The Next Time Anybody Insists California Has Recovered, Read This

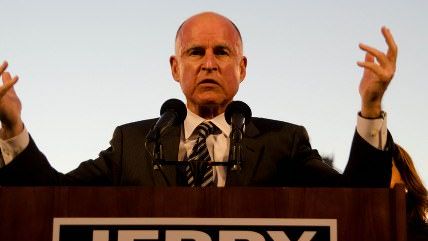

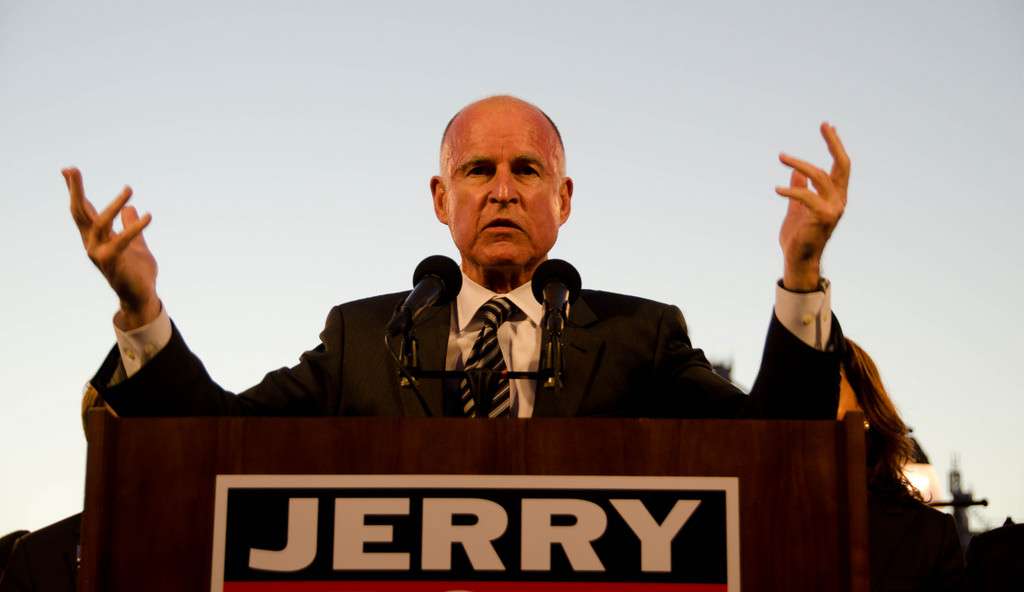

I have been pushing back on claims that California's economy is fine and awesome and should be used as a model for other states' recoveries. California is doing better these days than five years ago; but so are most states. However, it's sheer bullshit to say that the state doesn't still have huge, dire economic issues, and Gov. Jerry Brown, like previous California governors, is concealing the problems with accounting tricks.

So the next time anybody insists that California's problems are "fixed" or suggests that Brown's handling of the state's fiscal crisis should be a model for other states, drop some knowledge on them, courtesy of David Crane at Bloomberg View. He explains how Brown (and other governors) is able to trick journalists into thinking the state of the state is better than it really is:

They avoided scrutiny thanks to an accounting method known as "cash-based budgeting," which recognizes expenses only when cash changes hands and treats any cash received, even borrowed cash, as revenue. That's how New Jersey Governor Chris Christie "balanced" New Jersey's budget in 2010: by simply pushing a $3 billion pension payment from one year into the next.

Similarly, Brown is using cash-based budgeting to underreport the cost of an employee benefit—retiree health care—by $3 billion. The governor could have chosen to report the expense at its full size, but to do that under cash-based budgeting, he would have had to actually contribute $3 billion in cash to a retiree health-care trust fund.

That's exactly what governors are supposed to do. Retiree health-care expenses, like pensions, are supposed to be pre-funded in order to protect future generations from having to pick up an earlier generation's costs. But Brown chose not to do so, making his budget look rosier than it is. This shortchanges future generations, which will have less money for their own services because they will have to pay off the skipped costs.

Brown is also ignoring a $3 billion in required payments to the state teacher pension fund, so really there's $6 billion in payments unaccounted for by the state's budget. But thanks to these games, it's not counted as debt. And not paying it helps avoid putting the state back into a spending deficit, and the lack of a deficit is what folks are pointing to when they insist California has recovered. Crane notes:

Even though California teacher pensions—and therefore that debt—are guaranteed by the state, for accounting purposes the state treats that obligation as off its balance sheet, as if it's not on the hook. When the trust fund runs out of money, the debt will total more than $600 billion.

Crane concludes by pointing out how badly California is leeching off its citizenry. Despite getting more money from taxpayers than ever, the taxpayers themselves are getting crap out of it:

Just as California's budget wasn't fixed in 2000 or 2007, it isn't fixed in 2014. In fact, even though revenue, taxes and fees are higher now than they were the last time California reported a balanced budget, in 2007, state spending on most state services is lower. Spending on welfare, universities, courts and parks is down more than 20 percent because spending on employee salaries, pensions, retiree health care, debt service and Medicaid is up more than 20 percent.

And even with that huge increase in spending on its own workers, there's still billions of dollars in debt that's unaccounted for.

Show Comments (14)