Maybe It Would Be Better To Shut Down the Government Now Than Shut Down a Bigger Government Later

Amidst all the doom-and-gloom blathering over the budget showdown, lost are two important points: One is the unfortunate fact that the government won't really be shutting down at all—not in a Borders Books going-out-of-business sale sort of way, that is; and the other is that the government we have is wildly unaffordable and completely beyond the means of this country to sustain. If we don't rein it in now, it won't get any easier down the line. A "shutdown" won't be the end of the world—it won't even be the end of paying interest on debt already accrued. But kicking the ball down the road a bit more on dealing with the federal government's spending problem does take us in an increasingly unpleasant direction.

First of all, it's unfortunate that congressional Republicans have allowed the budget wrangle to turn into a pissing contest over Obamacare. As horrendously intrusive and economically illogical as that law is, it's small potatoes compared to the federal government's addiction to spending money that doesn't exist. That said, Senate Democrats play as big a role in the pending shutdown as House Republicans—they're the ones rejecting a spending bill that would keep the government open(er) after all.

A separate and somewhat overshadowed issue, though, is that the debt ceiling once again figures in the back-and-forth in D.C. This is an ongoing problem. The Bipartisan Policy Center points out that "On May 19 of this year, the debt limit was reinstated at a new, higher level, after having been suspended since February. Upon its reinstatement, the U.S. found itself up against the debt limit with the Treasury Department continuing to operate through the limited borrowing authority provided by extraordinary measures."

Basically, the junkie needs another fix. If one isn't forthcoming, we're told, the withdrawal will truly suck.

Fans of government spending insist that the U.S. risks defaulting on its debt, if the debt ceiling isn't raised, but that would only happen if federal officials deliberately decided to stop paying the bills. While failing to raise the debt ceiling would prevent the government from borrowing more, it wouldn't keep it from paying off its existing debt. In 2011, in response to the last round of the-debt-ceiling-is-falling hysteria, Reason's Veronique de Rugy wrote:

Technically, if the debt nears its statutory limit, the Treasury Department cannot issue new debt to manage short-term cash flows or manage the annual deficit—the government may therefore be unable to pay its bills. But in the real world things are different.

First, if the debt ceiling is not increased it doesn't mean the federal government will have to repay the entire debt at once. The government just won't be able to increase its borrowing. Americans understand the difference between not being able to borrow more money and defaulting on one's mortgage…

More importantly, the Treasury Department has other options. For instance, if the debt ceiling is not increased, the Treasury can prioritize interest and debt payment to avoid a default.

That's…not exactly the end of the world.

What else happens if Congress continues sparring and doesn't pass a spending bill? Well, "nonessential services" will taper off for the duration, but the military stays at its posts, the Post Office keeps losing your mail, Social Security and Medicare continue hemorrhaging money, and all the things politicians deem "essential" go about doing what they've always done.

But beyond the current budget battle, whatever we may think of politicians' budget priorities and their dividing lines between "essential" and "nonessential," raising the debt ceiling again and again isn't a solution of any sort; it's a refusal to come up with a solution. That's because the U.S. federal government continuously spends far more money than it takes in.

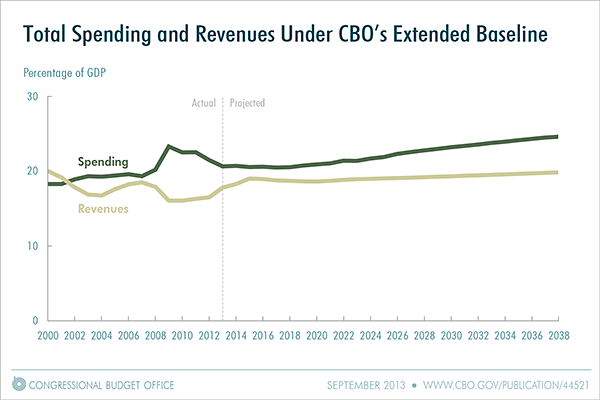

The latest Congresssional Budget Office long-term budget outlook "projects that federal debt held by the public would reach 100 percent of GDP in 2038, 25 years from now, even without accounting for the harmful effects that growing debt would have on the economy (see the figure below). Moreover, debt would be on an upward path relative to the size of the economy, a trend that could not be sustained indefinitely."

So, put the Obamacare spat to the side. It's worth fighting, but separately. The real budget battle should involve efforts to rein-in an out-of-control federal government that's addicted to spending money that doesn't exist. If we don't do it now, it only gets nastier when we have to cut even less affordable programs, "essential" and "nonessential," in the future.

Show Comments (31)