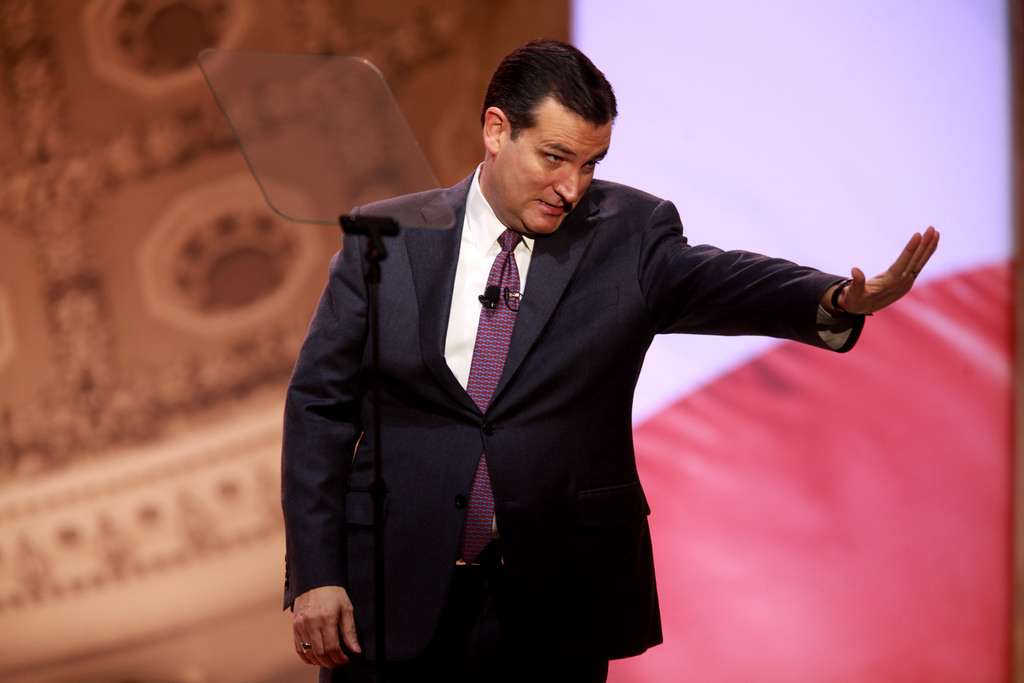

Ted Cruz Takes a Stand Against Operation Choke Point

"The Obama administration initiated Operation Choke Point to punish law-abiding small businesses that don't align with the president's political leanings," says Cruz.

For the first time since he announced his presidential ambitions, Texas Sen. Ted Cruz (R-Texas) is doing something I can applaud. Teaming up with fellow Republican Sen. Mike Lee (Utah), the Cruz has introduced a measure to bring down "Operation Choke Point," the Department of Justice program that pressures banks into dropping "risky" clients like porn stars and gun shops.

"Under President Obama's reign, the DOJ has abandoned its longstanding tradition of staying out of politics and has instead become a partisan arm of the White House," Cruz said in a statement Wednesday. "The Obama administration initiated Operation Choke Point to punish law-abiding small businesses that don't align with the president's political leanings. The DOJ should not be abusing its power by trying to bankrupt American citizens for exercising their constitutional rights."

Cruz and Lee's bill serves as a companion to the Financial Institution Customer Protection Act (H.R. 766), which passed the U.S. House of Representatives in February. The measure would prohibit federal officials from ordering banks to terminate customer accounts without a good justification for doing so. Specifically, it states that "the appropriate Federal banking agency may not formally or informally request or order a depository institution to terminate a specific customer account or group of customer accounts or to otherwise restrict or discourage a depository institution from entering into or maintaining a banking relationship with a specific customer or group of customers unless—(A) the agency has a material reason for the request or order; and(B) that reason is not based solely on reputation risk to the depository institution."

The bill also states that federal regulators must issue an annual report to Congress providing "the aggregate number of specific customer accounts that the agency requested or ordered a depository institution to terminate during the 1-year period preceding the issuance of the report" and "the legal authority on which the agency relied in making the requests and orders described."

Operation Choke Point was initiated in 2012 and has been controversial all along. "Since the program's inception, many gun sellers, pawn shops, and short-term lenders reported their bank accounts being shut down," The Daily Signal notes. And they weren't the only ones: many people working in adult entertainment or sex-related businesses, including porn performers and sex-toy sellers, were also affected.

The DOJ still insists that Operation Choke Point "was designed to combat fraud, not to affect the relationship between any lawful business and its bank." But even if regulators' intent was pure, in practice the program has impacted far more folks than just fraudsters. A former Choke Point chief-architect even admitted as much last week. Michael J. Bresnick, who served executive director of the Obama administration's Financial Fraud Enforcement Task Force (under which Operation Choke Point was created), said the program had "unintended but collateral consequences" for consumers. Worried about targeting by Choke Point's enforcers, financial institutions have "raised their hands in frustration and simply avoided lines of business typically associated with higher risk."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Why are these clients considered "high risk?"

Pawn transactions, for example, can involve the exchange of property that was involved in criminal activities. It is not unheard of and even the most diligent pawn shop owner may be transacting in stolen goods without realizing. So, yes, pawn shops are likely labeled "higher risk" by financial institutions.

Does that mean that pawn shops shouldn't have bank accounts? No. Indeed, it makes FAR FAR more sense to have these "high risk" businesses in the financial system; these transactions will occur, whether or not pawn shops exist. Pawn shops are highly-regulated and maintain (auditable, subpoenable) records; if pawn shops are forced to close because they can't get access to the financial system, then LEOs lose these records.

Pawn shops were not the target of Choke Point.

Gun stores were.

The bill also states that federal regulators must issue an annual report to Congress providing "the aggregate number of specific customer accounts that the agency requested or ordered a depository institution to terminate during the 1-year period preceding the issuance of the report" and "the legal authority on which the agency relied in making the requests and orders described."

Do regulators ever come through on these demands requests from legislators?

Of course they do! Otherwise they would face all kinds of dire consequences like, um....uh...hm.

Alt-text:

Evil Deafness Demons Come OUT!!!

This bill is not bad by any means but I am not sure it would really put a stop to this. The thing about operation Choke point is that DOJ had no authority to tell the banks to close the accounts. The whole thing was nothing but crude blackmail. "Close this account or we will make your life hard" kind of thing. Even as strongly worded as this bill is, it would only mean that DOJ would have to be a little less direct in their threats.

When this happens, how does a business know it was DOJ that was behind it? How do they prove that DOJ threatened the bank and what would be their remedy if they did?

The only way I can think to stop this is to prohibit DOJ from ordering the closing of any bank account for any reason. If you don't do that, I think DOJ would have a pretty easy time ignoring this.

The feds don't typically tell a bank to close a particular account. Instead the bank will be notified that because they have certain types of accounts the regulators will have to look at them a bit more closely than usual. Then when the regulators come in they nitpick over every operation of the bank. It only takes being put through the wringer one time for the bank to decide they no longer wish to handle certain types of business accounts.

Yes. And I don't see how this law really stops that. It will just make the regulators be a little less crude in their threats. Moreover, if they just ignore it altogether, I don't really see where there is any remedy other than Congress being upset.

Congress could fine the DOJ for every instance a bureaucrat is found abusing power. Have the banks or whomever this is happening to report to congress and if our reps find overstepping, the DOJ loses a million. The government loves fines and penalties so why not fine them. Of course this could be sidestep by fining them and then increasing there budget but then our reps in Congress could be held accountable by their voting history.

Mafia government.

From the beginning, I've found "operation choke point" unbelievably brazen. Is it even Constitutional? Regardless, I can't believe it's taken this long for the Republicans to act. And yet we're facing another presidential election where "the future of the country hangs in the balance?????" HA!

Are you serious? Are you serious?

I don't think there's a question of it being Constitutional. That's why it's just been ignored instead of justified.

Is it even Constitutional

Commerce Clause. I'm serious.

financial institutions have "raised their hands in frustration and simply avoided lines of business typically associated with higher risk."

What a crock. That was the intent all along. I really don't think the institutions would just 'raise their hands in frustration' if DOJ wasn't making inquiries about those 'higher risk' businesses. Think about it, if the DOJ isn't making inquiries and/or threats about those risky businesses, what do the financial institutions have to be frustrated about?

Actually - those businesses wouldn't be particularly risky if it wasn't for the DoJ meddling. Most of the bank involvement was processing payments. No real risk to the bank there. Then the DoJ got involved and the risk became not 'we might lose money dealing with these businesses' but 'we might go to jail' dealing with the DoJ.

While despicable, I kind of hope Obama vetoes the bill. Then, when President Trump starts using it to clobber companies that say, hire lots of Mexicans, serve a disproportionate amount of gay customers, or are heavily unionized, perhaps Team Blue retards will begin to see the perils of an Imperial Presidency. Probably not. I know one can hold out hope they won't revert to "Wrong Top Men Theory of Governance", but one can hope.

Apologies in advance to any Mexicans, Gays, or Union folks out there that would get screwed in my absurd hypothetical.

You still think Trump is a Republican, huh?

Yeah they saw the problem with an imperial president name George W Bush. Blinded by ideology. Same goes for Repubs. My CEO hates Obama for violating the constitution but defends Bush. But I can't tell them apart can you?

Which has declared war on a Middle Eastern country? Which expanded govt healthcare. Whose DOJ abused power for partisan gains. They never learn.

https://www.youtube.com/watch?v=G3rNJwPqGHA

"One can hold out hope they won't revert to "Wrong Top Men Theory of Governance"

You slay me! You really do.

"Ted Cruz Takes a Stand Against Operation Choke Point

"The Obama administration initiated Operation Choke Point to punish law-abiding small businesses that don't align with the president's political leanings," says Cruz."

Which is the exact same sort of thing I did as Solicitor General.

Other than the fact that Choke Point wasn't arguing that the affected businesses were illegal and the SG was, that's a good comparison.

And Choke point wasn't a law passed by the group that the SG represents and was obligated to defend, yeah, totally the same thing.

That's more than a little bit ridiculous. Yes, it may be the same outcome, but there's a defensible reason for a state SG arguing in federal court in favor of his state's use of its plenary police power, regardless of what that use is. Cruz's actions were in accordance with the rule of law, the DOJ's actions completely undermine it.

I think there's a defensible reason for heaping well-deserved opprobrium on a guy who defended a horrible, freedom-destroying bit of legislative fiat.

If you stumble across it, be sure to post it.

I forgot about this. It's so hard to keep up with all the banana republic political crimes of this administration.

Is that it? That is absurd. Is it not a bigger story because Obama is cool? Sure, Ted Cruz hates a dildo, but he never closed bank accounts.

Thank you.

And as through your life you travel

Yes, as through your life you roam

You won't never see a dildo-banner

Drive a family from their bank account

~Guthrie Juggler

Ma and Pa Fleshlight getting their bank account closed because they are in the sex toy business is pretty awful.

Today I sat in a Tesla, and this weekend I am going to sit in a Prius, and both of those subsided vehicles are driven by people who make over six figures, so yeah, getting involved with Big Subsidy is probably the right way to go.

Don't blame the dildos

I completely forgot about that skit, Hugh.