Why Taxi Medallion Owners Don't Deserve a Government Bailout

Innovation, not government policy, is transforming the taxi industry.

Who's going to shed a tear for Andrew Murstein, the wealthy founder and president of the investment firm Medallion Financial, if his net worth plummets because the high-tech car services Uber, Lyft, and Sidecar obliterate the traditional taxi industry? Among other things, Murstein's firm is a holding company for taxi medallions—transferable licenses to operate cabs that in New York City sell for over $1 million a piece. Mediallions are now losing value because Uber and its competitors—whose drivers don't pick up hail passengers off the street and therefore aren't required to hold medallions—are luring drivers and passengers from the traditional cab industry.

But how about New York City's independent cabbies whose retirement savings are tied up in medallions they borrowed to purchase and have spent years paying off? Or the "40 young Ghanaian men" featured in Emily Badger's recent story on Chicago's taxi industry, "mostly in their 20s," who in the past two years bought medallions in the Windy City with "little or no money down?" As Badger notes, these investments are probably already underwater, since a recent city auction of medallions apparently drew no bidders.

In an article in Truthout, economist Dean Baker recounts how he caught a ride from a worried Pakistani driver in San Francisco who saved for years to buy a medallion, and is now spending $2,300 in monthly mortgage payments on the purchase. Baker argues that his driver's losses should be viewed "in light of the larger issue of…growing inequality:"

On the current path, these medallion owners will just be out of luck. Their life savings will be made worthless by young kids who are better at evading regulations than immigrant cab drivers; so much for the American Dream.

In last week's episode of Russ Roberts' podcast EconTalk, Duke University political scientist Mike Munger mused about whether medallion holders deserve a government bailout:

Suppose that we don't take any action and the value of these medallions falls to zero. Are we obliged to offer compensation, because we in effect made a regulatory decision that is a taking? This property right, this medallion, had significant value. We made a choice, without due process, that said we are going to reduce the value of this medallion to zero…There is a difference between private property and…rent-seeking…[But] I'm not as sure as I was that the difference is as clear as I thought.

Here's why medallion owners shouldn't get a bailout, and why the issue is far more clear-cut than how Munger and Baker frame it

: As I mentioned above, medallions are only for cars that pick up hail passengers, not for car services, which were never required to hold these exclusive permits. Uber, Lyft, and Sidecar aren't "evading regulations." Several states have enacted new laws to insure that their drivers carry commercial insurance, but medallioned cabbies still hold a monopoly on picking up hail passengers off the street.

By introducing great mobile apps, Uber and its competitors simply made car services more convenient for many customers than stepping off the sidewalk and sticking an arm in the air. In other words, it's technological innovation not a policy change that's transforming the cab industry.

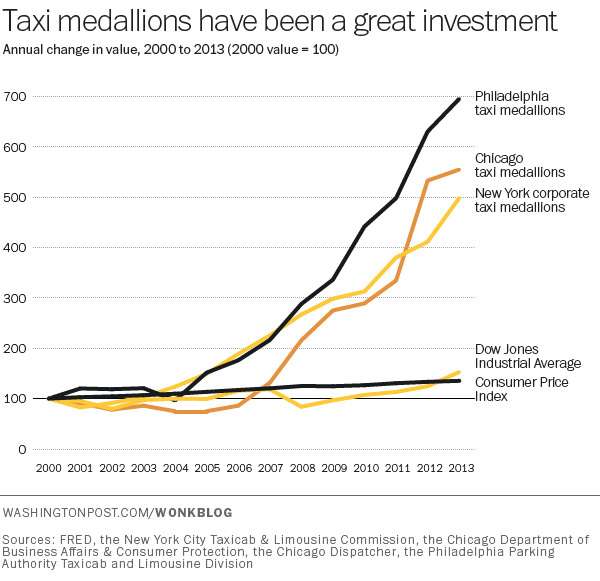

As Emily Badger notes, taxi medallions have "been the best investment in America for years," outpacing the S&P 500 by a longshot (see her chart above); with great reward comes great risk. Even small investors shouldn't be protected from the consequences of their investment decisions.

In this recent Reason TV video, I looked at how Lyft is transforming D.C.'s taxi market:

Show Comments (30)