The Left's Secret Repeal of No Taxes on Tips

Progressive cities are scrapping the tipped-wage credit, shifting workers from tax-free tips to taxable wages, and likely leading to lower take-home pay.

What began as a campaign promise in Nevada became law this summer with the passage of the One Big Beautiful Bill Act: "No taxes on tips" is now nationwide. But even as pundits debate its merits, progressive cities are quietly undoing the tax cut—and few are noticing.

Progressive cities such as Washington, D.C., and Chicago have recently eliminated the tipped-wage credit, which lets employers pay tipped employees below minimum wage as long as tips filled the gap. Now, New York City is the next battleground in a push to mandate a one-size-fits-all minimum wage.

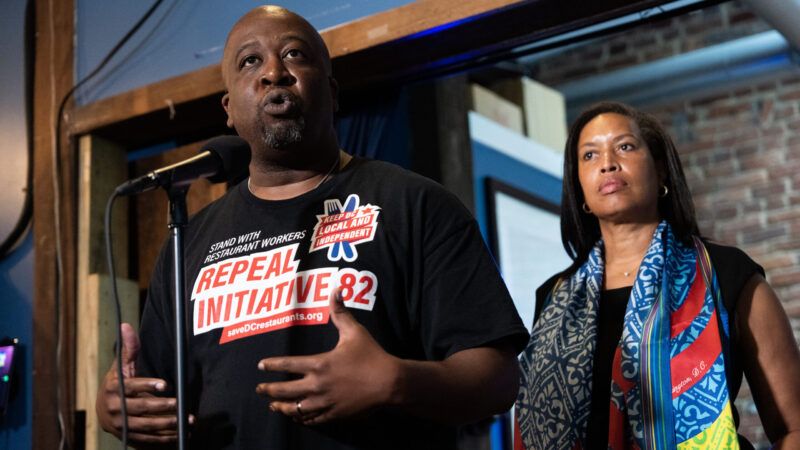

The campaign against the tipped-wage credit began before then-candidate Donald Trump floated "no taxes on tips," but few have considered how these ideas play out together. To see the consequences, look at what happened when D.C. scrapped the tipped-wage credit.

After D.C. repealed the credit—causing such a backlash that the city council has already voted to partially reverse the decision—servers reported tips falling from roughly 23 percent to 25 percent to 18 percent to 20 percent. Research from the Census Bureau shows that for every $1 increase in the mandated minimum wage for tipped workers, tips drop by about the same amount.

Prior to the repeal, the minimum wage for D.C. servers was $5.35 an hour; the rate was scheduled to increase to $16.10 by 2027—a $10.75 jump. The back-of-the-envelope math shows the potential tax implications.

On an average night, a D.C. server at a quality establishment might turn over four to five tables during the two-hour dinner rush, and the total gross sales from those tables may be modestly estimated at $500. If that server was tipped at 23 percent prior to D.C.'s elimination of the tipped-wage credit, they would have made $115 in tips, vs. an estimated $95 after the repeal—a $20 expected decline in tips. But that is before the "no taxes on tips" landscape.

At first glance, higher base pay seems to offset smaller tips ($16.10 per hour over that two-hour period versus $5.35 per hour would work out to $21.50 total in extra wages). But those new wages are taxable. For a server in the 12 percent tax bracket—typical for D.C.—a $21.50 raise nets only about $19 after taxes, less than the $20 in tax-free tips they lost. The gap widens the more tips a worker earns.

If every extra dollar in required wages replaces a dollar in lost tips, as Census Bureau data suggest, then repealing the tipped-wage credit effectively swaps tax-free income for taxable income. The same could soon hit gig workers and hotel staff.

Eliminating the tipped-wage credit now shifts earnings from tax-free to taxed—a de facto tax increase on these workers that could also lead to lower take-home pay in many scenarios.

If the left's anti-tip-credit movement continues to spread, "no taxes on tips" could be repealed without Congress even holding a vote.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Funny, I thought the tipped wage credit was a state law implementation of a federal law.

Silly me.

Tipping culture is bullshit to begin with. As a consumer I'm much happier seeing those jobs shifted to wages that make sense and taking the burden off of customers to pay abitrary wages to their employees.

I have zero faith in the goals of these big city dems, but will applaud the destruction of tipping culture and laws that encourage it.

You can also enjoy the following considerable drop in service.

Just sayin'.

Remember how lovely employees are at retail? You will get that at restaurants too.

With higher costs to boot.

Good plan. Really.

This is nothing but an untested assumption.

I've lived for extended periods in four generally similar, English-speaking democracies: Australia, Canada, the United Kingdom, and the United States. I also, when I was considerably younger, worked as a bartender and as a waiter in three of those countries, including in places with and without tipping.

When I worked in hospitality, I put the same amount of effort into my job, whether i was tipped or not. I had good days (in terms of my efficiency and quality of service and general demeanor) and bad days, whether I was tipped or not. And in my experience as a customer, the service I've received varies about as much, in terms of its general quality, within each of the countries as between them. In almost four decades of patronage at bars and cafes and restaurants in various countries, I've noticed no evidence of any correlation between tipping and overall quality of service.

In fact, to the extent that I notice differences, it's that, in some establishments in countries where tipping is the norm, the service tends to be excessively "acted out" and obsequious, with lots of faux friendliness, without actually being better. Ask an Aussie or Brit, and one thing many of them will tell you is that they find the American habit of servers introducing themselves by name to be quite weird and offputting. I tend to agree; I don't want a server to be my buddy or tell me their name or ask me about my day. I don't even care too much if they're friendly. I just want them to do their job of making my drink or bringing me my food, and in my experience, servers in non-tipping places do that just as well as servers in tipping places.

I largely agree, but restaurant table service is an exception for me. It helps weed out the bad servers. Someone good at the job can make a very decent living waiting tables. People who suck at it don't and won't stay in the job for long.

This is "We should have ER capacity to accommodate everyone who could contract COVID 24/7 for the next 'two weeks." mentality.

If my diner is empty from 1:30 to 5:30 and the waiters are bussing tables, it doesn't make sense to pay them as if they were making $100 off every table.

If they remember the customer's names and drink orders and work well with the kitchen staff to the customer's advantage and the customer pays them $120 on a $100 meal, who would I be to say I'm owed that extra $20 to pay all the other waiters a flat wage? I quoted the $100 to cover the cost, profit included.

The minimum wage in this progressive city is $22 an hour, they can pay the fucking taxes on their horseshit 30% tips.

The tax isn’t gay if they only take the tip?

Why do I feel like I'm getting the shaft?

There might be some pushback to this.

If they've got the balls.

Unknown if they offer free refills.

Tips should be pegged to inflation anyway.

It's the deflation afterwards which lets everybody down.

They will come out even in the end.

Should there be any adjustments if there is a stimulus package?

Elect progressives and they (D)emonstrate how much progressivism you should get.

Amend the 16th Amendment to read "to lay and collect taxes uniformly on all income" and add "except that a single, uniform, deduction per person shall be made, and all of these income taxes shall be paid directly, biweekly, by the individual citizens".

One rate, and stop hiding behind "withholdings". Just let people see what a massive clusterfrak this whole thing has become, all in the name of "fairness".... i.e. 'those dirty rich people should pay for whatever I want'

I almost think having payments be annual or semi-annual would be more effective. Give people the shock of writing one big check for a big chunk of their income and I bet attitudes about government spending will change quickly.

Milton Friedman invented withholding during WW II and said it was one of the worst things he had done. (Eh, may have details wrong, and I'm too lazy to look it up.)

I put VAT and tariffs in the same category. Taxes should be visible, not hidden, so people know how much their government costs. I put property taxes on rental property in the same category; they should be charged to the tenants, not the landlord, just to make sure they know how much tax they are paying.

Both Zeb and SGT get my point..... make it painful to pay those taxes so the plebes get reminded how much this really hurts. Whichever hurts more is fine with me.

FIFY

I like that!

Much better than my timid mods!

Here’s a tip: quit voting for fucking Democrats.

But Trump!

Fine, they can stop voting for Trump in the 2028 cycle too.

But then what will we talk about when his third term is complete?

Nonsense. These policies are how we tax the lower income classes.

None of the people affected by this give a shit.

None of these people are calculating the tradeoffs.

I work with far more educated, and highly paid, people who don't think these things through.

Plenty of people who work for tips give a shit and know that this will fuck up their incomes.

They don't count - they're going to vote blue no matter who anyway.

Well Progressives are So[zi]alist[s].

It's FAR better they keep as much of their idiocy as local as possible.

As-in; keeping as much taxation LOCAL as possible.

[Na]tional is half the CURSE behind [Na]tional So[zi]al[ism].

You nailed this one! Spot on! I always ask my server if they make minimum wage like McDonalds workers or the tipped wage before deciding how much of a tip I will leave.

So many no sense articles for a mag named Reason.

The debate about tips v non tips has been going on for a long time. Saying that the Ds are waging a war on the tip tax break is quite dishonest.

This is also an example of why taxing some income and not others in stupid. Either tips should be taxed or all low income people should be exempt from income taxes.

Somewhat agree here. Actual gratuities should not be taxed. That's an actual gift of appreciation. The issue is this carveout that allows employers to outsource their payroll to customers.

My 17 year old made $200 on her first 4 hour shift at a normal restaurant. It's a crazy amount for entry level labor and also crazy that a skilled laborer makes around the same but also gets raped by the government.

Slightly OT [Dons foil hat]:

Various restaurants have the touchscreen payment systems that automatically prompt you for a tip, right? So, in short-order restaurants and similar payment-up-front arrangements, you have to complete the tip question before the order goes up. The computer and even any intelligence it's attached to can manipulate the order to its own ends after you have or haven't tipped.

Why? Well, if you're the POS payment provider cash tips/no-tips don't go through your platform. So, if you can make it look like they screw up orders more often and the customer either tips electronically here or someplace else, so much the better. Moreover, if you said "venti" and the cashier heard "venti" and even pressed the "venti" button on the register, when you get a grande that has "grande" on the label you, in fact, paid for a venti and got a grande, which makes their inventory look better.

Needlessly complicated? We're talking about using the phone to buy a $7 cup of "coffee" on credit. Hanging chads were needlessly complicated in 2001.

I'm still just confused about how grande means small.

But remember - the Democrats are the party of the poor and downtrodden, protecting them against the ebul rethuglicans.

Which is why, in 2028, I am once again asking you to vote, reluctantly but strategically, for Kamala Harris because the Democratic Party has no one better than a Black Woman of Colour who has no accomplishments of her own except the most important one of being Black and a Woman even though being a woman is a choice when its convenient and not a choice when its not.

the party of the '[WE] Identify-as' gets to STEAL from those 'icky' people.

'poor' just being one of those [WE] Identify-as categories.

Wow, progressives/leftists behavior directly contradicts their statements and virtue signaling. Who'da thunk it?