The Volokh Conspiracy

Mostly law professors | Sometimes contrarian | Often libertarian | Always independent

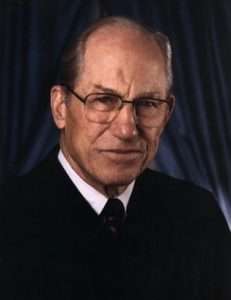

Today in Supreme Court History: April 16, 1962

4/16/1962: Justice Byron White takes oath.

Editor's Note: We invite comments and request that they be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of Reason.com or Reason Foundation. We reserve the right to delete any comment for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Ashcroft v. Free Speech Coalition, 535 U.S. 234 (decided April 16, 2002): striking down on First Amendment and overbreadth grounds Child Pornography Prevention Act of 1996 banning virtual pornography (despite fact that it's difficult for law enforcement to discern virtual from real children) because it extends beyond "obscenity" (which is bannable) and limits free speech

Allen v. McVeigh, 107 U.S. 433 (decided April 16, 1883): no federal question presented by dispute over promissory note where promisor, resident in Alexandria, Virginia, had fled to Confederate territory to join his family after Union troops overran Alexandria and left his "notice of protest" there (probably because it wasn't an international or even interstate issue -- the "Confederacy" was not recognized as a nation and it was the individual states who were at most "in rebellion" -- at least that's my reading of this)

Genesis Healthcare v. Symczyk, 569 U.S. 66 (decided April 16, 2013): offer of judgment under Rule 68 does not make a case moot if the plaintiff rejects it (this seems pretty obvious but it was a 5 - 4 decision) (claim was for violation of Fair Labor Standards Act and offer was for full restitution)

Burgess v. United States, 553 U.S. 124 (decided April 16, 2008): state penal offense punishable by more than one year is "felony drug offense" so as to invoke aggravated penalties of Controlled Substances Act even though state statute calls it a misdemeanor

Baze v. Rees, 553 U.S. 35 (decided April 16, 2008): three-drug lethal injection method was not "cruel and unusual punishment" despite increased risk of improper administration causing pain

Cooper v. Oklahoma, 517 U.S. 348 (decided April 16, 1996): state statute requiring that incompetence to stand trial be proved by clear and convincing evidence violates due process; preponderance of evidence is enough

Kay v. Ehrler, 499 U.S. 432 (decided April 16, 1991): successful pro se plaintiff in §1983 action who happens to be a lawyer is not entitled to attorney's fees (what a jerk)

Kerr-McGee Corp. v. Navajo Tribe of Indians, 471 U.S. 195 (decided April 16, 1985): tribe can impose taxes on sale and lease of lands without approval of Secretary of the Interior

Rawlins v. Georgia, 201 U.S. 638 (decided April 16, 1906): due process not violated by statute excluding lawyers, ministers, doctors, dentists, and railway engineers and firemen from grand and trial juries (I imagine this statute is no longer in force -- but what was the impetus for it?)

Super Tire Engineering Co. v. McCorkle, 416 U.S. 115 (decided April 16, 1974): contention that state law making striking workers eligible for welfare interfered with right to bargain was still justiciable due to continuing existence of law despite settlement of strike; remanded to Third Circuit (which upheld the statute, 550 F.2d 903, cert. then denied)

Genesis Healthcare v. Symczyk is a conservative-liberal split on the sort of issue that tends to split conservatives and liberals. Symczyk's lawyers wanted her to be the lead plaintiff in a class action. She (they) rejected an offer of judgment for all individual relief requested including costs and fees. Under Third Circuit precedent that mooted the case. Her lawyers wanted to keep going and find some new plaintiffs. The Third Circuit said go for it. The court noted a circuit split on whether an offer of judgment truly moots the case, but that wasn't the issue the court accepted for review. If the offer of judgment mooted the case, as it did under Third Circuit precedent, then the possibility of a class action did not rescue it.

thanks

More specifically, Symczyk had conceded that her personal case was moot; she wasn't appealing that to SCOTUS. She was appealing the question of whether she could still maintain the case nonetheless.

No; you're misunderstanding the context. (Though it's a common misunderstanding.) FLSA cases don't have class actions. FLSA cases are collective actions, not class actions, and work very differently. With most claims, one can certify a class which then has independent existence, containing multitudes of class members. One can't do that with a collective action. No class is ever certified, and only individual plaintiffs who affirmatively opt-in are participants in the case. As such, when her individual case was moot, the case was over because there were no plaintiffs.

However, a few years later in Campbell-Ewald Co. v. Gomez, SCOTUS addressed the issue unresolved in Symczyk, the one identified by captcrisis: whether an unaccepted offer of judgment for 100% relief moots a case. Although it seems obvious, there was a circuit split¹ on this, and SCOTUS's ruling was only 6-3 in favor of the textual position that an unaccepted offer has no effect of any sort and therefore the case is not moot.

¹At least one circuit's precedent held the insane notion that an unaccepted offer of judgment moots the case and that the plaintiff isn't entitled to anything at all because he didn't accept the offer!

I don't think the notion is entirely insane; If you didn't want relief, what's the point in continuing a process whose only justification is that it will lead to relief?

Thanks! I’ll correct my summary.

"Rawlins v. Georgia, 201 U.S. 638 (decided April 16, 1906): due process not violated by statute excluding lawyers, ministers, doctors, dentists, and railway engineers and firemen from grand and trial juries (I imagine this statute is no longer in force — but what was the impetus for it?)"

In some states, it also included schoolteachers. The rationale for it was, essentially, public convenience -- that there would be public disruption by demanding these people for jury duty. This was back when the fireman (a) shoveled coal into the locomotive and (b) added water as it was boiled off as steam, and (c) watched the gauges so the boiler didn't explode -- and the engineer ran the train. You could be short a brakeman but without these two guys, the train got canceled.

Back then, ministers were social workers -- the did social work during the week and preached on Sunday. Doctors (and maybe dentists) did housecalls, there was no EMS as we know it and this is why MD license plates were issued. (As late as the early 1970s, a lot of fire departments had a local MD who went to fires just in case someone got hurt.) Teachers were expected to be teaching every day and someone thought that lawyers were important.

As to the railroad, look at what crew shortages do to airline schedules today. The other professionals were independent and (particularly in rural areas) didn't have anyone to cover for them.

Thanks -- good points, esp. in small towns.

Angels and ministers of grace can defend us, but they can't judge us.

New York used to exclude a wide variety of professions from jury duty automatically, including lawyer. In the 1990s they abolished that rule, and shortly thereafter, Rudy Giuliani, the then-sitting mayor (and an attorney at the time), ended up getting called for jury duty, and actually serving.

My deepest sympathies to the parties to that case.

Well, to one of them, anyway.

I read that comment as meaning that even the prevailing party would be notably worse off for Giuliani having been on the jury.

“Courage is grace under pressure.”

Giuliani had none.

It was highly weird that neither party struck him. He wasn't crazy like he is today, but he was always a bigmouthed personality, and it would be natural to think he'd be a distraction in the jury room.

Quite true.

"Super Tire Engineering Co. v. McCorkle, 416 U.S. 115 (decided April 16, 1974): contention that state law making striking workers eligible for welfare interfered with right to bargain..."

While the court referred to it as "state welfare assistance", in most states today (and I presume then), unemployment is actually an insurance program largely paid for by an assessment on employers, with (usually) an additional assessment for each unemployed employee receiving benefits.

All I could find was this footnote:

"Chapter 156, p. L.1947 (R.S. 44:108) defines reimbursable public assistance as 'assistance rendered to needy persons not otherwise provided for under the laws of this State, where such persons are willing to work but are unable to secure employment due either to physical disability or inability to find employment.'" [emphasis added]

Reimbursable by whom?

I can see an issue here if the struck company is required to pay benefits to the strikers.

I wonder if making unemployment benefits taxable (this was started under Reagan) changes that analysis. Usually insurance proceeds aren't.

Money you earn working gets taxed, why not money you "earn" for not working??

And the whole idea of an "Income" Tax is total BS (I know there's a Constitutional Amendment allowing it)

My Theory is I trade 8,9,10 how ever many hours that I could be doing something else more fun (Working Out, Reading, Volunteering, OK, pretty much jerking off and drinking/smoking) in exchange for some Paper with George Washington's Picture. Not like I just happened to get this money for nothing (Chicks for Free, you play the Guitar on your MTV)

So there's no "Income" I traded my valuable time for some Somolians,

I know this Theory has been tried many times and only ends up with time in a Federal Correctional Facility...

Frank

But there is income. Suppose you earn $100 for working. You now have $100 that you didn’t have before. Income stems from the fact that you now have money you can spend to acquire goods and services from other people. You did not generate something spendable by working out or jerking off (unless you’re a porn star and people pay to watch you jerking off).

My times worth way more than $100

Not from what I’ve heard.

So you're an IRS Agent? Income for 2022 over a Million, (Ok, not that impressive in 2023, sort of "Upper Middle Class" 1: Partner in a busy Anesthesia Practice, so there's that, 2: Co-Owner in a Pawn Shop, lets me practice my Jeweler (Hey, I'm Jewish!) and rip off the Hoi Poiloi (i.e. Afro Amuricans) on, umm practically everything, unless you immediately turn around and walk out, you're gonna leave with less $$$,

3: work as a "Consultant" requires travel, hotels, what we in the Biz-Biz call "Deductions"

But my Bad, you obviously got the Shee-ot!

(Don't bother making up anything)

Frank

I was basing that off your comments here. Anyone who says as many stupid things as you do should not be surprised if people conclude you’re not merely pretending to be an idiot.

Good point. This is why I believe inheritance should never be taxed more favorably than earned income. Reward work, not indolence.

"Coach" Jerry, no Homo or anything, but "I think this is the beginning of a beautiful friendship"

(I'm Rick, no Homo)

wait a minute.....

"Never be taxed more favorably"??

damn double negatives,

Inheritance shouldn't be taxed at all, it was already taxed when I earned it!

Knew it was too good to be true,

Here's looking at you, kid (meant for a sensual Lauren Bacall, not "Coach" Jerry"

Frank

Your "Theory" makes no sense whatsoever.

Money you get paid for selling something, including your labor, is income.

Now, in a funny way, you have a complaint.

If I spend $250,000 on some merchandise, and then sell it for $500,000, I'm taxed on my 250K profit.

If you spend $250K acquiring some skill, and then sell your services for $500K, you are taxed on the whole $500K.

OTOH, if someone else invests $250,000 in a business, and then sells it for $500,000, they also pay tax on only $250K, and get a favorable rate to boot.

Insurance proceeds normally aren't taxed for the good reason that the premium you pay is not usually tax-deductible.

Whatever the cost to the employee - even if implicit - for unemployment insurance, it is, effectively, tax-deductible.

As I understand it, the reason for "janitor insurance" -- corporations like WalMart taking out life insurance on low level employees (payable to WalMart) is that they can deduct the premiums and the payouts are tax free. Hence with large numbers they almost break even (less the profit for the insurance company) except the taxes they dodge makes this profitable.

I was under the impression that insurance proceeds weren't taxed on account of theoretically not being profit, but instead just erasing a loss; The loss of whatever was insured supposedly balancing the money handed over.

Wonder if he was asked his opinion on Abortion during his confirmation hearings? Or if JFK asked?

Memory is that Abe Fortas (LBJ) was the first to appear before the Senate in person.

The crazily inventive Roe v Wade ukase wasn’t until ’73, so why would anyone ask that question in '62? (White dissented. Whether JFK being Catholic or an inveterate cocksman would have affected his desired answer is a different question.)

OK, Moron, Roe v Wade was argued in 1972

The point I was trying to make that obviously went over your Water-Head was that Nobody of substance in 1962 was for Abortion (OK, George Wallace would probably support 60 million less (fewer?) Blacks being born from 1973-present, but never came out for Abortion)

Probably the first was "Acid-Amnesty-Abortion) McGovern in 1972" but he was still trying to carry working class districts in the Midwest and the South, Abortion wasn't really a winning Ish-yew there. (60 million less (fewer?) Blacks being born from 1973-present might have been)

Frank

Oh, wow, dipshit, Roe was argued in ’72 even if not decided until ’73? That really destroys my point, doesn’t it? Especially since what made Roe important is not that it was ARGUED before SCOTUS, but that the DECISION was so nuts, In 1973.

As to “Nobody of substance in 1962 was for Abortion”, that is as stupid as all your other comments. Abortion was effectively legal before Roe in many places. But it wasn’t an issue in selecting Justices for SCOTUS before Roe was DECIDED. In 1973.

Dunno whose prick is causing irritation by being up your ass, but if you don’t want it to be followed by my boot stay in your own circuit of retards where you’re not so badly outclassed. You and Artie deserve each other.

"Dipshit"?? way to go "High" ("High" 5!")

Umm, yes, not even knowing the basics of the year the case was "Argued" (is that the term? I guess it is)

2: Abortion was effectively legal before Roe in many places. (Where? must not have been many for "Roe" to cause such a Kerfluffle)

3: "Dunno whose prick is causing irritation by being up your ass, but if you don’t want it to be followed by my boot stay in your own circuit of retards where you’re not so badly outclassed. You and Artie deserve each other."

I think you and Artie already "know" each other

Frank

You think all sorts of stupid shit, including that because I know that Roe was decided in ’73 I somehow don’t know that “Jane Roe” brought the case in 1969. In Texas. Which says nothing about how abortion was already effectively legal, before 1973, in other States that didn’t get upset at Roe. E.g., effective legalization in California goes back to approximately 1966. Once “medically necessary” abortions are allowed at doctors’ discretion there is no ban. Anyone can get one.

“The crazily inventive Roe v Wade ukase wasn’t until ’73” is perfectly accurate even if I didn’t insert “decision” between “inventive” and “Roe”, and you’re just making an ass of yourself by continuing to pretend otherwise.

While not all the laws had taken effect, when Roe was decided in '73, abortion had been legalized in half the states -- in which 3/4 of women lived.

Under some circumstances, anyway. Though the pro-abort lobby loves pretending that abortion is either legal under all circumstances, or totally illegal, it's basically always a mixed bag outside of a handful of maximally pro-abort states that have legalized elective abortion right up to birth, and maybe a few hours afterwards.

I believe that even in many of the states that had already legalized abortion under some circumstances, Roe went further.

But as I frequently point out, the big deal ruling was actually Doe v Bolton, decided later that same day. It was the ruling that opened the door to pretextual declarations of medical necessity gutting the Court's promise states could regulate abortion after the first trimester, by prohibiting second guessing a doctor's declaration on that question, and declaring that doctors could make a declaration of medical necessity based on essentially anything they wanted, not just strictly medical issues.