The Bush Tax Cut Issue in One Chart

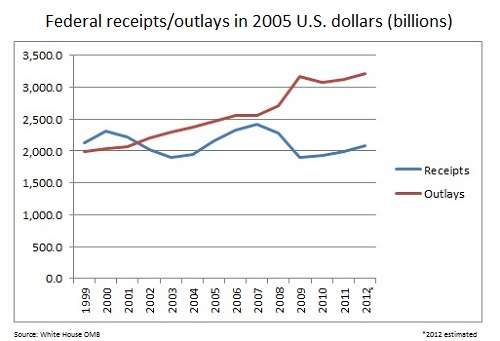

Federal receipts and outlays, 1999 to 2012

Federal outlays and receipts in the last two years of the Clinton Administration, all eight years of George W. Bush and Barack Obama's first term:

In 2011, income tax revenue made up about 55 percent of federal receipts. Raw data here and here

A few notes: George W. Bush and supporters of the tax cut said federal revenue would go up after passing the cuts and it appears it did. In fact, federal receipts reached Clinton-era levels without Clinton-era tax rates in 2006, not long after all the cuts went into effect (passed in 2001 and 2003, they were tweaked with in 2005). Bush passed a tax cut as stimulus in 2008 and Barack Obama's trillion dollar stimulus package in 2009 included some type of tax cuts as well, but does that chart look like a revenue problem or a spending problem?

And for those who would say "well of course the government has to spend more when the economy is hurting" only one question applies: has it helped? If you think so, I've got a tiger-repellant rock to sell you.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Listen up, "Ed"! It's a REVENUE problem because why do you hate babies and minorities?

Minority babies!

Looks like it's both to me. Spending has gone

up in a fairly linear fashion while revenues have dropped during the depression.

In 2001-ish they were balanced and we are slightly below that in revenue, ten years later. Spending increased 50% while revenues did not increase.

Amazingly, in 2006 they got pretty close, which is after the last tweak of the Bush tax cuts.

Housing bubble effect in 2006.

And who caused the housing bubble?

Fannie Mae and its catspaws.

I like that term, Brutus. Reminds me of an old-school Trek episode. I think Kirk chewed on the scenery in that one.

We can go back even further in the culture and find another just as apt: Stooges.

In which episode did Kirk not chew the scenery?

"The Tholian Web"?

Did Fannie Mae cause the dot-com bubble too?

All bubbles are market driven by profit mania and delusion.

Fannie Mae still exists and is buying more paper than ever - by wingnut reasoning the housing bubble is bigger.

Speaking of delusion, Fannie Mae certainly played a significant part in the dot-com bubble. You act as if market actors don't respond to incentives. Nope, that housing bubble just spontaneously appeared. Never mind that the government was backstopping sewage and keeping interest rates suppressed.

housing bubble*

"everybody needs a house" + unprecedentedly low interest rates for years = housing bubble

Simple as that.

if you do the math, you will see it had very little to do with low interest rates and very much to do with low downpayment requirements. low interest rates allow people to afford an incrementally bigger house, but their impact on how many people can buy houses is relatively trivial. people who bought too much house may be under water - people who shouldnt have been able to buy any house are on the street

Did the dot-com bubble blow up to stratospheric proportions like the housing bubble? Was U6 hovering around 16% five years later? No? Well, imagine that.

Did Fannie Mae cause the dot-com bubble too?

No, but Fannie definitely caused the housing bubble, and lots of connected Democrats got stinking rich off it, including a number of individuals inside the Obama administration.

Wrong. Fannie Mae had higher credit standards than the subprime originators did. Banks were stuck with trillions in bad paper they could not offload to the GSE's.

Don't get your financial education from AM radio, please.

Federal Reserve.

Don't get your financial education from AM radio, please.

I got it from NYT financial reporter Gretchen Morgenstern, shriek. Banks were mostly caught with loads of MBS's they bought from outfits like Fannie, not lousy primary market mortgages.

Jim Johnson, heavy-duty Dem operative, was the driving force behind Fannie's foray into shit mortgages, with interference run by the likes of Barney Frank who would decry any attempt at reining in the renegade GSE as a flint-hearted attempt to deny the American Dream to minorities.

IOW, right out of the southpaw playbook.

Opps...Morgenson.

Palin's Buttplug| 11.30.12 @ 5:34PM |#

"Did Fannie Mae cause the dot-com bubble too?

All bubbles are market driven by profit mania and delusion."

Yes, especially when the gov't gives out money for free for real estate, dipshit.

I know a guy who, in 2006, was in grad school while his wife was unemployed. They got a zero down jumbo loan from the FHA to buy a 4-plex to rent out. Who in their right mind would lend them anything? The FHA did. By 2008, they were underwater on it by almost $200k. Anyway, after a bunch of loan forgiveness, a hit on their credit, etc. they've refinanced and they're almost breaking even with the rent. Still way underwater. They were dumb and the FHA was dumb.

A little something called the Federal Reserve just might have had something to do with the dotcom and housing bubbles? Of course artificially lowering interest rates and expanding the money supply couldn't have bad consequences

And you act as though greed is new.

Now that's silly. By your reasoning, the housing bubble is bigger -- in fact that there are bubbles all around.

Here's how it works. Greed is everywhere at all times. What you need to get a bubble are circumstances that allow it to act in ways that compound, rather than counteract one another.

Fannie Mae and Freddie Mac were among the gov't policies that created those conditions. You see it again in the tuition bubble. Your theory - of markets driven by profit mania and delusion - doesn't help explain much in the way of public university tuition bubbles. But loose money policies do. Just the same as loose money policies help explain the housing bubble and dotcom bubble.

Progressives like yourself too often rely on miracles, animal spirits, meteors to explain things that fall out of the sky. "Mania & delusion."

It's not that people are not give to periods of idiotic crowd behavior - look at the average Obama voter - it's that you have to create the conditions for those things to take off.

Fannie Mae may be buying more paper than ever, but it's not acting as an implied backstop for other lenders and buyers - those purchases have fallen and pretty much remain down.

Pretty much every significant bubble in industrial age history had something to do with government monetary policy or direct subsidization of industry.

The US railroad bubble of 1850-1890 belies your theory. The bubble burst and led directly to the Long Depression. And there was no Federal Reserve then either.

You do realize the federal government subsidized railroads, right? The Long Depression is also mostly a myth. There was a recession, but the 1870's and 80's were a period of great economic growth.

For a little history on economic cycles before the Fed, here's a start (it's long, but you don't have to watch the entire thing to get the point)

http://www.youtube.com/watch?v=TxcjT8T3EGU

You're really using the railroads as your example? The same railroads that were essentially national government programs? That were financed with government bonds? That were heavily involved in corruption and crony capitalism?

Honestly, the Credit Mobilier scandal almost brought down the president when Grant held the office. If you aren't familiar, the scandal I'm talking about was a situation where a U.S. congressman became president of Credit Mobilier and then made his brother the head of Union Pacific. They then sold stock options to other politicians. The scandal implicated the Vice President of the United States.

THAT'S your example of a bubble occurring without government?

The government likely had a hand in the dot-com bubble as well.

There was a government hand in the tech bubble. Major tech companies, including Intel, Cisco, Dell, Oracle and others successfully lobbied the Clinton administration to delay the adoption of international accounting standards that would have required the expensing of stock options. Tech start-ups used options as compensation and established companies used their own stock as currency to buy other companies. Mark Cuban got paid $billions in Yahoo stock for Internet Radio, for example. The tax on equity compensation income approached 40% of federal tax receipts in 1999 and helped push the budget into a surplus. The resulting overhang of stock and the rapidly rising prices had nowhere to go but down by 2000.

But the government was subsidizing railroad.

So, no, you're wrong on that point.

Moreover, he said "pretty much."

It is possible to get bubbles in all sorts of ways. Beanie Babies were not a gov't sponsored bubble. But to fling around the amount of empty credit, you've got to have institutional framework issues. You have to have someone at the end of those chains of credit you believe will backstop the problem. Luckily, we have that entity: the Federal Government.

No, spending increased 104% from 2001 to 2012 (1.86T to 3.80T). Revenues increased 25% (1.99T to 2.47T).

The chart doesn't match the data in the historical tables at

http://www.whitehouse.gov/omb/budget/Historicals

How about a statist repellant rock. I'll even throw it if I have too.

In washington, it wouldn't matter who you hit, democrat or republican, they're still statists.

Federal receipts outpaced spending in years 1999-2000 = annual surplus.

But wait! Posters here said that didn't really happen!

Amazing how you can type while giving Barry a handjob, shrike.

That's because he's giving him a handjob with his mouth.

I was just looking at his ridiculous fiscal cliff plan and laughing.

Your turn, Boehner.

They are playing cat and mouse to make the other go on record for SS cuts.

About the only thing leftists ever want to cut is military spending.

Like shrike, for instance.

So is it a revenue problem or a spending problem? I can't help but notice that outlay has inched up by about a third and change, while revenue sits a skosh under the median. But a marginally higher income tax on the upper crust should shore up that difference, right?

It is both.

Raising taxes on evil wealthy people will barely give us a week of operating capital, shrike.

But if it makes you feeeeeel batter...

No, it's a spending problem. If we had kept spending constant, increasing only for inflation and population increase, we'd have a miniscule deficit now, probably under $150B.

Bush sucked on spending, but it took Harry Reid and the Botox Bolshie in the House to really crank up the money machine.

Since Reid took over in 2007 two supplemental spending bills have passed. Both were temporary, TARP and the Obama stimulus. Together they are about $1 trillion and 1/4 of that were tax cuts.

The GOP was responsible for the rest of the $9 trillion in debt since 2001.

And I am letting the GOP slide for TARP.

So Democratic Congressional leadership isn't responsible for its spending binge?

And since TARP was voted down by the Republican caucus in the House, that's mighty white of you.

But GOP leadership begged for TARP from Bush to Boehner and Paul Ryan.

Dems were too weak to challenge Bush. They suck too - just not as much.

But GOP leadership begged for TARP from Bush to Boehner and Paul Ryan.

Funny that the caucus voted it down. So why didn't your Dummycrats oppose it, it being a Bushpig thing and totally irresponsible?

This week in dipshittery: Voting overwhelmingly in favor of something equates to being too weak to challenge it.

TARP House roll call:

Aye - 241 (D), 19 (R)

wrong, 91 House Republicans voter FOR the final TARP bill.

http://en.wikipedia.org/wiki/E.....ct_of_2008

Which does not change my point at all.

They suck too - just not as much.

My previous quote on Dems. We agree then.

They were against it before they were for it (and got their pork).

Together they were $1.5 trillion, and both have now been added to baseline spending. Are you ever honest about anything, Shrike?

Fuck you Shreek!

Obama has spent in 4 years what Booosh spent in 8.

No, fuck you, cut spending!

Maybe we can marshmallow-experiment Congress: Sure, you COULD tax the dregs of the productive economy, eat the seed corn, and run this ship aground... or maybe slacken the vise-like chokehold you've got on job creation and wealth perpetuation and let's see whether the market can pull you and the rest of us out of the muck. Either spend your 3-trillion-some now or twenty trillion over the next ten years.

Right, revenue is too low and spending is too low.

That chart doesn't even truly do justice to the spending explosion. It ends at $3.2 trillion, but our current spending is now $3.6 trillion per year.

Yep, spending has increased by a mind-blowing fifty percent in the last twelve years! It's almost impossible to believe, especially when the left-wing scumbags love to tell us that there has been no inflation for years and years, but it's true.

It's in constant 2005 dollars.

Your beloved GOP is responsible for the vast bulk of it.

Oh bullshit, you lying motherfucker. Bush, Obama, Nancy Pelosi, John Boehner, Bill Frist, and Harry Reid all bear equal and enormous measures of responsibility for the hellish mess we're in.

Do the plent a favor and just drink that cup of cyanide already.

Yeah, we see from the chart above what Democratic fiscal responsibility looks like.

Whose beloved GOP?

I despise the GOP AND the Jackass party.

The difference between us is you know which is worse and I don't.

Mike M is GOP. I have posted here long enough to know most of the regulars.

You are deluded, Shriek. You spout nonsense in reply that does not follow what the poster (Mike M) wrote. It's just cut and paste, cut and paste, jerk off when someone tries to reason with you, cut and paste, and on and on.

This is your life. Seek help.

Wars are really expensive.

Spending was still WAY too high during those years, even if they did manage to plunder the public enough to cover it.

Pretty much this. It begs the question and beggars imagination that we're quibbling about which number leads the twelve-digit budget parade.

Federal receipts outpaced spending in years 1999-2000 = annual surplus.

Cool...then lets go back to 1999-2000 levels of spending.

Wimmins and minorities hardest hit.

The Treasury Dept says it didnt happen.

Depends how you want to count intergovernmental dept. The Treasury Dept counts it.

Also, dont forget the worst offender: "Off budget spending". How the fuck can anything be off budget?

intergovernmental debt, not dept

How do you think we accumulate so much consumer debt, too?

But wait! Posters here said that didn't really happen!

Actually, the Treasury says it didn't happen, dummy.

only one question applies: has it helped?

Without the stimulus, the nation would have collapsed into chaos and despair rivaling the Dark Ages.

So we didn't have a stimulus?

We didn't have enough stimulus. Duh.

Well, shrike is doling out oral handjobs upthread, so there's some stimulus for ya.

Hey I bought one of those tiger repelling rocks and I haven't been bit yet!

Yup, that looks like a revenue problem to me.

George W. Bush and supporters of the tax cut said federal revenue would go up after passing the cuts and it appears it did.

Yes it did - temporarily and during the housing bubble.

Tax cuts don't increase revenue despite contrary supply side myth (see the last ten years).

Milton Friedman was right. Tax cuts without a decrease in spending is just a delayed tax hike. Now we will do just that.

Thanks, Bushpigs!

Thanks, Obamapigs, as well.

You're really itching to get that 8 1/2 day supply of operating funds known as "the end of the Bush tax cuts for the wealthy", aren't you?

IIRC the tax cuts for those earning over $250,000 were only about 1/8 the total.

Glad to see you admit lower taxes are part of the problem.

I freely admit higher spending is.

I do no such thing; I got over petty, childish wealth envy half my lifetime ago.

You, OTOH...

1, there is no problem. They can go bankrupt for all I care.

2. Lower taxes are not a "problem" even if they do result in lower revenue. DUCY?

3. The current levels of spending are so far and beyond anything approaching reasonable that all your prevarication about taxation means nothing. Eliminate the income tax, eliminate 80% of Federal spending, then we can talk.

Tax cuts without a decrease in spending is just a delayed tax hike.

Once again you are forgetting it was Obama who signed the bill that raised spending $800 billion in February of 2009.

If he had not signed that bill we would not be in this mess.

Also if Obama cut 800 billion out of the budget today we would be out of this mess.

On the other hand taxing the rich will only get us 70 billion a year in more revenues...which will not even make a dent in our over trillion dollar a year deficits.

Yeah, but if he hadn't signed the Stimulus, we wouldn't be enjoying the 5% unemployment we have now as promised, now would we?

The $787 billion Feb 09 Obama stimulus was a one-time event. 1/3 of that was tax cuts.

It does not appear in today's budget.

And all it did was make things worse, by its own measure.

Maybe. That is subjective. I am just banging the fact-hammer in this thread.

If by "fact" you mean "information that doesn't prove I'm right" then yes, you're banging yourself pretty hard in this thread.

He's literally incapable of proving a point. He'll fly in, throw down two sentences which we then prove wrong and then he'll just ignore our arguments and move the goalposts.

It's astounding.

Don't worry, that astonishment fades in time.

darius404| 11.30.12 @ 7:37PM |#

It's astounding.

"Don't worry, that astonishment fades in time."

Yes, it turns to amusement. Shreek is funny, but not in a way shreek intends.

After the Obama Stimulus spending stayed at virtually identical levels for the next four years.

It was a one time event after which they made the new spending rates the baseline.

Spending stayed the same because the Obama stimulus was off budget.

Supplemental spending only adds to the debt. (See also Iraq War 2003-09)

Spending stayed the same because the Obama stimulus was off budget.

...

You are an idiot. Off budget is only for the budget. It is a trick government plays to trick itself.

No one looks at budgets for determining total federal spending after the fact.

CNN does not go "Oh this was off budget we had better not add that to our info graph"

The $787 billion Feb 09 Obama stimulus was a one-time event.

Then why didn't spending drop $787 billion the following year?

In Trillions:

2008 5.34

2009 5.97

2010 5.94

2011 6.11

The stimulus got rolled into the budget...and the above numbers prove it.

Federal spending will be $3.6 trillion this FY. Your numbers are whack. (probably includes states and counties/cities)

As much is it pains me to say it, he's right. Total government spending is estimated to be 6.4 trillion dollars this year.

http://www.cato-at-liberty.org.....-trillion/

According to Cato, total federal spending is actually 4 trillion dollars because of gross outlays related to offsetting collections and offsetting receipts.

He's not right about the "one-time event" though:

FY 2009: $3.517 trillion

FY 2010: $3.456 trillion

FY 2011: $3.603 trillion

FY 2012: $3.796 trillion

I thought we didn't have a budget; just a series of continuing resolutions using the 09 budget plus so-called stimulus as a baseline.

Nothing does, because there isn't a budget, and there hasn't been one in years.

Yet somehow they still manage to send $3.6T per year. Fancy that.

taxing the rich will only get us 70 billion a year in more revenues.

It is estimated that the US could save that same 70 billion a year by health care malpractice reform, but the Dems don't want to insult their big donor trial lawyer pals, so they say the amount from doing that is "inconsequential."

Apparently it is consequential enough to tax the evil rich.

Oh, I see. Shrike thinks the housing bubble only lasted 4 years.

Fuck you again ass clown.

Lisa, I'd like to buy your rock.

Notice well how federal revenue starts declining BEFORE those evil Bush tax cuts for the rich went into effect, then a couple of years after those evil Bush tax cuts for the rich go into effect, revenue begins going up, up, up to the point where the deficit was right on the verge of being eliminated before the shit hit the fan.

Hmm, so what happened in the late '90s and early 2000s to cause revenue to suddenly drop like that before those evil Bush tax cuts for the rich went into effect? Oh yeah, that's right: there was a recession! Which liberal pundits have conveniently forgotten was the reason why all the Keynesians in the government agreed to cut taxes in the first place.

Gee, it almost seems like the federal revenue impacts of marginal changes in the tax rates are negligible compared to the performance of the overall economy or something! Naaah, can't be.

"well of course the government has to spend more when the economy is hurting"

Still down 4 million jobs since the bottom. That is not including changes in demographics.

We need 125,000 new jobs every month to accommodate new people entering the job force to stay flat.

so we hit the bottom about 2 years ago which would be 3 million jobs added to stay even with demographics.

All told we need to add about 7 million new jobs to be fully recovered from the recession.

Every recession since the great depression we have recovered quickly...ever recession but the last one when we actually did spend massive amounts on stimulus....If anything stimulus spending has proven to slow recovery.

2008-09 was not just a recession - it was a financial crisis (last prior one was the 30s).

US net wealth fell $15 trillion in 2008. That slammed demand. 1981-82 and 2001-02 were lightweights in comparison.

Uh, I remember some difficulties from 1974 - 1982. We called it "stagflation".

I didn't like 12% annual inflation and 18% API. I don't think you will either.

Wealth rose 74-82. See chart.

http://en.wikipedia.org/wiki/File:Graphic.png

That's the total wealth of everyone in the country and the dollars don't seem to be adjusted for inflation. That's a useless graph for determining good economic times. You do realize that, in a time of high inflation, we can expect total amount of dollars to increase right? Those dollars will be worth less so it doesn't tell us anything about actual wealth.

By your reasoning the sharp drop in 2008 was simply deflation and not wealth loss. Tell that to the people whose home values and 401Ks plunged.

No, by my reasoning the drop in 2008 was a financial crash because everyone knows it was a financial crash. You aren't using this to prove anything about 2008 though, you're using it to prove '74-82 had an increase in wealth.

We had close to 10 percent inflation for the entire back half of the '70s and by 1980 we had 14% inflation. This is the longest and worst inflationary period in this country post-WWII so you can't throw up a graph that isn't adjusted for inflation and claim that wealth increased.

Inflation is a sign of an overheated economy and loss in the strength of the currency.

Job gains were superb in the Carter years. He ranks with Clinton and Reagan for job gains.

Job gains are a stupid measure of economic health. By 1980 unemployment was 7.1. Do you really think 7.1 percent unemployment and 14% inflation are a sign of economic health? Imagine if we had 10% inflation right now. How screwed would an unemployed individual be if prices were increasing at the rate of the late '70s?

Overheated economy? What sort of revisionist lie is that. Gas lines, 14% inflation and 7.1 percent unemployment...boy that sure was a great time to be alive, wasn't it.

No you are wrong.

As a proportion of GDP and total wealth this recession was no deeper then previous ones...the only difference is the delayed recovery.

The numbers do not support your claim.

It's also a nonsensical myth lowlifes like Shrieking Idiot are trying to spin these days that the economic growth we had during those few years was entirely due to the housing bubble.

Housing and real estate are certainly a very important part of our economy, but they are FAR from being the entire economy.

it was a financial crisis

Also should point out that once again you are focusing on Wall street rather then the US economy.

The financial market is only a fraction of the US economy and only a fraction of total wealth.

This is why you run around telling everyone that we have had a recovery when we still need 7 million jobs to break even and we have GDP growth that is below inflation.

You conflate Wall Street with the US economy and that is why you are wrong every time the subject is discussed.

Financial markets are the frosting not the cake.

If anything, shouldn't he be pissed that the stock market has recovered but the economy hasn't? All those damn rich investors are making money while inflation is high and the rest of the country is hurting! If Bush were in office the progressives would be shrieking about income inequality, but with Obama in there this is all proof of our grand recovery.

For all the crying that shrike does about Bush's spending, in conjunction with his crowing about GDP growth under Obama, if he actually knew how to do math, he'd see that all of Bush's deficit spending was the only thing keeping the GDP propped up during his presidency.

Of course, Obama's running the same trick, but whenever anyone points this out, shrike moves on because he's a fucking idiot that can't do math.

Obama's even worse than Bush was. We had 1.7% GDP growth last year. Our deficit is like 10% of GDP. We're spending 8% more than GDP growth. That is completely unsustainable.

Don't forget that government spending is part of GDP, so it's even worse than that.

I like tax cuts, but the rise in revenues in 2005 and 2006 has less to do with the effectiveness of tax cuts than the effects of the housing bubble and other measures that produced an economic frenzy at the time.

OTOH, If spending had been restrained in that time instead of being allowed to drift up continously, the baseline for current expenditures would have been lower and, probably, so would the current deficit. (TBS, when have politicians ever had the foresight to restrain spending when the good times are rolling?)

Correct.

"(TBS, when have politicians ever had the foresight to restrain spending when the good times are rolling?)"

Never. It's the fantasy that makes Keynesian econ fail in real world applications.

You mean the OTHER fantasy that would cause it to fail.

"Sounds like Springfield's got a discipline problem."

"Maybe that why we beat them at football nearly half the time, huh?"

Sometimes dude you just have to hit it.

http://www.anon-ut.tk

The problem is that the Democrats don't care if cutting taxes helps the economy. And they don't care if overspending hurts the economy either.

They just care about Obama.

How do we make people care about not hurting themselves and each other?

I thought it might help if we got rid of Obama, but now I don't know the answer.

Your assumptions are always wrong, Ken.

Look at you, Shrike.

What does Sarah Palin have to do with anything?

Sometimes you can pass for a pretty good example, too.

Why do you think they're so eager to make everything about social issues in the midst of major economic turmoil? They have no legitimate argument about economics outside of what they gleaned from the latest Krugman column, so they make everything about women, gay people and minorities.

It's a study in tribalism and cult dynamics, not reasoned argument.

If you want to understand the Democratic voter, just look at Tony...

Tony couldn't care less if he's dead wrong about spending and taxes.

It doesn't make any difference to him.

It's about Obama.

There are a few exceptions. ...but not enough to make any difference.

Hey, Buttboy. I like that after trying to argue that the late 1970s were an economic boom period and that Obama secretly lowered spending when no one was looking, you come down here and throw out another meaningless sentence with no evidence. So tell me, how are 14% inflation and 7.1 percent unemployment examples of an 'overheated economy' again?

Job creation since 1970 % increase:

Jimmy Carter (1977-81), 3.11%

Bill Clinton (1993-2001), 2.42%

Harry Truman (1945-53), 2.38%

Richard Nixon (1969-74), 2.30%

John Kennedy (1961-63), 2.28%

Ronald Reagan (1981-89), 2.04%

Gerald Ford (1974-77), 0.95%

Dwight Eisenhower (1953-61), 0.87%

George H. W. Bush (1989-93), 0.59%

George W. Bush (2001-09), 0.28%

And how was employment?

Hey, shrike. What is this supposed to prove? 7.1 percent unemployment. 14% inflation. It's not really Carter's fault because most of it was the fault of Nixon and Ford. There were price controls and high levels of government intervention, all of which resulted in terrible economic circumstances.

I say again: Job creation numbers are a terrible measure of economic health. Unemployment in the late 70s was almost as high as today and their inflation was 6 times what ours is. I wasn't alive in the 70s, but every economic indicator other than the one you gave is heavily negative. One good economic indicator does not mean the economy is in good shape. Or do you think we should be dancing in the streets because the stock market looks good today?

Actually, the stock market looks pretty much like it did 15 years ago. No growth in 15 years.

Economic conditions were so much different in the late 70's and early 80's from what they are now, that it doesn't even make sense to compare them. Interest rates and inflation were so high that it distorted almost every financial transaction or plan that you made. The idea pushed on everyone was to be in debt, because only suckers saved and watched inflation eat away your assets. Better to be a debtor and let inflation erase your debt.

The best fixed rate mortgage we could get on our first house was 14.5%. Just writing that now seems insane. But we were happy to "lock it in". That is what people did when they put a contract on a house, you locked in your interest rate, because you assumed it was just going to go higher. It is hard to imagine what kinds of distortions and unexpected effects such interest rates have on the economy and the mind set of everyone in it.

The other difference between now and the late 70's were marginal income tax rates. If you want to see a scary/depressing chart look at http://www.stanford.edu/class/.....on/Federal Tax Brackets.pdf

. Every financial move you made was predicated on the tax effect. We were in the 43% bracket. Which meant that we got to keep about 50 cents of any extra dollar we made. So every deduction was worth 50% of the actual expenditure. Therefore, a big mortgage was a good thing. It might even get you into a lower tax bracket.

It wasn't a great time, and not just because of the clothes, haircuts and horrible cars. Be glad you didn't live through it. If you want to see how dreary it was just watch a movie of the times like Marathon Man. .

I would also add that creating government jobs that drag on the real economy probably isn't a good thing.

Sustainable jobs through sustainable economic growth and "jobs" aren't the same thing.

Besides, if a president like Carter can take any responsibility for job growth during his term, it was due to things his deregulation program. If Clinton can take any responsibility for job growth during his term, it was due to things like the free trade agreements he didn't screw up...

Has Obama deregulated like Carter? No, he dumped heaps of regulation on the banking industry at a time when the economy was starving for lack of credit. And I know both the free trade agreements Obama dealt with he let the UAW hold hostage--and renegotiated them on the union's terms.

Show me what Obama's doing to stimulate job growth like Carter or Clinton did, and I might be impressed. But I'm guessing that policy points don't really matter to Shrike. What matters to Shrike is "Republicans bad, Democrats good".

Not to mention that Obama signed a tire tariff into law. It takes a hell of a free trade president to decide trade war with China should be declared because of freaking tires.

Shrike's numbers are also skewed by the fact that Carter and Clinton inherited a terrible economy while both Bushes walked in on the tail end of a boom. Inheriting a terrible economy should make high percentage job growth easy to produce. BO has underperformed on that count.

Source?

I don't think you copied and pasted since you claimed it's since 1970 yet you have Truman, Kennedy, and Ike there.

You also forgot Obama. Or are you only counting prezzes with positive job growth?

Clive James wrote a very good essay on Isaiah Berlin several years ago, and made the point that for some it may just be too overwhelming to face facts that contradict their own assumptions so dramatically. Apropos, I think:

"For some it may just be too overwhelming to face facts that contradict their own assumptions so dramatically."

Talking to most Democrats about the economy is like talking to creationists about evolution.

...only the Democrats are basically running the economy now, and that's much worse than creationism.

It's bad enough that the Democrats refuse to believe the bridge has washed out--much worse since they're the ones driving the bus.

But...I just got told that a 3% job increase means unemployment and inflation indicators don't matter.

Are you telling me that's not true?

It was Iggy's use of the term "cult dynamics" that made me recall this essay. At some point we have to realize that facts and figures are not enough, because we are dealing with an ingrained world view that *believes* in higher taxes and more government control over the economy and the constraint of individual liberty for the common good.

No graph showing that spending is the issue, or that tax-cuts lead to revenue increases, or that Obamacare will lead to higher health care costs, is going to change minds. It's a belief held with religious fervor, thus the response to, say, continuing high unemployment is that the ideas (stimulus spending) were right, but just not implemented fully enough. This is eerily similar to the responses to the failures of communism.

Case in point: I just read a Washington Post article that claimed we'd have 2.5 million fewer jobs without the stimulus. The people making this claim are the EXACT SAME PEOPLE who claimed that unemployment wouldn't go over 8 and that it would be back down to 5 by now.

They're like fucking witch doctors. It's irrelevant how many times they're wrong, the same exact people have their word taken as gospel by the press every time they make a pronouncement.

No one bothers asking 'wait, how do you know that?' No one really wants to know. Once they see a stat or a number that reaffirms their worldview, all cognitive function stops.

"We are dealing with an ingrained world view that *believes* in higher taxes and more government control over the economy and the constraint of individual liberty for the common good."

I think you are absolutely right.

Americans are historically an extremely religious people, and just because some of us no longer consider ourselves religious, that doesn't mean we aren't religious people anymore. Many of us just don't call it "religion" anymore--we call it "politics".

The politics is about what they *believe* in. You hit the nail right on the head. And just like creationists, you can't change what some people *believe* in. ...or sometimes whom they believe in. How many facts does it take to turn a fundamentalist creationist to reason?

I don't think that transformation has to do with facts. I think that's an internal transformation that comes by way of things like personal integrity.

You have to want your own beliefs to accurately reflect reality.

I don't know how to convince someone to want that. Maybe you can inspire someone to want that through literature, etc., but at some point, that desire to have your beliefs accurately reflect reality, that has to come from within.

Well, not to be morose, but tens of millions of murdered people was not enough to convince many of the intellectual elite, especially in Europe, that communism was a failed ideology. Belief systems are powerful things.

I maintain that our best bet is a return to Federalism, so that these conflicting ideas can play out among the States. We're already seeing that to some degree, but not nearly enough for the true believers to take notice. And as long as the majority of funding is collected and redistributed at a federal level, we'll all be paying the price for the upcoming failures of individual states.

"When a man ceases to believe in God, he does not then believe in nothing. Rather, he believes in everything."

- CS Lewis

CS Lewis is one of those people that a large number of people think is very very smart, but that only proves how dumb they are.

Juice is one of those people who think they have something to say but really just engage in personal attacks.

I'm only piping up to say that I don't understand the quote at all. It seems like he's saying something complimentary about atheists, but I'm not really sure.

His point is that people who lose their faith quickly substitute faith in something else...often something ridiculous.

Oh. Well that's silly. The way I read it seemed a bit nicer, but your read of it makes more sense, considering the source.

Another solar company goes bankrupt:

http://www.wlox.com/story/2022.....is-closing

I think that graph is labelled wrong... it says "millions" but the outlays are in the thousands...and a thousand million is a billion. So unless the government is spending $3 billion a year, the chart should be changed to "billion" dollars.

I think he just linked the graph the way the White House put it up.

Whoever put the chart up at the White House probably thought, "Oh well, it's good enough for government work".

I actually made the chart myself and just realized the mistake. I originally inputted 7 digit numbers which would be millions and then mixed myself up. Now fixed!

Well nobody's perfect!

It's a great piece. Thought provoking. Discussion provoking...

Keep up the great work.

Work like this is why I give money to Reason.

Thanks!

Job creation since 1970 % increase:

What in the fuck is that gobbledygook supposed to "prove"?

I also like that he doesn't bother telling us what the percentage even means. Is it total increase over the term? Average yearly increase? What's it based off of?

Who am I kidding? These minor quibbles are too small for the genius we call Palin's Buttplug.

Job creation numbers are a terrible measure of economic health.

I would even go so far as to say "job destruction" could very well be a better measure of economic health.

The Obama administration in particular (Boooosh did it, too!) has been frantically attempting to make every job, no matter how economically unproductive or unnecessary, permanent. There are a lot of jobs which really should be allowed to vanish, and the sooner we clear away the dead wood, the better. Unfortunately, we now have a regime which wants to only create new jobs for people who will effectively put an end to innovation and productivity improvements.

This is the result of fetishizing "jobs" over productivity.

That chart looks wrong. Spending is like 3.8 trillion now.

Needs moar Christ-fag/less Bushpig

What about Bush-fag and Christpig? We never get those.

So, per capita tax receipts have fallen while per capita government outlays have risen? We can't tell from the chart, although both likely true because the population has grown by about 35 million in the last 14 years

Very shallow analysis and nearly meaningless chart without taking account of population at least. I could use the same data source to show that receipts as a percentage of GDP have fallen over the last 14 years. Try harder.

Outlays have gone up by 60% while population has gone up 10%. You already had enough info to figure that out.

Not sure why per capita values matter anyway; many of the outlays are constant regardless of population.

s/are/should be/

How much has the population grown over the last four years? Because immigration has nearly stopped due to the economy and our birth rates are at all time lows.

I agree that it should be scaled to some baseline and probably should be per capita, rather than simply being total outlays and receipts. However, I don't think you can argue that the increase in spending is the result of population growth when America has been at all time low levels of population growth over the last couple of years.

Epic reading comprehension fail.

No you couldn't because they haven't

It is to barf:

http://www.cnn.com/2012/11/30/.....?hpt=hp_t2

per capita tax receipts have fallen while per capita government outlays have risen?

Per capita tax receipts are likely to fall when the trend is for more and more "capitas" to pay no income tax at all.

Maybe "per capita receipts" from actual payers would make an interesting chart.

Hi Ed,

If you look at the tax receipts in $ terms it is more comparable using inflation adjusted dollars. If you look at it that way then the tax receipts in 2007 were about 25% lower! It is even worse because the GDP had increased by over 60% while the tax receipts in unadjusted $ remained the same.

A more appropriate way to look at it is to look at the tax receipts as a ratio to GDP otherwise it is misleading. The GDP in 1997 was about $8T while the GDP in 2007 was about $13T (or about $10T after adjusting for inflation.) Again for a 25% increase in GDP in same $ basis we had the same tax receipts in $. That means tax cuts did not lead to higher tax receipts even after adjusting for inflation.

Just to reiterate what 700 other people have said, we have both a spending and tax receipt problem. Your conclusion, at best is misleading and at worst is intellectually dishonest. We are all intelligent people here striving to solve a problem we have in common, let's try to address it in a Reason-Able way.

This chart DOES show inflation adjusted dollars! And if you chart receipts/outlays as a percentage of GDP, the shape is very similar.

Ed,

You are correct that receipts/GDP ratio trend is the same but the peak receipts were down from 20.6% to 18.5%. Two percentage points in the world's largest economy is a very big number.

Again, my point is not to argue about whether 18% or 20% receipts is correct for the nation, it is just that we need to be balanced about it over the long run. Not but cutting spending during recession but by saving the tax receipts during boom periods. This is where our political leaders fail. Only because we know that if there is a boom it will be followed by a bust...and if there is a bust it will be followed by a boom!

I am confident that We the People can intellectually Reason with the politicians and are Able to make them change.

BTW: You were correct that the dollars you had plotted were inflation adjusted dollars. My apologies.