Here Are 3 Reasons Why the 'Big Beautiful Bill' Won't Generate 3 Percent Growth

The White House is promising higher growth, but tariffs, borrowing, and rising interest rates will be a drag on those expectations.

The White House is promising that the "Big Beautiful Bill" will provide a jolt to the economy—but those expectations fail to take into account three direct consequences of the bill that independent analysts believe will sap growth in the long run.

White House press secretary Karoline Leavitt and others in the Trump administration have been touting the White House Council of Economic Advisers' projections showing that the bill will generate 3 percent annual growth. President Donald Trump, as usual, has gone even bigger. Last month, he suggested that the tax bill could grow America's economy by "3, 4, or even 5 times" the current levels—currently pegged at 1.8 percent by the Congressional Budget Office.

Those expectations are well in excess of what serious and independent economists expect.

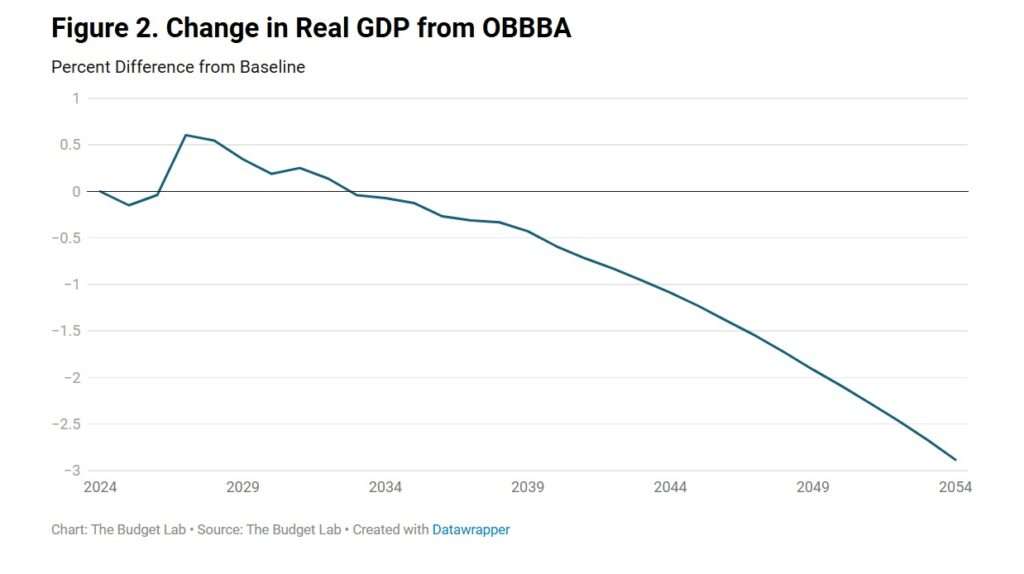

The Yale Budget Lab, for example, estimates the tax bill would add just a small boost to the economy in the short run. That would be followed by decades of lower growth (relative to what would happen if the bill didn't pass) as the negative consequences of extra borrowing take their toll.

The Yale analysis is in line with other projections by the Tax Foundation and the Penn Wharton Budget Model, both of which project less than 1 percent higher growth as a result of the bill's passage—though neither looks as far ahead as the Yale analysis does.

Why the big difference?

The White House's argument rests on the assumption that lower taxes will generate greater growth. That's a well-established principle, but the problem with applying it here is that this bill isn't lowering taxes—with the exception of some relatively small details, like abolishing income taxes on tips and overtime pay. Rather, it is extending current tax rates that were set by the bill Trump signed in 2017. That bill did indeed reduce the amount of money that most Americans owed to the federal government, and those tax cuts did spur greater growth, but the dynamic this time around is fundamentally different.

In short, extending tax cuts is not the same as cutting taxes.

If that was the only way that the White House was stretching the truth, I might be inclined to cut the Trump administration some slack. There are worse policymaking crimes than being overly eager to keep tax rates from snapping back to their higher, pre-2017 levels.

Unfortunately, there are three other big reasons why the White House's math doesn't add up.

First, the tariffs. Tariffs are simply taxes, and the tariffs Trump has (unlawfully) imposed on nearly all American imports are the single biggest tax increase in several decades. If tax cuts encourage economic growth, guess what huge tax increases do?

But the White House is not including the economic consequences of higher tariffs in its GDP estimates—even though it is including the revenue from the tariffs in its claim that the tax bill will help reduce the deficit. The White House is trying to have its cake and eat it too.

Second, more borrowing. Despite the Trump administration's unwillingness to admit as much, the tax bill will absolutely add to the budget deficit over the next decade. That means the federal government will have to borrow even more heavily than it already expects to, and that additional borrowing will be a drag on economic growth.

In its analysis, the Yale Budget Lab says economic growth will slow in the long run "because of the debt load from the One Big Beautiful Bill Act (OBBBA) that raises interest rates and results in crowding out." (Crowding out is a term used by economists to describe the phenomenon in which higher government spending depresses private sector productivity.)

Finally, higher interest rates. This goes hand in hand with larger deficits since more borrowing is likely to push interest rates higher. And higher interest rates also sap future growth, because a larger portion of those future gains will have to be spent paying back what was borrowed—whether it is individuals or the U.S. Treasury doing the borrowing.

Specifically, the Yale analysis estimates that the yield on 10-year U.S. Treasury bonds will be 1.2 percentage points higher by 2054 if the bill passes vs. the scenario where it does not.

Yes, all projections are just projections, and no one knows the future. In this case, however, the White House seems to be deliberately misleading the public (and members of Congress) by overestimating the jolt that the tax bill could provide and totally ignoring the piles of contradicting evidence.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

First, the tariffs. Tariffs are simply taxes, and the tariffs Trump has (unlawfully) imposed on nearly all American imports are the single biggest tax increase in several decades.

Are the tariffs in the bill?

Powell has already indicated the tariffs have delayed rate cuts…so the tariffs have already cost more money than they could raise because interest on the debt is such a big deal now. I find it hilarious that people voted for Trump because of the deficit when Kamala would have had the deficit/GDP ratio under 4% next year.

Are the tariffs in the bill? The article is about how the bill will not spur growth. Are the tariffs in the bill? I really dont know.

Not sure the point of the question, but to my knowledge there are no NEW tariffs in the bill - why would there be when Trump thinks he can unilaterally apply them whenever he wants, no "bill" or congressional approval needed?

The bill does tout all the usual tariff "benefits" with zero mention of costs.

I find it disingenuous to write an entire article touting 3 main reasons why this bill wont create the growth they claim and one of the 3 main reasons is something that is happening outside the bill.

The whole "3 Things" is a bit kitchy - you could find Many things wrong with it, same with any other bill. But it doesn't make what he said not true. Even if you want to bypass the Tariff thing, is there really Nothing in the article you find credible? Gonna ignore ALL of it because you don't like that one part you find "disingenuous"?

I"m talking about the disingenous part, which is the tariffs, which i am not a fan of but they are not part of the spending bill, which I'm also not a fan of.

I want the federal budget slashed by at least 90% so nothing will ever really please me.

Doesnt mean that I cant recognize 'less bad' situations when they occur and this bill is less bad than it could have been. All the dems wanted to hike taxes and I'm opposed to any tax hike whatsoever on anyone.

is there really Nothing in the article you find credible?

50% on the by line and the rest goes downhill from there.

Boehm even identifies as a "Reporter", but this is more of an OpEd.

What makes it not true is reality moron.

Eric continues to use models that have zero predictive ability. And like him, you fall for the bullshit lol.

Welcome to Reason, disingenuous is expected

There are no tariffs in the bill retard. As the reconciliation only effects mandatory spending programs.

God damn you're retarded.

All I care about is the deficit…Kamala would have had the deficit GDP ratio under 4% by next year. I know you vote on things like “mean Truths awesome” and “BJs bad/asexual Christian nut with sense of entitlement off the charts good” and “black lady trying to reduce obesity bad/white crazy guy with sense of entitlement off the charts trying to reduce obesity good” but some of us vote on reducing the deficit.

Kamala would have had the deficit/GDP ratio under 4% next year.

LMAO. That is too hilarious.

Don't blame me, I voted for Javier Milei.

Hilarious! After seeing [D]-trifectas run consistent >$1T (Biden running closer to $2T/yr) deficits and [R]-trifectas run consistently <$1T deficits.

You voted for the guy that added $8 trillion to the debt!! You are a fucking moron!!!

That was Joe Biden and it was practically $8.5T moron.

Trump Debt 2017=$20.2T to 2020=$27.7; total debt $7.5T

Biden Debt 2020=$27.7T to 2024=$36.1T; total debt $8.4T

2019=$22.7T making Trumps first 3yr average $2.5T/3yr = $0.8T/yr

...or without DEMOCRATS pitched Cares Act total Trump Debt ~$3.2T.

Wow you people are dumb…you are admitting you voted for a president that added $7.5 trillion to the debt when he inherited a 3% deficit/GDP ratio from Obama.

Trump didn't STOP 'us' [D] so it's all his fault! /s

A president that didn't VETO [D]'s massive $4.5T Spending Bill pitched by a [D] in a [D] House.

A bill who's only objection was by Republicans.

The only point you have is the biggest mistakes Republicans make is when they don't STOP the Democrats.

Democrat filth, who exploded the deficit, are blaming the republicans are not cutting the deficit. While simultaneously opposing any and all budget cuts.

Yep. It’s the same shit for decades.

Indeed. Democrats are [WE] Identify-as team/gangster oriented.

Precisely why they gang-up in urban areas.

Precisely why they preach ‘Democracy’ over the Bill of Rights / Constitution.

Precisely why they embrace ‘Communism/Socialism’.

Precisely as it has been recognized for a long time (birds of a feather stick together).

Principles and Logic has no purpose beyond striking [WE] Identify-as points in their [OUR] gang RULES/STEALS roots.

And congress shut down a massive amount of deficit spending Biden wanted, so that Biden debt would have been closer to $10T if it weren't for the republicans. And I'm not saying R's are the party of cutting government, we didn't get here by D hands alone, but the D's were on a spending spree. Remember, never let a good crisis go to waste was the D motto and still is.

Sure. Follow the science. Stop the spread. Flatten the curve. Boehm just bleats the regime line.

Reminder. Boehm has been demanding the tax cuts extentions fail. A tax increase double the tariff estimates he is against.

Boehm is a fucking moron.

A tax cut has to be extremely irresponsible to impact growth like the 2003 Bush Tax Cut which firehosed dollars into a dysfunctional economy and produced near 4% growth while exploding the deficit. We could have had a surplus through 2010 but for Bush asinine tax cut that exacerbated inflation that tanked the economy when CPI was elevated for 4 years. Trump’s first tax cut wasn’t a big deal which is why we didn’t have 3% growth under Trump.

lol yeah the tax cuts are the problem. US Gov taking ONLY 30% of GDP out of everyone's hands is the problem. It should be more! good lord.

Clinton and Obama slashed defense spending to get the deficit to manageable levels…I’m so sorry we slaughtered fewer innocent Muslims by adding less to the debt. 🙁

The Tea Party and Newt Ginrich would like a word.

If Gingrich supports slashing defense spending while jacking up tax revenue then I support him. Unfortunately Bush/Cheney ran on slashing taxes and jacking up defense spending.

Trump could eliminate the DoD and there would still be a budget deficit. Defense spending is not the problem. Free retirement and medical care for Boomers is the problem.

Defense spending isn’t a problem thanks to Obama. The only way we get to 3% deficit/GDP ratio is with a 39.6% top tax rate and Fed rate under 2%. It’s actually not that hard to get under 4% which is why Trump floated a 39.6% top rate a few weeks ago.

And yet you're against those programs being cut by 8% you're against audits of those programs whose fraud is estimated 5-10%.

¯\_(ツ)_/¯

Also Obama, Afghan check, Iraq check, and then lets add Syria and Libya check and check.

Yup checked, Obama slaughtered a lot of innocent Muslims.

Good, fuck ‘em. My issue is with sacrificing Americans to slaughter them which Bush/Cheney did to the tune of 15 fallen a week for 4 years. By 2015 Obama had it to 20 a year which is fewer than have died in accidents under Trump in 3 months.

Obama. The TRIPLE the deficit king?

You R F'En retarded.

Nope, that was the Bush Recession. Obama had both the GWOT and deficit to manageable levels by 2015 and so Trump inherited a great situation and then exploded the deficit.

Gosh you're stupid.

Bushes last year 2008 deficit = $459B

Obama's first year 2009 deficit = $1.4T ( 3-TIMES).

Obama's 2nd, 3rd, 4th [D]-trifecta deficits $1.3T,$1.3T,1.1T.

The only thing that got 'managed' was electing an [R]-Congress to manage Obama & [D]'s spending spree.

Wrong, dipshit.

Jan. 7, 2009, 9:25 AM EST / Source: The Associated Press

The federal budget deficit will hit an unparalleled $1.2 trillion for the 2009 budget year and the U.S. economy will likely contract by more than 2 percent, according to a new Congressional Budget Office report.

....

The eye-popping estimates reflect plummeting tax revenues because of the recession and about $400 billion spent to bail out the financial industry and take over mortgage finance companies Fannie Mae and Freddie Mac. Last year's deficit was $455 billion.

Notice the date. Bush/Cheney was still presidents.

It was Obama’s budget that got passed.

https://www.thebalancemoney.com/fy-2009-u-s-federal-budget-and-spending-3306311

But nice try projecting the blame.

Not as-if the >$1T deficits in the subsequent years couldn't possibly be a factor. /s

You're too stupid to know this but FY 2009 actually began Oct 1, 2008.

+10000000000

And ended on Sept 1, 2009 being exploded by Obama's American Recovery and Reinvestment Act of 2009 Signed into law by President Barack Obama on February 17, 2009.

TJJ2000, you can’t be this stupid. What is the point of lying in the comments section of a website?? How did your life come to such a pathetic low point?? Don’t you have a better way to spend your time like watching porn and masturbating instead of lying to rationalize voting Republican since 2000??

The retards still dont know Obama signed FY09 after Bush refused.

You still support Bush!! 7000 Gold Stars!! Walk tall!! 😉

Obama permanently raised baseline spending with ACA. Whatever deficit Biden and Trump had to contend with, Obama owns much of it. The deficit came down during a bit as the war in Iraq wound down and he didn't further extend the trillion dollar bailout. Whooop de doo.

If my monthly spending went up by 500,000 dollars, the fact my "deficit" was 10% lower than it was before the hike is not some big win. Especially if I have to keep on borrowing money to sustain spending.

Obama spent a ton of borrowed money to bail out industries on the brink and raised taxes. He essentially took money away from the private sector to close the spending of the government, which amounts to dumping gallons of new watet on a bathtub with a hole.

ACA incidentally helped destroy the 9 to 5 working model and gave rise to the gig economy. I was hired a month out of college in 2003. America was never the same under 16 years of democrat rule post Clinton.

Obama spent a ton of borrowed money to bail out industries on the brink and raised taxes.

TARP (passed Oct 2008) was 100% on Bush the Lesser.

Obama cut the deficit in half before Donnie blew it up.

TARP was 100% repaid by the very one's who participated and not even 1/3rd of Obama's American Recovery and Reinvestment Act which never got repaid at all...

Obama TRIPLED the deficit. Republicans STOPPED the year after year TRIPLED budget Obama PUT THERE.

Dishonest BS is all leftards are made of.

None of that matters as Obama had 3% deficit/GDP ratio by 2014. So Trump inherited a manageable deficit and exploded it. Biden was on track to hit 3% deficit/GDP ratio by 2026 on the same timeline as Obama.

Biden’s last year $1.8T was only surpassed by his first year $2.8T.

The only way Trump exploded it was by not STOPPING the Democrats Cares Act.

As all previous years were <$1T which is far-less than Obama's [D]-trifecta.

https://en.wikipedia.org/wiki/CARES_Act

Introduced in the House by Joe Courtney [D].

Who cares? Trump inherited 3% and then exploded the deficit. For some reason you hold Republicans to a different standard than Democrats when Democrats haven’t inherited a manageable deficit since Carter.

The problem is Democrats DON’T manage a Deficit as this entire discussion proves. As-if giving FDR 12 F’En years of the Greatest Depression ever didn’t close that case.

The only thing you’re advertising, and apparently believe, is all of Democrats Debt/Deficit is all the previous [R] Administrations fault.

Leftard Self-Projection 101.

Good Grief; It's not like Democrats have ever even tried lobbying for fiscal sanity. All they lobby for day-in and day-out is MORE spending, MORE spending, MORE spending.

Clinton had a surplus!! Obama had it at 3% by 2014. Bush and Trump exploded the deficit.

Clinton never had deficit surplus until a full [R] Congress.

As did Bush.

Obama TRIPLED the deficit until a full [R] Congress.

The only praise you’re establishing is praise for an [R] Congress.

[D]-trifectas (no Republicans to stop them) spend 3-TIMES more than their [R]-trifecta counter-part practically every time throughout all of history.

Because decreasing revenue while increasing spending is the responsible thing to do. Yup.

"increasing spending" - LIE, after LIE, after LIE....

What do you call it when the federal budget increases? Budget cut?

What do you call it when the federal budget proposal is 8% less than last years?

Gosh. Even Anti-Trump Sullum came out and admitted it was 8% less.

A proposal is just a proposal, nitwit. The new budget will be bigger than the last.

So you're raging against your imagination while blaming trump?

And here sarc admits he wants to raise income taxes but rages against raising other taxes. Ignore the income taxes are twice estimated tariffs.

Almost looks like a hockey stick. That's how you know it's definitely true.

Anxious to see how the sycophants complain about this one from Reason, far-left communist rag that they are. Lemme guess... since one article recently mentioned how one sector of the economy haven't felt the tariffs yet and is doing fine (link helpfully provided!), and things like the PPI is doing gangbusters - it therefore Completely negates all the warnings, all the history, all the logic, all common sense - and the Big Beautiful Bill is JUST the tonic we need that can ONLY be achieved, and provided, by Big Beautiful Government.

Uh huh. Sure. Have at it, Trumpers. I'll go grab some hot cocoa.

Quit pretending like you know anything about anything.

Are you saying that, so far, it's all been a 'net benefit'?

Like immigration?

What a retard you are. Lol.

Cut Spending. 123% Debt to GDP. The nation is broke.

The tax cuts of 2017 failed to boost GDP. Fatass Donnie never managed a full year of 3% growth and his four year total was a miserable 1.8%.

KamKam was ditzy but electing her would have meant gridlock and none of this tariff bullshit.

#MAGA KamKam.

Actually for old white Republican presidents you round up, and for Black presidents you round down. So Obama’s 2.95% GDP growth in 2015 gets rounded down while Trump’s 2.95% GDP growth in 2018 gets rounded up to 3%. That’s how whites like Bush and Lizard Cheney and Hegseth and RFK jr and Trump get ahead. 😉

It's easy for the GDP (a unreliable indicator of the nation's financial well being) to go up when the government spends a ton of money to prop up failing businesses, who turn record profit by expanding overseas and outsourcing jobs. He was undoubtedly the best president big business ever had.

The guy led to his party being wiped out in midterms, lost 2 million vote in the reelection, then set the stage for MAGA by starting the gig economy and doing nothing to stop the invasion at the borders. Only the cult of personality kept him relevant.

I will defend Bush on the border as construction is the sector with the highest percentage of Latino workers and so we were building homes under Bush/Cheney and then under Obama we had a housing glut with low illegal immigration. But that’s something else that undermined the Bush economy—the lone economic bright spot was residential construction and the workers were largely illegal immigrants!?! So not only were good union jobs being shipped to China but construction was booming but the workers weren’t Americans and a lot of the money was being sent to Mexico.

He became president in 2016, and you think by 2017 tax cuts would dramatically boost GDP by 2018.

GDP only measures output. Most things "produced" here don't go through American middle class. The mid 2010s were the starting point of brick and mortar and physical products really starting to go downhill. My house still had landline phone in 2016.

CA is the most expensive place to live in, and it has the most immigrants. If the Trump tariff remains in effect and someone like Rand Paul took over CA, my cost of living might down by 50%. It's always amusing to see leftards share their delusion that their democrat overlords were some big plus for the economy. LOL

Dishonest Trump defenders (redundant I know) will cite the Laffer curve and say that any and all tax cuts boost revenue. By their logic the ideal tax rate for maximum revenue is 0%.

Did you say "maximum" 'armed' THEFT?

You leftards all have the same base principle ... HOW TO STEAL SHIT.

Sarc still doesn't understand the difference between a line and a curve. This is the 3rd time you've said this retarded statement.

I'd read the article Boehm, but you guys have been wrong on everything so far.

Even when he admits to being wrong he argues he was actually right.

“In this case, however, the White House seems to be deliberately misleading the public….”

This is outrageous, only Congress has the authority to deliberately mislead the public.

Congress, the Media, Public Health Officials, the FBI, Police, Pro Athletes, Influencers, Tech Executives, Foreign Leaders, College Administrators and Professors, Community Organizers, Schoolteachers... at this point, if the WH *weren't* deliberately misleading anyone, they'd be the only ones.

Right... Yale and Penn Commie-Indoctrination camps is definitely where I'd go to get predictions... /s Dumb*sses can't even figure out their own gender.

"In short, extending tax cuts is not the same as cutting taxes."

Yeah, I'm gonna disagree with that. It's not a NEW tax cut.

Tariffs are more sales tax than an income tax. While it would lead to higher prices, more often than not, people will adjust to it. Some companies may very well decide to move production here. You can try to negotiate better tariff rates. There's no escaping California's labor and housing costs.

Trump almost certainly saved the nation untold millions, if not billions, by deporting the illegal migrants that crossed our borders. The future catastrophe this man helped the nation dodge cannot be understated. Again, this is something that would permanently damage the nation. Tariffs come and go.

I'm assuming Trump didn't propose any big spending like ACA. If he did I'm sure Reason would be all over it. So any growth will be stopped dead in its tracks thanks to the future borrowing we'd need to make up for the tax cuts, even though we've always borrowed money.

Don't let Marxists take over government. That's the first step to prosperity. Make adjustments in between.

A record number of apartment units and hotel rooms were delivered the last several years…construction has always been a high percentage of illegals including in 2019 when Trump was president. The fentanyl deaths and violent crime spiked in 2020 when illegal immigration was at record lows.

See the tariffs are going to tariff the tariff which will tariff the effected tariff and then the tariff will cause tariff which ends up in tariff any that's effectively a tariff on the people who tariff.

Someone reset the Boehm NPC. It's glitching.