The Left's Secret Repeal of No Taxes on Tips

Progressive cities are scrapping the tipped-wage credit, shifting workers from tax-free tips to taxable wages, and likely leading to lower take-home pay.

What began as a campaign promise in Nevada became law this summer with the passage of the One Big Beautiful Bill Act: "No taxes on tips" is now nationwide. But even as pundits debate its merits, progressive cities are quietly undoing the tax cut—and few are noticing.

Progressive cities such as Washington, D.C., and Chicago have recently eliminated the tipped-wage credit, which lets employers pay tipped employees below minimum wage as long as tips filled the gap. Now, New York City is the next battleground in a push to mandate a one-size-fits-all minimum wage.

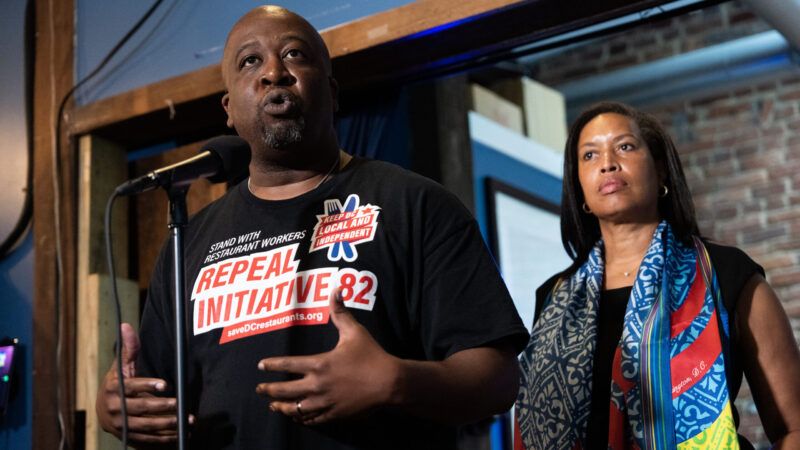

The campaign against the tipped-wage credit began before then-candidate Donald Trump floated "no taxes on tips," but few have considered how these ideas play out together. To see the consequences, look at what happened when D.C. scrapped the tipped-wage credit.

After D.C. repealed the credit—causing such a backlash that the city council has already voted to partially reverse the decision—servers reported tips falling from roughly 23 percent to 25 percent to 18 percent to 20 percent. Research from the Census Bureau shows that for every $1 increase in the mandated minimum wage for tipped workers, tips drop by about the same amount.

Prior to the repeal, the minimum wage for D.C. servers was $5.35 an hour; the rate was scheduled to increase to $16.10 by 2027—a $10.75 jump. The back-of-the-envelope math shows the potential tax implications.

On an average night, a D.C. server at a quality establishment might turn over four to five tables during the two-hour dinner rush, and the total gross sales from those tables may be modestly estimated at $500. If that server was tipped at 23 percent prior to D.C.'s elimination of the tipped-wage credit, they would have made $115 in tips, vs. an estimated $95 after the repeal—a $20 expected decline in tips. But that is before the "no taxes on tips" landscape.

At first glance, higher base pay seems to offset smaller tips ($16.10 per hour over that two-hour period versus $5.35 per hour would work out to $21.50 total in extra wages). But those new wages are taxable. For a server in the 12 percent tax bracket—typical for D.C.—a $21.50 raise nets only about $19 after taxes, less than the $20 in tax-free tips they lost. The gap widens the more tips a worker earns.

If every extra dollar in required wages replaces a dollar in lost tips, as Census Bureau data suggest, then repealing the tipped-wage credit effectively swaps tax-free income for taxable income. The same could soon hit gig workers and hotel staff.

Eliminating the tipped-wage credit now shifts earnings from tax-free to taxed—a de facto tax increase on these workers that could also lead to lower take-home pay in many scenarios.

If the left's anti-tip-credit movement continues to spread, "no taxes on tips" could be repealed without Congress even holding a vote.

Show Comments (40)