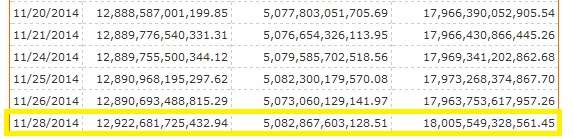

Federal Debt Soared Above $18 Trillion Last Week

Congratulations, America! You, or rather your elected officials, smashed through the $18 trillion ceiling last week, raising the United States government's total outstanding public debt to new heights and leaving shards of devalued greenbacks scattered around the place.

Woo hoo.

One decade ago, on December 1, 2004, the sum was a wussy $7.5 trillion. It took a lot of hard work to run up another 10-plus trillion in debt in those intervening years. This country won't bankrupt itself, you know. It takes government officials years of subsidizing, overpromising, overspending, and maybe some outright theft to put that many numbers in a row, slather them with red ink, and hand the bill to our grandkids.

The killjoys at the Congressional Budget Office say this pattern of continuing deficits and rising debt threatens to drain money from private investment, compromise national security, and lock the federal government into doing little other than paying the interest on what it already borrowed—a situation they call "unsustainable."

But that's just crazy talk. Who says you can't just borrow your way into the future and never pay it back without nasty consequences? Whaddya say we shoot for $50 trillion?

Free Minds and Free Markets aren't free! Support Reason's annual Webathon with a tax-deductible donation and help change the world in a libetarian direction. For details on giving levels and swag, go here now.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

BOOOOOOOOOOOOOOOSHHHHHHHHHHHHHHHHH

"Booooooooosh is responsible for the entire $7.4 trillion accumulated over the last six years because uh, war, tax cuts, Medicare Part D, housing bubble, blah blah blah.

And besides, those ratfucking Teabaggers who control the House and Senate forced Obama to sign continuing resolutions all these years.

If only he was an absolute dictator and could do whatever he wanted, we'd be running trillion dollar surpluses right now and the debt would be zero!"

How did I do? Did I get all the Journolist talking points down pat?

But the Obamessiah (swt) still deserves the credit whenever anything good happens.

You forgot the Kochtopus gazillionares who control everything feeding off the government teats.

People wonder why the economy sucks - pretty simple, the federal government is sucking all the wealth out of it. All this new spending and debt WITH a tax-hike in the middle. There's just too little left for the private sector to grow out of it.

Remember when markets used to correct themselves without multi-trillion dollar "stimulus" plans?

Ah, the good ol' days.

Coincidentally, that was back when recoveries didn't feel like recessions.

The stimulas was nothing more than a kickback to the public service unions that bought him the presidency.

That's not fair. There was a lot of kickback in their for his rich campaign donors as well!

On one of the message boards I used to frequent, somebody would claim with a straight face that the debt was meaningless because Treasury notes don't actually represent monetary value because the US dollar is actually debt. His whole theory to money was interesting, a lot of extreme anarchist gold-bug ideas; I'm not going to say it was entirely wrong, just not grounded in, you know, the reality we happen to live in.

Not sure why I shared this story now that I've written it..

The correct way to finish a story like that is, "And then I found twenty dollars!" Just, for the future.

Interesting how the debt is rising so rapidly, yet spending is also rising. I know the first thing i would do if i fell into debt, is to spend more. Need cuts across the board, which includes massive cuts to military spending.

You'd think a spending FREEZE would be a no-brainer, yet I have heard that phrase in years.

have not

All right-thinking people know that even a reduction in the rate of growth of spending will turn us into the United Stateless Zones of Somalia.

"We don't have a spending problem, we have a paying-for problem; we aren't paying for the things we buy!"

What's incredible is that the FedGov is now taking in more revenue than it ever has before, and yet the deficit is still close to half a trillion dollars a year!

And the insane Obama left says that a deficit of "only" half a trillion a year is something for us to celebrate, because it's lower than it was a few years ago. Brilliant.

Remember that to FedGov, to progs, and to most conservatives, a "spending cut" means slightly reducing planned spending increases. And even when they do that, many of them make cries that it's going too far.

No, we're headed straight towards the iceberg, and the Captain is continuing to increase the power of the engines.

But we're just about to win it all back.

But you are a currency user. The federal government is a currency issuer. I'm not suggesting the federal debt does not matter, just pointing out a key operational difference. Individuals, households, states, and businesses are currency constrained. Uncle Sam is not. The risk for the federal government is inflation, not solvency.

I understand that household are very different from governments.

However, if national insolvency and sovereign debt crises can't exist, why does this article also exist?

A debt crisis is not insolvency, as the Wikipedia article points out. Of course, a debt crisis would be terrible and involve massive inflation -- but operationally, that's different from insolvency.

Hyperinflation is really bad, and I think that's what many of us are concerned about. Plain old inflation is no fun, but hyperinflation would likely reduce living standards much, much more.

If we look at the history of hyperinflations in the last 100 years, in each case something else has happened besides high government debt. Those events tended to be things like a massive collapse in production, loss of a war, regime change or regime collapse, rampant government corruption, or ceding of monetary sovereignty via a pegged currency or foreign denominated debt. Look at each example and you'll see at two of those things almost every time. Weimar Germany: regime change and foreign denominated debt. Greece (1944): civil war, regime change. Hungary (1945) war, foreign denominated debt. Zimbabwe: regime change, foreign denominated debt.

from the article:

I think a person can argue about both simultaneously.

Yes, it's true that the government will never run out of money. However, if the government decides that the only way it can avoid insolvency is to have the Fed print money it can spend, then that money will land in the economy, and produce inflation.

So, saying we don't have to worry about insolvency, just inflation, sounds like someone arguing that we don't have to worry about smoking, just lung cancer. Because smoking can't kill you, but lung cancer can.

Or arguing that we don't have to worry about obesity, just heart attacks. Because, really, you can't get so fat that you explode. So don't worry about being fat. Worry about heart attacks.

Well said. I don't mean to suggest we don't have to worry about insolvency or, more accurately, hyperinflation.

The debt can and does matter, but because we have a fiat currency, the whole system is quite complicated.

I worry more about inflation -- and hyperinflation. More precisely, I worry about living standards. The federal debt, inflation, the value of the dollar, interest rates... all that stuff really boils down to living standards and reasonable opportunities (and freedoms) to improve our living standards. The value of the U.S. dollar has declined 90% since 1913 (the inception of the Fed) -- but our living standards have not declined 90%. The opposite has happened.

I think that if spending and taxation can generally be done in accordance with our nation's productive capacity, then we should be able to avoid undue hardship on the private sector via a reduction in real living standards.

Serious question:

I keep seeing references to the deficit being $500 - 600BB last fiscal year. Yet the debt increased by nearly $1.1TT last fiscal year.

http://www.treasurydirect.gov/.....dYear=2014

What gives?

Buttplug will be along shortly to explain it in terms that make no sense.

It's Bush's fault, right?

My Obot Facebook friends will either remain silent on the matter or do enough cherry-picking of the data to prove the saying that a half-truth is a whole lie.

"If we've been telling lies, you've been telling half-lies. A man who tells lies, like me, merely hides the truth. But a man who tells half-lies has forgotten where he put it."

Reading Schiff yesterday:

http://reason.com/archives/201.....-inflation

would be interested in seeing the numbers on this.

What gives?

Interest on existing debt? Just spitballing...

I think that counts as spending. But, its government accounting, so who knows?

That might be it. Interest last year was @430BB, which is roughly the gap between the "deficit" and the increase in debt.

http://www.treasurydirect.gov/.....xpense.htm

It's the Social Security "Trust Fund". The reported deficit is all revenue including FICA minus all spending. But part of the debt is the the IOU's that the Federal government pinky swears it will pay back to the Social Security trust fund from general revenue some day.

I don't think so. Last I heard SS was running a deficit. Even if it's in the black again, it's not to the tune of 3 or 400 hundred billion.

They didn't include the $328 billion that was added on after the shutdown.

My bet is interest on outstanding debt. 600 billion is about 3.5% interest on 17 trillion outstanding. But I have not confirmed this.

Off budget spending

We just need to put together a panel to look into implementing some serious budget reform. Maybe we can get some statesmen like Phil Gramm, Warren Rudman, and Fritz Hollings on it - that'll fix things right up I'm sure.

Ahem. [Taps microphone]. Is this on? Good. "No, fuck you, cut spending."

I'd like to ask the Reason Foundation to set aside a special donation bucket to take whatever donations are necessary for Reason to publish something like "No, fuck you, cut spending" as a part-time motto until spending is, in fact, cut. With fusion-powered laser chainsaw (by the way, do Jedi gardeners have light saber chainsaws?). I'm okay with "fuck" being converted to "screw," "fuck you" being changed to "piss off," etc. The message is more important than the fucking.

This is not to say that I think spending is the only problem this government has. This government parasite sucking our precious economic fluids away.

A crysknife would be more enjoyable and cause more pain.

You're such a chick.

Not at all. The government's fucking is a matter of indifference to me.

People have come to believe in an inverse Stein's law: Whatever cannot go on forever will do so anyway

I have a two good friends in finance, one a libertarian and one a dope smoking elitist type. BOTH tell me that "everything's fine, since all debt is denominated in dollars." So to answer the 'who says we can't borrow' question: everyone who thinks they understand our nations finances.

I'm not a finance guy so hell, maybe they're all right and the party will continue through 2100 and beyond. But beyond the common sense problems simpletons like me associate with accumulating too much debt, I don't believe the soothsayers since their ilk are batting .000 on predicting collapses and crashes.

I wonder what unfunded liabilities are now. As scary as the $18T is, unfunded liabilities are much worse.

Last I saw, unfunded liabilities were "more money than you can shake two sticks at, plus the sticks".

The last estimates I saw ranged pretty widely from $100T-$150T.

We really are so fucked. The disruption and dislocation that's going to occur is without precedence.

Bah!

/Ghost of a Spanish Habsburg

It will either be an entire era of squalor, or a quick, painful collapse followed by armed conflict. I vote for the second, only because it'll force people to reconsider their worship of the fedgov. The first would leave the possibility of the good ol US of A sticking around as a totalitarian shit hole.

And the second would have a good chance of a strongman savior to come in and become a dictator. Maybe the Lightworker Himself.

Given his (nonexistant) popularity in the military and what the people who actually own guns think the odds of Obama (or any other libprog) taking over in that scenario are basically 0

I got my AR! Maybe next time we'll REALLY ennumerate those rights!

In other words, private U.S. Dollar savings parked in U.S. Government securities reach $18 trillion. This partly derives from the more organized Baby Boomers' efforts to pile up financial resources for their retirements:

http://research.stlouisfed.org/fred2/graph/?g=mzu

Whaddya say we shoot for $50 trillion? I think that's now the idea. And why stop at 50?

Perhaps most people do not understand that the US political class controls in its reserve currency a powerful tool to tax well beyond the US borders. The dollar is without some link to real resources (except for those used to enforce exclusive legal tender status and collect taxes in dollars), and it has reserve status for currencies throughout much of the world. So why would the debt ever stop growing, let alone decrease? The Fed's and other central banks' balance sheets can just keep growing. Prudence might call for a steady-as-she-goes recipe for monetizing the debt, but why should one think that the political class would ever stop debasement of the dollar and linked currencies? The debt held by central banks represents the inflation tax paid by all users of dollars and dollar-linked currencies. Yes, the rest of the world is paying a part of the US government's spending, but that's just one privilege of empire.

If the world drops the dollar as the standard we are in deep shit.

This is a matter of when, not if.

The one thing we have going for us is that most of the world's currencies are in such shitty shape, there's really nothing better for anyone to switch to. At least for now.

It doesn't seem like any of the major currencies are going to improve anytime soon so I guess we can ride that wave a bit longer. But as you say, "For now..."

Yeah, one thing no one really wants to look at is basically the entire world has been riding on the US's economic coattails for 60 years.

Even the other strong first world economies were indirectly propped up by the dollar requiring strong US consumer markets for their survival

The US Military backs the US Dollar.

"Government debt at 18 trillion"

They probably spent it all on welfare and Xunlight. It's a good thing you blew up the graph so one can't see the effect on revenue coming from the Bush tax cuts. Because what we have in this country of increasingly arrogant plutocrats is a spending problem.

First off, the retarded don't rule the night. They don't rule it. Nobody does. And they don't run in packs. And while they may not be as strong as apes, don't lock eyes with 'em, don't do it. Puts 'em on edge. They might go into berzerker mode; come at you like a whirling dervish, all fists and elbows. You might be screaming "No, no, no" and all they hear is "Who wants cake?" Let me tell you something: They all do. They all want cake.

It's a good thing you blew up the graph so one can't see the effect on revenue coming from the Bush tax cuts.

Considering how paltry the percentage cuts were, you're really not in any position to be crying about this.

So, in what year did spending decline? I know that as a socialist, you are a complete economic illiterate, but I'll bet you can at least run a household budget. If you find that you can't cover the rent next month because you bought a new car, who do you blame?

Booosh, the Kochtopus and wreckers and hoarders and kulaks!

american socialist|12.2.14 @ 10:52AM|#

"They probably spent it all on welfare and Xunlight"

Hi slimeball! Pay our mortgage yet? Still licking mass murderer ass?

Just making sure you're still the sleazy POS we know and despise!

Re: American Stolid,

"Because debt is good if you spend it in the thinks I like."

No consideration at all to the principle that placing people's future in hock is immoral regardless of the intentions, but like I said: little red Marxians are confused.

"The effect on revenue", you say.

Yes, massa, my money is really the State's.

Asshole.

"It's a good thing you blew up the graph so one can't see the effect on revenue coming from the Bush tax cuts. Because what we have in this country of increasingly arrogant plutocrats is a spending problem."

Because if there's one thing we all agree on, it's that we should all be taxed more so the government can spend more money. Really, who sees a downside in that? Other than greedy plutocrats?

Hey, your guy Obama has a pen and a phone and can do whatever the hell he wants. Why doesn't he seize all of Warren Buffet's assets? Why, that would pay down like $50 billion right there!

Oh right, Buffett is on your team, so he's one of the good guys. Only your enemies deserve to be targeted, right?

$300 Billion a year for about 14 years = $4.2 Trillion

However that assumes that the $300 billion a year tax cut generated absolutely no new economic activity that was taxed and is the ENTIRE tax cut 90% of it went to the poor and middle class.

The tax cut on the rich was only $30 billion a year.

Can't afford to. Gotta pay that debt. Besides, the dollars I'd donate today if I could afford it won't be worth shit tomorrow anyway. /sarc

I'm so looking forward to the coming collapse. The welfare camps, the starving orphans mugging one another for scraps, the rape gangs roaming the streets, the most recent Congress and administration hanging from light poles.

Good times.

It won't be good times unless and until there is a pile of 545 skulls on the Capitol lawn. As a memorial and warning.

The base of Warty's throne?

But some of them excaped. There are only 420 skulls making up the throne.

He had some slain in gladiatorial games or fed to various beasts from his menagerie.

I guess what STEVE SMITH did could be considered "feeding."

No. Khorne's The Skull Throne. Blood for the Blood God! Skulls for the Skull Throne!

What's also really scary and something that almost no one is talking about yet is the fact that, unlike the old days when most of the national debt was in long-term bills with decent yields, the overwhelming majority of the debt now is short-term debt with interest rates barely above zero that has to be continuously rolled over. Here's Jack Lew speaking to Congress about a year ago:

As long as the debt-holders continue to agree to do this we can probably go on, but if and when the day comes that they decide that they no longer want to roll it over and want to get paid off, we're kind of screwed, as we're already past the tipping point.

The good news is that a lot of the debt is held by people (insurance companies, pension plans, etc.) who are essentially required to put a big chunk of their assets into Treasuries.

Won't be much longer before this rule is extended to tax-favored retirement vehicles. Mark my words.

"Be a Patriot! Buy Government Bonds! Or Else..."

Star Spangled Man with a Plan! Call Cap! Get the tights! It's SHOWtime!

The really weird part is people keep loaning money to these government officials who clearly don't intend to actually pay back the money.

Perhaps these lenders think default / massive inflation isn't possible? Trying to wrap my head around the delusional thinking here.

They don't see massive inflation coming. Hell, they barely see any inflation even into the long-term. The 30 year Treasury yield is only 3.00 right now.

EDG, the Treasury market has been massively manipulated for years. Essentially, the Fed is clearing all the auctions at a predetermined low interest rate. We have no idea what the "real" interest rate would be.

I agree. But everyone (important Wall St. types) seems to be fine with buying this debt. I wouldn't touch it, myself. It'll blow up in their face.

Cronies and approved "Top Men" will get paid off. They always do.

But everyone (important Wall St. types) seems to be fine with buying this debt.

Lots of it is held by the Fed.

Lots more is held as overseas reserves.

And yet more is held because some businesses are required to hold part of their assets in Treasuries.

Besides, Wall Street runs on the principle that it can unload its garbage on the Next Sucker.

"Trying to wrap my head around the delusional thinking here."

Musical chairs; I'll get mine, someone else won't get theirs.

Oh, piffle! We just owe it to ourselves. See, we just transfer some money from our savings account to our checking account...

Oh, well, don't worry; we have plenty of checks left.

If this is such a problem-- and recent research suggests it isn't-- maybe we should raise taxes on rich people.

Re: American Stolid,

Research, you say? Ok, sure.

Whatever happened to not spending more than what you make? Research tells us that that works very well.

If its not a problem, why have taxes at all? Why don't we just print however much money the fedgov needs every year?

More to your question though, seizing every penny of assets from the hated 1% wouldn't even run the government for a year. Never mind paying off debt or unfunded liabilities.

"seizing every penny of assets from the hated 1% wouldn't even run the government for a year. "

I think you are on to something here. Let's say rich people get taxed at 40% of their income (they don 't, but I 'm just being conservative). According to google the top 1% make an average of 380k a year. Assume we expropriate the remaining. 60% of their salary at their hedge fund this would be ( $380000/yr*300000000 people*0.01*0.6=684 billion/yr. voila. Problem solved. Wouldn't cost me a penny.

It's really quite amazing--reading your posts, I can palpably feel myself getting stupider.

You do realize that you just multiplied $380K per year by the entire US population, don't you?

Essentially, your argument is correct, as long as everyone is in the top 1%.

Do you see a problem with your logic?

Did you see the 0.01? It's just an academic exercise, I know. I'm fine with taxing rich people at only 94%-- like we did when GDP growth was 5%.

I'm fine with taxing rich people at only 94%-- like we did when GDP growth was 5%.

Don't you mean when defense spending was 50% of the budget and total federal spending was 20% of what it is today, inflation-adjusted?

I'm willing to go back to Eisenhower-era tax rates if you're willing to go back to Eisenhower-era budgets.

Maybe you should go work for Reinhardt and rogoff, Brian. They've got work for someone with math skills like you!

So, basically, you think that multiplying $380k per year by the entire US population, as if everyone is making $380k a year, and then multiplying that by 1%, gives you the income of the top 1%?

You realize your equation is essentially the income of 1% of 300 million people making $380k a year. Do 300 million make $380k a year?

No, I don't think you see the problem in your logic.

Here's how you fix it:

1. Find out the actual number of people in the top 1% (hint: it's not 300 million)

2. Estimate their income by multiplying that by $380K.

3. Multiply that by 60%, to get that portion of their hedge fund salary in taxes. Because everyone making that much money must be a hedge fund manager, because, by golly, $380K a year is a ton of money. Who else could it be?

Then, proceed with bizarre argument.

Oh, wait, no. I see: 0.01 of 300 million is the top 1%.

My bad.

"My. Bad"

No worries. We all fuck up our Excel spreadsheets, blithely publish our shit data in journals that are too lazy to check calculations, and get grants from right-wing think tanks once in a while.

I'll do it your way, Brian. This time without a calculator. 1% of 3.0*10^8= 3.0*10^6 people.

The average salary of those 3.0*10^6=3.8*10^5

3.8*3=1.14*10^1

1.14*10^1*10^6*10^5=1.14*10^12

Multiply that by 0.6 and you get 6.84*10^11= 684 billion.

Yeah, I get it.

Do you see how my conceded my own error without making excuses and blaming you for noticing or caring?

It's called "intellectual honesty."

"Do you see how my conceded my own error without making excuses and blaming you for noticing or caring?"

I strive for the same. We all make mistakes.

Ok, can you use intellectual honesty and examine the ramifications of taxing everyone who makes over $380K/year all of their income, as if they just keep on doing that, and you can only fund about 40% of government spending?

Naturally, once you seize all salaries above $380K/year, companies are just going to keep on paying those salaries. Because companies love sending money to the government, and can't imagine any other use for it. The employees won't care, because they wouldn't get anything over $380K/year anyway.

And, back when the top rate was 90%, what do you think the effective rate was? Hint: nowhere near 90%.

Year 1, assuming you imposed this tax retroactively, you would raise your $600BB.

Year 2? You'd be lucky to get 10% of that amount.

As fun as your little exercise in mathematics is AMSOC. Human beings are not numbers, nor are they "Money Batteries" that the state can tap into anytime it likes without repercussions.

You statist types always view the Universe with deterministic colored lenses. Your States always fail, because you ignore change, and uncertainty.

Brian, rc, jpyrate:

I did a bit of independent research on my own on this subject. I was looking for an effect of higher tax rates on rich people on GDP. My assumption is that i would see a negative effect. I looked up historical tax tables, got the top tax rate , put this on my x-axis and then placed GDP growth on the y-axis. What I found from the tax years of 1940-2012 was that there was a weak correlation between GDP growth and the top tax rate. Meaning the higher you taxed rich people the more GDP growth you would get.

Being intellectually honest I took out the years 1940-1945 since there was tremendous economic growth under FDr. I still got a weak core relation between GDP growth and the top tax rate. I tried all kinds of ways of seeing an effect-- by biasing my results by 1,2, and 5 years, but got really no correlation between GDP growth and top tier tax rate.

Do you guys have any evidence that economic growth is affected by the rates we tax rich people? There certainly is convincing data out there that shows too much accumulation of wealth by rich people results in depression and recession. I would think there is a negative effect, but I've never seen compelling data that shows it.

So, basically, you're saying that, unless someone can show you in a manner that convinces you, with historical data, that taxing the rich is correlated with GDP growth, then you're going to assume that you can arbitrarily tax them at will with absolutely no negative effects?

Thomas Piketty:

What do you think he was talking about, when he said that?

Perhaps you should share your analysis with him.

This is data?

Is this like when right-wingers whip out their Laffer Curves and tell us that raising taxes from 36 to 39% on incomes above 1 million dollars is going to collapse the economy?

I'm just asking a question. I would presume that somewhere out there there is a tax rate on the wealthy that would impede economic growth. I have not seen any evidence of this so I'd like to see if there is a paper on this. I figure CATO or the AEI would be a good place to start.

Well, you haven't exactly refuted your own cite below.

Basically, it argues that the correlation with lower GDP growth isn't as bad as Reinhart and Rogof suggests. However, it doesn't argue that there's no correlation, or an opposite correlation.

So, if you're looking for evidence, haven't you already cited it?

I'm arguing for sanguinity. I didn't argue that high debt loads were "no " problem. I just argued they aren't much of a problem. That's why I said. "Such a problem." Maybe a little coy, but I think smart people like you are capable of subtlety.

Further, I don 't think that the easiest way of addressing this problem-- raising tax rates on rich people-- is likely to cause much problems with economic growth. Thus, we can solve our debt problem without throwing grandma into a shitty poor house.

I just think its time for deficit bean counters to put away their deficit countdown to doom clocks. Has anything they've said over the past decade come true?

Are you referring to the CBO?

Yeah, screw them. When does anything they say come true?

In the same way, we can solve our debt problem without having to cut back on the military spending.

"We might get away with government doing it and not causing an economic catastrophe" is kind of a low bar.

Further, it seems like a double-standard to brush off debt as not "much of a problem", right after whining about how much tax cuts contribute to the deficit. Apparently, it's not problem, but you'll be happy to blame it on tax cuts, anyway.

"Being intellectually honest I took out the years 1940-1945 since there was tremendous economic growth under FDr."

That was called WW2, and it's aftermath.

The economic boom was caused by the rebuilding of Europe, and Japan. It had nothing to do with taxing the rich.

That, and the USA was pretty much the last manufacturer left standing.

How does your analysis of the taxes on the rich, going forward, take into account that that will never happen again, barring WW3, with us winning?

Those are important years to leave out. Why would the government lower tax rates after the war?

Maybe to spur economic activity that would help in the rebuilding?

Do you guys have any evidence that economic growth is affected by the rates we tax rich people?

Considering we've only gone above 19% of GDP in revenue eleven times since 1948, no matter where the tax rates were set, your argument that tax rates will increase revenue is not just question-begging, but flat-out historically inaccurate.

You realize that the initial errors that were identified didn't invalidate their research, only changed some of the parameters, right? And they certainly aren't the only ones that have identified the problem of government spending and its real downward impact on employment and economic activity.

Paying off the debt isn't necessary -- we have a fiat currency system. (It's interesting to note that each time there was a federal budget surplus, we had a severe economic depression or recession within two years. Pres. Andrew Jackson managed to retire the federal debt and we had a true surplus, then experienced the worst economic depression in history up to that point. The Clinton surplus was an exception, although I'd say that the "great recession" was delayed due to the tech stock bubble, the real estate bubble, and Greenspan's easy money policies.) Keeping the debt at a reasonable level relative to the productive capacity of our economy is more important. Most of the money supply growth in our modern economy is from the private sector. Loans (private sector)create deposits. Taxes help control the temperature of the economy, although not very efficiently at times. I'd say taxes also have something to do with the rule of law.

Of course, the government abuses their powers (rule of law isn't perfect) and the government wastes money, regulations choke off economic growth at times, etc. I get the Libertarian arguments, and agree with most of them.

What I differ is on the federal debt and our currency system. The federal government has no solvency constraint, like a household, business, or state. Inflation (hyperinflation to be more accurate) is the risk.

Why is that? After all, the conditions you're talking about apply to governments which have gone through insolvency.

Since monetizing the debt is a way that governments manage solvency, with the associated dangers of hyperinflation, I'm not sure I understand the distinction.

What hyperinflation? You mean the hyperinflation of the worth of arguments put forward by prominent deficit scolds and agonists? I agree! That is a problem !

So, are you asserting that hyperinflation never happens?

Yes, hyperinflation happens:

If we look at the history of hyperinflations in the last 100 years, in each case something else has happened besides high government debt. Those events tended to be things like a massive collapse in production, loss of a war, regime change or regime collapse, rampant government corruption, or ceding of monetary sovereignty via a pegged currency or foreign denominated debt. Look at each example and you'll see at two of those things almost every time. Weimar Germany: regime change and foreign denominated debt. Greece (1944): civil war, regime change. Hungary (1945) war, foreign denominated debt. Zimbabwe: regime change, foreign denominated debt.

You mean the hyperinflation of the worth of arguments put forward by prominent deficit scolds and agonists?

You do know how a compound function works, right? Taken a look at the inflation calculator over the last 40 years?

Hyperinflation in the U.S. and Europe is currently masked by actual wealth. AMSOC read another article on how infrastructure in the U.S. and Europe is deteriorating, because of capitalism.

Idiot.

https://www.youtube.com/watch?v=H6LBhjc08vo

With all due respect, AmSoc, can you please provide your research?

And, at the risk of feeding the trolls, why raise taxes on rich people when there are other, less combative, ways to reduce outgo?

Either you are just out to get the rich folks, so you are letting your personal distaste for those with more get in the way of actual economic decisions, or you actually believe that it is the best possible solution, in which case I need to see your research that proves you are right. Please advise.

"Provide your research."

Sure. One of a number of papers: http://www.peri.umass.edu/file...../WP322.pdf

I'm curious what your "less combative ways to reduce outgo" are. If we are talking about zeroing out the DoD budget we may agree on more than we disagree.

Oh yeah, we should imitate exactly what western Europe has been doing, because that has worked so darn well for them. No debt whatsoever for those enlightened Europrogs!

We should not imitate western Europe as it relates to their monetary system or fiscal policies. In some ways, we couldn't anyway -- because our monetary system is different. The euro is a flawed currency design.

The paper comes to the same essential conclusion as the paper it "refutes": higher debt-to-GDP ratios are correlated with lower GDP growth.

The claim that is actually refuted, based on the available data, is the "nonlinear response" of GDP to high debt.

However, the two papers share the same fundamental lack of data and analysis concerning countries with extremely high debts (on the order of multiple times GDP).

american socialist|12.2.14 @ 11:35AM|#

"If this is such a problem-- and recent research suggests it isn't-- maybe we should raise taxes on rich people."

Maybe slimeballs like you should donate your entire income.

I think I'm arguing the exact opposite. Since I 'm not wealthy why would my argument that rich people should pay more in taxes imply that I want to pay more?

I know: you're one of the poor sods who needs government to take care of you, in a manner totally consistent with Marxist class theory, which I assume is completely endorsed by your link.

Funny, how when you point this out to people, they usually get all uppity over it, when I'm only applying their own social theories to themselves.

What a brilliant idea! I'm sure there will be no unintended consequences and all of our problems will be solved!!! You paid beyond what the IRS asked for this past year didn't you comrade???

Sure, ok lets do that.

Lets institute a 100% tax on all income above $200,000 a year effectively creating an income cap.

Assuming absolutely no negative economic impacts from doing that and absolutely no changes in behavior from anyone just how much additional revenue do you think that would generate?

$1.5 trillion a year

Now of course the idea that there would be no economic impacts from that is laughable. New Business creation would basically end, Most small businesses would shut down immediately, Most of Hollywood would shut down because the income cap just wouldn't be worth risking up $80 million+ for a movie, most musicians would pare back their concert dates to just a handful a year since they would basically stop making money after just 4 or 5 concerts, Broadway would be in basically the same boat, and so on.

Like most economically illiterate socialists you just have no sense of how much money $18 trillion dollars is and how little money there is available to be taxed from the rich. As a practical matter you could maybe get another $200 billion a year in extra taxes from the rich before you start collapsing the economy by actively discouraging any risk taking.

The 30 year Treasury yield is only 3.00 right now.

One of these days, the Fed won't be able to prop the market up.

The mantra of the [nutty] political right since 1971 and eeeviilll Nixon. Is this what nick gillespie is talking about when he refers to a moral panic?

Re: American Stolid,

Actually, AS, the Fed was NOT able to prop the market up from 1971-1980. Volcker conceded defeat and reigned in the printing press.

The difference now is that Bernanke and Yellen (or Dumb and Dumbest) will not concede defeat.

Of course, suppressing interest rates (also known as "financial repression") has no negative effects on capital formation or on the incomes of retirees and others living off of their savings.

And, yes, financial repression is the avowed policy of the Fed.

maybe we should raise taxes on rich people

"This goose is delicious!"

And the value of assets owned by the federal government? The debt number by itself doesn't mean much -- there's another side to the balance sheet. The fossil fuel resources alone owned by the federal government are worth over $100 trillion.

Beyond that, it's stupid to compare the federal government to a household, business, or state. We have a fiat currency system. Solvency is not the constraint. The risk is inflation, or, more precisely, hyperinflation.

Heard this fantasy before; it's bullshit from end to end.

Assets are only assets if they can realistically be turned into income.

I'm not suggesting the debt/deficit does not matter. Inflation, especially hyperinflation, can be damaging -- terrible. Operationally, that's not the same as running out of money.

The assets I mentioned are not fantasy or bullshit. The revenue Uncle Sam collects from fossil fuel royalties is now second only to income tax.

Yeah, if only we tapped all of the fossil fuel resources and burned them into the atmosphere, we'd be rich.

I wonder if anyone has a problem with that.

This article is malarkey. I've been assured by such august experts as Professor Matthew Yglesias that there's no reason to fret about the debt because, hey, we can just print more money!

Or mint a $1 trillion coin!

/Kruggie

I'm not gonna look for the tweets but Iowahawk was really on a roll when that idea was being pushed.

#saveusmagiccoin

Hey: that debt is backed up by the full faith and credit of the US government.

Why do you hate the USA, radar?

Start working at home with Google! It's by-far the best job I've had. Last Wednesday I got a brand new BMW since getting a check for $6474 this - 4 weeks past. I began this 8-months ago and immediately was bringing home at least $77 per hour. I work through this link,

go to tech tab for work detail ????????????? http://www.jobsfish.com

Assume we expropriate

No.

Naturally, once you seize all salaries above $380K/year, companies are just going to keep on paying those salaries. Because companies love sending money to the government, and can't imagine any other use for it. The employees won't care, because they wouldn't get anything over $380K/year anyway.

Well, those corporations could always compete by offering non-cash fringe benefits, like gold plated health insurance.

USA is in very difficult situation. It is very high federal debt. People try to solve their financial help but it is very difficult that is why many of them take financial help. Today many people take loan online from Personal Money Service . It's very good money service which proposes financial help for everyone who needs it. This service is available 24/7. You can take loans even if you have bad credit score.