Government at Work: Handing Out Billions in Tax Refunds to Con Artists

Here's the good new: the Internal Revenue Service believes it's not handing out quite so many billions of dollars to identity thieves as it used to. Yay, IRS. Your government at work: hectoring you about your supposed obligation (and even delight!) to cough up the goods to Uncle Sam while handing out free money to con artists. And the feds are still doing their best to prove that crime does pay. The U.S. Treasury Inspector General for Tax Administration says the latest figures have the IRS paying out $3.6 billion in bogus tax refunds in 2011.

According to the breezily titled, Detection Has Improved; However, Identity Theft Continues to Result in Billions of Dollars in Potentially Fraudulent Tax Refunds (PDF), dated September 20 but published online November 7:

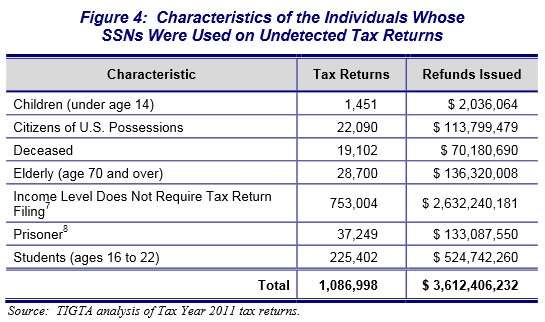

Our analysis of Tax Year 2011 tax returns identified approximately 1.1 million undetected tax returns filed using SSNs that have the same characteristics of IRS-confirmed identity theft tax returns. Potentially fraudulent tax refunds issued total approximately $3.6 billion.

As mentioned, this is an improvement, since TIGTA fingered $5.2 billion in fraudulent returns for 2010.

As the title suggests, the report touts the IRS's ever-improving efforts to detect fraud and not dole out cash to scammers. The key to a more honest world, we're told, is "[a]ccess to third-party income and withholding information." That's right, if we'd just cough up more data to Uncle Sugar, he'd stop handing checks to anybody who asked. We have nobody to blame for the IRS's missteps but ourselves and our stubborn insistence on not living in glass boxes.

When the IRS processes fraudulent returns and mails out checks, it doesn't just piss money away, it also delays the processing of legitimate returns by taxpayers whose Social Security Numbers were appropriated by the con artists. Well, the live ones, anyway. The thousands who were dead and buried before returns we submitted in their names probably don't care. In fact, though, most of the fraudulent tax returns were submitted using the data of people who don't actually have to file. In addition to those who are pushing up daisies, that is.

Show Comments (12)