Government at Work: Handing Out Billions in Tax Refunds to Con Artists

Here's the good new: the Internal Revenue Service believes it's not handing out quite so many billions of dollars to identity thieves as it used to. Yay, IRS. Your government at work: hectoring you about your supposed obligation (and even delight!) to cough up the goods to Uncle Sam while handing out free money to con artists. And the feds are still doing their best to prove that crime does pay. The U.S. Treasury Inspector General for Tax Administration says the latest figures have the IRS paying out $3.6 billion in bogus tax refunds in 2011.

According to the breezily titled, Detection Has Improved; However, Identity Theft Continues to Result in Billions of Dollars in Potentially Fraudulent Tax Refunds (PDF), dated September 20 but published online November 7:

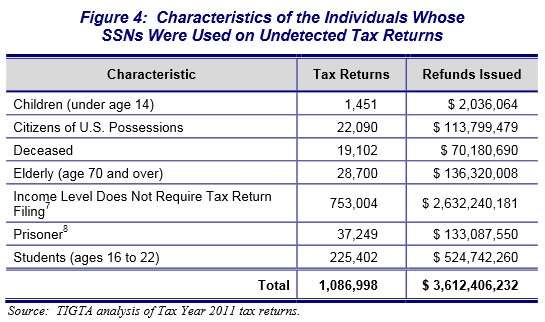

Our analysis of Tax Year 2011 tax returns identified approximately 1.1 million undetected tax returns filed using SSNs that have the same characteristics of IRS-confirmed identity theft tax returns. Potentially fraudulent tax refunds issued total approximately $3.6 billion.

As mentioned, this is an improvement, since TIGTA fingered $5.2 billion in fraudulent returns for 2010.

As the title suggests, the report touts the IRS's ever-improving efforts to detect fraud and not dole out cash to scammers. The key to a more honest world, we're told, is "[a]ccess to third-party income and withholding information." That's right, if we'd just cough up more data to Uncle Sugar, he'd stop handing checks to anybody who asked. We have nobody to blame for the IRS's missteps but ourselves and our stubborn insistence on not living in glass boxes.

When the IRS processes fraudulent returns and mails out checks, it doesn't just piss money away, it also delays the processing of legitimate returns by taxpayers whose Social Security Numbers were appropriated by the con artists. Well, the live ones, anyway. The thousands who were dead and buried before returns we submitted in their names probably don't care. In fact, though, most of the fraudulent tax returns were submitted using the data of people who don't actually have to file. In addition to those who are pushing up daisies, that is.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

But half of the Obama cabinet didn't pay their taxes, so it all evens out.

The only people who feel there shouldn't be more coming in to the federal government from rich people are the Republicans in the Congress. Everybody else, including rich people, are willing to pay more. They want to pay more

Fuck you Reid. I will pay more in taxes only if I can watch you be sodomized with a hot branding iron.

This will come as a big surprise to most of my clients.

TOP MEN don't have to pay taxes. They get PAID with taxes.

And they know just exactly what the facts is.

Sloppy reporting.

The chart doesn't show $3.6 billion in fraud, it shows $3.6 in categories where the individuals may or may not have had taxes withheld in excess of taxes owed, and so which may or may not be eligible for refunds. There may be other fraud not shown in these categories.

For example, some or even many children, teenagers, and elderly may in fact be legally entitled to have a refund of taxes withheld in excess of what they owe, but every single one of them is counted as being potentially fraudulent.

Two points:

1) The feds don't know how much fraud goes on.

2) In my view, it isn't fraud for anyone to get a refund up to the entire amount of taxes withheld. That is what I call "recovery of stolen money". It is asinine for an allegedly libertarian site to characterize people finding a way to unofficially cut their tax bill as being fraud and theft from the rest of us.

What if I lie about my withholding to get a refund? What if I intentionally under-report my income?

I don't think the chart shows the categories of children, deceased, low-income, etc. - it shows the categories where the suspected fraudulent claims came from. It's not saying children, dead people and poor people are crooks, it's saying fraudsters pretend to be children, dead people and poor people.

I do agree with your points, however. To start analyzing fraud, you first have to define your terms and I would categorize a lot of subsidies and contracts and regulation (and the contingent expense of overseeing the subsidies and contracts and regulation) as a fraud against humanity.

And I don't give a rat's ass if Donald Trump gets a $12 million tax refund for giving blowjobs to donkeys - anybody getting money back from the government for any reason is fine in my book.

(It irritates me no end to hear people complaining about people not paying their fair share in taxes - fair, by definition, is whatever is mutually agreed upon. If I buy a loaf of bread I have paid a fair price because it is the price at which the baker has agreed to sell and I have agreed to buy. I will start paying my fair share of taxes the day the IRS sends me a letter asking me what I think would be a fair amount to pay. Until then, any amount they demand and coerce is by definition an unfair amount.)

Leaving aside the vast injustices in our tax code and in most if not all taxation in general, fraud is the name of the game. Most welfare is likely at least partially fraudulent. As are many subsidies. Like any criminal enterprise, our government is rife with, what else, crime.

Don't worry. once the IRS finds out that a tax return was submitted with identity theft, they will seek return of the funds from the actual person. Fuck you, that's why.

Sounds like a slam dunk to me dude.

http://www.Privacy-Road.tk

The IRS detecting fraud? This is the same agency who can't account for millions in their own budget every year for decades. So what is the discussion? What is the solution? Maybe Reason should start selling popcorn.