Trump's Tariffs Have Already Hurt the Economy—and the Pain Is Only Beginning

The OECD just published its projections for American growth, and they're grim.

The U.S. economy is already feeling the effects of Trump's tariffs, and the Organization for Economic Cooperation and Development (OECD) projects that things could get worse.

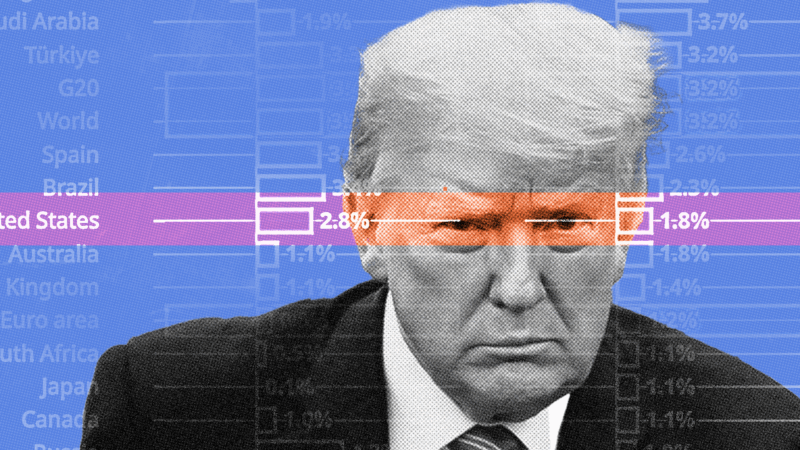

The OECD's biannual interim economic outlook, published on Tuesday, forecasts U.S. growth will fall by a full percentage point from its 2024 rate. While this might not sound like much, this will translate to Americans missing out on trillions of dollars of goods and services by 2035 if this decrease in growth persists.

From 2010 to 2019, American gross domestic product (GDP) grew by an average of 2.4 percent per year. In 2024, it grew by 2.8 percent. Now, the OECD projects that the economy will grow by only 1.8 percent in 2025 and 1.5 percent in 2026, "owing to higher tariff rates [and] moderating net immigration," among other factors. Assuming that yearly GDP growth neither rebounds nor falls further but persists at 1.8 percent, the U.S. economy will be $2.2 trillion smaller in 2035 than it would be had President Donald Trump not adopted his protectionist policies and growth remained at 2.4 percent.

Even though the OECD's growth projections show the long-run macroeconomic damage of Trump's tariffs, the American economy has remained relatively strong since he took office. The stock market is at an all-time high while inflation has been about the same as that experienced during the last year of the Biden administration: The average monthly inflation from January 2024 to August 2024, as measured by the consumer price index (CPI), was 0.2 percent. From January 2025 to August 2025, monthly CPI growth was not much higher: 0.225 percent. Meanwhile, the average monthly increase in the producer price index (PPI), which measures changes in expenses borne by American businesses, was 36 percent lower compared to the same time last year.

The Bureau of Labor Statistics (BLS) explains that "imports are excluded from PPI." The experimental BLS index, which incorporates imports, tells a story similar to regular PPI: this index experienced 38 percent lower inflation from January 2025 to July 2025 than it did during the same period a year ago.

Relatively stable consumer price inflation and lower producer price inflation—excluding and including imports—under Trump are surprising. After all, the president has more than tripled the average effective tariff rate to 11.6 percent on approximately $2.2 trillion worth of imports, according to the Tax Foundation. Therefore, all things being equal, CPI and PPI should be elevated. So, why aren't they? The answer lies in the delayed implementation of Trump's tariffs: Although "Liberation Day" was April 2, the "reciprocal tariffs" announced then were postponed for months, finally taking effect on August 7, meaning "the full effects of tariff increases have yet to be felt," as the OECD explains.

While most Americans have not yet felt the tariffs' full effects, businesses have started to. An August survey administered by the Dallas Federal Reserve found that 60 percent and 70 percent of Texas retailers and manufacturers, respectively, said that Trump's tariffs were negatively affecting their businesses. Earlier this month, The New York Times reported that Section 232 tariffs on imported steel and aluminum have cost John Deere "$300 million so far, with nearly another $300 million expected by the end of the year." The company has already laid off "238 employees across factories in Illinois and Iowa." While anecdotal, John Deere's struggles are reflected in the 48 percent lower growth in total nonfarm employment from January 2025 to August 2025 (598,000 jobs added) compared to those months last year (1.1 million jobs added).

Trump can reverse course at any time by rolling back the Section 232 tariffs and reciprocal tariffs. Even if Trump insists on hobbling the economy with his pointless trade war, Americans could soon enjoy some relief when the Supreme Court convenes in November to hear arguments about the constitutionality of his "Liberation Day" tariffs.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Ripples!

Ignorance!

Poor sarc.

Assholic troll!

Yes, democrats like you and Nicastro are extremely ignorant. Kind of stupid too.

Compared to the effect this is going to have on prices and job security, CK will be RIPples.

Everyone is getting sick of you leftists. Soon, there will be no more tolerance, and you will be dealt with.

2Q25 GDP revised up to 3.8%

First. Oecd.

Second. GDP, so reduction in government spending. I know reason hates that.

Third. Why trust this prediction after months of other failed predictions based on the same keyenesian models?

Fourth, other outfits have raised growth estimates and shown no effects from tariffs after accounting for prior failed predictions, why not cite those as well?

Fifth, how much of this decrease is based on another large revision down in jobs from last year that kept fed rates above neutral?

Government spending should really be subtracted from GDP, because it is mostly a deadweight loss. I know that isn't perfectly accurate, but more accurate than adding it.

If government spending were multiplied against a productivity coefficient. It would certainly be a very low number.

Keyenesian multiplier is estimated at 1.4 x gov spending for most of these models.

Actual data puts it at 0.4 to 0.7, a loss.

.4 sounds about right.

LOL you guys are so stupid. If government produces a pencil, that is production. The government will probably do it less efficiently, meaning fewer pencils will be produced for the same money, but however much it actually does manage to produce is still stuff produced. That's exactly what GDP is meant to measure.

So, you really believe that real “reason” and actual facts matter? Understand: the name of the site is wishful. They wish that they could employ logic and “reason”…but they can’t.

https://www.youtube.com/watch?v=3sQvH1LjFCw&list=RDiTI92w0VYaQ&index=12

This made me chuckle, thanks.

True libertarians understand that taxes make us rich!

True retards continue to rely on bumper sticker strawman arguments despite months of being wrong.

Reminder. You wanted to increase income taxes by double the cost of current tariff estimates.

2nd reminder, you once wrote you refused to work OT because your take home pay would be less.

He also wants to destroy the US job market so he can save an extra 5% buying cheap Chinese crap, while helping to prop up the ChiComs.

It’s the democrat way.

Spot on.

you hated Rocky IV didn't you?

Statistics and economic predictions that contradict Trump are leftist. But don’t worry. Trump will keep firing economists and statisticians and replacing them with people who know nothing about economics and statistics until they get the numbers right. And we will know the numbers are right when they align with what the administration wants them to be.

They are wrong because they are keyenesian built on false assumptions who have been proven to be wrong year after year you fucking moron. What is their track record? What is yours?

They aren't even built on statistics, they are built on their prior assumptions. It isnt feeding historical data in to make a predicted guess.

Are you just this fucking retarded?

Youre still defending a statistician who had back to back years of 6 sigma delta lol.

All economists except for Trump, the smartest economist ever, are keynesian leftists. And I'm sure none of them have thought of the false assumptions that you thought up in a minute because you're an internet smart guy.

How about an actual response instead of the strawman?

Eliminate the income tax now.

^ This

< That

V The other

Quit your job and pay your mortgage with a credit card.

Wut?

Oh. I forgot. You love income taxes and want to increase them. What was your statement earlier?

sarcasmic 1 hour ago

Flag Comment

Mute User

True libertarians understand that taxes make us rich!

It was not surprising seeing sarc try to chaff & redirect away from the libertarian concept of eliminating income taxes.

He should just admit he’s a far left democrat who believes in destroying our job market and enriching China at our expense.

I see some grey boxes beneath my comment. Time to call an exterminator.

Scumby Chimp-Chump is sitting and shitting on THE Moist PervFectly WONDERFUL libertarian cuntcepts and ideas about how to run a PERVFECTED society with ZERO taxes!!! With NO taxes for ANYONE!!! And equally shared PervFection for ALL of us, ass in Heaven on Earth!!!

Yet sad to say, PervFected Scumby Chimp-Chump is SNOT sharing the details of Shit's PervFected Plans with ANY of us lowly peons and illegal sub-humans!!! Twat and udder slurprise!!!

I can see him masturbating to videos of Milei…and then his penis going flaccid when he says negative things about tariffs. Poor Chumby. 🙁

"True libertarians understand that taxes make us rich!"

Amazingly imbecilic claim! Trade increases wealth; coercion decreases it. Everywhere and always.

Agreed. Particularly our federal tax code which is strictly a collection of special favors granted to the biggest, most powerful interest groups or favored voter blocs.

I'd be all in on a flat tax with no bottom an no top. Everyone needs to feel the pinch of raising taxes or raising spending, which will eventually raise taxes. But the right has little interest in leveling the tax burden or in decreasing spending, and the left is driving us towards economic collapse at 200 mph, so this is really just another libertarian thought experiment.

I'd be all in on a flat tax with no bottom an no top.

National sales tax. Income taxes definitionally require the state to spy on its citizens. Every district in the country has the infrastructure to deal and collect them, they are "flat" by design and can be structured to not be overly regressive-- despite the claim that they're regressive. When you have an income tax you have the impossible task of defining "income" and creating an environment where the government can stop you at any time, look into your bank account and demand 'where did that dollar come from'?

Flat tax of zero.

How do we pay for all the constitutional obligations of the federal government? If it’s an organ harvesting program featuring compulsory donations by democrats. I’m all for it.

It's not the tariffs that are hurting the economy. It's the trade war, the victimhood mindset about all our foreign relations, and the arbitrary whim of decisions.

Judging by recent Dow jones performance, people with real money invested in this economy feel differently.

China is up by 37% this year. The rest of the world xUS is up 24%. SP500 is up 13%.

You're right. Some people are winning the trade war

"China is up by 37% this year."

Right. Over 1/3rd.

JFucked probably believed Soviet harvest claims. JFucked is stupid that way along with many others.

China’s economy is in deep trouble. Are you really claiming otherwise?

Q1 and Q2 have done nicely; I'm not 'buying gold'.

Same here, not nearly as good as I did in 2022/23 with my real estate portfolio…but I’m not complaining like you were!!

My net gain was $25,000 last month just in my 401k accounts. Somewhat questioning why I work 45 hours a week.

I think you can safely cut back to 44 hours per week, maybe even 43.

^+1

Health insurance…that’s why you don’t really have a choice but to work.

What? Obamacare was supposed to cure that.

Some states still haven’t fully implemented Obamacare. But if you live in most states you can get Medicaid which is fine thanks to Obamacare. The Obamacare plans are good in Florida because Rick Scott knew how to make it work, but in most states you might as well work instead of paying for an Obamacare plan.

cite?

The year Obamacare took effect it cured my bank account of an extra $3700.

Gold nudging 3800 per ounce on the spot market. Best investment I hold. Foreigners aren't buying treasuries because the USD is spiralling to zero. Gotta put the money somewhere.

If the USD spirals to zero, then it's Mad Max time and it won't matter what you're invested in. You can't eat gold.

Tariffs are a very regressive form of taxation…they are clearly impacting the lower class. I’m upper class and so as usual…whatever makes them more work harder for less is fine with me!

Incorrect as usual.

It is "the victimhood mindset" domestically.

Has nothing to do with foreign relations.

There wouldn't be any need for BIG taxes/tariffs were it not for a BIG welfare system bankrupting the nation pretending 'Guns' can make sh*t.

Trade wars are two way street. Trump raises import taxes to try to shut out imports. By making the stuff more expensive.

They respond by raising taxes when Trump raises taxes. Which makes our exports more expensive for foreign buyers. That means less stuff sold. Less stuff produced. Job losses. Trade wars are dumb.

Tell us again about that 80% domestic 'Trade-War' with citizens.

You're actually on to something. You just have a blind-spot as big as Texas.

Except when Trump does it. Then it pays off the debt, creates jobs, and doesn't cost us anything!

What do you mean paying your bills hurts your economy?

Democrats sold it all as ?free? sh*t without explaining who will supply it.

Funny how the national debt doesn't seem to be an issue anymore now that coastal democrats are actually getting a bill now. OMG! The pain of paying bills we added up! /s

Funny how you don't give a shit about the debt when it's under Republicans.

Not at all what he said

We could cut a lot of it weren’t for democrats. This is all your fault.

Don’t ever pretend otherwise.

IT'S ONLY JUST BEGINNING!

BWAHAHAHA!

--"Reason"

Trump should mind the economy and forget tariffs — as well as aggressive immigration enforcement. Minding these two instead has only made things worse.

Open-Doors and don't pay the bills???

Oh yeah; That's certainly a recipe for success. /s

If you're a drugged-out idiot who deserves to live on a park bench.

They have to go back.

He cares about the economy, only about his own economy and the economy of his friends. Ordinary people (like me) live in constant fear of losing their jobs. It got to the point where I restored my account on my old betting service - https://download1xbetindia.com As long as there is internet, you can earn money without government officials keeping a close eye on your pocket.

Does anyone out there calculate GDP without government spending? And have they done it back through time (since we know what previous spending was, we should be able to subtract that from the equation to get a more clear idea of how the ACTUAL economy fared through all of these political shitstorms we call Presidencies.)

No. The government made fake-$ precisely so no-one would know exactly how D.C. ended up getting 5-Times more than anyone else in the Union while producing absolutely nothing to speak of.

Did the OECD forecast the economic destruction of the Biden administration?

Which didn't happen.

You should be kicked out of the country. Maybe deport you to Somalia.

LOL it's all Biden's fault. He did a delayed effect ninja move just to spite Trump.

Thank God statistics can be manipulated by those in power.

Otherwise, all us illiterate plebeians might find out what's really goin on in economy, something our glorious dear leaders want to keep from us.

Meanwhile:

https://x.com/brewmarkets/status/1971214493385621667

https://www.cnn.com/2025/09/25/economy/us-gdp-q2-final?Date=20250925