Moving Your Company Overseas Is So Evil, Jack Lew Would Ban it in the Past!

Treasury Secretary Jack Lew, who can't pass a quarter-sized knothole in a fence without seeing a tax "loophole" through which lucre might pass that the government could otherwise palm, joins his voice to those condemning U.S. corporations who move overseas to reduce their tax burden. In a letter to four members of Congress, he also manages to imply that it's wrong to move yourself overseas to avoid Uncle Sam's sticky fingers. In fact, he's so repelled by the practice of shopping for lower tax rates that he wants the practice stopped in the past.

The letter, dated yesterday and addressed to Representatives Dave Camp (R-Mich.) and Sander Levin (D-Mich.), of the House Ways and Means Committee, and Senators Ron Wyden (D-Ore.) and Orrin Hatch (R-Utah) of the Senate Committee on Finance, complained about the practice of "inversion," whereby companies move their headquarters to low-tax countries while continuing to operate in to U.S.

In recent months, there have been reports of a number of corporate inversion transactions designed to change the tax domicile of a U.S.-based multinational firm with minimal change in its business operations. These transactions involve the purchase of a foreign corporation (generally with a much lower corporate tax rate and generous rules for shifting income between countries), the transfer of tax domicile to the foreign firm's country of incorporation, and the shifting of tax liability for the combined firm to the new foreign tax domicile.

Lew whines on, "these firms are attempting to avoid paying taxes here, notwithstanding the benefits they gain from being located in the United States."

Because, apparently, taking their facilities, jobs, technology, and investments with them would be the proper thing to do.

As with every complaint about inversion so far, Lew's letter comes off as a flag-wrapped serving of patriotic mush. Like other non-fans of inversion, he fails to acknowledge that, maybe, the United States just isn't that competitive in some areas (such as corporate taxes) and should try something smarter than chanting "USA!"

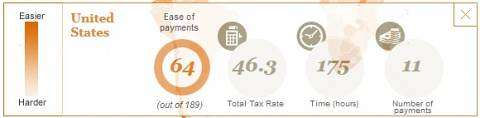

Incidentally, according to rankings released last year by the consulting firm PricewaterhouseCoopers, the U.S. ranks 64 out of 189 for ease of paying business taxes. This country also has a total tax rate that's above average, and barely seems to be trying to compete with other countries that Americans once mocked as overtaxed and overgoverned.

Canada ranks at 8, the U.K. at 14, and Australia at 44—with burdensome bureaucracy as big a concern as the government's take. Ireland, where several U.S. firms recently relocated their headquarters, comes in at 6.

Maybe there's room to quibble with those rankings, but the idea that companies can't and shouldn't hunt for environments that don't strangle them in red tape and suck them dry is ludicrous.

In fact, Lew seems to resent anybody going hunting for friendlier environs. "We should prevent companies from effectively renouncing their citizenship to get out of paying taxes," he says. Ah. Shades of efforts to penalize individuals for seeking lower-tax homes elsewhere. We're all in this together, or else.

And what's Lew's solution?

Senators Ron Wyden and Carl Levin and Congressmen Sander Levin and Chris Van Hollen have supported this idea in Congress and have put companies on notice that any transaction that takes place after early May 2014 will not have the desired effect of lowering future U.S. tax liabilities. Congress should enact legislation immediately—and make it retroactive to May 2014—to shut down this abuse of our tax system.

What's that Latin phrase? Ex post…something. It will come to me.

Maybe we could just improve the tax environment in this country so that people and businesses want to stay. And, to his credit, Lew does recommend lowering the corporate tax rate, and simplifying the tax system, though he also wants to "broaden" the tax base and, of course, close "loopholes."

Hey, you can't have a little tax reform without vilifying, threatening, and flag-waving at the folks asking for some relief.

Show Comments (135)