The Feds Don't Seem to Understand Bitcoin

Last week, the Treasury Department's Financial Crimes Enforcement Network (FinCEN) made waves in the Bitcoin community by releasing a statement of guidance that paid special attention to virtual currencies. Patrick Murck, who provides legal council to Bitcoin.org and contributes to the foundation's blog, expressed concerns about the implementation of the suggestions, which are being made to the Bank Secrecy Act.

Murck said he "was happy to see FinCEN issue some clarity around the overly-broad pre-paid access rules and definitively state that they do not apply in the context of bitcoin," but he was also pretty worried about the ill-fitting definitions FinCEN came up with:

Left unsaid are any specifics around the facts and circumstances that would constitute "engaging as a business." [In reference to the definitions of "User", "Administrator" and "Exchanger"]

FinCEN's guidance implies that every person who has ever had any virtual currency and has ever exchanged that virtual currency for real currency may now be considered a money transmitter under the Bank Secrecy Act. That is, of course, an untenable position.

What is crystal-clear is that once a person sells a single Satoshi for real currency that person is no longer a "User" and therefore not categorically exempted from MSB registration.

Murck summarized the FinCEN guidance as follows:

- A person may spend money to purchase bitcoin or mine bitcoin and then exchange the currency for goods and/or services without having to register with FinCEN as an MSB.

- If a person receives real money in exchange for their bitcoin they MAY have to register with FinCEN.

- If a miner exchanges their mined bitcoin for real money they MUST register with FinCEN.

- Anyone transacting bitcoin on someone else's behalf MUST register with FinCEN.

Murck also tried to calm businesses and individuals working with the currency, noting that "under the Administrative Procedures Act (APA), FinCEN can't promulgate new rules without going through a notice and comment proceeding whereby the public may have their voices heard."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Or you could secede, tell the feds to back off, and see how that works.

Feds don't understand bitcoin? I don't think they understand dollars, why would they understand bitcoin?

Spongebob: "I don't understand why people don't want to buy our chocolate."

Patrick: "I don't understand anything."

The federal government has the intellectual capacity of a starfish.

How is trading in Bitcoin any different from trading in rice kernels or shiny rocks? If I create some rice and trade it for "real money" do I have to register with FinCEN? If I trade my rice for some shiny rocks and then exchange them for "real money" might I have to register with FinCEN?

I know, I know... Because fuck me, that's why.

We should rush out and trade our make believe paper money with make believe virtual money.

This should end well.

Bitcoin is worlds different from fiat money.

It's backed by the same thing (i.e. nothing).

The only difference is that the quantity of currency in circulation is regulated by a computer encryption system in the case of Bitcoin, and by central banks in the case of fiat money.

Sigh.. that's a meaningless statement and everything--including gold (which btw I am a fan and buyer of)--is ultimately "backed" by nothing.

Bitcoin serves as a medium of exchange and has high utility for that by far. As far if it becomes money, that remains to be seen since that is a continuum issue. The longer people hold on to it and evaluating things in terms of it, the more money like it becomes.

Furthermore, considering how fiat money is infinitely inflationary while Bitcoin has supply growth already slowed down (increased mining difficulty) and has a hard limit, making ultimately deflationary, that is alone is a considerable difference.

Aside from the fact that it is decentralized and disintermediates all transacations, unlike fiat money.

*gah* if only there was an edit button..

Bigger sigh

Money is that which has bearer negotiability ? the holder need not prove property (right of ownership) in it ? that which extinguishes credit and that which no one trades for itself, e.g., no one trades $100 for $100.

Food stamps EBT cards serve as a medium of exchange, but no one would claim such as money.

Of course, Bitcoin never could be money from a political perspective ? politicians, their courts ? because the U.S. only accepts Fed Res centralized bank notes to pay public debts (taxes).

Under the current setup, it could never be money.

However, all that could change.

Because fiat money can be used during a power outage.

Visa and Mastercard aren't very useful in a power outage either but people still use them.

This got me to thinking, those of us who live in earthquake zones are familiar with these little things they call 'earthquake kits'. Stuff everyone should have in their homes in the case of a serious earthquake.

Some potable water. A small crowbar or "wonderbar". Cash*

*because during a power outage, Visa and Mastercard don't work so well.

Technically speaking, it's just guidance and not law, where not complying is technically not illegal. Their rationale is to have a process to monitor people--KYC, AML, Suspicious Activity Reports (e.g. $10,000 cash transactions), etc.--to mitigate investigations into money laundering. Effectively it becomes de-facto law because there's a presumption of guilt by not complying.

There is a loophole however: using goods as intermediaries for currency exchange since buying and selling goods for bitcoins do not fall under FinCEN.

I agree with Murck that it's basically untenable when it comes to individuals and various small shops, and unenforceable with foreign based exchanges.

They didnt understand E-Gold either and jsut shut them down costing a lot of people a LOT of real money.

http://www.MaxAnon.tk

They did understand e-Gold, and that's exactly the reason they shut it down.

Jesus fuck! Anonbot is sentient!

And smarter than most Americans.

Hey!

"Vera Soliman is a 2013 Reason intern."

And the deadline to apply for intern is ... today!

I smell a rat. Was the intern spec written for a pre-selected candidate? Did REASON somehow become a defense contractor?

The Feds Don't Seem to Understand Bitcoin

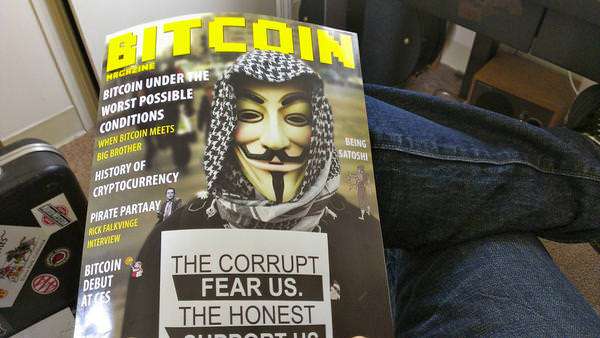

The proper alt-text is: "Nothing douche-er than a guy wearing both a Guy Fawkes mask and a Palestinian murder scarf keffiyeh."

My boyfriend says he'll give Bitcoin credibility when you can put it down to buy a house.