John Boehner is Right: "The Talk About Raising Revenue is Over."

Over the weekend, Speaker of the House John Boehner (R-Ohio) appeared on ABC News' This Week. His big quotes included this one about the government's balance sheet:

"We do not have an immediate debt crisis," Boehner said on ABC News's "This Week With George Stephanopoulos." "But we all know that we have one looming. And we have — one looming — because we have entitlement programs that are not sustainable in their current form. They're gonna go bankrupt."

I'd quibble with Boehner a bit on this. Maintaining a gross national debt greater than 90 percent of GDP - something the government has done since the finanical crisis in 2008 - is a clear drag on current and future economic growth. As Carmen Reinhart, Vincent Reinhard, and Kenneth Rogoff have shown, such "debt overhang" for five or more years corresponds with long-term reductions in economic growth:

When accumulated gross debt exceeds 90 percent of a country's total economic activity for five or more consecutive years - reduce annual economic growth by more than one percentage point for decades.

Over 20 years, [Reinhart, Reinhart, and Rogoff] write, there can be a "massive cumulative output loss" that reduces gains by 25 percent or more. The U.S. went over the 90 percent threshold after the 2008 financial crisis. At $16.3 trillion, our current gross federal debt represents more than 100 percent of 2012's total economic activity or gross domestic product.

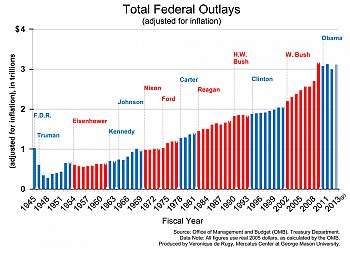

That may not constitute an "immediate" debt crisis, but it's one that demands immediate and serious attention from both parties - not the phoney-baloney long-term spending plans put out last week by both the Republicans and the Democrats. Neither of these is a serious attempt to rein in long-term spending that is behind our mounting debt levels. The GOP wants to increase spending by 42 percent over the coming decade while the Dems call for 58 percent more spending. (Read more details here and here.)

However, Boehner said something that set off the chatterati that is absolutely, unequivocably accurate when it comes to taxes for next year:

"The talk about raising revenue is over."

Give the speaker credit for hitting the nail on the head. Both the House Republican and Senate Democratic budgets agree that in fiscal year 2014 the federal government will have raise $3 trillion from all sources of revenue. The budgets differ on the amount of spending they propose: The GOP wants to spend about $3.5 trillion in 2014 while the Dems want to spend $3.7 trillion.

As the budget season gets underway, it's is worth hammering home a few things. First and foremost, despite containing projections for a 10-year "budget window," annual budget documents are only really about one fiscal year - in this case, 2014. The decade-long projections are nice but are in no way binding and are mostly used to score ideological points, not guide actual governmental behaviors. Second, both parties agree on how much revenue the government will generate in 2014. Third, they differ on spending by just $200 billion - a huge amount, of course, but a small fraction of budgets that approach $4 trillion.

The federal government has gotten used to operating without an actual budget that has been worked out through the normal legislative process. That has actually been good for restraining spending - it's hard to boost spending under a series of continuing resolutions. But it is a sign of a very basic level of incompetence that can't and shouldn't go on indefinitely (and note that this is irresponsibility, not gridlock - Congress has a knack for getting shit done when they really want to). Uncertainty gives ulcers to Rhesus monkeys and it's not good for long-term economic growth - which is already staggering under excessive debt.

But Boehner is right that revenue for next year - the only year under actual discussion in the 2014 budget - is a settled matter. All that should be left to discuss is how much the feds plan to spend. And even there, the difference is little more than a grandiose elaboration of petty differences.

Maybe after Boehner, Reid, Obama, et al. hash that minor disagreement out, they will actually start dealing with long-term drivers of debt and the weak economic growth that piling on trillion-dollar deficits tends to engender.

Show Comments (36)