go to tech tab for work detail,,,,,,,

------------------>>> http://www.highpay90.com

Yes. The great thing about these states instituting these schemes is that the tax bill always comes due.

The states that do not flush their money down the toilet need to fight any attempt for fed money to bail these schemes out.

My best friend's sister makes $89 an hour on the internet . She has been out of a job for six months but last month her check was $14750 just working on the internet for a few hours. Go this website and click tech tab to start your work... Now this website... http://goo.gl/bvaZx7

Residents of Chicago already pay for water and sewer services?like anyone else does.

Well water and a septic tank here. Not everyone is your fancy urban-dwelling fancypants. When will you elitists get that there's a whole other America on the other side of the suburbs?

I live in Hampton Roads, homie. On the other side of the suburb, there's another city.

You know, I use that term, but I really don't like it.

Oh, a "Tidewater" guy, huh? Or are you one of those weirdos that refers to places by their actual names?

Or are you one of those weirdos that refers to places by their actual names?

Everywhere except P-Town.

Lived there for seven years while my father was at Langley. God I hate humidity.

Taxing human waste????

You mean the police and teachers are going to pay higher taxes? I don't believe it.

There will absolutely be a proposal to bail out the Chicago pension fund with federal money.

Here's hoping the reaction in the rest of the country involves tar, feather, rails, pitchforks, and torches.

Don't forget the woodchippers...or have we moved on from that?

And the stock market bubble hasn't even popped yet.

Chicago is left with only one option: find a way to pay for promises that probably never should have been made in the first place.

The Mayor just announced hiring of 1,000 more cops. Nobody asked where the money comes from.

I expect the murder rate to increase.

I expect the murder rate to increase.

Probably not, people killed by cops don't contribute to the statistic.

3,000 people have already been shot this year. You don't have to worry about police shootings, they won't due their job anymore. I don't blame them. It's a sign of the times

I have to admit, that "fifty-year" projection cracked me up.

Agreed, I heartily nominate it for Reason's Infographic-Of-the-Year Award.

Starting next year, though, they'll be paying an extra 30 percent for the privilege of having indoor plumbing.

I have a cunning plan....

The shit, indeed, is hitting the fan.

Reason has had a few articles such as these, as well as the Federal level one. I just don't think people realize that the ALL the ponzi schemes are due for collapse - Federal, State, County, Municipal, and "special" units. The Federal level ALONE is more than individual wealth, presuming the Feds endeavor to come even close to making good in their multi-decade promises. We're not talking some nips and tucks, a boost in co-pays, and productivity growth, we're talking about HUGE economic catastrophe and the use of Force that would make a Nazi blush. To put it in very brief, but long view terms - Jefferson said that a society needs revolution every 75 years - presumably to clear out the leeches. Well, we were due for one circa 1930, but the people were bought off with smoke and mirrors. Now it's another ~75 years since. Ponzi's and smoke and mirrors are coming to an end, there's no place to turn. Hopefully we can use Venezuela as a lower boundary of what to expect. But I wouldn't hold our collective breaths.

I'm thinking medieval England as a lower boundary.

I expect the rat population to increase.

Oh wait, I already said 1,000 cops are being hired.

Since the Illinois Supreme Court ruled in March that retirement benefits are sacrosanct and cannot be reduced,

I would think a good lawyer would know how to defeat this.

The 7.5% return isn't realistic and it isn't specified in the IL Constitution, so it certainly can't be sacrosanct. If the rate of return was a more realistic 4%, the pensions would be 90% funded and there wouldn't be a crisis.

Why not make the expected return 12% and declare martial law because the rate is sacrosanct?

Don't think it works the way you think.

Lowering the discount rate would decrease the funding level and increase the unfunded liability. Most governments use a 7% discount rate for their pensions.

The Government Accounting Standards Board just mandated that new financials include the pension liability at a 1% increase and decrease from the discount rate currently used. Chicago's financials come out in March so they will have to report this difference and now their unfunded liability will also have to be reported as a liability, so their balance sheet won't look pretty.

City officials say the new tax on water and sewer service will refill the pension fund to 90 percent within 50 years.

Multiplier, biotches! Ah, I fondly recall Obama bragging about the new solar power facility at a military base a few years ago, that cost $100M to build, and will save $1M/year.

O_0

Let me do the math here... nothin' and a nothin', carry the nothin'...

But it will save $1M/year. PER. YEAR!!!!!@@!!1!

local school district solved their underfunded pension plan by issuing a bunch of zero-coupon muni bonds and investing the proceeds in the stock market. They figure that in 20 - 30 years, when the bonds come due, the stock market gains will pay off the bonds and the excess returns will fill the pension gap. Might work, although they are going with an active, not passive, investment style so there's a 50-50 chance that their investment advisor will under perform the averages ... though certainly the investment advisor's compensation over that timeframe will outperform their pensions.

Ah yes, pension bonds, the investment for the truly stupid.

My proposed fix: a tax on the salaries of municipal employees.

Winner!

Actually, if they don't raise the salaries of muni workers for, say, fifty years, the problem will take care of itself.

It is amazing that their top court while knowing this program is in deep trouble and just does not work with the benefits promised to employees insists they adhere to this insane scheme that will inevitably fail and have to be bailed out by those that do not have lucrative pensions. Insanity is the normal now.

I live in Chicago and grew up here. This is a good report highlighting a dim future. Beneath all the numbers, though, Chicago has some terrible demographics that will further impact its prospects.

Residents are leaving (boasting the worst growth rate of the ten largest cities), there are practically no more families, depleting its public school enrollment, while the cost of the system continues to rise, and the city spends its TIF funds on providing tax breaks and subsidies to 'hip' new businesses and 'artist lofts' in newly gentrified (at taxpayer expense) areas.

Basically, it's a Leftist paradise or a cosmo's wer dream

Charge 'em for the lice, extra for the mice

Two percent for looking in the mirror twice

Here a little slice, there a little cut

Three percent for sleeping with the window shut

When it comes to fixing prices

There are a lot of tricks I knows

How it all increases, all them bits and pieces

Jesus! It's amazing how it grows!

"Residents of the city will pay $57 annually as part of a rescue plan that hinges on several questionable assumptions.

...

It's going to cost the average Chicago household about $53 in 2017, but will increase over the next four years."

The article is inconsistent and incomplete. The amount is starting at 1x and going up by 1x every year for 4 years.

"The tax is to be phased in over four years. It will cost the average homeowner in Chicago about $53 more next year, going up to about $226 more in 2020. The city is poised to earn about $240 million from the tax in 2020."

http://wgntv.com/2016/09/14/ch.....-tax-hike/

Also, the bill is actually a percentage rate. It maxes out at a 30% adder in 2020. So, it will go up as the city and water rates are increased in the future.

Also, it should be clear by the graph above that this tax, even when fully implemented, will not close the gap. The gap has been over $500 million for the last 5 years. This will cover about half the gap.

So expect another big tax in the next few years, as this pension fund rapidly drains out. The city needs to collect an additional $500 per year per household. Also, it's important to remember that this is only one of Chicago's pension funds.

"Once fully phased in, the new tax would produce an estimated $239 million a year to help reduce the $18.6 billion the city owes the municipal workers' fund, which represents nearly all city workers except police officers, firefighters or employees who do manual labor."

The use of the phrase 'nearly all' is comical in that context.

http://www.chicagotribune.com/.....story.html

"The city is poised to earn steal about $240 million from the tax in 2020."

I don't dispute the thesis that this and many other public employee pension funds are well and truly screwed, but I think it is unlikely that "The influx of new tax revenue will only get the pension plan back to 90 percent funded if the plan earns at least 7.5 percent every year for the next 50 years, says Jesse Hathaway, a research fellow at the Heartland Institute who has been tracking Chicago's pension problems".

Are you sure he didn't say that it would have to average 7.5% over that period? One can easily envision a (extremely unlikely) scenario where the fund returns 7.75% annually for 10 years, 0% in year 11, and 7.75% again in every future year. I strongly suspect that such a scenario would return the fund to 90% or better, despite having in a single year fallen short of 7.5%.

Don't know much about investment returns or markets, eh?

What I don't know about investments and markets, I make up for by knowing what the words "only" and "every" mean. I assure you that it is mathematically possible for the funds investment returns to fall short of the 7.5% bogey in one year without making 90% funding impossible.

Though, as I noted in my comment, such a scenario is extremely unlikely. I don't for a moment think that these public employee funds might climb out of their funding shortfalls by way of investment performance, nor do I think their investment return assumptions are reasonable. I do, however, think Mr. Boehn got carried away with his use of "only" and "every".

I was considering a job with a state agency once (yea yea, I know) and I mentioned to a friend that I wouldn't want a state pension plan due to the risk of idiot politicians creating funding problems like this, and that I'd prefer to stick to my 401(k) or open an IRA. He replied that if the financial institutions become insolvent, you could just as easily lose your 401(k).

What do you guys think? Is a 401(k) just as likely to disappear as a pension plan?

Disappear?

Yes, because the feds will likely confiscate, I mean, roll it over into a much more secure retirement system known as Social Security while acting as your un-appointed financial advisor. No one has constructed that lock box yet and Peter will continue to rob Paul. Look for them to raise the retirement age on SS as well.

Bwahaha Take the tax hit and bury it. Better than getting decimated by a market crash/correction that seems inevitable.

Disclaimer: I am not a licensed financial advisor (no gubmint license- no legitimacy). There is risk and my prediction may be overly optimistic, however; my Magic 8 Balls have been right on lately. I gotta go to my dealer to get another as my last one got mixed up with some baking soda and whatnot and seems to have disappeared.

No. Depending on which 401(k) financial group you use, there are multiple checks and balances built into the stock market or would be if government stopped trying to wreck free market. There are huge numbers of people and large amounts of capital moving through the stock market which is why it takes a lot to cause massive losses to 401(k)s.

Pensions are basically ponzi schemes because they almost always depend on current influxes of money to keep them afloat while the current recipients are taking money out. Pensions usually have more money being taken out then coming in. That is by design because politicians always offer more than they can afford to buy votes.

The key difference is that 401(k) management tends to take politicians out of the equation. Pensions are popular with politicians and that should say it all.

"...there are multiple checks and balances built into the stock market or WOULD BE if government stopped trying to wreck free market."

Are the checks and balances there or not? You seem to be hedging your assessment.

During 2015, the fund realized a 6.8 percent return on investment. That's not bad?actually, it's pretty good in a year when the S&P 500 Index dropped by about 2 percent and more than 70 percent of investors lost money?but because of the unrealistic expectations, the fund actually finished the year $30 million deeper in the red.

This is the most salient point and one that will eventually defeat the union whiners.

Even estimating the current yearly inflation rate at 3% (the CPI is not that high), the pension returns are doing extremely well at their job of keeping pace or exceeding cost of living increases.

The problem was back in the high-inflation rates of 8% and 9% in the late 1970's, the "safe" long term bond investments of most pension funds were returning 4% and 5%. They were not keeping up with the cost of living. So then the pension funds were "required" to meet an arbitrary percentage negotiated in a CBA, rather than a defined index.

In the late 70's, a negotiated rate of 8% basically matched the rate of inflation. But as inflation fell, public unions refused to lower the negotiated rate to the current inflation rate. The only thing the governments are trying to avoid funding are the phony-baloney "shortfalls". If you were to take the pension funds' annual returns indexed to each years' actual inflation rates rather than the flat 8% rate in the CBA's, there would be NO funding shortfall whatsoever and the pension funds would be in fine shape.

Source: Employee Benefit Research Institute

https://www.ebri.org/publications/ib/ ?fa=ibDisp&content_id=4192

"401(k) losses from the economic crisis: During 2008, major U.S. equity indexes were sharply negative, with the S&P 500 Index losing 37.0 percent this year, which translated into corresponding losses in 401(k) participants are affected by the crisis is largely determined by their account balance, age and job tenure."

I'm making over $9k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life. This is what I do.... Go to tech tab for work detail..

CLICK THIS LINK???? >> http://www.earnmax6.com/

til I looked at the receipt which said $4688 , I accept that my mother in law had been truley earning money part-time at their laptop. . there mums best friend started doing this 4 only 21 months and a short time ago paid for the loans on there apartment and bought a new Aston Martin DB5 . read the article...

CLICK THIS LINK=??????=>> http://www.earnmax6.com/