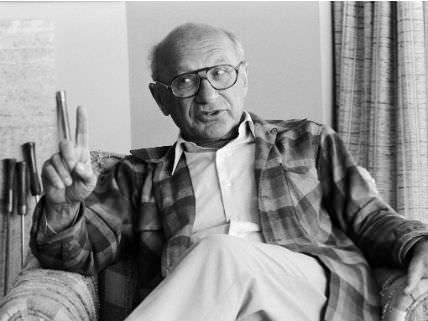

Milton Friedman Saw the Euro Crisis Coming

The libertarian economist predicted Europe's current problems 17 years ago.

Among the general public, Milton Friedman is mostly remembered for the libertarian views outlined on his PBS show Free to Choose. Among economists, he is best known for his monetarist position on Fed policy. What's less well known is that he was also a soothsayer, accurately predicting the euro crisis that now has the global economy in upheaval.

The Nobel laureate believed the boom-and-bust business cycle was mostly caused by central banking errors that allowed a country's money supply to fluctuate. Thus, he advocated for a policy rule under which the Federal Reserve would engineer a steady 4 percent increase in the money supply each year to help prevent recessions.

Friedman came to that view by collaborating in the 1960s with National Bureau of Economic Research economist Anna Schwartz on a major history of U.S. monetary policy. Perhaps their most important finding was that Federal Reserve policy errors had allowed the money supply to drop sharply in the early 1930s, dramatically worsening the Great Depression.

At the time, the Depression was widely seen as a failure of capitalism. The work of Friedman and Schwartz opened the door to the neoliberal revolution of the 1970s and '80s by showing that bad monetary policy had destabilized an otherwise well-functioning economy. By the 1990s even many liberal economists had concluded that market economies work, so long as monetary policy makers provide a stable backdrop.

Ironically, the political right would become increasingly skeptical of efforts by central banks to alter the money supply even as the political left was coming to embrace some of Friedman's ideas. Conservatives began to worry about the potential for abuse of a discretionary Fed. Some even called for constraining monetary policy makers, for example by establishing a single currency to be used across multiple countries.

The most important such currency is, of course, the euro. That project, which began in 1999 with 12 members, has since expanded to 19 countries, including much of continental Europe and Ireland. The year before it launched, however, Friedman offered a strikingly prescient observation about the coming eurozone experiment.

In a 1998 interview, Friedman was asked whether he believed the European Monetary Union would be a success. The economist responded that he was dubious.

"There are some cases where a single currency is desirable and some where it is not," Friedman said. "It is most desirable where you have countries that speak the same language, that have movement of people among them, and that have some system of adjusting asymmetric effects on the different parts of the country. The United States is a good area for a common currency, for all those reasons. But Europe is the opposite in all these respects."

He continued: "The exchange rate between different currencies was a mechanism by which they could adjust to shocks that hit them asymmetrically—that hit one area differently from another. The Europeans have, in effect, entered into a gamble in which they have thrown away that adjustment mechanism. It may work out all right. But on the whole, I think the odds are that it will be a source of great trouble."

What Friedman understood was that, despite being a free trade area, goods and capital both move less freely through Europe than through the United States. In addition, the European Commission in Brussels spends a small fraction of the total that the governments of the member countries spend. They, not the European Union's bureaucracies, are the important political entities. Under those circumstances, flexible exchange rates are essential.

Let's say a country is affected by a negative event that calls for lower wages relative to other countries. Pre-euro, that could have been achieved simply through currency devaluation. Today, it requires thousands upon thousands of separate wage changes in all the country's industries and jobs.

So why implement a single currency at all? The answer is politics, not economics. The aim of the euro was to link Germany and France so closely as to make a future European war impossible. Eventually, it was to lead to a sort of United States of Europe. Instead, the euro has exacerbated political tensions between northern and southern European nations. How to handle shocks that in the past could have been accommodated by exchange rate changes has become a divisive political issue.

Recent history shows the monetary policy that's appropriate for Germany probably won't be right for Greece. Friedman called it the one-size-fits-all problem.

But it's not only that. Today, many people assume that Germany favors tight money per se. And indeed, because Germans fear inflation, they insisted the eurozone be biased toward contractionary policy. But back in 2005, the European Central Bank (ECB) had in place a policy that was actually too contractionary for Germany, which at the time suffered from over 11 percent unemployment. Just a decade ago, news articles were calling Germany the sick man of Europe.

ECB policy since 2008 has continued to be far too contractionary. I've argued European institutions should target nominal GDP growth at something like 4 percent per year. The ECB opted for a strict inflation target of just under 2 percent and has been falling short of even that. It recently had to resort to "quantitative easing," like that undertaken here in the Untied States after the Great Recession, to avoid the opposite peril: deflation. ECB policy is supposed to be appropriate, on average, for the entire eurozone. In reality, since the recession it's been about right for Germany but much too contractionary for most other members.

So it's not just that an otherwise appropriate monetary policy isn't working for Greece because of that country's special circumstances. Greece needed the ability to devalue its currency both to correct its own country-specific imbalances and also to offset the incompetence of ECB policy makers in Frankfurt. At least half a dozen eurozone members would have greatly benefited in 2010 from being able to devalue their currencies, but the euro prevented that from occurring.

The failure of the euro should have boosted the libertarian movement. Today's events were predicted with amazing precision by the most famous American libertarian of the 20th century. Moreover, this crisis is an almost perfect example of the "fatal conceit"—a concept from another prominent libertarian, Friedrich Hayek, who warned of the dangers of allowing technocrats to dream up complex new policy regimes without any mechanism for adjustment if things don't go according to plan.

Instead, too many economists on the right are claiming the euro isn't the problem. Yes, Greece suffers from an excessively regulated and inflexible labor market, which has hampered its economy's ability to grow. But Europe's one-size-fits-all currency is also a problem—a severe one that Milton Friedman saw coming from nearly two decades away.

This article originally appeared in print under the headline "Milton Friedman Saw the Euro Crisis Coming."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

How I miss a person like him.

Proud that he was born on the same date as I am--July 31st, different year.

"Instead, too many economists on the right are claiming the euro isn't the problem."??? One wonders if this guy reads the National R

"....Instead, too many economists on the right are claiming the euro isn't the problem."

One wonders if this guy reads the National Review or Weekly Standard?

I sure have read lots of stuff there supporting his argument. Maybe he does not like conservatives and had to make a jab at them...

He's correct to the extent he is talking about the monetary policy of the euro and its disparate impacts. Conservative economists generally seem to oppose the euro for other reasons, and you rarely hear them argue the ECB has been too tight.

Tight monetary policy has always been a giant blind spot on the right, an especially unfortunate situation because too-tight money led to Nazism, FDR, the ChiComs (silver standard deflation), and Barack Obama. It's always perceived as a "failure of capitalism" and the central planners move in, licking their chops.

Hayek saw the problem too - 40 years ago.

"This (free banking and concurrent currencies) seems to me both preferable and more practicable than the utopian scheme of introducing a new European currency, which would ultimately only have the effect of more deeply entrenching the source and root of all monetary evil, the government monopoly of the issue and control of money"

Had a good solution too - the denationalization of money - even if he prattles on about hyperinflation and ignores problems more relevant today. Unfortunately, neither (Hayek/Friedman) ever got off their hobbyhorse about government. The problem is not GOVERNMENT monopoly over money. That has not existed since the first banknote. The problem is MONOPOLY over money. Banks (or any money depository) never actually compete with each other because they are not stand-alone entities. They need interbank settlements to survive and that is what then gets monopolized when banks insist/threaten that the settlements system also serve as government-enforced fraud insurance for banks. 'Monetary policy' then becomes centralized top-down planning. Banks give the appearance of noisy 'free market' but it is a Potemkin facade. They are mere 'branch offices' of their central bank.

I wish someone knew how to get from here to there (money that doesn't need depositories). Until money itself is a true free market; there can be no free market with true price signals - in anything else - built on top of cartelized money.

Just to illustrate the paradox here. Metal coins are imo a form of money that doesn't need depositories to serve as money. Obviously not in denominations of 25 cents. But precious metal coins could easily have varying denominations of up to $500 or $1000 or so. THAT is money competition which doesn't require banks much at all for most people or for most daily purposes.

But I'm gonna guess that 99% of commenters here would oppose the US Mint getting back into the business of 'free minting' of coinage (as it did before 1873). Solely because its gummint. And if it came down to that - would prefer the privatized monopoly and central planning of the Federal Reserve over money.

You might be right that a majority of people might prefer the central authority, but I doubt you'd find that's true among the crowd on this site.

The thing is, money is a fantasy. It pretends to make value at least partially objective, but no matter what it is based on - paper, gold, or large stone wheels - its value remains subjective. The Spanish conquistadores set of a 400% inflation (over some time) by importing Gold from the Americas.

Money is a handy shared fantasy. It lubricates an economy that would bog down in barter. It is, ultimately, founded on a network of trust.

Trust? Every exchange incl barter is based on trust. Not sure why 'subjective value' is such an important objection to coinage. Exchange can't happen without 'subjective' value. If I and baker agree that coin bread; there is no exchange. If I think bread coin and baker thinks coin bread, then we have basis for win-win exchange. The value is both subjective AND different.

The difference between coin money and debt money has nothing to do with this. It has to do with the transaction. A coin transaction is closed the second it is done. I walk off with bread, baker walks off with coin. There is no third party or further transaction required. The coin contains all its value in the form of the metal in it - and the bread contains all its value. Obviously trust is required that it is not counterfeit but that applies to both bread and coin. That trust is the basic weights and measures and other trust-inducing standards of that market.

Damn no edit button. there should be 'greater than' signs in first paragraph to show value of coin compared to value of bread from each persons perspective.

Debt money means a market transaction is never between two people and never closed. Exchange bread for IOU (ie some claim on some account somewhere). The bread still contains its value but the IOU doesn't contain anything in itself. It can still be counterfeited like coin but even if it is real that doesn't mean it will be honored. It is only honored on presentation to third party at some later date. Which now introduces new risks that never existed in the transaction itself.

That latter 'bank' money is well suited for industrial transactions where producer borrows work capital to produce something to sell later to get money to pay off the work capital. But when that sort of money is the ONLY money around, then all individual-to-individual market transactions are hostage to 'industrial' money stuff. If the big system breaks down (see 2008/1929/1907/1894/every financial crisis ever); it forcibly grinds everything else to a halt and those in charge of the big system then have power to demand whatever they want to start things back up since ALL money depends on them.

Friedman and Hayek's economics were very similar and both understood the source of business cycles and inflation to be central bank monetary policy. They differed in an important respect and the Great Depression provides the best example. Friedman focused on the decline in money supply which directly caused the crash. Hayek focused on the extraordinary monetary growth of the 1920s that resulted in economic distortions during the 1920s boom. I side with Hayek and believe most libertarians who have read both do as well.

We had gold/silver money with no central bank from the termination of the Second Bank of the US through the Federal Reserve Act of 1913. We also had commercial banks which had most money on deposit and issued paper notes that committed those banks to exchange for gold on demand. This system actually worked quite well (not perfectly) once the shocks from the elimination of the Second Bank of the US, the CA Gold Rush and the Civil War had worked through the system. The US absorbed tens of millions of immigrants and became the wealthiest country on the planet during this time.

The problem is not banks per se - it is banks with the Federal Reserve and its currency monopoly (via legal tender laws) serving their interests with excessive monetary expansion. The Fed is technically was created by federal legislation and has members appointed by the president - so it is essentially a governmental institution with a GOVERNMENT monopoly on money.

The Federal Reserve is not a govt institution. It was created by banks for banks. It is owned by banks. The legislation Act was passed in order to force small banks into big bank system. The FOMC wasn't created until the 30's but it is run by NY Fed (owned/run by primary dealers). The Board is govt appointees but have staggered terms of office that are deliberately long-term so 'monetary policy is not subject to the vagaries of politics (ie government)'. If they are not accountable to govt, then wtf are they accountable to? Aliens?

Most (99% probably) money is created when banks make loans and create money out of thin air. If everyone in the US paid off their loans -- there would be NO MONEY (except coins). The current system is a BANK monopoly over money.

And btw we did have a defacto central bank the second we demonetized silver in 1873. From roughly 1890 on his name was JP Morgan. He controlled the gold flows to/from London and T-note distribution. Gold didn't circulate as coins. It was deposited into banks and JP Morgan decided which banks would be able to honor withdrawal demands for gold.

JFree|9.18.15 @ 9:09PM|#

"The Federal Reserve is not a govt institution."

Bullshit:

"As stipulated by the Banking Act of 1935, the President appoints the seven members of the Board of Governors; they must then be confirmed by the Senate and serve for 14 years only.[6] Once appointed, Governors may not be removed from office for their policy opinions.[1]

The nominees for chair and vice-chair may be chosen by the President from among the sitting Governors for four-year terms; these appointments are also subject to Senate confirmation.[7] By law, the chair reports twice a year to Congress on the Federal Reserve's monetary policy objectives. He or she also testifies before Congress on numerous other issues and meets periodically with the Treasury Secretary."

Search for wiki.

That's only sort of true. If I lend you $100, and you lend $90 of it to Sally, and she lends $80 of that to Harry, and he lends $70 to Joe, and so forth, how much money has been created? None, of course! You're just moving the same money around.

Of course the trail of debts does exist. But they aren't really "money" although they're considered part of the "monetary base" because that's a useful measure of economic activity.

Great wiki on this topic

Currency failures are very painful. Free banking might be the ideal system, but voters will never allow it in our lifetimes.

Friedman recanted 2 years before his death about that 4 percent inflation.

He decided that Hayek was correct, repudiated "Chicago School" and said he was Austrian through and through.

"Inflation Is Not Neutral!"

Im making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do. http://www.OnlineJobs100.Com

Google pay 97$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12k for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it out.

This is wha- I do...... ?????? http://www.Money-Hours.com

In Hong Kong, the banks issue the cash. You get your *bank note* and it has the issue bank on it aka HSBC.

I thought this was going to be about his "You can have open borders and you can have a welfare state. You can't have both" quote referring to Germany's attempt to import every single male from Syria and give them welfare...

????Start your home business right now. Spend more time with your family and earn. Start bringing 78$/hr just on a c0mputer. Very easy way to make your life happy and earning continuously. Start here?...................

http://www.jobhome20.com

The single most important class I took in college was Econ 101. Thank goodness one of the two textbooks was Milton Friedman's. I clearly remember his young Santa Claus face on the cover, and contrasting it with the sourpuss of Paul Samuelson on the other. I don't recall a thing about Samuelson's textbook: it didn't make sense, and it ignored human nature. But Friedman's book made lots of sense and demonstrated an understanding of how humans work (individually and collectively); he succeeded in describing people in a way that allowed him (and me) to like people despite their flaws, and to trust freedom to work its magic.

There have always been a lot of reasons for the EU to be a bad idea;

It is the logical sequel to the establishment of the Unites Nations, and thus could be expected to work about as well.

It was an open invitation for the Clerisy to form another layer of obdurate bureaucracy, which invitation they have accepted with the restraint one normally associates with a company of long-voyage sailors answering an invitation to a whorehouse.

It depends on the French getting along with the Germans. Setting aside the issues of two World Wars and that Franco-Prussian business in 1870, the French haven't forgiven the Germans for siding with Wellington.

It included under its umbrella several Nations - I'm looking at YOU, Greece - in which bilking the government is a national passtime almost more popular than bed-sport.

I understand that deeply, having been among a company of long-voyage sailors answering an invitation to a whorehouse.

Google pay 97$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12k for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it out.

This is wha- I do...... ?????? http://www.online-jobs9.com