Just Like Cheese, Wine, & Bread, There's Good Austerity and Bad Austerity

Austerity - attempts by governments to reduce the debt-to-GDP ratio - is very much in the international news these days. Most countries have been spending money they don't have and are getting worried that excessive amounts of debt are impeding economic recovery.

Broadly speaking, every politician is in favor of austerity, including Barack Obama, John Boehner, and Harry Reid, who all agree we need to stabilize and reduce our debt-to-GDP ratio. Yet we read almost daily that Britain, or Ireland, or Greece, or wherever has "tried" austerity and "it" has failed. Most recently, the ass-kicking that the party of Italian politician Mario Monti took at the polls has been read as yet another indictment of "failed austerity." The standard line is that Monti put in place "savage" cuts that did nothing to revive the economy but made every aspect of Italian life worse by cutting the social safety net and draining the economy of demand.

Denunciations of austerity might scant the many pragmatic (not ideological) reasons to reduce the debt-to-GDP ratio. Interest in austerity isn't about some weird, left-over Protestant admonition against taking on debt. In countries with smaller economies, tightening the debt-to-GDP ratio typically reduces borrowing costs since it's seen as a sign that a government is not spending wildly and risking all sorts of meltdowns associated with that sort of behavior. In general, smaller debt-to-GDP ratios mean that there's some sort of political harmony between taxes and spending, which relieves fears of major tax hikes and other unpredictable political events in the future (parties paid for by borrowed money have to end sometime). From a strictly Keynesian perspective, a tight debt-to-GDP ratio means that short-term, temporary stimulus spending is not only easier to finance but more likely to give the sort of economic boost the theory describes. The best argument for austerity, though, has to do with national debt's long-term effect on growth rates. Economists Carmen Reinhart, Vincent Reinhart, and Kenneth Rogoff argue that sustained debt-to-GDP ratios greater than 90 percent ("debt overhangs") are likely to massively reduce future growth for decades. Indeed, in the episodes they surveyed, debt overhang clipped more than a percentage point off of growth for 20-plus years, meaning that overal growth could be reduced by almost 25 percent. That can be the difference between first-world and second-world living standards. Debt overhang effects the U.S. economy, the world's largest, even if we don't have to worry as much as Greece about lenders calling their notes.

There are different ways to enact austerity and which way you choose matters immensely.

You can raise taxes, cut spending, or some combination of the two. As economists Alberto Alesina and Veronique de Rugy (the Reason columnist, Mercatus Center analyst, and my frequent co-author) argue in a piece at Forbes and in a major new study released by Mercatus, the best way is to sharply reduce spending while either holding taxes constant or cutting them and enacting other pro-market reforms. At Forbes, they write:

"Austerity" implemented through tax hikes is harmful, but austerity based on appropriate spending cuts is the best way to reduce a country's public debt burden. Implementing pro-growth reforms as part of the fiscal adjustment process can minimize any economic cost that budget cuts may have. This is especially important in the case of highly regulated economies where the government spends about half of its GDP, as is the case with Italy.

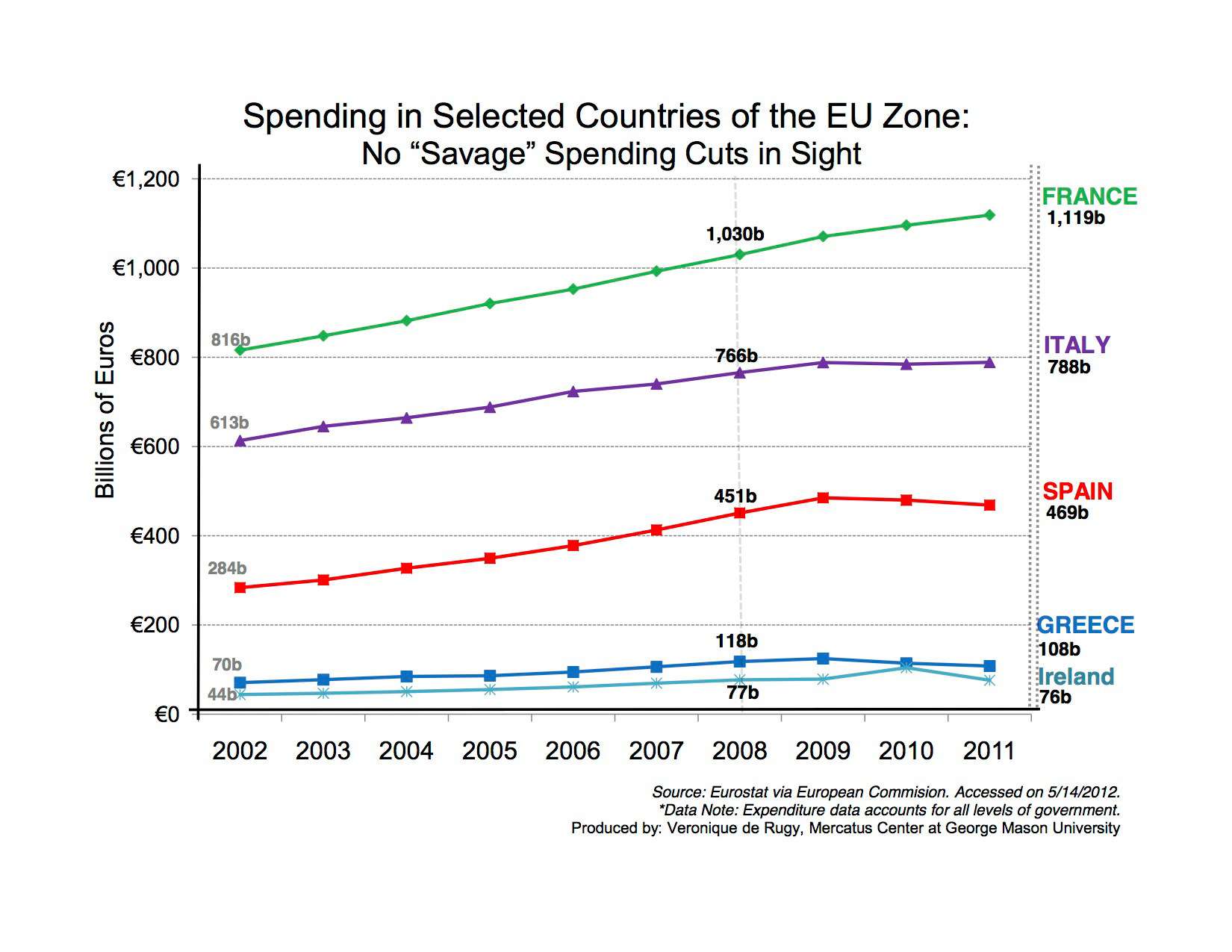

Observers such as Paul Krugman are mistaken when they point to European austerity measures and say such outcomes prove that cutting spending doesn't work. The fact is that spending generally hasn't been cut. Monti might have been elected on promises of cutting spending but, write Alesina and de Rugy at Forbes, "the Italian government implemented the wrong kind of austerity":

First, it raised the tax burden on its workers. Tax revenues consumed an additional 2.5 percent of GDP, bringing the total up to 45 percent. While some of those increases were already in place when Monti took office in November 2011, he chose to continue with the tax hikes. Considering the large amount of tax evasion in Italy (estimated conservatively at around 15 per cent of GDP) those who actually pay their taxes are truly squeezed.

Second, with the exception of good pension reform, the effect of which will not be felt on the budget for a few years, the actual spending cuts have been minuscule. Traditionally, the "cuts" in the budget presented in parliament are mostly a reduction in transfers from the central government to local governments. But the latter often reacts by raising local taxes, effectively wiping out the good from "spending cuts." The only real cuts approved by the Monti government in 2012 were tiny; somewhere between 1 billion and 8 billion euros, representing at best, less than 1 percent of the $790 billion budget. These are a tiny fraction of Italy's GDP, plus it remains uncertain whether or not they'll be fully implemented to begin with.

So the next time someone squawks that "austerity has failed in Europe!" ask them two questions: How much was spending actually cut and how much were taxes actually raised? I've found that most people who pooh-pooh the very idea of austerity or the spending-cut version generally have no grasp of whether spending has been cut or taxes raised. Last May, for instance, I appeared on MSNBC's Melissa Harris-Perry show with the Washington Post's Ezra Klein and The Nation's Katrina vanden Heuvel, neither of whom was willing or able to point to actual spending cuts by the British government at that point in time. Yet that didn't stop them from pronouncing on the issue.

Part of the confusion is that politicians - surprise! - often due the exact opposite of what they say they will do. In the Mercatus paper, Alesina and de Rugy note that the British government enacted the reverse of its announced reforms:

In a paper on the United Kingdom's fiscal adjustment, economist Anthony Evans noted that the original austerity plan announced by Chancellor George Osborne would cut £3 in government spending for every £1 in new tax revenue over the full austerity cycle. But what was announced has not happened yet. A look at the first two years of fiscal adjustment, for instance, reveals that roughly £40 billion was shaved from the deficit during the 2010–2011 budget cycle by raising £3 of new tax revenue for every £1 in cuts—exactly the reverse of what was promised.

Raising taxes and making minor spending cuts are actions that should sound familiar to Americans. If that doesn't work either to reduce the debt-to-GDP ratio or to revive the economy, what might?

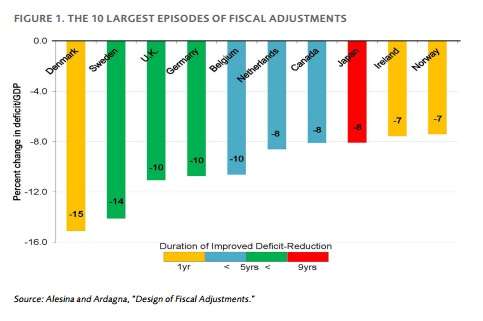

Alesina and de Rugy look at successful attempts to reduce the ratio (and note that about 80 percent of attempts fail) and find common traits. When it comes to reducing debt-to-GDP, the most important thing is that action happens on the spending side rather than the tax side. That is, spending cuts are made, along with liberalization of labor and trade laws, and the like. They stress that in advanced-economy countries where the government is already spending a relatively large share of GDP, it is relatively easy to trim outlays without gutting social safety nets (they note in passing too that politicians who cut spending are often rewarded with re-election). The hugely successful example of Canada's spending-cut-based austerity program from the 1990s - the country cut spending and taxes while reforming its pension system - is worth looking at in some detail.

Alesina and de Rugy stress that reducing the debt-to-GDP ratio by cutting spending doesn't necessarily mean that the economy will bounce back. But they also note

while not all fiscal adjustments lead to economic expansion, spending based adjustments are less recessionary than those achieved through tax increases. Moreover, when successful spending-based adjustments were not expansionary, they were associated with mild and short-lived recessions, while tax increases were unsuccessful at reducing the debt and associated with large recessions.

One of the great fears of cutting government spending is that it by definition reduces short-term GDP (simply because most government spending, unlike private-sector spending, is automatically counted as GDP). That fear - remember the uproar over the last quarter's shrinkage attributed to a reduction in defense spending? - justifies never cutting spending, which only perpetuates sluggish economic growth, which in turn justifies more borrowing and spending.

The paper by Alesina and de Rugy should be required reading for all economic analysts and policymakers. It offers a perspective that is rooted in real-world experience that has, not surprisingly, been largely ignored by the people who should be most attentive.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Interest in austerity isn't about some weird, left-over Protestant admonition against taking on debt.

Maybe it should be.

It's not even a "Protestant" admonition--for fuck's sake, if even the ancient Israelites recognized that the "borrower is servant to the lender," you'd think modern, post-industrial economies would be able to do the same thing.

even the ancient Israelites recognized that the "borrower is servant to the lender,"

Those are just stories and parables in a very old book written millenia ago by ignorant people who thought every calamity was a sign from some mythical sky daddy. It has no relevance to today's world. /prog-tard

Interest in austerity isn't about some weird, left-over Protestant admonition against taking on debt.

No one in the debate is using the word to mean that, so what is the point of bringing that up?

Did you see my response?

Im suggesting it should be used that way, and Im part of the debate.

Oh good another article with a bunch of graphs. Hey Nick, how about an update on the election chia pets.

I'm a lumberjack and I'm OK

Free market ideologues at free market think tank discover spending cuts but not tax increases are the best way to enact austerity. I'm shocked, shocked at this conclusion.?

That's your only takeaway? How about the willful deception of Krugman, Klein, etc. for their "austerity doesn't work" proclamations? When confronted with it, they are unable to provide actual evidence of the "savage cuts" and simply point to politicians' rhetoric.

Are you claiming that if only European countries cut more deeply, somehow they'd see a turnaround?

Read the actual report. There are a lot of claims and a lot of speculation but no real evidence that austerity is the right solution or that spending cuts alone are the best way to enact it.

before European countries can "cut more deeply", they have to cut period. Raising taxes has dampening effect on any activity being taxed. It's folks like you who pretend that productivity is the one exception to this rule.

Taxation is not intended to dampen the economy, so therefore it doesn't. Anyone who says otherwise is a mean person who doubts our leaders' good intentions. Besides, taxation isn't just about revenue. It's about fairness. It's about equality. It's about sticking it to the rich who accumulate these vaults of cash that could be used to feed starving children.

Why do you love the rich? Why do you hate starving children?

They have been cutting, deeply. To the point of causing riots. Tax hiking has always been a part of austerity policy--since the goal is to close the budget gap.

It's really just a question of who you are asking to pay for the policy: those who benefit from the social safety net, or those who would be affected by tax hikes. Both decrease demand in the economy, which is why austerity is bad during a recession.

Tony, de Rugy just showed us data indicating that they haven't been cutting spending at all. You're going to have to cite some data if you want us to take your claim seriously that "They have been cutting, deeply."

I guess I should say Gillespie and de Rugy have shown this.

Did you not read his post? There's riots! The people are revolting! It's not like the people rioting are just throwing a hissy fit because they're pissed over losing their cushy government jobs or having to take a relatively minor hit to their gold plated pensions, or have to work a couple more hours a week! Surely the rioters are all poor people who have been left to die in the streets by heartless right-wing ideologues who have hijacked the governments of Italy, Greece, et al. Surely! Because it's not like people are craven fucksticks who will piss and whine over the slightest little thing.

It's really just a question of who you are asking to pay for the policy

No, those who benefit from the safety net don't pay for the policy in either case, they benefit from it. Only the taxpayers pay for it.

Yet, the cuts are not evident on the spending charts.

Any chance that its the tax hikes causing riots?

I'm not claiming cuts will cause a "turnaround" -- I'm claiming that there haven't been cuts at all, much less "savage" or "draconian" cuts. It's deceitful to claim otherwise.

There are a lot of claims and a lot of speculation but no real evidence that austerity is the right solution or that spending cuts alone are the best way to enact it.

ITT: Tony admits that he can't be bothered to read the footnotes.

There are a lot of claims and a lot of speculation but no real evidence that austerity is the right solution or that spending cuts alone are the best way to enact it.

They don't have much of a choice. These are countries that have revenue to GDP ratios that are 10-20% higher than ours, yet they can't pay their bills. France wants to raise revenue, so their wealthy citizens are telling them to go fuck themselves and are leaving. And just look at all the European "tax exiles" that have left their various homelands since the 1970s.

Europe is trying to run a 20th century economy in a 21st century world, and their systems can no longer handle the scale of demand being placed on them, even with the sky-high tax rates they have in place compared to us. So they're either going to have to adapt and learn to live with less, or break apart. Considering the history of complex societies, my money's on the latter. It's just a question of when.

Of course the largest hand wave is just what exactly constitutes a debt crisis. It's even more mysterious in the US which has the benefit of possessing the currency of choice for global markets.

The bottom line is none of you can be trusted on this issue because debt isn't your primary concern--it's cutting government programs you don't like, with debt being the excuse.

Yes, a debt of more than 100% GDP is a "hand wave". You're such a bullshitter. We hate the debt because of what it does, AND we hate government programs we don't like. You on the other hand don't care about debt at all, just the absurd idea you can get whatever you want without a cost.

The bottom line is none of you can be trusted on this issue because debt isn't your primary concern--it's cutting government programs you don't like, with debt being the excuse.

When your spending far outstrips your historical revenue intake, then yes, programs will have to go. The math always wins, and thankfully it doesn't give a shit about social justice or any other libshit histrionics.

Really, Tony, you embody this statement:

http://www.oftwominds.com/blog.....12-10.html

No, the primary concern is taxation (force).

Leftist ideologue resorts to ad hominem attacks instead of addressing an argument. I'm shocked, shocked at this behavior.

Considering we're spending 6.5% over historic revenue to GDP ratios, but taking in 2.5% less than the historica average on the revenue side, the math says that spending cuts are the best way to enact real, actual austerity (not the cut in the rate of spending increase that libshits are chimping out about).

Fifth grade math smacks you in the head once again.

Do they teach about denominators in ratios in 5th grade or is that something that waits till later?

Considering the basic differences in the ratios are sufficient, maybe you should just taking your ass-whipping like a man and move on.

I realize your hard-on for every-increasing government expansion is perpetual, but the numbers just aren't on your side.

Here's some more math for your dumb ass--in 1960, per capita government spending adjusted for inflation was about $4500. Today, it's over $12,000.

For someone who's constantly crying about how RETHUGLICANZ UGH destroyed our glorious regulatory bureaucracy, the numbers sure don't reflect your drama.

Math doesn't matter. What matters is feelings. Rethuglicans make Tony feel angwy, while Democrats make him hard. That's what matters.

Yeah, but even Tony should be able to pull out a graphing calculator to do a basic function, and see what happens when you have annual deficits that are 8% of GDP and annual GDP growth that is 2%.

I have a sneaking suspicion that Republicans make Tony hard. Angry, but hard.

Why not count state and local government spending? Include total government spending per capita and it's actually gone down in the Obama administration from where it was at the end of the Bush administration (though still elevated due to the Bush recession). By far the largest hike in spending (and deficits because taxes were drastically cut at the same time) was during Bush, and it has actually gone down during Obama--because in case you didn't notice, Republicans won't let him spend anything. I'm talking about total government expenditures, which is the relevant measure when we're talking about economic impact.

We don't actually have a spending problem. We have a problem of Republicans refusing to pay for the expenses mostly they racked up.

I can tell that Tony has never taken any physics or higher math. If he had then he would understand that when you cut the rate of increase in something, it still increases. It just doesn't increase as fast. But he has not taken physics or higher math. Disciplines like that require logic and problem solving skills. Tony possesses neither.

Why not count state and local government spending? Include total government spending per capita and it's actually gone down in the Obama administration from where it was at the end of the Bush administration (though still elevated due to the Bush recession).

Um, no, it hasn't, you moron. Even Obama's own OMB confirms it:

http://www.whitehouse.gov/site.....s/hist.pdf

Look at Table 15.3. Oh hell, I'll just post the numbers as a big, fat, "Go fuck yourself":

2008--32.6

2009--37.1

2010--35.4

2011--35.4

By far the largest hike in spending (and deficits because taxes were drastically cut at the same time) was during Bush, and it has actually gone down during Obama--because in case you didn't notice, Republicans won't let him spend anything.

Yeah, spending's gone down--by $61 billion between FY 11 and FY 12. That's less than 2 percent.

http://www.fms.treas.gov/mts/mts0912.pdf

But we're not even close to what the FY 08 spending totals were, because Obama took the TARP-laden budget Bush proposed, added another $400 billion in March of 09, and kept it above that baseline. So spare me the argument that Obama's "cut spending"--he hasn't. He's just cut, minisculey, from the over-laden budgets he put in place.

Like Tony's going to allow facts to get in the way of his feelings.

Broadly speaking, every politician is in favor of austerity, including Barack Obama, John Boehner, and Harry Reid, who all agree we need to stabilize and reduce our debt-to-GDP ratio.

Someday.

But not today.

And not tomorrow.

Kinda like how "The Public" means "everyone but you" when dealing with a public servant, when cutting the budget everything is on the table except any individual item that is being examined.

Free market ideologues at free market think tank discover spending cuts but not tax increases are the best way to enact austerity.

Or, you know, people who can add and subtract.

That's what makes you a free market idealogue.

Bruce Krasting had a hilarious article yesterday that pointed out how all the media libshits that were crying about deficits during the Bush years are now saying it's no big deal during the Obama years.

Funny how a guy who oversaw more of a debt increase in four years than Bush did in eight shouldn't be held accountable for that increase.

The Flobots played at Obama's nomination convention in 2008. This was one of the songs they played:

http://www.azlyrics.com/lyrics.....thing.html

...Human needs not corporate greed

Drop the debt and legalize weed...

And now? Crickets.

Traditionally, the "cuts" in the budget presented in parliament are mostly a reduction in transfers from the central government to local governments. But the latter often reacts by raising local taxes, effectively wiping out the good from "spending cuts."

I am actually "in favor" of this, in the feeble hope that people might be made more aware of the true cost of all the wonderful free shit bestowed upon them by their Beneficent Protectors.

ps-

Your proofreader needs a good thrashing, Nick.

"Your proofreader needs a good thrashing, Nick."

I shall offer him my finest endangered species ivory cane!

I said this a few days ago, I'll say it again:

Austerity in Europe means raising taxes; we are told that austerity in Europe has failed so we must raise taxes.

"Yet we read almost daily that Britain, or Ireland, or Greece, or wherever has "tried" austerity and "it" has failed. "

That kind of reminds me of the fairy tale that FDR's "New Deal spending was working during the Great Depression and the economy turned down again in 1937 because he started cutting spending.

Just the other day I read an Associated Press story reprinted in the local newspaper that reported that as if it were an established fact.

It's fascinating how easily a counterfactual history becomes an article of faith among people for whom real history is inconvenient.

I know, right?

So you're making a confession.

The "fairy tale" you refer to is considered accepted history. Right-wing bullshitters have made up their own history that better fits with their preconceptions.

There, fixed your post for you.

Here's some ACTUAL history:

Henry Morgenthau, FDR's own Treasury Secretary and the man most singularly responsible for implementing the "New Deal" admitted it was a failure in 1939.

He said "We have spent all this money and it does not work".

That kind of reminds me of the fairy tale that FDR's "New Deal spending was working during the Great Depression and the economy turned down again in 1937 because he started cutting spending.

Well, yeah, when you grow your economy through deficit spending rather than actual capital growth, removing the deficit spending results in an economic downturn because the "recovery" was a phantom.

Of course, back then people understood that you couldn't run deficits in perpetuity and expect a sustainable economic recovery.

Also, relying on bogus* GDP calculations is bogus.

*by which I mean all GDP calculations.

Those crazy anarchists, rioting over imaginary cuts in government spending.

Makes sense, as no anarchist would riot over real cuts.

Jesus Christ! Why is everyone responding to that mendacious fuckwit?

Im not, I dont even see his posts.

I wish reasonable hid all responses to filtered posts too.

Tony should have just skipped commenting on this thread. He's been thoroughly thumped, even more than normal.

Good to know. I couldn't get through more than a few responses before giving up. Lost cause.

Spending is eventually cut, one way or another. When I try to figure out how exactly the average voter's stupidity works, I generally come to the conclusion that an inability to distinguish between money and goods and services is a large part of the machinery of idiocy.

Eventually, the U.S. dollar will become like the old Italian Lire, and then much worse, before it is just a joke that is no longer used in exchange. As that situation develops, the U.S. government will no longer be able to provide the handouts that so many Americans unwisely rely on. The government will be unable to provide handouts because the only thing the government CAN hand-out is currency. And currency is NOT goods and services. Once the purchasing power is gone, that's it. It's worthless.

Right now, I know I sound like I wear tinfoil on my head, but I just cannot fathom any other destination for our current political and economic path.

I don't care about the losers who mooch off government by choice. But I worry about those who actually NEED the help, and for whom there is insufficient tradition of charitable giving to sustain. This gimme-state is going to fail.