Oil Prices to Fall to $20 Per Barrel?

Surprise: Oil production did not peak on Thanksgiving Day 2005

Peak oil is soooooo last decade. Goldman Sachs is suggesting that the price of oil could fall as low as $20 per barrel during the next few years. (Grain of salt warning: Keep in mind that back during the last peak oil craze in 2008, Goldman was predicting $200 per barrel oil.) A drop to $20 per barrel would mean that in real dollars the price of oil would be back to its lowest ever 1999 price.

So why might crude prices drop to $20 per barrel? Two reasons. First, vast new supplies of petroleum have been accessed by fracking and horizontal drilling. Fracked oil is now swing production that can come quickly online whenever prices to start to rise. And second, oil states like Russia, Nigeria, Venezuela, Iran, and Saudi Arabia must keep pumping even at low prices in order to generate the cash they need to buy off their restive citizens.

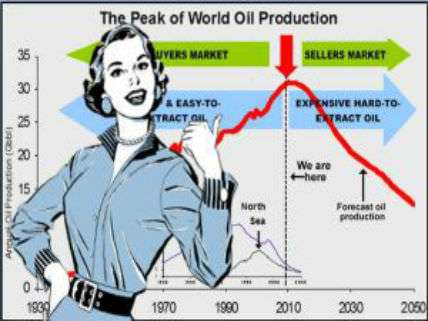

Princeton University geologist Ken Deffeyes predicted in 2001 that global oil production would peak "right smack dab on top of Thanksgiving Day 2005." In 2005 global oil production averaged 85 milion barrels per day; today it is about 95 million barrels per day.

In my new book, The End of Doom: Environmental Renewal in the Twenty-first Century, I explain how commodity super-cycles work:

The super-cycles are driven by periods of accelerating economic growth that boosts demand for commodities, thus pushing up their prices. Rising commodity prices in turn encourage the development of more supplies and the invention of resource-conserving technologies. As economic growth slows down during the second part of a super-cycle, the real prices of the now copiously supplied commodities fall. In fact, the researchers find that the prices for nonoil commodities do not generally recover to their preboom averages. Before the recent fourth super-cycle upsurge, nonfuel commodity prices had fallen by a cumulative 47 percent over the past hundred years. …

Figuring out when a super-cycle has topped or bottomed out is a fraught exercise. Nevertheless, many researchers believe that the current super-cycle in commodity prices has peaked and will soon move into its downward phase. By February 2015 the International Monetary Fund's commodity index has fallen by about fifty seven percent from its July 2008 peak. If the past is any guide, commodity prices could well fall to levels even lower than the price nadir of the 1990s as the expansionary phase of the current super-cycle begins to fade.

By the way, the IMF commodity price index has now nearly fallen to back where it was in 2005.

I once again urge that "Peak Oilers Shut Up Forever Please."

Show Comments (82)