Growth in the National Debt: Ten Years and Ten Trillion Dollars

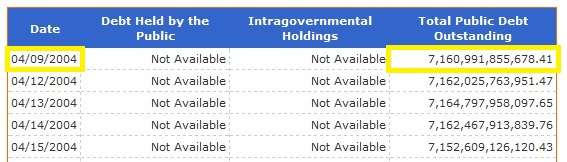

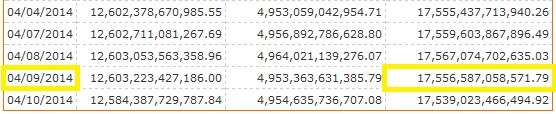

I know the national debt isn't supposed to matter, at least, so some well-placed pundits in the media tell me. But it's hard to head off a modicum of concern when I glance at the figures and notice that the total public debt outstanding has risen from $7.16 trillion to $17.56 trillion in ten years.

At some point, you have to think that it's going to occur to people that the United States government seems neither willing nor able to stop borrowing, and to start paying the sum down, even a little bit.

The "stop borrowing" part would be a good start. But that's a lot of money to pay back.

And eventually, the bill will come due.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Relax, we've got plenty of checks.

Yeah, and we 'owe' the money to ourselves anyway.

"At some point, you have to think that it's going to occur to people that the United States government seems neither willing nor able to stop borrowing, and to start paying the sum down, even a little bit."

I'm not going to do the search this evening, but I think daily operational costs are now funded something close to 50% on borrowed money, the equivalent of taking out a loan to buy half your groceries.

So to begin paying it down, we have to start cutting expenses by that amount and as we know, there is NOTHING LEFT TO CUT!

Looks closer to a third by what I can find. Still, Sevo, your point stands.

Interest payments on deficits of yore are increasingly big chunk of why USA borrows today.

It is worth observing that in some twisted actuarial way we are still paying interest on things like Imelda Marcos's shoe collection - among eleventy billion other things charged to the card that all were sorely needed I'm sure.

I wouldn't mind her shoe collection or for that matter still paying off the cost to build the Monitor for the civil war; both were one-time costs.

Paying off a debt to buy last week's coffee pisses me off!

How about the assets side of the ledger?

Interesting question and for some perspective, the total value of all US real estate in 2010 was $34.5Tn according to this:

http://wiki.answers.com/Q/What.....eal_estate

The gov't owns quite a bit, but most isn't very valuable. It owns a lot of military hardware, but that's of transitory value. What else?

Given the unaccounted liabilities in retirement benes, I'm pretty sure the gov't is upside-down.

You're forgetting the most valuable US asset: the printing presses.

Pipes in "The Russian Revolution" mentions that the largest Russian gov't expenses in 1918 were paper and ink for, yep....

Their most valuable asset is the ability to extract wealth from the citizenry by force. Without that, they have nothing.

"Their most valuable asset is the ability to extract wealth from the citizenry by force. Without that, they have nothing."

Again, reference to the failed commie experiment, pretty sure that's the reason the banks and investment houses loaned all that money to the Soviets right before they found out the citizenry was gonna pay those taxes with the worthless paper the government put out.

How about the assets side of the ledger?

I know of some land that Harry Reid is giving to the Chinese, and his son who works for them, for solar panels.

Though there might be some mark down as some guy keeps putting his cattle on it.

You're the assets side of the ledger. Now get back to work.

Relax, people. We'll grow our way out of it. Once the economy reaches peak velocity, tax revenue will increase exponentially resolving the whole issue. derp, derp.

I actually do think that if you completely unshackled the people of this country, the resulting growth in the economy would be enough to provide a way out.

I wonder what inflation will look like when the economy heats up again?

If only Tony were here.

A GOVERNMENT BUDGET IS DIFFERENT FROM A HOUSEHOLD BUDGET.

Because it's not counterfeiting when the government does it.

We'll never pay it back. That's a total fantasy. I'd even say that not adding more to it every year is a pipe dream. We're a nation of drunken sailors and shore leave isn't over until the ship sinks.

I agree, I don't think the will for the development of a long term disciplined deficit reduction program is going to materialize basically ever. Any attempts to address it will run up against the brick wall of political opportunism. No matter how critical reform is there will be some cynical cronyist or true-believer type to promise that the circus can go on and an increasingly frightened population will latch onto it.

And when America goes tits-up it is going to be ugly everywhere. I fear a sort of authoritarian dark age is coming. The bones of it have been lain over the last century and a world-wide super depression (starting with the US and spiralling out) would be just the spark needed to set the tree of liberty aflame.

Pretty depressing to think about, but I'm just not seeing any broad trends that could meaningfully deflect us from this course.

Yep. And demographics increasingly favor expansion of the Nanny State. Any objective analysis that doesn't candy-coat things leads to an inevitable conclusion: we're screwed.

Meh. I like to think they won't be able to afford the authoritarian super-state. Paper money loses value, eventually.

I keep scoffing at the current price of gold. 80% of me says that it's way overpriced. The other 20% says that 5 years from now I will be sorry if I don't buy some now.

So buy a few coins and throw them (well, place them gently and reverently) in the gun safe. Its called hedging, betting that your main position is wrong.

DwT-

Thanks.

I needed another excuse for my sixth drink tonight.

I'm not dying fast enough...

Hey now, we drunken sailors can only widely spend on booze and whores the money we actually *have*.

We'll never pay it back.

I can see a stretch of brutal inflation, allowing us to pay it back in nominal terms.

Of course, in constant dollars, we can't even come close. Paying it back with devalued dollars still represents the destruction of an enormous amount of value.

Well, at least 2chilly is still out there.

And interest rates are still at rock bottom. Wait 'til they hit 4%.

"I'm sorry, your Obamacare subsidy has been reduced again. You're going to have to pay the full two thousand dollars per month for your policy. Will that be cash or charge?"

No, fuck spending, cut you!

Something like that.

The government counts you sharecroppers taxpayers as assets; don't forget that.

New tubes in the amp. They're probably only around 12 hours so far.

It was (4) 6550 (electro harmonix), one went bad. I've switched to 4 KT88. They're finally sounding nicer. Just a little bit of cooling and they needed another hour to warm up.

Eh, a real man uses the "super" 6BG6. Takes some socket rewiring, but the plate caps look cool and they seem to be impossible to kill. They're apparently 7027A stuffed into a different bottle.

Fun Fact: the I-V curves of transistors today are still called "pentode" curves even though they're 3-terminal devices. Legacy from the emission coils in tubes. That being said, unless you're working in a plasma physics or high rad environment, I don't have much use for tubes...

Some people would rather drive a 2014 Lexus than a 1957 T-Bird. It's all cool.

I've heard the "pentode curve" thing for FETs, but never bipolars. They even call the part below the pinch-off voltage "triode region."

Fun thing about bonds. They maintain value. Until they don't. And then it happens really fast.

Parking tickets, OTOH, tend to increase in value!

Except in Detroit. Then it costs more to collect than the value.

Ladies and Gentleman, allow me to present the $17.56 trillion dollar coin.

Who's head is on it?

Igor Sikorsky's

Render unto Igor

We are all helicopter currencies now.

LOL

"Gimme, gimme, gimme, whop, whop, whop!"

Is it an ounce of antimatter? Cause that would be cool is SOOOOO many ways.

It's an ounce of red matter.

/bad plot devices

Papaya has been smoking the Krug huh.

That shit gets you so high.

You're like "THERE AREN'T ENOUGH GLASS HOUSES MAN...."

The special reserve accounts will save us. That noise you will hear in the background is a Chevy Volt's batteries exploding after it is turned over and torched.

17.6 trillion? So let's say that Obama escapes from office with a debt of only 20 trillion or so and interest rates rise to the usual 5-6% where they were under Clinton and much of Bush.

That's a trillion per annum in service alone. Sounds like whoever inherits the mess of Harry and Barry will need to refinance--maybe the Lending Tree can help them out.

But we need to borrow now when interest rates are low. The eighth dwarf, Bobby Reich, told me so. How can an interest only (or negative amortization) loan possibly hurt us...?

Are we still borrowing short term to keep today's interest down and screwing the future more when rates go up?

Dammit, doesn't anyone here read Krugman?! LO-FLATION is the existential menace that we're facing, not debt!

+1 Krugabbe

Inflation is the sign of a growing economy. Duh. Didn't you learn anything from 1979-82?!

Sounds like a very good plan to me dude. Wow.

http://www.GotsDatAnon.tk

Maybe we should go back to teaching math in school.

I don't get how so few people on the left seem concerned about the debt. Even with interest rate lowest in years, we're paying out almost a quarter trillion a year servicing the debt. Imagine all the 'good' you could do with that money, lefties!

You can't put that genie back in the bottle. Leftists, to the extent they're capable of logic, figure it would be too painful to all of their pet project with other peoples' money right now to start actually cutting back or - laughable, I know - paying it down. We're riding this saddled lemming all the way to the cliff's edge, kemosabe.

Your really Machiavellian "the worse the better" leftists are probably looking forward to the currency - economic - social collapse as their best opportunity to really take over and do away with the vestiges of restraint on the Total State.

And you know something? They're probably right.

I disagree. The total state is expensive, and people have more and more tools to escape its grasp.

Spain is now 20% black market and growing. Most of the western world is heading that way.

If the government paid off $1 tillion per year (which is a fuckload every year), it would take over 17 years to pay it all off. If the government paid just $250 billion back per year (a much more reasonable figure), it would take 68 fucking years! People should probably start realizing that.

I thought all of this inflation was good for the nation? Yet everyone's paying more from the supermarket to the gas station. So many delude themselves and lap up the mental masturbation, that they are ready to submit to, and bow down to the slavery that is rampant throughout this nation.

This is with interest at 0%. If it goes up to 6% (not unreasonable), that's all she wrote for the FedGov. No more social safety net. No money to pay bureaucrats to 'protect' us. Nothin'.

Could someone Voxsplain this to me?

No, fuck you, cut spending