Here Are 3 Reasons Why the 'Big Beautiful Bill' Won't Generate 3 Percent Growth

The White House is promising higher growth, but tariffs, borrowing, and rising interest rates will be a drag on those expectations.

The White House is promising that the "Big Beautiful Bill" will provide a jolt to the economy—but those expectations fail to take into account three direct consequences of the bill that independent analysts believe will sap growth in the long run.

White House press secretary Karoline Leavitt and others in the Trump administration have been touting the White House Council of Economic Advisers' projections showing that the bill will generate 3 percent annual growth. President Donald Trump, as usual, has gone even bigger. Last month, he suggested that the tax bill could grow America's economy by "3, 4, or even 5 times" the current levels—currently pegged at 1.8 percent by the Congressional Budget Office.

Those expectations are well in excess of what serious and independent economists expect.

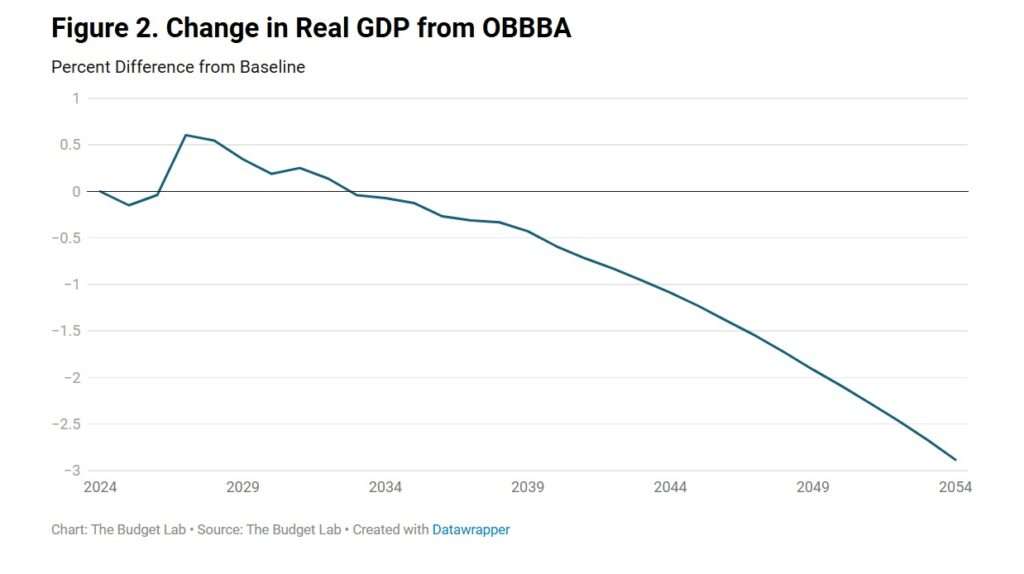

The Yale Budget Lab, for example, estimates the tax bill would add just a small boost to the economy in the short run. That would be followed by decades of lower growth (relative to what would happen if the bill didn't pass) as the negative consequences of extra borrowing take their toll.

The Yale analysis is in line with other projections by the Tax Foundation and the Penn Wharton Budget Model, both of which project less than 1 percent higher growth as a result of the bill's passage—though neither looks as far ahead as the Yale analysis does.

Why the big difference?

The White House's argument rests on the assumption that lower taxes will generate greater growth. That's a well-established principle, but the problem with applying it here is that this bill isn't lowering taxes—with the exception of some relatively small details, like abolishing income taxes on tips and overtime pay. Rather, it is extending current tax rates that were set by the bill Trump signed in 2017. That bill did indeed reduce the amount of money that most Americans owed to the federal government, and those tax cuts did spur greater growth, but the dynamic this time around is fundamentally different.

In short, extending tax cuts is not the same as cutting taxes.

If that was the only way that the White House was stretching the truth, I might be inclined to cut the Trump administration some slack. There are worse policymaking crimes than being overly eager to keep tax rates from snapping back to their higher, pre-2017 levels.

Unfortunately, there are three other big reasons why the White House's math doesn't add up.

First, the tariffs. Tariffs are simply taxes, and the tariffs Trump has (unlawfully) imposed on nearly all American imports are the single biggest tax increase in several decades. If tax cuts encourage economic growth, guess what huge tax increases do?

But the White House is not including the economic consequences of higher tariffs in its GDP estimates—even though it is including the revenue from the tariffs in its claim that the tax bill will help reduce the deficit. The White House is trying to have its cake and eat it too.

Second, more borrowing. Despite the Trump administration's unwillingness to admit as much, the tax bill will absolutely add to the budget deficit over the next decade. That means the federal government will have to borrow even more heavily than it already expects to, and that additional borrowing will be a drag on economic growth.

In its analysis, the Yale Budget Lab says economic growth will slow in the long run "because of the debt load from the One Big Beautiful Bill Act (OBBBA) that raises interest rates and results in crowding out." (Crowding out is a term used by economists to describe the phenomenon in which higher government spending depresses private sector productivity.)

Finally, higher interest rates. This goes hand in hand with larger deficits since more borrowing is likely to push interest rates higher. And higher interest rates also sap future growth, because a larger portion of those future gains will have to be spent paying back what was borrowed—whether it is individuals or the U.S. Treasury doing the borrowing.

Specifically, the Yale analysis estimates that the yield on 10-year U.S. Treasury bonds will be 1.2 percentage points higher by 2054 if the bill passes vs. the scenario where it does not.

Yes, all projections are just projections, and no one knows the future. In this case, however, the White House seems to be deliberately misleading the public (and members of Congress) by overestimating the jolt that the tax bill could provide and totally ignoring the piles of contradicting evidence.

Show Comments (83)