Will Obama Take Credit for Slowing the Rate of Increase in Federal Spending?

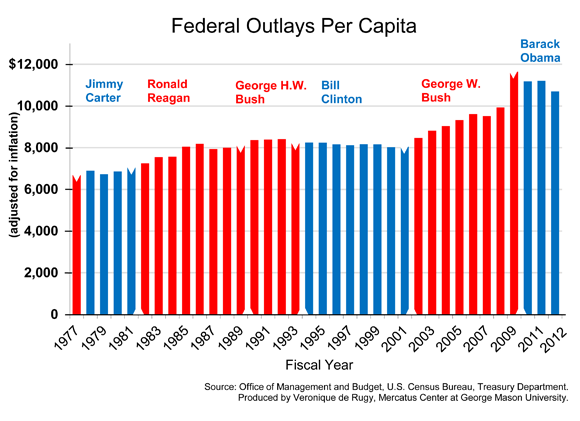

Above is an updated chart by Reason columnist and Mercatus Center analyst Veronique de Rugy. It shows federal outlays per capita in 2010 dollars from 1977 (Gerry Ford's last budget year) through fiscal 2012 (which ended on September 30 of last year). What it show is a pretty clear pattern that we've commented on before: Spending increases under Republican presidents (Reagan, Bush II) and those increases are consolidated under Democratic presidents.

What this chart shows - and Dems and Reps are slow to acknowledge, though for different reasons - is that George W. Bush and a GOP Congress have a ton to answer for in terms of kicking out the jams when it comes to spending. Note that 2009, which was Bush's final budget year, does include a chunk of Obama spending as well (mostly the stimulus).

So does this mean that Obama is putting the government on the path to fiscal rectitude? Not hardly. Even though 2012 shows lower spending levels than the previous three years, outlays are still higher - in real dollars and per capita - than they were in 2008. And here's another chart that de Rugy has put together:

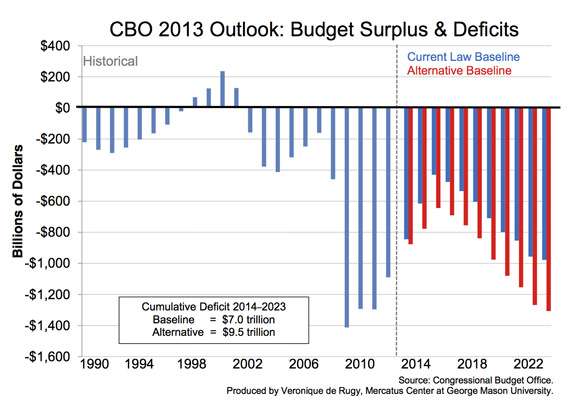

So Obama has not only spent more in his first years in office than any other president, he's also racked up higher cumulative deficits. And by the Congressional Budget Office's estimates, his record streak won't end anytime soon. Note that in the figure above, "current law baseline" uses data and budget trends that conform to politicians' fantasies; these are the best-case scenarios spun out by the president basically - that growth will be strong, revenues high, that long-scheduled cuts in Medicare reimbursement rates will actually take place, etc. The red lines of the "alternative baseline" is the CBO's attempt to realistically predict what is likely to actually happen. As such, the alternative baseline is a better guide to what is likely to happen. Which explains why the red lines show bigger deficits than the estimates using the president's data.

It's unlikely that Obama will crow about slowing the growth of government spending. In fact, he will almost certainly claim that we need to be spending more than ever in order to get out of a sluggish economy (which we will be doing this year, even if the sequester actually goes through). And he will claim that the "job of debt reduction [is] nearly done" - despite the fact that he has only added trillions of dollars to the national debt since taking office.

Reason's Peter Suderman notes that rereading what Sen. Obama had to say about debt and deficits is a laff-riot. Here's the future president jawboning in 2005: "You don't have to be a deficit hawk to be disturbed by the growing gap between revenues and expenses."

Nope, you don't. And when you become president, you can even stop pretending to be disturbed by borrowing 40 cents of every dollar that the feds spend.

Our spending patterns are unsustainable. As Obama put it in 2006:

We've been able to get away with this mountain of debt because foreign central banks—particularly China's—want us to keep buying their exports. But this easy credit won't continue forever. At some point, foreigners will stop lending us money, interest rates will go up, and we will spend most of our nation's output paying them back.

Earlier today, I reiterated the case that the level of debt we're already carrying will likely dampen economic growth for the next two decades or more - and that cutting spending to reduce the debt-to-GDP is a proven solution to cure what ails us. Here's hoping that after tonight's sure-to-be-repetitive State of the Union address - in which Obama says we need to spend more more more and make the rich pay more more more and isn't it great everything I've done and aren't the Republicans just awful and I get it now really, it's all about jobs jobs jobs - that maybe we'll inch closer to reducing spending to an amount that's vaguely in line with revenues.

Thrill now to Reason TV's remix of Obama's 2010 State of the Union address, "Obama's Doublethink Doubletalk":

Show Comments (10)