Tax Reform Was Easy, Spending Cuts Are Un-possible

President Trump and the GOP leadership has already reneged on promises to tackle entitlements.

With the stroke of President Trump's pen, long-promised tax reform is now the law of land. With it comes more than a few excellent developments—a major, overdue reduction in the corporate rates, a shift to a territorial system of collection, caps on tax expenditures such as deductions for state and local taxes and mortgage interest, the end of the individual mandate for Obamacare—and a whole new set of concerns, none more pressing that a certain reduction in revenue even as government spending increases.

Like Obamacare, this tax-reform legislation was purely a partisan affair, which is rarely the best way forward for major legislation, leaving it open to quick revision, repeal, or slow death (see: Obamacare). Still, precisely because one party could muscle through something, regardless of how controversial and unpopular (tax reform, like Obamacare at its passage, is polling terribly with the public), it's relatively easy. It just takes the determination of the majority party. President Obama and the Democrats had to pull out all the stops and pour "sweeteners" down the throats of recalcitrant party members, many of whom choked to political death (where have you gone, Sen. Ben Nelson of Nebraska?).

So here's the thing: What are Republicans going to do on spending? Cutting taxes is the frosting, not the cake, when it comes to actually making America great again. Our $20 trillion national debt (this figure includes both debt with investors and what various parts of the government owe each other and is the most accurate measure) is undoubtedly retarding economic growth for a variety of reasons:

Balancing budgets and reducing the size, scope, and spending of the federal government is not simply a puritanical accounting fetish. Economists on every point of the political spectrum agree that debt-to-GDP ratios of ov—er 100 percent are a drag on the economy because everyone knows that a major restructuring is coming eventually. Taxes will need to go up, services will need to be cut, and inflation will rise—or most likely, some combination of all three.

As it happens, the modern Republican Party, at least since the Reagan era, has defined itself as the party of low taxes and low spending. That ideological commitment has been purely rhetorical of course, with George W. Bush and his GOP majority in particular blowing out the federal budget in then-unprecedented ways. But that was then, right? And this is…now?

More precisely: This was now. Earlier in December and almost certainly as a way to disarm budget hawks, Speaker Paul Ryan pledged that right after tax cuts, the GOP would start work on cutting spending, especially on entitlements. Here his on December 6:

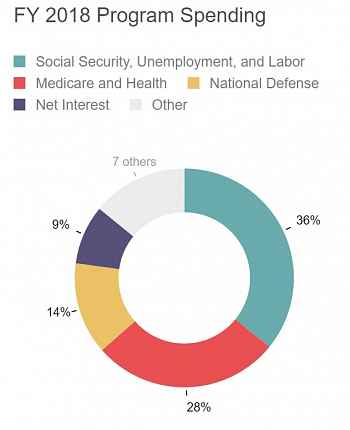

"We're going to have to get back next year at entitlement reform, which is how you tackle the debt and the deficit," Ryan said during an appearance on Ross Kaminsky's talk radio show. ". . . Frankly, it's the health care entitlements that are the big drivers of our debt, so we spend more time on the health care entitlements - because that's really where the problem lies, fiscally speaking."

Republican tax-cut activist Grover Norquist told me the same thing in a pre-passage interview:

Norquist: …April 2018, we're going to do welfare reform. Welfare, TANF is a very small number. We're going to add food stamps, a very small number, well 75 billion or so. It's not too small. And we're going to add in Medicaid which is a quarter of all state and local budgets. And take those together and probably also what's left of Obamacare in terms of spending and block rent those to the states and limit their growth to below the way it's growing now. So that you out 10 years or whatever, ask Peter [Ferrara] what the numbers are. He says in a matter of 20 years it's trillions of dollars that you get just from taking the rate, bringing it down a little bit.

Gillespie: By the same token, Medicare and Social Security spending are going to go up. They're already effectively running deficits so we're going to need more taxes if we don't change their benefit forecasts.

Norquist: How do you eat an elephant? One bite at a time. If you do this and make it work, I believe you can. We did it with welfare reform with Clinton. This is what we're going to shove down the Democrat's throat.

Norquist, of course, isn't Speaker of the House. So here's Paul Ryan now, on December 20:

House Speaker Paul Ryan ruled out cuts to Medicare in 2018 to beneficiaries despite previously calling for reforming healthcare entitlements.

Ryan said on ABC's "Good Morning America" Wednesday there could be some Medicare provider issues the Republican Congress could address in 2018.

"Some providers in the Medicare field are getting overpaid," he said. "As far as you talk about beneficiaries, we are not focused on that."

So you see Ryan already walking away from the single-biggest driver on automatic increases in government spending. And give Ryan at least some fake street-cred for even bothering to bullshit about tackling expensive entitlements. His counterpart in the Senate, Majority Leader Mitch McConnell, has even taken welfare reform off the table for the coming year. As summarized by Axios:

Senate Majority Leader Mitch McConnell threw cold water Thursday on the idea of doing welfare and entitlement reform on a partisan basis next year. He told Axios' Mike Allen that he "would not expect to see" welfare reform on the agenda in 2018.

"We have to have Democratic involvement. So things like infrastructure…to do something in that area we're going to have to have Democratic participation."

While signing the tax bill into law, Trump himself eschewed talk about cutting spending, choosing instead to talk excitedly about getting back to infrastructure spending, which kept calling an "easy" sell. Suddenly, we've gone from headlines either trumpeting or darkly warning that tax cuts pave the way for spending cuts to ones like this Fox Business beaut:

Trump's tax reform win paves way for infrastructure spending and higher stock prices

The most-common number bandied about is "$1 trillion," though it's anyone's guess what that means or how many years it's spread over. But assuming the 10-year budget figures that are typical, that's still $100 billion a year, or a pledge to spend more than even Norquist at his most excited calculated annual savings from welfare cuts (that again, are off the table anyway).

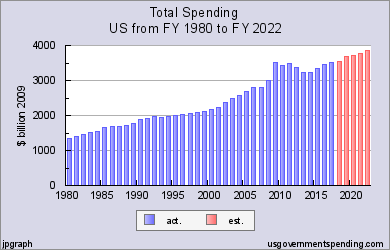

Back in the Reagan years and the first year or two of George H.W. Bush's one term, fiscal hawks routinely complained that Republicans always got rolled whenever they agreed to tax cuts NOW in exchange for spending cuts LATER. In the early 1980s, for instance, Reagan agreed to hike business and excise taxes in exchanged for promised cuts down the road: "The tax increase is the price we have to pay to get the budget cuts," he wrote. H.W. Bush did something similar in 1990. We're still waiting on those year-over-year cuts. (Ironically, as can be seen in the graph to the right, the one exception came after the historic uptick at the end of the George W. Bush years, when Obama managed to elect a Republican Congress and neither side even pretended to actually pass budgets, relying instead on continuing resolutions.)

But because history presents itself first as tragedy and then as farce, we've gotten a Benny Hill version of the old shakedown: Republicans have promised to cut taxes now and reduce spending later. And have already reneged on that, before the ink on President Trump's signature dried. Or, if we're being strictly accurate, before the legislation even landed on his desk.

Enjoy the tax cuts, which will put extra money in most of our pockets. I think I'm going to save most of mine for that rainy day that's out there on the horizon.

Looking for portable Reason content?

Show Comments (54)