Christian Britschgi: Zoning Restrictions Worsen the Housing Crisis

Associate Editor Christian Britschgi breaks down how zoning restrictions distort the housing market.

If you want less expensive housing, you need more housing. And the way to get more housing is actually pretty simple: You have to let people build it.

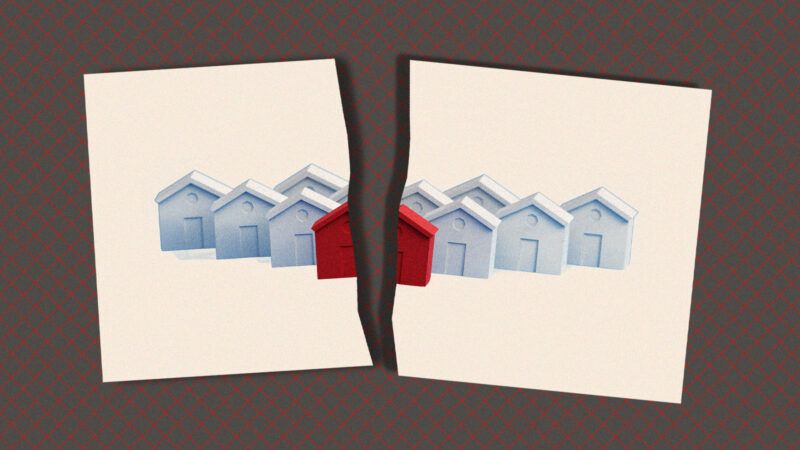

But that seemingly simple solution has turned out to be incredibly difficult, mostly because of politics. More specifically, the problem is zoning.

Local zoning rules put limits on what can be built and where. Zoning rules restrict how high a building can be, or how many units can occupy a given parcel of land.

In some cases, they also require aesthetic features that can be cumbersome or expensive to build.

In other words, zoning makes housing more scarce—and more expensive.

In theory, President Joe Biden has staked out opposition to the worst of these building restrictions. While campaigning for president, he backed loosening zoning rules.

And the bipartisan infrastructure law Biden signed last year contained billions of dollars for transportation grants the administration indicated could go to localities that reformed strict zoning laws, as part of the administration's Housing Supply Action Plan, which the White House has described as a plan to "ease the burden of housing costs."

But that plan has produced disappointing results.

That's the topic of this week's episode of The Reason Rundown With Peter Suderman, featuring Reason Associate Editor Christian Britschgi.

Mentioned in this podcast:

"Joe Biden's Use of Transportation Dollars To Incentivize Zoning Reform Is a Big Flop" by Christian Britschgi

"Environmental Lawsuits Tried To Block 50,000 Homes From Being Built in California in 1 Year" by Christian Britschgi

"Are San Francisco's NIMBYs Finally Getting Their Comeuppance?" by Christian Britschgi

"Marc Andreessen's High-Tech Fix for the Housing Crisis Lets Him Keep Being a NIMBY" by Christian Britschgi

Audio production and editing by Ian Keyser; produced by Hunt Beaty.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

When the CFPB started horning in on community bankers, Blacks with black clients, the housing debacle started. I KNOW but can't reveal that many banks went into poor black neighborhoods and made loans they knew were bad, crowded out the community bankers -- and all so they could avoid the more expensive CFPB fines.

Apr 19, 2018 — But at $1 billion, the civil money penalty would be by far the largest the CFPB has ever issued to a bank.

So you make bad loans, you flush out the local lenders, and you are ahead of the game.

The housing crisis would mostly evaporate if we promoted marriage and family.

When Liu and Yu calculated the cost in terms of increased utilities and unused housing space per capita, they discovered that divorce eliminates economies of scale. Among the findings:

In the United States alone in 2005, divorced households used 73 billion kilowatt-hours of electricity and 627 billion gallons of water that could have been saved had household size remained the same as that of married households. Thirty-eight million extra rooms were needed with associated costs for heating and lighting.

Between 1998 and 2002, in the United States and 11 other countries (among them Brazil, Costa Rica, Ecuador, Greece, Mexico and South Africa), if divorced households had combined to attain the same average household size as married households, there could have been 7.4 million fewer households in these countries.

Around the year 2000, the numbers of divorced households in the 12 countries ranged from 40,000 in Costa Rica to almost 16 million in the United States.

In divorced households the number of rooms per person was 33 to 95 percent greater than that in married households.

https://www.nsf.gov/news/news_summ.jsp?cntn_id=110798

Nice option. Actually I believe that it's really cool that there are so many sources that can help you with it. You may have a glance at these houses for sale in Benahavis right there because it seems to me that it can help you find the best house or apartment for yourself there. Try to check some variants

Yeah because nothing increases housing prices like illegals moving into the neighborhood.

Absolutely right.

Innovation and a free market would encourage investment in new communities in undeveloped areas. We don’t have that, so most jobs and housing remain in established cities.

A healthy immigration policy would slow population growth to what the market can accommodate. We don’t have that, either.

Instead, we have a ton of illegal aliens pouring through our borders and ports, undercutting wage growth by taking low skilled jobs, and taking up a big chunk of the affordable housing.

Zoning isn’t the problem. Bad business policy and immigration policy are the problem.

I am creating eighty North American nation greenbacks per-hr. to finish some web services from home. I actually have not ever thought adore it would even realisable but (dbt-19) my friend mate got $27k solely in four weeks simply doing this best assignment and conjointly she convinced Maine to avail. Look further details going this web-page.

.

---------->>> https://cashprofit99.netlify.app/

Not sure what you meant by that.

It is the neighborhoods without restrictive covenants that have owners subletting to any and all. That is the problem. As to housing prices, it is more the instability and not the actual situation that destabilizes prices that only the wealthy can wait out.

And you don't mention Biden, the real villain according to Joel Kotkin, my go-to on housing issues.

"One might be inclined to ask why, if transit constitutes less than 1% of passenger travel in the US, does it represent 28% of the funds Biden proposes to spend on transportation? The answer is clear: to make it easier for people to live in deep blue, high density areas.

Thanks to the Government and companies like BlackRock, where investors accounted for roughly one out of five US homes bought in 2021 — a 50% jump from 2020 — ordinary Americans have been locked out of the housing market."